The Average Fico Score Increase In The Last Decade

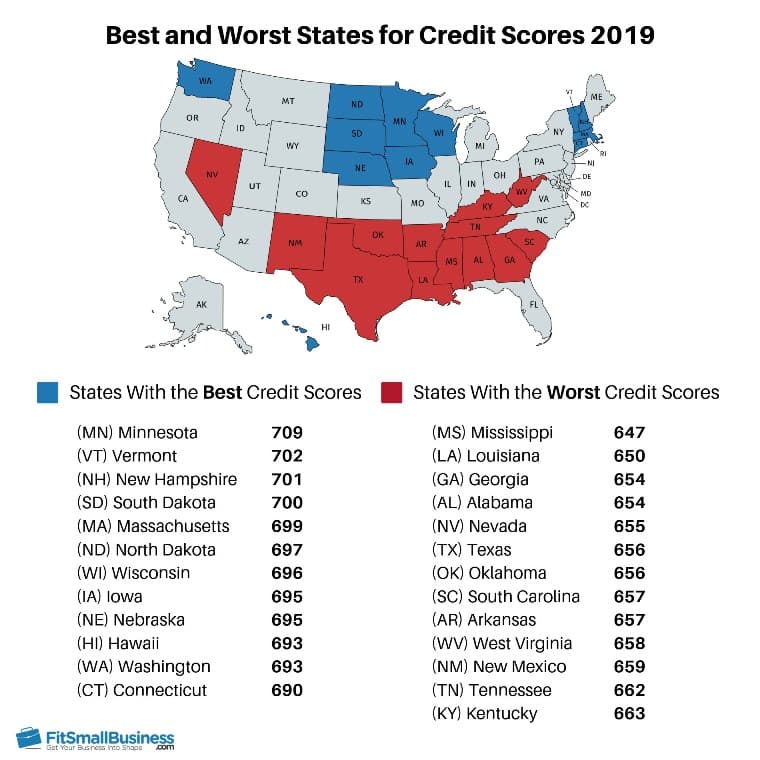

Between 2010 and 2020, the average FICO score has increased by approximately 24 points. The average FICO score in 2010 was 687, while todays average FICO score in the United States is 711.

This trend increase in credit score statistics also seems to appear in different age brackets, as illustrated in the data above in Experians and The Ascents reports.

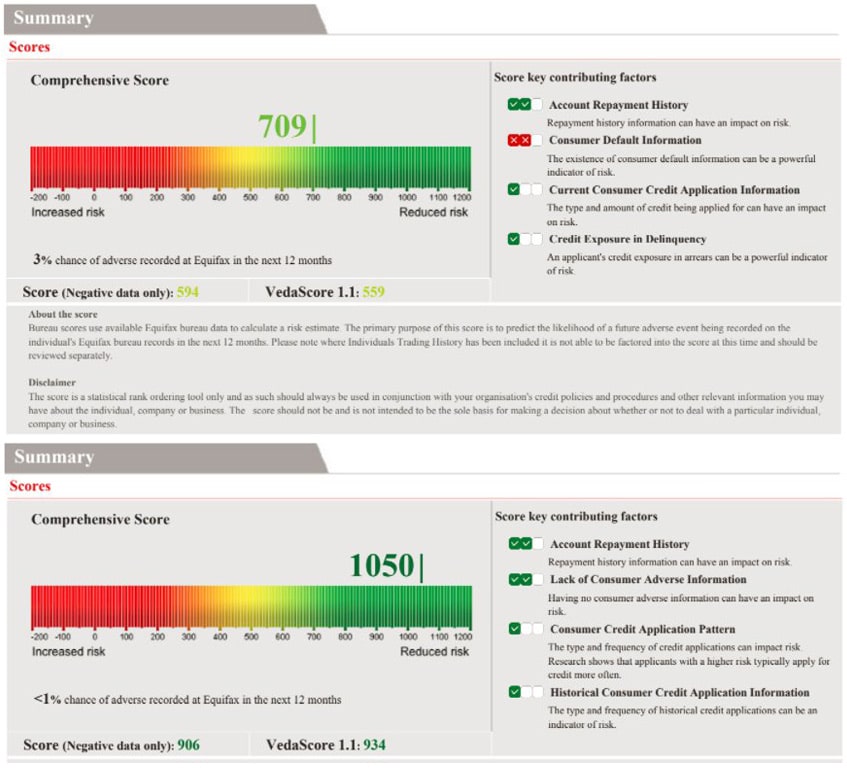

So Can I Lease A Car With A 709 Credit Score

There are two kind of leasing deals namely the normal deal and the promotional deal. A promotional car lease deal is one offered via auto makers and their merchants temporal period . The arrangements are vigorously promoted and can be seen on car organization sites.

As a rule, these extraordinary arrangements depend on lessened costs, and helped lease-end residual value. Besides, there might be mileage confinements and up-front installment to be required. When you will try to lease a car with 709 credit score, keep in mind that only people with good or excellent score point are entitled to this promotion the reason being that most car companies go on loss because some people do not fulfill the lease agreement most of the time.

How To Improve A 709 Credit Score

Work on removing all negative accounts such as collections, charge-offs, medical bills, bankruptcies, et al.

Remove as many excess hard inquiries as you can. Get your revolving utilization as low as you can . Ensure you have a good credit mix of installment loans and revolving accounts.

Last but not least, make sure you have at least two revolving accounts older than 2 years

We recommend taking a look at Credit Glory. Give them a call

It’s generally much faster if you worked with Credit Glory, and they happen to have incredible customer service.

You May Like: Does A Credit Report Show Credit Score

Strategies To Build 700+ 750+ Credit Score And Above

Your credit score of 709 is already good, but did you know that there are ways to make it even better? A “very good” score can get you the best rates on loans and credit cards. The good news is that it doesnt take much to improve your credit when you’re already in the good range. Pay attention to these credit score factors:

Credit Score: Is It Good Or Bad

Your score falls within the range of scores, from 670 to 739, which are considered Good. The average U.S. FICO® Score, 711, falls within the Good range. Lenders view consumers with scores in the good range as “acceptable” borrowers, and may offer them a variety of credit products, though not necessarily at the lowest-available interest rates.

21% of U.S. consumers’ FICO® Scores are in the Good range.

Approximately 9% of consumers with Good FICO® Scores are likely to become seriously delinquent in the future.

You May Like: What Is A Perfect Credit Score 2020

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.

What Is The Average Credit Score

Data provided by Experian revealed that the average FICO credit score for Americans was 716 in 20212.

According to Experian, this average FICO score may be a result of credit scoring factors such as fewer late payments or delinquencies on credit cards, shrinking debt , and a decrease in credit utilization.

There are other credit scoring models such as VantageScore, but the majority of lending decisions are made using FICO scores, so this review is focused only on FICO scores.

Don’t Miss: What Makes Your Credit Score Go Down

Advantages Of Your Very Good Credit Score

A credit score in the Very Good range signifies a proven track record of timely bill payment and good credit management. Late payments and other negative entries on your credit file are rare or nonexistent, and if any appear, they are likely to be at least a few years in the past.

People with credit scores of 779 typically pay their bills on time in fact, late payments appear on just 22% of their credit reports.

People like you with Very Good credit scores are attractive customers to banks and credit card issuers, who typically offer borrowers like you better-than-average lending terms. These may include opportunities to refinance older loans at better rates than you were able to get in years past, and chances to sign up for credit cards with enticing rewards as well as relatively low interest rates.

Average Credit Score By Income

According to American Express, the average credit score by income are as follows4:

- $30,000 or less per year: 590

- $30,001 to $49,999: 643

- $50,000 to $74,999: 737

The correlation between lower average credit scores and lower-income may be associated with factors like higher-income individuals being able to pay back credit card debts more easily as well as being able to maintain a lower credit utilization ratio.

Those with higher income may also have higher credit limits in comparison to those with lower income.

That being said, income is not the most accurate measurement of scores. Income is only one factor that plays a role in your score. You can still have a low income and have good credit. If you fall into a lower income bracket, dont worry. Your income doesnt determine your score.

Recommended Reading: How To Check Credit Score With Itin Number

Maintaining A Good Credit History

The average American consumer has a good FICO® score. With some time and effort, you can increase your score into the Very Good range or even the Exceptional range . Moving in that direction requires an understanding of the behaviors that help grow your score and those that hinder growth.

Late and missed payments have a significant negative impact on your credit score. Lenders prefer borrowers who pay their bills on time, and research shows that people who have missed payments in the past are more likely to default on debt than those who pay on time. If you have a history of making late payments, you can improve your credit score considerably by changing this habit. In fact, 35% of your credit score is determined by whether or not you have late or missed payments on your record.

Your is a good way to gauge how close you are to “maxing out” your credit card accounts. You can measure it on an account-by-account basis by dividing each outstanding balance by the card’s spending limit and then multiplying by 100 to get a percentage. To get your total utilization rate, add up all the balances and divide by the sum of all the spending limits.

| Balance | |

|---|---|

| $20,000 | 24% |

39% of Individuals with a 709 credit score have credit portfolios that include auto loans and 29% have a mortgage loan.

Shield Your Credit Score From Fraud

People with Very Good credit scores can be attractive targets for identity thieves, eager to hijack your hard-won credit history. To guard against this possibility, consider using credit-monitoring and identity theft-protection services that can detect unauthorized credit activity. Credit monitoring and identity theft protection services with credit lock features can alert you before criminals can take out bogus loans in your name.

was the most common form of identity theft , followed by employment or tax-related fraud , phone or utilities fraud , and bank fraud in 2017, according to the FTC.

You May Like: Does Paypal Affect Credit Score

How To Fix A 709 Credit Score

In summary your credit score determines your ability to borrow. Its important that you manage it. If you have 709 credit score then your focus should be on driving it higher. To do this follow these simple tips:

- Pay down your debt If you have debts but also have savings then you need to ask yourself do you need all that cash in the short term? Could it be used better if it was spent on paying down debt? This would be an excellent use of your funds in a low interest rate environment and would have the beneficial affect of moving your 709 credit score even higher.

- Get a credit report Like everything else in life mistakes can happen in any area and that includes the record of your debt repayments. Its possible to get a credit report to see if all the information that lenders have on you is correct. If it is not and there are records which indicate that you missed a payment which you never missed, or you applied for finance at an institution you have never even heard of then you need to correct that. Correcting those errors will also drive that score towards excellent.

- Avoid short term debt Before you take on short term debt do a simple mental exercise. Consider an item you wish to buy, look at the price, now ask yourself what the real price is if you use short term finance given the high interest rates that can apply. In some cases, this can mean that the item will cost you twice as much as the list price. At that price is it still something that you wish to buy?

Dealing With Negative Information Which Impacts Your 709 Credit Score

If your credit score is a negative in your life, then there are several things you can do if you want to improve it.

Firstly, you can enhance your 709 credit score by simply paying all your bills on time. Making late payments, partial payments or trying to negotiate with lenders all work to drive your score lower. To make sure you can pay your bills on time you should ensure that you have a monthly budget. Stick to it, pay your bills first and your credit score will improve over time.

In addition to paying your debts on time, taking on as little debt as possible in the first place will keep your credit score in good health. Lenders can only lend you so much. If you have a lot of debt your repayment capacity will decrease and your credit score will follow. Again, budget so you do not need to borrow.

If you do need to borrow then make sure you pay off the debt as quickly as possible. Dont just make the minimum repayment, this again will aid an increase in your credit score.

Another aspect of your 709 FICO score is one not many people know about. Every time you apply for credit that application is logged.

The more applications you make the more it looks like you cannot manage your finances and always need a constant stream of loans to meet your day to day obligations. So again, if you do need credit, only apply when your going to draw it down and make as few applications as possible.

Read Also: Does Requesting A Credit Line Increase Affect Credit Score

No Longer Above Average Even In The Pandemic

Back in 2005, a 700 score would have marked you as above the average, which was 688, according to the FICO blog. Since then, average credit scores have been trending up, but usually only a couple of points a year. From 2019 to 2020, that average score jumped eight points. The COVID-19 pandemic has made both consumers and lenders more cautious.

Scores have actually improved throughout the pandemic, says Griffin. Thus far, consumers have continued to manage their credit well. However, as economic challenges continue to grow, that may change. Its too early to tell at this point.

Banks tightened standards across all three consumer loan categoriescredit card loans, auto loans and other consumer loansover the first quarter of 2020, on net, according to an by the Federal Reserve.

Lending standards tightened considerably in 2020 and early 2021 as the pandemic made banks nervous, says Rossman. The minimum credit score required for many credit cards jumped from about 670 to 720, or even higher. Improvements on the health and economic fronts have brought lending standards more or less back to pre-COVID standards, but theres still a lot of uncertainty.

Fears about high inflation and a possible recession are once again making lenders nervous, as are rising delinquencies among subprime borrowers. And we may start to see that minimum credit score drift higher again, says Rossman.

Percent Of Credit Files That Dont Qualify For A Fico Score

The Ascent reports that data released in 2019 found 11 percent of Americans dont qualify for a FICO credit score5.

In order to qualify for a FICO score, you must have:

- At least one credit account that has been open for at least six months

- At least one account that has reported to credit bureaus within the past six months

- No deceased status on your account6

If you share a credit card or other types of credit with someone who has passed, this may account for the deceased status thats preventing you from receiving a FICO score on your credit report. Watch your credit with a credit reporting agency like Experian to report this.

Don’t Miss: How Long Does It Take To Get A Credit Score

Do Check Your Credit History

Get free copies of your credit reports from the major credit bureaus from annualcreditreport.com. These reports will give you a detailed look at your creditworthiness.

Go through your credit history carefully. Errors are common and getting them corrected can have a significant impact on your personal finances and can help you score lower rates and favorable loan terms.

How To Increase Your Credit Score

Now that you know a little bit more about credit scores, you might be motivated to increase yours. Luckily, there are many ways that you can work to improve your score. Dont be discouraged if youre unable to increase your credit score overnight. It will take some time, but it will happen with intentional steps.

Also Check: Does Cancelling Finance Affect Credit Rating

Is Your Credit Score Average For Your Age

Given that younger borrowers may not have a long history of credit to drive their credit score up, it shouldn’t be surprising that average credit scores for American borrowers improve throughout their lifetime. As borrowers mature, they also become more aware of the factors that drive credit score improvement and are motivated to increase their scores to allow home purchases and other large investments that require loans or lines of credit.

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

You May Like: Does Apple Card Show On Credit Report

Build Your Credit Mix

We generally dont recommend taking out a potentially expensive loan just to build your credit scores. But its true that having a mix of different types of credit can benefit your scores over the long term. Types of credit include revolving credit and installment credit .

But theres a wrinkle: Applying for new credit can lead to a hard inquiry on your credit reports, which can have a negative impact on your scores. While this impact is typically minor, too many hard inquiries in a short time period can be a red flag to lenders. Thats why its important to have a general sense of how likely it is that youll be approved before you apply for a credit card or loan.