How Can You Maintain A Good Credit Score

A good credit score comes with responsible credit behaviour. Here are some of the factors which will help you in maintaining a good credit score:

- Consistent Repayment: Credit score calculations lay nearly 35% weightage on your payment history. If you want to maintain a good credit score all the time, your repayment record should be 100% positive. For this, you must ensure to never miss a repayment.

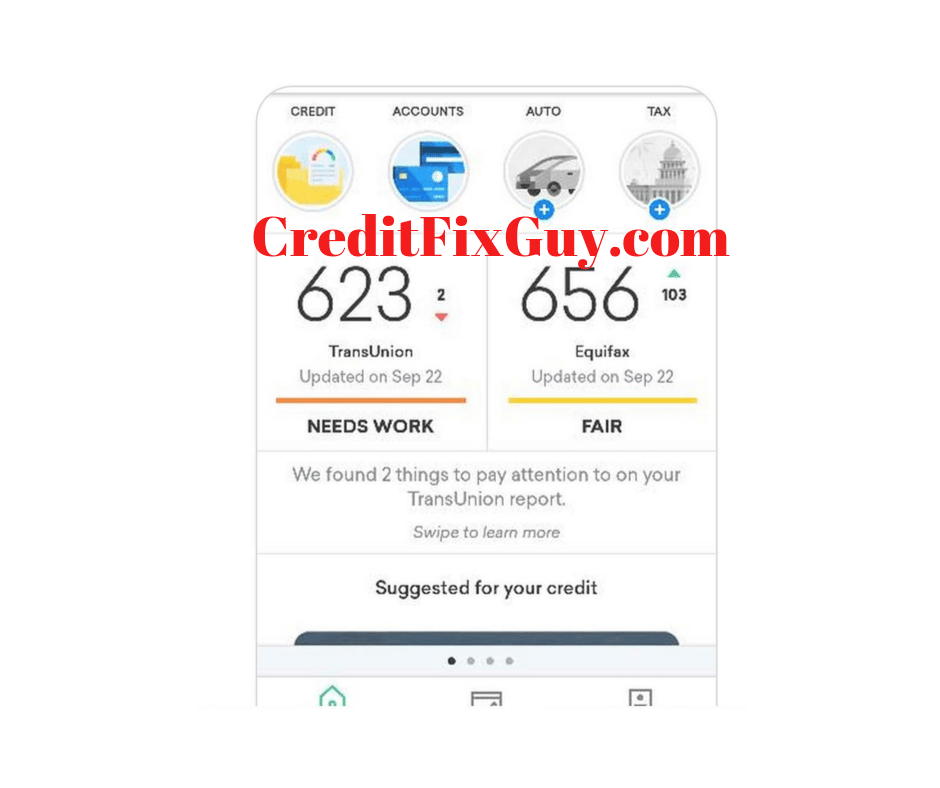

Understanding Credit Score Ranges

The credit score you see if youre signed up for TransUnion Credit Monitoring or if you purchased a credit score with your credit report is based on the VantageScore® 3.0 model. Scores in this model range from 300 to 850. A good score with TransUnion and VantageScore® 3.0 is between 720 and 780. As your score climbs through and above this range, you can benefit from the increased freedom and flexibility healthy credit brings. Some people want to achieve a score of 850, the highest credit score possible. Having this perfect score may feel like a win, but it isnt necessary to enjoy the benefits of strong credit.

In TransUnion Credit Monitoring, you may also see a letter grade with your credit score. For VantageScore® 3.0, an A score is in the range of 781850, while a B score is 720780. A score of 658719 is labeled a C. Think of these rankings and ranges as guides, not hard-and-fast rules for what good credit is. You can use them to help stay on the right track, but they dont necessarily indicate if you will or wont be approved for credit.

Think of these rankings and ranges as guides, not hard and fast rules for what good credit is.

What Are The Benefits Of A Good Credit Score

Making timely repayments of loans and credit card bills can fetch you a good credit score. This has numerous benefits. Here, we have listed some of the major benefits of a good credit score:

1. Low-Interest Rates on All Types of Loans

This is a major benefit when it comes to having a good credit score. Everyone aims to maintain good credit so that loans can be availed at low-interest rates. This can further help in paying off loans faster and reduces a significant amount of financial burden. Even a slight reduction in big-ticket loans such as home loan, loan against property, etc., can save you a lot of money in the long run.

2. Improved Approval Chances for Loans and Credit Card

Every lender first goes through your credit score and reports as soon as you apply for a loan or credit card. This is called a hard enquiry and it can also impact your credit score. The impact can hurt your credit score in case the application gets rejected. However, with a good credit score, the credit approval chances are higher since lenders will not have a strong reason to reject your application.

3. Higher Credit Limits

4. More Negotiating Power

Read Also: What Should Your Credit Score Be To Rent An Apartment

What Does A Credit Score Of 800 Mean

Youre still well above the average consumer if you have an 800 credit score. The average credit score is 704 points. If you have a credit score of 800, it means that youve spent a lot of time building your score and managing your payments well. Most lenders consider an 800 score to be in the exceptional range.

If you have a score of 800 points, you should be proud of yourself. You wont have any trouble finding a mortgage loan or opening a new credit card with a score that high. Here are some things your 800 FICO® Score says about you:

An 800 credit score isnt just good for bragging rights. Some of the benefits youll enjoy when you have a higher score include:

Can You Pay Off Your Balance Each Month

Never apply for a loan or credit if you dont first believe that you can afford to pay off the balance at the end of each month. This may sound obvious, but youd be surprised at how many people apply for credit or loans without asking themselves this question.

Ask yourself how you will use the credit card. Will you carry a balance, or can you indeed pay it off each month? Will you pay it off some months and not in others?

Roughly three fifths of all Americans who possess a credit card have a balance on that card. Despite this, you may want to pay off your balance at the end of each month so you can definitively avoid additional interest charges.

Don’t Miss: Does Pre Qualify Affect Credit Score

Youll Qualify For Lower Interest Rates And Higher Credit Limits

With an 800-plus credit score, you are considered very likely to repay your debts, so lenders can offer you better deals. This is true whether youre getting a mortgage, an auto loan, or trying to score a better interest rate on your credit card.

In general, youll automatically be offered better terms on a mortgage or car loan if you have an exceptional credit score . If you have an existing loan, you might be able to refinance at a better rate now that you have a high credit score. Like any refi, crunch the numbers first to make sure the move makes financial sense.

Credit cards are different, and you might have to ask to get a better deal, especially if youve had the card for a while. If your credit score recently hit the 800-plus rangeor if youve never taken a close look at your terms beforecall your existing credit issuers, let them know your credit score, and ask if they can drop the interest rate or increase your credit line. Even if you dont need a higher limit, it can make it easier to maintain a good .

Monitor And Manage Your Exceptional Credit Score

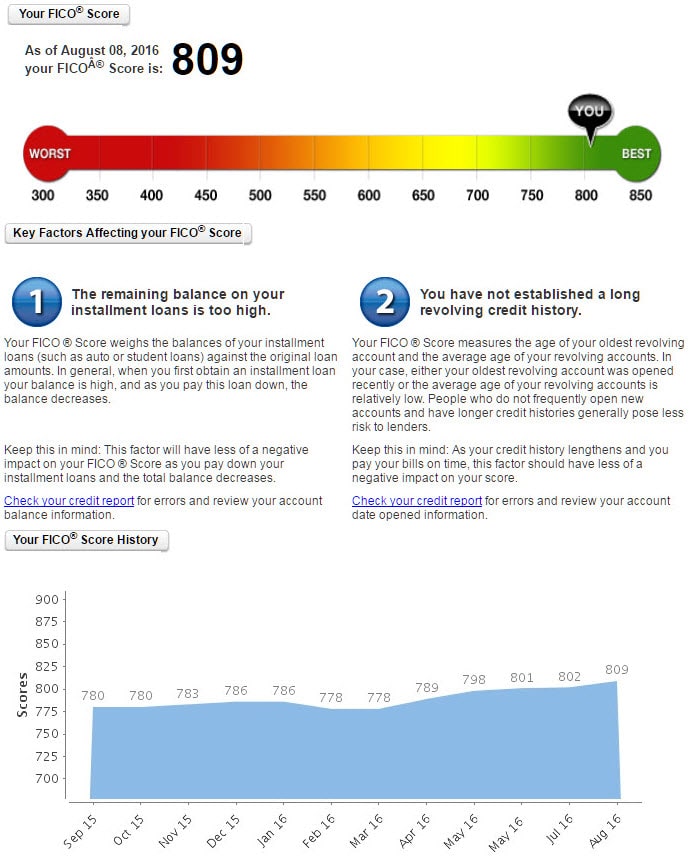

A FICO® Score of 809 is an accomplishment built up over time. It takes discipline and consistency to build up an Exceptional credit score. Additional care and attention can help you keep hang on to it.

Whether instinctively or on purpose, you’re doing a remarkable job navigating the factors that determine credit scores:

Utilization rate on revolving credit. Utilization, or usage rate, is a measure of how close you are to maxing out credit card accounts. You can calculate it for each of your credit card accounts by dividing the outstanding balance by the card’s borrowing limit, and then multiplying by 100 to get a percentage. You can also figure your total utilization rate by dividing the sum of all your card balances by the sum of all their spending limits .

| Balance | |

|---|---|

| $20,000 | 26% |

If you keep your utilization rates at or below 30% on all accounts in total and on each individual accountmost experts agree you’ll avoid lowering your credit scores. Letting utilization creep higher will depress your score, and approaching 100% can seriously drive down your credit score. Utilization rate is responsible for nearly one-third of your credit score.

Time is on your side. Length of credit history is responsible for as much as 15% of your credit score.If all other score influences hold constant, a longer credit history will yield a higher credit score than a shorter one.

Recommended Reading: When Buying A Car What Credit Score Is Used

What Percentage Of The Population Has A Credit Score Over 800

Most lenders use the FICO® Score when they need to run your credit. The FICO® scoring system assigns everyone a credit score between 300 and 850 points. Your payment history, rate of credit usage and length of account activity all play significant roles in your FICO® Score calculation.

The average credit score in the United States has steadily risen since 2009. Today, about 21.8% of consumers have a FICO® Score over 800 points, according to Experian. In 2009, only about 18.2% of the population held a credit score greater than 800. The average credit score in the United States hit 704 in 2018, which is the highest its ever been.

Experts believe that increased consumer awareness and education is helping consumers understand the importance of managing credit well. The number of consumers with a credit application fell from 43.7% in 2014 to 42.2% in 2018. This means that fewer people have applied for credit than in previous years. Consumers also miss fewer payments now than in years past. In 2018, 23% of consumers had an account open with a debt collection agency for a past-due account. This number is 5.7% lower than when past-due accounts spiked in 2014.

Who Has The Best Auto Loan Rates Credit Unions Banks Or Online Lenders

Trying to figure out who has the best auto loan rates can feel like an impossible task.

It is natural to want to use your local Credit Union or Bank because you feel loyalty to the financial institution that you trust with your monthly banking needs.

In some instances, going directly through your Credit Union or Bank can be your best bet. Your bank or credit union knows your finances and may consider information other than your credit score when they make an offer.

However, local Credit Unions and Banks may be limited in the loan programs they can offer. They may not be able to compete with the lowest online auto loan rates.

You also have to consider the time it takes to go to your local financial institution to obtain a quote for an auto loan. Online lenders may give you a quote in seconds.

Be Careful!Be careful if you get an auto loan from a Credit Union or Bank that you have a checking, savings, or CD account with. Some financial institutions require you to sign a document allowing them to take payment without your permission if you do not pay.

In comparison, you can obtain four loan offers within two minutes of filling out a short, one-page application with Auto Credit Express®.

Even if you decide to see what your bank or credit union has to offer, getting an online lender quote is free and takes next to no time.

Purchasing a car can be a stressful endeavor because of all the decisions you must make with that helpful high-pressure car salesman stuck to your hip.

Read Also: How To Read A Transunion Credit Report

Staying Out Of Subprime

Bruce McClary, vice president of communications at the National Foundation for Credit Counseling, says that a subprime FICO scoreat which a borrower is offered no credit or very expensive creditis similar to Experian’s range, with “good” starting at 660 or 670.

“Certainly if someone’s score dips below 600 on the FICO scale, thats a critical situation,” says McClary. “Many lenders wont lend to you, and those who will are going to offer you credit at the highest possible cost or interest rate.”

With a FICO score of under 600, you might be able to get a or subprime bank loancalled a signature loanbut it could charge up to 36 percent interest, the highest allowable by law, McClary says.

Katie Ross, education and development manager for the Boston-based American Consumer Credit Counseling, a nonprofit that offers guidance to consumers nationwide on budgeting, credit, debt, and related issues, plants the boundary between fair and good at 600. “What matters most is that you manage your credit so that it’s above the fair credit score range,” she says.

Points To Keep In Mind While Clearing Your Past Dues

- No Due Certificate: After paying your outstanding dues in full to the lender, obtain a No Due Certificate. This is the proof and indication that you have closed the loan completely.

- Incorrect Closure of Credit Card: Some agencies or the credit card issuer might offer you a discount on closing the outstanding dues on your credit card. Lured by the offer, you might tend to settle for 80% or 90% of the amount to be paid. However, this is not a complete closure. The discount will not be taken into consideration by the bureaus and eventually, you remain with bad credit. Hence, make a complete closure to clear your negative status completely.

- Removing negative issues from your credit report does not mean it will improve your credit score, it can only prevent a further drop. You should have a loan or credit card account active to get an improved credit score over a period.

- Becoming credit healthy does not happen in a day. You will have to be patient as there is a certain procedure followed across all banks and credit bureaus.

- Get your credit report and look for any errors on it. By raising a dispute resolution with the lender and credit bureau, you can get the errors removed.

Was this helpful?

- Check your credit score frequently

- Use a credit card to have lengthy credit history

15. What is the difference between a credit report and credit score?

16. How long will it take to improve your credit score?

17. Can I get a loan or credit card with a credit score of 500?

Don’t Miss: Does Debt Consolidation Show Up On Credit Report

Check If You Linked Your Account To Others

People link their cards with friends and family. Linking to an individual who has a bad credit score harms your financial record. It is necessary to cut off links with people who might bring your credit down. Before embarking on such a mission, ensure that the person you are connecting to has a consistent record.

Linking your account to people with a bad credit score severely affects your financial records. The individual linked to you on the other hand benefits. It is important to make sure your account is not linked to people who may harm your credit score. Regular checks on your records are advised.

Dont Cancel Old Cards

Some credit card holders think that they should cancel their old credit cards to get that last push toward a perfect score. After all, more cards mean more opportunities to overspend right?

The truth is that closing old lines of credit can harm your credit score. When you close a credit line, you give yourself access to less credit and automatically raise your utilization. For example, imagine that you have a couple of credit cards and they each have a $1,000 limit. You put $300 on one card each month your total utilization is 15% . You dont use one of the cards at all, so you decide to close it. Even if you still spend $300 a month, your utilization is now 30% because you only have $1,000 of available credit.

Is a certain card tempting you to overspend? Keep it in a locked safe or desk drawer instead of closing it to maintain your score.

Don’t Miss: Does A Late Payment Affect My Credit Rating

Mortgages You Can Get With An 809 Credit Score

Youre eligible for any type of standard mortgage if you have a credit score of 809. The following are all the mortgages you can get:

- FHA loan: Your credit score qualifies you for maximum financing on a mortgage backed by the Federal Housing Administration .

- Conventional mortgage: Youll meet the credit requirements for any conventional mortgage because your credit score is well above 620, which is the minimum score required by the Federal National Mortgage Association and Federal Home Loan Mortgage Corporation . 89

- VA loan: The US Department of Veteran Affairs backs VA home loans, and youll be eligible as long as youre a member of the military or a family member of someone who is.

- USDA loan: As long as you have two tradelines that have been open for 12 months in the past two years, youll meet the credit requirements for a USDA loan. 10

- Jumbo loan: Compared with conventional conforming mortgages, jumbo mortgages are larger, and they exceed the maximum value that Fannie Mae and Freddie Mac will accept when buying mortgages from lenders. Because jumbo mortgages come with a higher risk, lenders will only consider giving you one if your credit score is very good.

How To Raise Your Credit Score:

1. Correct errors, and track your report for future errors. Order your credit file from each bureau at least once per year.

2. Lower your balances. If your debt levels are above 50% of your available limit, create a payment plan to reduce your balances.

3. The biggest tip to having a good credit rating and a high credit score is to continually use credit and to repay that credit on time all the time. Set up automated payments to help with this.

4. If you have no credit history, or need to rebuild your credit, open a secured credit card account. You pay a deposit, which sets the limit of your card, then use it like a regular credit card. The secured credit card provider reports your payment habits to the credit bureau, so you will be able to gain points with an account in good standing. Choose from a Home Trust Secured VISA.

5. Look over our list, read your credit report, and identify any areas that could be improved for a higher credit rating.

Remember, your credit rating is not a reflection of your personal worth it is merely a credit reporting tool Margaret H. Johnson. The good news is your credit rating is like your self-esteem, sometimes in your life it will be high and sometimes it will be low however, you can always rebuild it over time!

Recommended Reading: What Happens To Your Credit Score When You Get Married

Auto Refinance Rates With 800 To 809 Credit Score

You can qualify to refinance with a 800 to 809 credit score!

If you had a lower credit score when you took out your car loan or if you financed your car through a dealer and didnt get a great deal, you could save money by refinancing.

Refinancing may be able to lower your monthly payment and put that extra saved interest right into your pocket.

If you refinance with a longer-term loan you could lower your monthly payment considerably. You will pay more in interest and you may end up owing more than your car is worth.

If youre considering refinancing, check your loan agreement first. Some loans have prepayment penalties that make refinancing less desirable.