Report The Fraud To The Three Major Credit Bureaus

You can report the identity theft to all three of the major credit bureaus by calling any one of the toll-free fraud numbers below. You will reach an automated telephone system and you will not be able to speak to anyone at this time. The system will ask you to enter your Social Security number and other information to identify yourself. The automated system allows you to flag your file with a fraud alert at all three bureaus. This helps stop a thief from opening new accounts in your name. The alert stays on for 90 days. Each of the credit bureaus will send you a letter confirming your fraud alert and giving instructions on how to get a copy of your credit report. As a victim of identity theft, you will not be charged for these reports. Each report you receive will contain a telephone number you can call to speak to someone in the credit bureaus fraud department.

Experian 1-888-397-3742

How Do I Remove Negative Items From My Credit Report

To recap the material already presented, you have several ways to legally remove negative credit report items:

- Dispute erroneous items on your credit reports by doing the work yourself.

- Hire a credit repair service to dispute inaccurate items on your behalf.

- Send a goodwill request.

- Send a pay for removal request.

- Wait for items to age off your reports.

The last item, waiting for bad items to age away, is the easiest method, as you dont have to lift a finger for it to work. The downside is that it may take several years to bear fruit.

You can initiate credit repair yourself without the expense, although youll have to devote some time to the process. Alternatively, you can pay credit repair companies to do the job for you.

are better positioned, have superior knowledge, and can usually complete the job for under $1,000, sometimes considerably less.

How Long Does A Debt Settlement Stay On Your Credit Report

A debt settlement will remain on your credit report for seven years from the original delinquency debt, or longer if you cannot effectively make timely settlement payments. If you settled your debt five years ago, you would have to wait for the seven years to be completed.

It is crucial to note that the credit report presents a history of managing your credit accounts. When a debt is paid off and an account is closed, the lender updates the report’s new payment status. However, paying off an account and closing it does not change its status on the report immediately.

Recommended Reading: R9 Credit Score

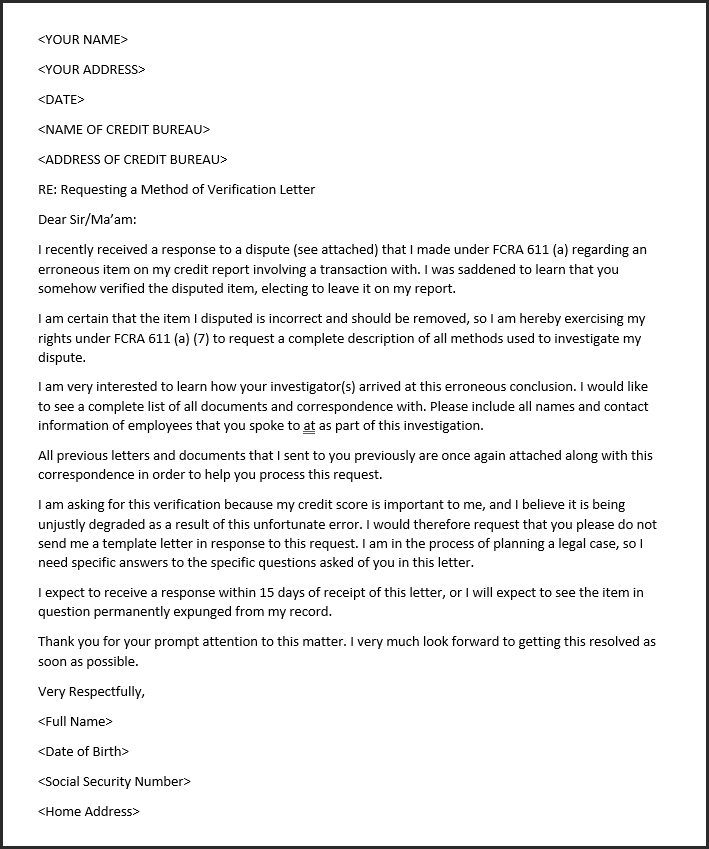

File A Dispute Directly With The Creditor

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Once it receives a dispute, a lender is also required to investigate and respond to all disputes that might impact your score.

Remember to include as much documentation as possible to support your claim. It’s also helpful to include a copy of your report marking the error.

The address you should mail the letter to is usually listed on your report, under the negative item you’d like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file.

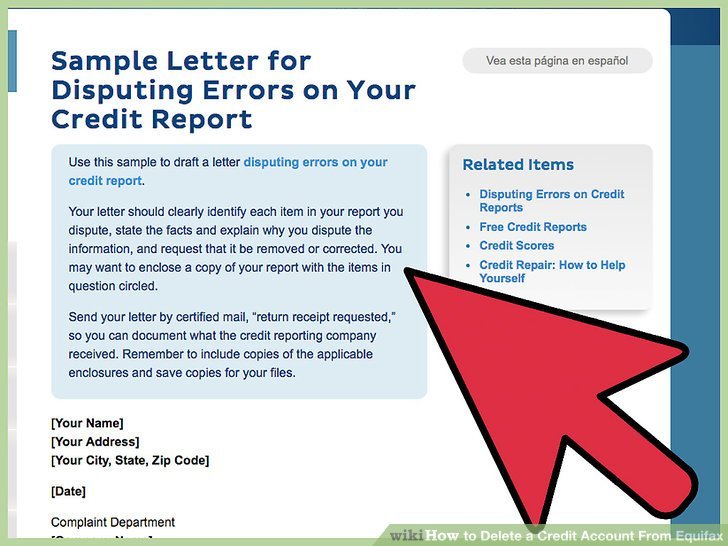

How Do You Dispute An Item On Your Credit Report

To dispute an item on your credit report, you’ll need to contact each credit bureau and file a dispute. You can file your dispute online, which is typically the fastest option. If you have supporting documentation, you can upload that, as well. You can also make a dispute by mail be sure to use certified mail if you do.

Don’t Miss: Sample Notification Of Death Letter To Credit Reporting Agencies

Dispute Inaccurate Items Yourself

You can embark on DIY credit repair by ordering your three credit reports from AnnualCreditReport.com, a source of free credit reports authorized by the federal government. You need all three reports because creditors may report transactions to only one or two credit bureaus.

After receiving the reports, review the four sections for errors:

- Identification: Information identifying yourself, including your address, date of birth, and Social Security number. Incorrect information may be a tip-off that the report covers accounts that dont belong to you.

- Tradelines: This contains your account data, which includes your use of credit and your borrowing activity. The data includes account balances, payment history, and a collection account or charge-off.

- Public records: Court information regarding adverse legal judgments, bankruptcies, liens, foreclosures, vehicle repos, and money owed for child support.

- Inquiries: Hard inquiries are those you authorize a credit provider to make when you apply for a credit card or loan. These can lower your credit score. Unauthorized soft inquiries have no impact on your score.

The hardest part of DIY credit repair is combing through your report data for accounts or account activity you dont recognize, incorrectly reported negative credit file items , and liens and judgments you have already paid. You also should check for hard inquiries you didnt authorize.

Add A Consumer Statement

If the credit bureau confirms the information is accurate but you’re still not satisfied, submit a brief statement to your credit report explaining your position. It’s free to add a consumer statement to your credit report. TransUnion lets you add a statement of up to 100 words, or 200 words in Saskatchewan. Equifax lets you add a statement of up to 400 characters to your credit report.

Lenders and others who review your credit report may consider your consumer statement when they make their decisions.

Don’t Miss: How Long Before Eviction Shows On Credit Report

Updating Personal Information On Your Credit Report

Your are based on information in credit bureaus’ databases, much of which comes from the data that creditors send to the bureaus. When you apply for a credit card or loan, the creditor may review your credit report and also send the credit bureau information from your application, such as your name, Social Security number, address, telephone number and the name of your employer. Once your account is open, the creditor will likely send a monthly update with your latest payment status , as well as your current account balance.

If you need to update your personal information on your credit report, you can generally do this by updating your information with your creditors. For example, if you move, you’ll need to update your address to ensure the creditor can send you mail, including your monthly statements. The next time the creditor sends an update to the credit bureaus, it’ll pass along your new address, which can then be added to the personal information section of your credit report.

The same process could work if you’re trying to update other personal details, such as a new name. However, your phone number and employment generally only get reported to a bureau when you apply for a new account.

You can make a direct request to a credit bureau if you don’t want to use a creditor as an intermediary or don’t have any open accounts. To do so, you may also need to send proof of the change, such as copies of utility bills or bank statements with your new address.

What Should I Expect After Filing A Dispute

Investigation of your dispute

When reviewing your dispute, if we are able to make changes to your credit report based on the information you provided, we will do so. Otherwise, we will contact the company that reported the information to us to verify the accuracy of the information you’re disputing.

Your dispute will be processed in approximately 10-15 days for electronic submission and 15-20 days for postal mail

After our investigation is complete, a confirmation letter or email will be sent to you with the results and outcome of the investigation. If we require additional information in order to complete our investigation, we will notify you. If you submitted your dispute electronically, we will notify you by email. If you mailed in your completed form and documents, we will send you a letter. Due to COVID-19, we are experiencing longer than normal processing times. We appreciate your patience.

Don’t Miss: Does Uplift Do A Hard Credit Check

Request Additional Free Credit Reports

California identity theft victims with a police report of identity theft are entitled to receive up to 12 free credit reports, one per month for the 12 months following the date of the police report. The procedure for requesting free monthly reports is different for each of the credit bureaus.

Experian: Make a single request to receive all of your free monthly reports. Mail your request for 12 free monthly reports to Experian at P.O. Box 9554, Allen, TX 75013. Enclose a copy of the police report of identity theft, a copy of a government-issued identification card , and a copy of proof of current mailing address . Also provide your full name including middle initial , previous addresses for the past two years, Social Security number and date of birth.

TransUnion LLC: Write or call in your request each month. Mail to TransUnion LLC, P.O. Box 2000, Chester, PA 19016. Or call the toll-free number printed on your most recent TransUnion LLC credit report. Provide your full name including middle initial , Social Security number, date of birth, and proof of residence .

Equifax: Write or call in your request each month. Mail to Equifax Fraud Department, P.O. Box 740250, Atlanta, GA 30374. Or call the toll-free number printed on your most recent Equifax credit report.

File A Complaint About The Credit Reporting Agency

You can file a complaint about a credit reporting agency with the Consumer Financial Protection Bureau . The CFPB will forward your complaint to the agency and try to get a response. If the CFPB thinks another government agency would be better able to help you, it will forward your complaint to that agency and let you know.

You May Like: Chase Sapphire Preferred Score

Contact The Creditor Directly

Contact the creditor that furnished the incorrect information, and demand that it tell the credit reporting agency to remove the data from your report. You can use Nolo’s Request to Creditor to Remove Inaccurate Information or write your own letter. If you get a letter from the creditor agreeing that the information is wrong and should be deleted from your credit file, send a copy of that letter to the agency that made the flawed report.

If you already contacted the creditor directly, it doesn’t have to deal with this dispute again unless you supply more information. But if you escalate your complaint, like to the president or CEO, because you believe the dispute was not properly investigated, and you demonstrate a strong basis for your belief, the company is likely to respond.

If the company can’t or won’t assist you in removing the inaccurate information, contact the credit reporting agency directly. Credit reporting agencies have toll-free numbers to handle consumer disputes about erroneous items in their credit files that aren’t removed through the normal reinvestigation process. Go to the Equifax, Experian, and TransUnion websites to find contact information for these three nationwide credit reporting agencies.

Negative Credit Report Entries That Impact Your Score The Most

Most accurate negative items stay in your file for around seven years. Fortunately, their impact diminishes as time goes by, even if they are still listed on the report.

For example, a collection from a few years ago will carry less weight than a recent one especially if there arent any new negative items in your history. Improving your debt management after receiving a derogatory mark can show lenders you’re unlikely to repeat the issue and help increase your score.

These are the most common items that can lower your credit score:

Multiple hard inquiries

Multiple hard credit checks over a short amount of time are a red flag for lenders, as it tells them that you are applying for credit too often and, potentially, being denied.

However, there are some exceptions to this. For example, if youre looking to buy a home and want to compare interest rates between several lenders, you can. FICO and VantageScore, the two most commonly used credit scoring models, give consumers a window of around 14 to 45 to compare rates this is known as rate shopping. All credit inquiries done between this period of time will show up on your file as one item.

Delinquency

Foreclosure

Foreclosure can also cause a credit score to drop substantially. According to FICO, a score can drop up to 100 points from a foreclosure, depending on the consumers starting score. Foreclosures stay on your record for seven years.

Charge-offs

Repossessions

Judgments

Collections

Also Check: Does Paypal Credit Report To Credit Agencies

How To Get Your Free Credit Report

Getting your credit report is easy, especially if you havent used AnnualCreditReport.com yet. You can use this service to pull your credit reports from all 3 of the major credit agencies/bureaus quickly and easily, and for free.

The law states that all consumers are entitled to 1 free credit report from each of the major credit reporting bureaus each year.

If youve used up your annual credit report and you feel that you need to pull a fresh report, then you can use any of the credit bureaus websites to pull your report.

Most offer credit reports from all 3 bureaus, too. Other services, such as MyFICO.com , offer 3 reports as well. It doesnt matter where you get them, just be sure to have a recent report just in case theres anything new that pops up, and its always good to know your current credit scores .

There are a few ways you can go about this.

1. File Complaints with the Consumer Financial Protection Bureau

2. Write dispute letters to the CRAs.

Hire A Credit Repair Company

If youre looking for the easiest way to fix your credit report, the following three credit repair services earn our top marks based on BBB ratings, industry reputation, and our own reviews.

These services challenge each of three major credit bureaus to verify, correct, or remove negative items on your credit reports.

| $79 | 9.5/10 |

The Fair Credit Reporting Act entitles you to dispute inaccurate items on your credit reports. You can do so through the mail or online at the three credit reporting company websites.

While you can attempt to fix your credit yourself, the process requires effort, patience, organization, and expertise. For what many consumers consider to be a reasonable price, you can hire a credit repair organization to do the work for you.

Some disputes are easy to resolve, such as the removal of outdated information. Other disputes require more work, including submitting evidence to contest items and forcing the bureaus to validate questionable data. The ideal outcome is to remove enough negative items to give your score a boost.

Most credit repair services offer a free consultation to review your credit reports and identify fruitful areas worth challenging. The credit specialist will review with you the different plans the company offers, what services come with each plan, and how much each plan will cost you.

Recommended Reading: Does Eviction Notice Go On Credit Report

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your record.

The NFCC can provide financial counseling, help review your credit history, help you create a budget and even a debt management plan free of charge. It also offers counseling for homeownership, bankruptcy and foreclosure prevention.

As always, be wary of companies that overpromise, make claims that are too good to be true and ask for payment before rendering services.

When looking for a legitimate credit counselor, the FTC advises consumers to check if they have any complaints with:

- Your states Attorney General

- Local consumer protection agencies

- The United States Trustee program

How To Remove Negative Items From Your Credit Report

First, it’s important to know your rights when it comes to the information in your credit history.

Under the Fair Credit Reporting Act , credit bureaus and lenders must ensure that the information they report is accurate and truthful.

This means that, if you find mistakes in your , you have the legal right to dispute them. And, if the information disputed is found to be incomplete or erroneous, the bureaus are obligated to remove it from your record.

Some common credit report errors include payments wrongly labeled as late or closed accounts still listed as open. It’s also possible for your report to include information from someone else, possibly someone with a similar name, Social Security number, or identifying information.

Bear in mind that correct information cannot be removed from your credit report. So, if your score is being dragged down by accurate negative information, youll need to repair your credit over time by ensuring you make payments on time and decrease your overall amount of debt.

Here are some tips to help you repair your credit history:

Also Check: Will Paypal Credit Report To Credit Bureaus

What Is A Fraud Alert

A fraud alert is a warning placed on your credit record that tells potential lenders to contact you typically with a phone call and verify your identity before extending new credit. If someone tries to get a new credit card or borrow money in your name, that contact should tip you off so you can take action to stop the new account.

A fraud alert can be a good option for consumers who want to avoid having to freeze and unfreeze their credit when they want to apply for credit.

There are three main types of credit fraud alerts:

-

Fraud alert: This basic type of alert is available to any consumer. It lasts for a year and is renewable. You don’t have to have been a victim of fraud or identity theft to request one.

-

Extended fraud alert: An extended fraud alert lasts for seven years. It’s available only to consumers who have been victims of identity theft and have filed a report with either identitytheft.gov or the police. Credit bureaus will also take your name off marketing lists for credit and insurance offers for five years unless you ask to stay on.

-

Active-duty fraud alert: This alert designed for military service members lasts a year and can be renewed for the length of deployment. In addition, the credit bureaus will remove your name from marketing lists for unsolicited credit and insurance offers for two years, unless you ask them not to.