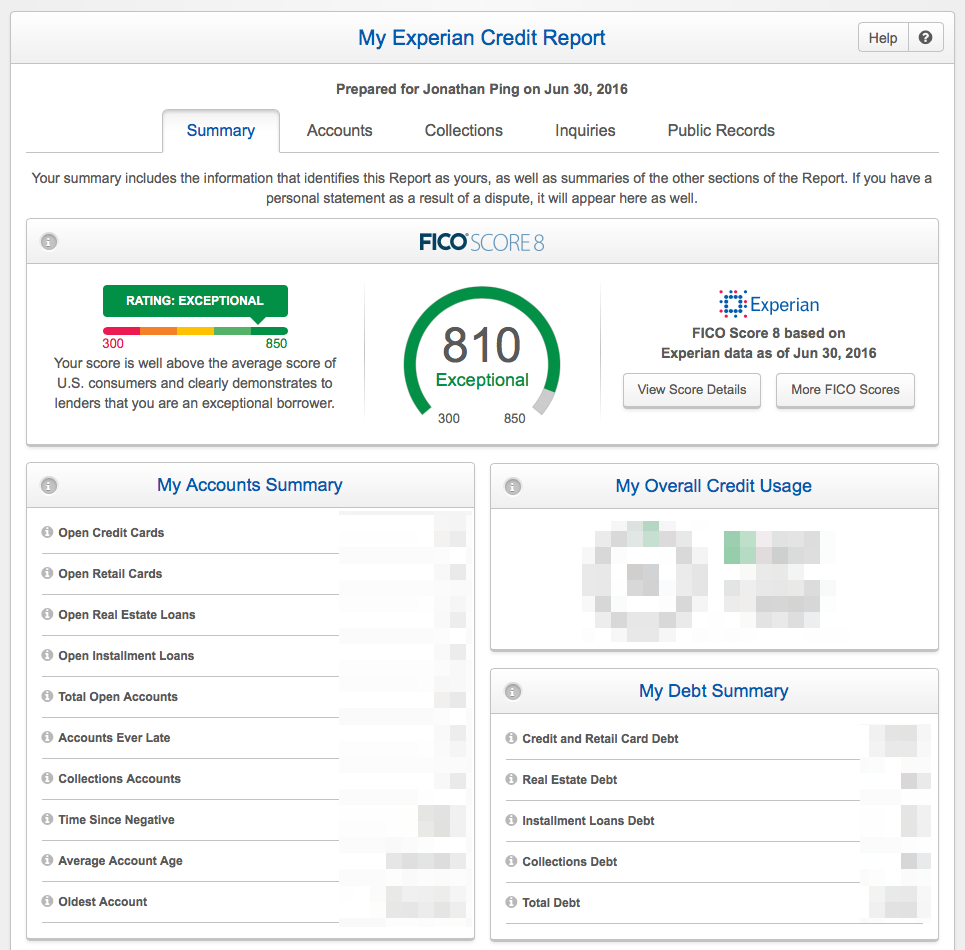

Review Your Report & Dispute Any Errors

Reading your credit report is one of the most vital steps when it comes to building credit and maintaining it. While reviewing your report, make sure your personal and account information is accurate.

Common credit reporting errors to look for include the following:

- Incorrect name or address

- Paid accounts that are listed as open

- Account balance or credit limit errors

- Accounts that dont belong to you

If you spot an error, dispute it with each credit bureau that lists it on your report or the creditor that reported it. The investigation will typically take 30 days to complete. Once its over, the credit bureau will remove the information if it finds that it is in fact an error.

Will Checking Your Credit Hurt Credit Scores

Regularly checking your credit reports and credit scores is a good way to ensure information is accurate. But can checking your credit hurt your credit scores?

Reading time: 2 minutes

Highlights:

-

Checking your credit reports or credit scores will not impact credit scores

-

Regularly checking your credit reports and credit scores is a good way to ensure information is accurate

-

Hard inquiries in response to a credit application do impact credit scores

Many people are afraid to request a copy of their credit reports or check their credit scores out of concern it may negatively impact their credit scores.

Good news: Credit scores aren’t impacted by checking your own credit reports or credit scores. In fact, regularly checking your credit reports and credit scores is an important way to ensure your personal and account information is correct, and may help detect signs of potential identity theft.

Impact of soft and hard inquiries on credit scores

When you request a copy of your credit report or check credit scores, thats known as a soft inquiry. Other types of soft inquiries result from companies that send you promotional credit card offers and existing lending account reviews by companies with whom you have an account. Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports. They are visible to you and will stay on your credit reports for 12 to 24 months, depending on the type.

Getting your credit reports

Why Should You Check Your Credit Reports Frequently

Your credit reports are updated about once a month with data the credit bureaus have received. Credit reports may contain information about your credit card accounts, loans and credit applications youâve submitted.

If you find errors in your credit file, it could mean youâve been a victim of identity theft. Any incorrect information may hurt your , which are calculated based on whatâs in your credit report. And a lower credit score might make borrowing more expensive or prevent you from getting credit. If you find an error, you may want to dispute the information.

Read Also: What Is An Inquiry Credit Report

Getting Free Credit Reports Under The Fcra

The three major credit bureaus have set up a central website and a mailing address where you can order your free annual report.

You may get your free reports at the same time or one at a time the law allows you to order one free copy of your report from each of the credit bureaus every 12 months.

To get your free reports, visit AnnualCreditReport.com. You can also complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281.

You May Like: Square Capital Credit Check

How Often Can You Get A Free Credit Report

Your credit report is one of many factors lenders review when you apply for a small business loan. Before you submit your application, youll want to ensure there arent any surprises or inaccuracies on your credit report.

How often can you get a free credit report? Find the answer to that question and more below!

Recommended Reading: Which Credit Score Is More Important

How To Order Your Free Credit Reports

One of the best ways to protect yourself from identity theft is to monitor your credit history. Now you can do that for free. Thanks to a new federal law, consumers can get one free credit report a year from each of the three national credit bureaus. Those bureaus are Equifax, Experian, and TransUnion.1 You can also get your reports for free from “specialty” credit bureaus. These companies prepare reports on your employment, insurance claims, rental and other histories.

Checking your credit reports at least once a year is a good way to discover identity theft. And the sooner identity theft is discovered, the easier it is to clear up. You can also identify errors in your credit reports that could be raising your cost of credit

How Many Free Credit Reports Can You Get Per Year

The number of credit reports you can get for free depends on where you get them from and whether youve placed a fraud alert on your credit reports.

For example, the Fair Credit Reporting Act entitles you to receive one free credit report from each major credit bureau a year. This means you can view all your credit reports for free once per year through AnnualCreditReport.com.

In addition, some credit reporting companies and personal finance websites allow you to check one or more of your reports for free. For example, if you sign up for myEquifax, you can get six free Equifax credit reports per year through 2026. Experian also allows you to view your Experian credit report for free 12 times a year.

You can also get an additional free copy of your report from each credit bureau if you suspect fraud and place a fraud alert on your credit reports. To do this, you must contact one of the credit bureaus.

If youve been a victim of identity theft and filed a report, you can get an additional six free credit reports per year, two from each credit bureau.

Don’t Miss: How Does A Landlord Report To Credit Bureau

Does Checking Your Credit Reports Hurt Your Credit

The good news is that checking your credit reports yourself doesnt hurt your credit scores.

When a lender has checked your scores , your scores may have dropped a few points. Because of this, you may be concerned that checking your own credit reports might lower your scores, too. But you dont need to worry.

When you check your scores or reports yourself, its a soft inquiry. When lenders check your credit to decide whether to give you a loan or a credit card, its generally a hard inquiry.

Soft inquiries dont negatively affect your credit score at all. These are mainly used for reasons other than underwriting for a loan, says Frank Acocella, an attorney and founder of CounselPro Lending.

Hard inquiries, on the other hand, can happen when a potential lender checks your credit, which they typically do to assess your creditworthiness. Unlike soft inquiries, hard inquiries could have a negative impact on your credit scores.

Because hard inquiries could mean youre taking on new financial obligations, multiple hard inquiries within a short period of time have the potential to lower your scores. This is because certain credit-scoring models may determine that opening multiple credit accounts in a short period of time represents a greater credit risk.

Request Credit Reports & Answer Any Security Questions

After you fill out the form, you can request your credit reports from the three major credit bureaus. Youll likely be asked to answer some security questions to verify your identity. For example, you may be asked when you were born or information about past accounts you may have owned. In addition, you may be asked to provide your phone number to receive a one-time password.

Don’t Miss: What Credit Score Does Navy Federal Require For Auto Loans

Enter Your Personal Information

Once youre on the correct website, click on the button near the top of the page or bottom left that says, Request your free credit reports. Afterward, click on the button with the same words below the line that reads, Fill out a form. Finally, complete the form by entering your name, birthdate, current address and Social Security number .

If you havent lived at your current address for at least two years, youll have to enter your previous address, too.

How Often Should You Check Your Credit Score

Your credit score is the number that reflects your credit activity. Its a simplified version of your credit report, and you can check it for free. You should check your credit score at least once per year, but its smart to check it more often if you are working hard to improve it, like in the situation of preparing to apply for a loan.

Recommended Reading: What’s The Highest Credit Score You Can Get

Free Annual Credit Report

Review your credit report often to make sure the information is accurate. If you see something on your report that you didnt do, it could mean youre the victim of identity theft.

You can get one free credit report each year from each of the three nationwide credit bureaus. The website annualcreditreport.com is your portal to your free reports.

Note: when you leave that website and move to the company website to get your free report, the company will probably try to get you to sign up for costly and unnecessary credit monitoring services.

You can also get your credit reports by phone by calling 1-877-322-8228. Under North Carolina law, credit monitoring services are required to tell you how you can get credit reports for free.

To keep track of your credit during the year, request a free report from a different credit bureau every four months. You can also pay for additional copies of your credit report at any time.

When Should You Request Your Credit Report

Its essential to check your credit report every 12 months. Ordering your free credit report wont impact your credit score, but leaving inaccuracies on your report can lower your credit score. Checking your credit report each year will inform you of any inaccuracies so you can proactively take action.

There are special circumstances that may allow you to get additional credit reports for free. Here are a few situations that would qualify:

You May Like: What Is The Most Important Credit Score

Generate Your Report Online

Once you access your credit reports, download them to your computer or print them before you exit out of the window for later review.

If you have trouble requesting an online copy of your credit reports, you can also request to receive a free copy by mail or phone. To receive a free copy by mail, fill out the mail request form and send it to this address:

Annual Credit Report Request ServiceP.O. Box 105281

The form asks you the same questions as the online form.

If you prefer calling instead, dial 877-322-8228.

Do You Have To Pay To Check Your Credit Score

Under the Fair Credit Reporting Act companies are legally allowed to charge you to view your credit score. However, there are many ways to view your score without paying a fee.

For example, several credit card companies have started offering this service for free to their customers. With credit reports, youre entitled to a free one every 12 months. If youd like to get additional credit reports from these bureaus, you can request them, but they may charge up to $12.50 for each one.

You May Like: Does Removing Hard Inquiries Increase Credit Score

Monitor Your Credit For Free

Join the millions using CreditWise from Capital One.

Will Checking My Scores Hurt My Credit?

Checking your scores wonât affect your credit, as long as the service uses a soft inquiryâlike CreditWise does. That means you can check your credit as many times as you want without hurting your scores.

According to Experian, you should do a credit check once a year to keep an eye on your credit score range and check to make sure the information in your credit report is accurate. If you find inaccurate information, you may file a dispute with the credit bureau where you found itâor directly with the lender.

How Often To Review Your Credit Report

As a minimum you should be checking your credit report once per year. This seems to be almost a forgot thing to do by the majority of consumers. It is usually done right before applying for a mortgage or a job.

This can almost be too late. For example if you have a . These are going to take at least 30 to 45 days to be disputed and possibly removed from your credit report. If they are not removed, you then have to contact your account to dispute the item and hopefully have them remove it. This will take even more time.

A more aggressive approach is to check you credit report every six months. I know that you get just one free one per year, but shows your financial fitness. You need to protect it.

If you just want to sleep at night not thinking about checking your credit report every 6 months you could sign up for a credit monitoring program. They do cost money, but not as much as you think. The best bang for your buck is the MyFICO quarterly monitoring.

So lets compare this to a 3in1 credit report that you would normally get which costs 39.95. This is every single one you get costs this much. With MyFICO quarterly monitoring it costs $49.95 per year. That is just $10 more. What you get will quarterly monitoring is a lot. First, you get to review your credit report every quarter. You will also get your FICO score every quarter. Plus you will get $25,000 in identity theft insurance.

Also Check: Which Credit Score Is Used To Buy A House

Does Checking My Credit Report Hurt My Credit

No, checking your credit report does not hurt your credit. And checking your credit score doesn’t hurt your credit either. These actions are considered “soft pulls” which don’t affect your credit score. Actions, such as applying for a credit card, which require a “hard pull,” temporarily ding your credit score.

Learn more: Check your odds of getting approved for a credit card without hurting your credit score.

How Do I Get A Copy Of My Credit Reports

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies . You can request a copy from AnnualCreditReport.com.

You can request and review your free report through one of the following ways:

- Mail: Download and complete the Annual Credit Report Request form. Mail the completed form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

You can request all three reports at once or you can order one report at a time. By requesting the reports separately you can monitor your credit report throughout the year. Once youve received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $13.50 for a credit report.

You are also eligible for reports fromspecialty consumer reporting companies. We put together a list of several of these companies so you can see which ones might be important to you. You have to request the reports individually from each of these companies. Many of the companies in this list will provide a report for free every 12 months. Other companies may charge you a fee for your report.

You can get additional free reports if any of the following apply to you:

Recommended Reading: How Often Is Credit Report Updated

When Not To Check Your Credit Score

Theres really no wrong time to check your credit score. However, if youre checking it because youre in the process of improving your credit, checking it too often may leave you feeling defeated. It can take time to repair your credit and to see improvements.

If youre checking it too often and getting discouraged by the results, it might be a good idea to stop checking in so frequently. Youll still want to check your report regularly to make sure there are no errors, but remember to give yourself some time to let your score improve.

Whats On Your Credit Report

Now that you have your credit report, youll need to know whats included and what you should review. Your credit report is a summary of all your credit-related activity. Every time you have a new credit inquiry, open or close an account, or miss a payment thats reported to a bureau, it will show up on your credit report.

You May Like: Is 604 A Good Credit Score

Which Credit Report Is Most Accurate

No one credit report is innately more accurate than the others. Your TransUnion credit report might contain information that your Equifax credit report doesnt, or vice versa.

This is partly because lenders are not required to report your information to all three credit bureaus. In some cases, they may only report to one bureau and not the others, or they may report information at different times.

In any case, its a good idea to review your credit reports on a regular basis so that you can be sure any discrepancies are minor.

Ready to help your credit go the distance? Log in or create an account to get started.

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days

- online at AnnualCreditReport.com youll get access immediately

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request

It may take longer to get your report if the credit bureau needs more information to verify your identity.

Also Check: How To Update Your Credit Report