What A Credit Bureau Is

are companies that collect consumer credit information. The information is compiled into a credit file or credit history and calculated into a credit score. The information is sold to creditors like banks, credit card companies, landlords, and employers. The information is used to decide if youre a reasonable risk and should be offered a loan, credit card, apartment, or job.

Where Can You Check Your Equifax And Transunion Credit Score

As mentioned in a previous post, checking both your Equifax and Transunion score is a good idea, especially if youre applying for credit in the near future. These options are both free now, they didnt used to be.

In my post about whether the credit score gets lowered when you check your credit, I list other options or places to check your credit score for free, such as through the big bank online banking portals.

To check your Equifax credit score, you can check it for free using Borrowell.

To check your Transunion credit score, you can check it for free using .

You can check your credit score for free now because these credit score agencies provide some recommendations to you in the form of financial products and thats how they make money.

Personally, I dont find these suggestions annoying as I tend to just unsubscribe from their emails anyways and just check my score as needed on an occasional basis .

Related Post: Borrowell vs Credit Karma: Which One is Better?

How To Get Your Equifax Credit Score For Free

Like Experian, Equifax offers a free 30-day trial of its full credit monitoring service. It costs £7.95 a month after the free trial.

Alternatively, you can get your Equifax report and score free through ClearScore.

The company makes its money from commission on products you take out via its website.

Don’t Miss: How To Get Hospital Bills Off Your Credit Report

Why Does Transunion And Equifax Different

The credit bureaus may have different information. And a lender may report updates to different bureaus at different times. So, it’s possible that Equifax and TransUnion could have different credit information on your reports, which could lead to your TransUnion score differing from your Equifax score.

Do Lenders Look At Equifax Or Transunion

- Post published:August 21, 2019

- Post category:Loans

Our for a loan? Wondering whether you’ll get approved? You’re probably trying to find out more about the decision making the process at hand, including the question of whether or not lenders look at Equifax or Transunion to get more information. That’s what we set out to explore in this post – and we bring you some answers.

Surprisingly, most lenders don’t directly use the scores from the three major credit reporting agencies when considering a loan because these scores are classified as educational that’s to say, they’re meant to educate consumers on the health of their credit and what they must do to improve it. In reality, lenders use actual FICO, or Fair Isaac Corporation, scores to help determine who gets a loan and who doesn’t.

FICO scores, however, are generated by the information reported by all three major reporting agencies that include TransUnion, Equifax, and Experian. So indirectly, your FICO score is still impacted by the information that’s available on you at these agencies, although it’s not an either/or situation. Rather, it’s a blend of all the credit information that’s associated with you. If you score high on the FICO scale, lenders will be eager to write loans. If you score low, not so much.

What information, exactly, does FICO harvest in generating your credit score?

Recommended Reading: How To Build Credit Score Quickly

Why Arent The Credit Scores The Same

Even if two CRAs show the same details about the same debts, they may calculate a different credit score for you. This is the bit people find most difficult. A few examples from readers:

- TransUnion gave me 2/5 with a default, then 1/5 when it was satisfied. Experian gave me a fantastic score 996/999 and ClearScore middle of the range but above the national average.

- With Equifax I have a poor score so below average and Experian an excellent score which is slightly confusing as they appear to have the exact same information.

- My scores with Experian, TransUnion and Equifax currently are 987,608 and 376 respectively, translating as excellent, good and OK.

So which is best? The answer is that you shouldnt think that any of them is the right score.

Lenders dont use the CRA scores at all they use their own systems to assess the details of your credit history.

A lender that is lending large amounts at a very good rate is likely to be much fussier than your average store card. And a bad credit lender may not care if you have a few missed payments a few years ago, but a mortgage lender may well reject your application.

And comparing the scores is further complicated by the fact that the CRAs have different score ranges:

- TrabnsUnion 0-710.

How To Check Your Credit Score For Free In Canada

If you want to obtain your credit score directly from TransUnion and/or Equifax, be prepared to pay around a $20 fee.

However, you dont have to pay any money at all! Borrowell , , and Mogo offer free and updated monthly credit scores to Canadians.

These companies make money when you apply for a credit card or personal loan recommendations through their website.

The credit score service is absolutely free.

My experience with Credit Karma is similar, and you can simply unsubscribe from receiving email updates and log in to your account only when needed.

The monthly score updates make it easy to monitor your credit for any potential problems, e.g. identity theft or fraud.

If you notice an odd drop in your credit score, you can quickly check your credit report to see whether someone opened a credit card in your name or if there has been a credit inquiry on your account that was initiated by you, for example.

Heres how you can dispute errors on your credit report.

Equifax: Order by phone at 1-800-465-7166 or download the request from their website and mail it to National Consumer Relations, P.O.Box 190, Station Jean-Talon, Montreal, Quebec H1S 2Z2 or by fax to 514-355-8502.

TransUnion: Access a copy online or copy their form and mail it to TransUnion Consumer Relations Dept., 3115 Harvester Road, Suite 201, Burlington, Ontario, ON L7L 3N8.

Recommended Reading: Is 791 A Good Credit Score

What Is A Consumer Credit

All agencies basically do a similar thing. They use public records and other sources to generate a credit report and score so lenders can use it to help gauge the risk in lending people credit. The first thing to know is each credit bureau creates its own proprietary report, but no single agency is more important than another.

The big three consumer credit bureaus most people are familiar with include TransUnion, Equifax, and Experian. But in reality, nearly 50 companies appear on the Consumer Financial Protection Bureaus list of consumer reporting companies. Probably the two biggest ones that get the most attention are TransUnion and Equifax.

Transunion Vs Equifax Credit Scores: Why The Difference Between Scores

I must admit, Im a terrible personal finance blogger because had never checked my credit score until a few months ago. Knowing your credit score is part of being able to manage your money in Canada. I remember knowing my credit score when I first applied for a mortgage a few years ago but never checked it again because I always thought that it cost money to check your credit score. Enter Transunion vs Equifax, they helped changed my personal finance life! In this post I will explain the difference between Transunion vs Equifax, and why are my Transunion and Equifax scores so different?

This post may contain affiliate links. Please see genymoney.cas disclaimer for more information.

I also didnt know there were two different credit bureaus and I didnt know there was a difference between the scores! So recently, I checked both my Equifax and Transunion scores.

There was a big difference between Transunion and Equifax.

I have always wondered why there was a difference between Transunion and Equifax scores.

Read Also: What Is Informative Research On My Credit Report

Transunion Vs Equifax Credit Scores: Why The Difference

Why are your TransUnion and Equifax credit scores different?

If you routinely vet your credit report and track your credit scores from the two main credit bureaus , you may have noticed that they can be a bit different.

If your credit score is poor, it means you are not good with other peoples money, and you will either not qualify for credit or will be required to pay more in interest charges for credit.

Equifax and TransUnion have their custom in-house algorithms for calculating your credit score, which may result in one score differing from the other.

In general, a good in Canada is 650 and above. You can assess where you stand as per below:

- 800 900: Excellent credit score

- 720 799: Very good

- 600 649: Fair

- 300 599: Poor

I paid to view my credit score once in 2015 when we started thinking about buying a home, and I wasnt 100% sure what my credit looked like. Since then, I have viewed my score multiple times for FREE through Borrowell and Credit Karma.

These 2 companies provide monthly updates that make it easy to monitor my credit profile and prevent identity fraud or theft.

This TransUnion vs Equifax comparison covers why your credit score from both financial institutions may be different.

Equifax Vs Transunion Score

As you plan your financial future, youll come to realize the importance of credit. Your credit is what many banks and credit card companies use to determine whether or not to offer you a loan or line of credit. Your credit score is made up of many factors, including the length of your credit history, the standing of your current and past credit accounts and the amount of available credit you have. Three different reporting companies compile your credit information. These companies assign you individual scores, which can vary.

Tips

-

Equifax and TransUnion differ in how far they go back in your credit history, how they weigh accounts and how they present your information. The credit scores also can differ in their calculations depending on how up-to-date and accurate each bureau’s information is.

You May Like: Is 760 A Good Credit Score

How To Get Your Transunion Credit Score For Free

You can access your TransUnion report and score for free via its service. This also advertises loans and cards you are likely to be accepted for.

Signing up to a free trial with CheckMyFile will give you access to all the information held on you by TransUnion, Experian and Equifax for 30 days.

After this, youll have to pay £14.99 a month to keep the service.

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Also Check: Will Being In My Overdraft Affect My Credit Rating

How Do I Check My Credit Score

Both Equifax and Transunion are required to offer Canadians a free credit report upon request, once per year. Requests can be ordered by phone or by downloading a request form and mailing it in. You can choose to pay the bureaus for regular monthly online reporting, but there is a way to get monthly reporting, and an updated credit score, for free.

What Is A Good Transunion Credit Score What Is A Bad Transunion Credit Score

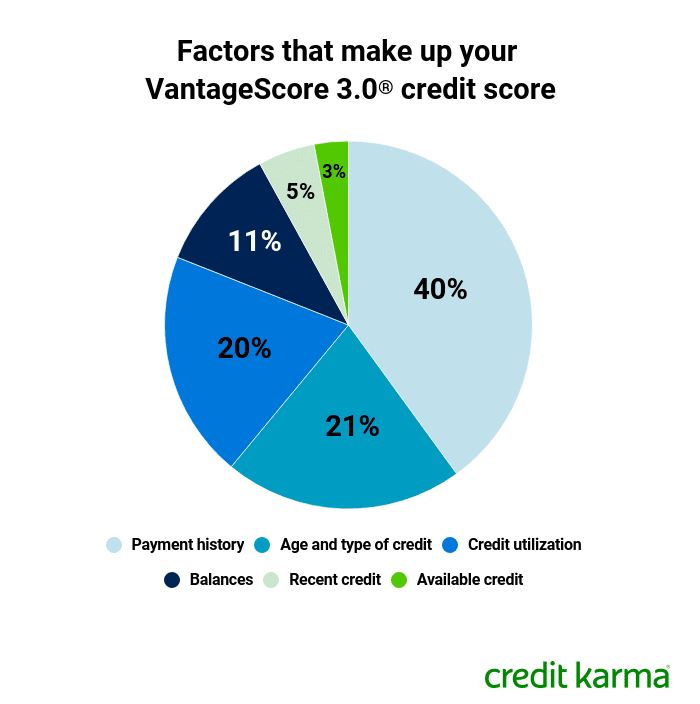

TransUnion uses something called VantageScore 3.0 to help determine individual scores. These scores are based on an alphabetic categorization:

While your credit score is never the single, determining factor in whether you’re able to secure a loan, it plays a huge roll that can’t be underestimated. The health of your credit is important, but even if you’ve had issues in the past, there are multiple things you can do to help repair and rebuild a low credit score:

Not enough emphasis can be placed on taking good care of your credit. It’s not a lesson taught in schools, yet it’s one of the most basic ways to get ahead, and to stay ahead, financially. If your credit score is lower than you’d like it to be, use the tips listed above to help you raise it back up to excellent.

Recommended Reading: Can You Have A Credit Score Without A Credit Card

What Is A Credit Score

Your credit score is a three-digit number that indicates how reliable you are at borrowing and repaying money.

The rating is calculated using a points system based on the information in your which can reveal how you’ve managed your debts and bills in the past.

There’s no such thing as a universal credit score. Each lender has its own system in place to decide whether or not to accept you as a customer, meaning you could be turned down by one, but successful with another.

How Does Your Credit Score Compare

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency uses a different numerical scale to determine your credit score which means each CRA will give you a different credit score. However, youll probably fall into one category with all the agencies, since they all base their rating on your financial history.

|

628-710 |

A fair, good or excellent Experian Credit Score

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent .

A fair, good or excellent TransUnion Credit Score

TransUnion is the UKs second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent .

A fair, good or excellent Equifax Credit Score

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent .

To get a peek at the other possible credit scores, you can go to ‘What is a bad credit score‘.

You May Like: What Does High Risk Fraud Alert Mean On Credit Report

Transunion Canada Vs Equifax Canada Credit Scores

Earlier, I mentioned that I signed up with Borrowell and Credit Karma to receive monthly updates of my credit score and report. Why did I sign up for both of them?

I did so because Borrowell gives me an Equifax credit score and report while Credit Karma supplies me with a TransUnion credit score and report.

The credit scores from these two main credit bureaus in Canada can be significantly different, and I want to see both.

How To Get Your Experian Credit Score For Free

The largest credit reference agency offers new customers a free 30-day trial of its , which gives you access to your credit report, score, and email alerts about any changes on your file.

After the trial ends, it will cost you £14.99 a month.

You can access your Experian credit score through a free Experian account. This is designed to help people shop around to see how they can save money by comparing credit deals based on their financial profile.

Once you’ve signed up, your score will remain free to access, but unlike the paid-for CreditExpert service, you won’t be able to see your credit report.

To be able to access both your Experian credit report and score for free, you can sign up to the Money Saving Expert Credit Club.

You can also see how likely you are to be accepted for the market-leading cards and loans and work out how much you can afford to borrow.

Unlike CreditExpert, you won’t receive alerts about any changes to your report.

Also Check: What Credit Score Is Needed To Refinance A House

Other Differences To Recognize

In addition to differences between VantageScore and FICO credit score calculations, each major player in the consumer credit scoring market has had several versions designed and implemented over the years. FICO has developed no less than 56 versions of its credit score one for each of the three major credit bureaus along with one for each specific industry that may use it.

For instance, auto loan lenders have an Auto Score available from FICO that uses the same credit information to determine specific risk factors a borrower may show as it relates to defaulting on a new car loan. The same is true for credit card issuers , mortgage lenders, and general credit inquiries.

While VantageScore does not have as many iterations of its credit scoring model, there are at least two versions still in use today by consumers and some lenders. The differences between these credit scoring versions might be subtle, but the details used to calculate an individuals credit score are varied enough to create multiple scores for a single person at any given time.

Address:80 River St., STE #3C-2, Hoboken, NJ,07030