Accounting Software And Credit Scores

You can get business credit scores from credit scoring companies and through some accounting software.

Itâs a good way to screen businesses before entering a contract with them. If the credit score is really low, you might take steps to protect your business â by either requesting a deposit, giving them shorter payment terms, or declining the business altogether.

You can also punch your own business into the software to see what people are told about your credit rating.

Another Businesss Poor Credit Could Affect Your Own Survival

As a small business, you depend on your customerâs ability to pay their bills. If your customers fall behind on their payments to you, then your cash flow suffers, which might mean that youâre forced to make late payments to your vendors. And late or partial payments can have long-term negative effects on your business.

Yet most small business owners donât run credit reports on potential business partners. Maybe a friend or colleague whom you trust refers you to your prospective partner. Or the meeting takes place in person and you âget a good vibe.â More likely, your conversation unfolds via email, and everything seems legit. But as above board as a company may look, proof is in the numbers.Always remember that a partner is going to present the best version of themselvesâafter all, they want to do business with you.

The sad reality is, though, that small businesses are more susceptible to fraud because of their limited resources. There often isnât a large accounting team that can catch discrepancies immediately, or an IT department that can go all out on security. And due to limited fraud protection for businesses , itâs up to you as the business owner to protect yourself. And youâve worked too hard to fail due to another companyâs bad business practices.

How Are Business Credit Scores Calculated

Many companies create credit scores and they each have their own proprietary system for doing it. This means your business will have several credit scores and you wonât really know how any of them were calculated. However there are some basic criteria that are probably used in developing all credit scores.

-

Most credit scoring companies are linked to debt collection services, so they know who is and isnât paying their bills.

-

They gather publicly available information about your business from government departments and banks.

-

Someone may report you to a credit scoring company if theyâre not happy with how fast you pay.

Your credit score might be on a scale of 1â5 or 1â100. The higher your score, the better you are at paying.

You May Like: Does Removing An Authorized User Hurt Their Credit Score

What Is A Business Credit Report

A business credit report is an aggregate of your business’s credit history. This is similar to a personal credit report, which is a snapshot of your personal credit use. Lenders use information found in your credit report to judge whether you can repay credit extended to you.

Here’s the typical information found in a business credit report, according to the Small Business Association :

- Company information including number of employees, sales, ownership and subsidiaries

- Historical data of the business

- Business registration details

- Public filings, such as liens, judgments and UCC filings

- Past payment history and collections

- Number of accounts reporting and details

Information in your business credit report impacts numerous financial decisions, which the SBA also provides:

- How much business credit a supplier will extend to you

- What repayment terms you’ll receive

- What interest rates you’ll pay

- How much credit or funding a bank or lender will extend to you

- How your customers view your business

- What insurance premiums you’ll pay

Enhance Your Credit Score

Business-credit-card score fluctuates due to certain factors despite on-time payments. Moreover, if you close any business cards, then your credit card score can get affected.

Furthermore, Equifax states that if there are negative changes to the factors that go into the score, such as lien filing.

Moreover, Experian says that negative marks on your business report may remain in place for some time:

- UCC filings are valid for five years from the last date of filing.

- Data on trade for the 36 months following the last report date.

- Bankruptcies are kept on file for ten years after they are filed.

- Tax liens are valid for seven years from the date of filing.

- For the past 36 months, data from banks, governments, and leasing companies have been collected.

- Collections are kept on file for six years and nine months after the last report date.

- Judgments are valid for seven years from the date of filing.

To improve your business credit card, you can lower the card usage open new lines of credit, pay off balances, ask for a larger credit line finally, pay your payments on time.

In addition, you can enhance your credit score by adding financial vendors or unlisted suppliers to your credit report.

Lastly, the PAYDEX score in Dun & Bradstreet defines a version of a business credit score. If you get 100 then you have paid creditors 30 days early before the due bill. Also, if you scored 80, it means you made a timely payment.

Also Check: Does Speedy Cash Report To Credit Bureaus

How Business Credit Scores Are Used

As vendors or suppliers need a medium to analyze your business health so that can approve financing. For this reason, business credit cards come into the picture. Furthermore, if your business has a higher score, then you will pay bills on time and easily gain the trust of vendors or suppliers. Moreover, your business credit scores and reports help vendors or suppliers to learn more about your business, its finances, and history.

Check out these points to learn how business credit scores are used.:

- Lending: Your business credit score helps to evaluate how much financing you can get or secure.

- Business Insurance: Your business credit card score is determined by insurance providers. It is used to assess prices on commercial insurance.

- More Time: If you want to improve cash flow, then you should secure longer terms with your vendors or suppliers. Note that Net-30 means you have 30 days to pay. Whereas, Net-60 means you have 60 days to pay. However, it is dependent on vendors or suppliers to decide the payment time.

The Difference Between Hard And Soft Pull Credit Checks

Not all credit checks negatively affect your credit score. Lenders do two kinds of checks before approving or denying a business loan application.

-

Soft pull inquiries

Individual and business profiles are subjected to soft pull inquiries everyday without being aware of it. Lenders can do a soft pull check for an overall idea of your financial status before pre-approving your application, or credit bureaus can soft pull your file if you request your credit score.

Soft pull inquiries have no impact on your credit score, but may be noted as a file access.

-

Hard pull inquiries

Hard pull credit inquiries involve an official check of your credit report. When you apply for a car loan, personal loan or home loan and allow a lender to check your credit file, the lender will conduct a hard pull. While soft pull inquiries have zero effect, hard pull checks are listed on your credit file and therefore can affect your credit score.

Every hard pull credit check is listed on your credit report, including which lenders have denied previous applications and how many times you’ve applied for loans in the past. Too many hard pull inquiries in a short space of time can negatively impact your credit score.

Recommended Reading: How To Get Credit Report Without Social Security Number

Select Reviews Common Questions Surrounding Business Credit Scores And Reports So You Can Familiarize Yourself With Your Business’s Credit Standing

Selects editorial team works independently to review financial products and write articles we think our readers will find useful. We may receive a commission when you click on links for products from our affiliate partners.

While you may think are reserved for individuals, businesses also receive that ever important number.

Similar to personal credit scores, business credit scores play a part in how lenders judge your business’s eligibility for credit products, such as loans and . If you’re a small business owner applying for credit, it’s important to understand what makes up your business credit score and how you can access your business credit report.

Below, Select reviews common questions surrounding business credit scores and credit reports, so you can familiarize yourself with your company’s credit standing.

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Don’t Miss: Does Opensky Report To Credit Bureaus

Ficos Small Business Credit Score System

One way to obtain your FICO Small Business Credit Score System score is to apply for a business loan.

Lenders often use SBSS scores when considering SBA loan applicants. They may request a customized SBSS report and include your FICO small business credit score with your loan documents. You can also obtain your SBSS score from third-party sources.

FICOs SBSS score pools data from the business credit bureaus, including Dun & Bradstreet, Experian and Equifax, as well as data associated with your personal credit score. Credit scores range from 0 to 300, with 300 being the best score.

An SBSS score of at least 180 is ideal. That said, it has been reported that the SBA requires a minimum of 155, with many SBA lenders requiring applicants to have a minimum of 160-165.

What Does A Business Credit Score Say

A good credit score means that youâre quick to pay bills and debts, so everyone is happier to do business with you:

-

Suppliers will probably give you more favourable payment terms.

-

Lenders will give you better access to credit and capital.

You can apply the same logic to businesses you deal with. If they have a good credit score, you know theyâll probably pay your invoices on time.

Read Also: Which Credit Score Does Carmax Use

Should I Get A Business Card That Doesn’t Affect Personal Credit

If you can imagine making a few slip-ups with business credit, you might want to get a card that doesnt report to consumer credit bureaus as a precaution. But generally, it’s a better idea to apply for the card that offers the rewards and benefits youre most interested in, instead of focusing on the cards reporting policy.

Its important to be mindful of how your business credit card affects your personal credit. But dont make the mistake of thinking you can get rid of all your personal liability by choosing a business credit card that doesn’t report to consumer credit bureaus. If you want to protect your personal assets, your best bet is to borrow sparingly and pay your bill on time, every time.

Which Option Should You Choose

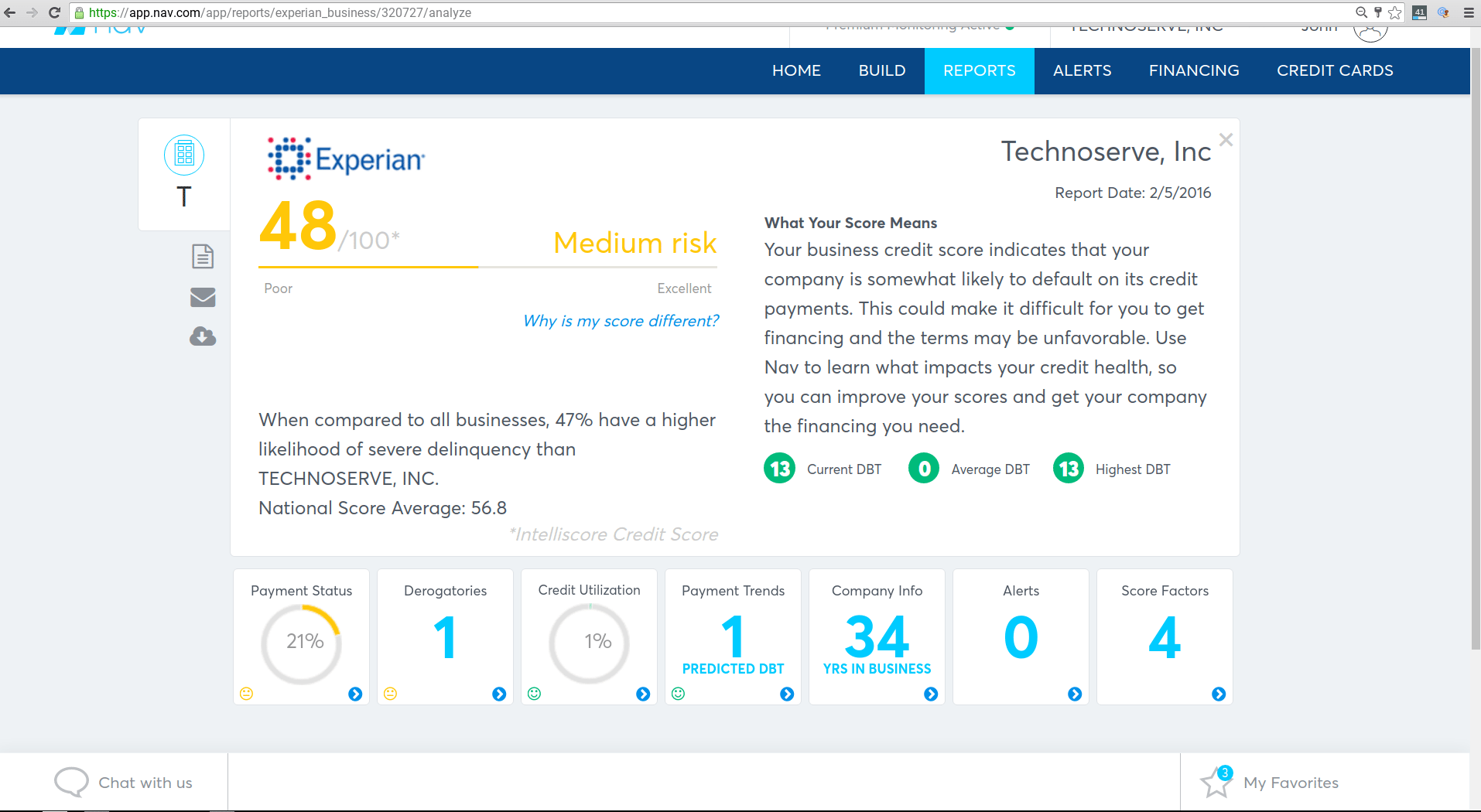

If you mostly just want to get a general idea of your business credit health, then one of the free options available to you may work fine. Just be prepared to provide considerable personal information, including your Social Security number, in order to create a free account. Also, remember that the information you get from a free business credit report will likely not be as comprehensive as youll find with paid business credit monitoring plans.

If you want ongoing monitoring of your business credit profile, then a paid monthly plan from a company like Experian or Dun & Bradstreet may make more sense.

Just make sure you do something when it comes to getting a handle on your business credit. Your business credit score may seem unimportant at the moment, but youll need a solid business profile if you want to apply for a business credit card, take out a business loan or work with vendors who extend credit. Your best bet is having an idea of your business credit score and taking steps to monitor it early on before you need it.

Read Also: What Credit Report Does Capital One Use

Not A Bank Of America Small Business Client

Small businesses choose Bank of America because we’re more than just a bank.

We’re a trusted partner empowering your business to grow and to keep serving your customers.

That’s why we provide tools and advice to actively manage cash flow, payroll, and point of sale services.

And now for the first time, we’ve partnered with Dun and Bradstreet, a leading provider of business data and analytics for almost 200 years to provide free access to a business credit score.

You can enroll and view your business credit score from your Business Advantage 360 online banking dashboard. There’s no need to navigate to an external website.

Business credit scores may be used by lenders, suppliers and underwriters to help make decisions about working with your business, so knowing where you stand can be important.

Several factors like past payment performance and financial information can impact the score. So we’re also providing educational information to help you understand your business’s credit health.

And if your business doesn’t have a score yet, you can still learn how to take the first step in establishing your business credit file on our Small Business Resources site.

A business credit score is not the only factor considered by lenders, including Bank of America, but knowing how your business may appear to others can empower you to take the next step to improve its financial health.

And when you’re ready, Bank of America will be there.

Monitor Your Credit Profiles

Once you know what your business credit scores are, you can start to work on improving them. But thats not the only thing you need to do it is also advisable to monitor your scores on at least a semi-regular basis by checking your reports from time to time at least once a year. Additionally, you will want to correct any mistakes on your business credit profile that could be negatively affecting your score. All three credit bureaus provide a process to correct inaccuracies on your report, like an inaccurate SIC code or wrongfully filed UCC lien.

Also Check: When Does Usaa Report To Credit Bureaus

How Are Business Credit Scores Used

Small business lenders rely on business credit scores from multiple credit rating agencies to decide whether or not to make loans to small businesses. The business credit score also helps lenders determine the size of a loan they are willing to make. Lenders look at factors like whether your business has been paying previous debts on time, how quickly you pay suppliers and how much revenue youve been bringing in over time.

Business credit scores provide them with recalculated ways of determining the creditworthiness of a business. High scores mean a business has been diligent in making payments to others while a low score sends up a red flag. Lenders need to know how likely it is that a business will repay the loan they are granting on a timely basis. The various rating agencies provide historical information that the lenders can access prior to making their lending decisions.

Like it or not, business credit scores are an important tool most small business lending companies use to decide whether or not you will get the loan you need. Most of the time, lenders consider both personal credit scores and business credit scores, paying attention to all the factors discussed above.

Your small business’ credit history also follows you from one business to another and records may become inaccurate over time so it is a good idea to maintain detailed records, even if one business closes and you open another one.

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Read Also: How To Take A Repo Off Your Credit

How To Check Business Credit With D& b

Access your D& B credit score, report, and monitor changes for free.

With Credit Signal®, you can monitor changes to your scores and ratings with up-to-date business credit information on your company.

Through D& B, paid credit reports are available for multiple companies and to upload multiple trade references to your account.

Free Business Credit Score Services

- Get a summary of your Dun & Bradstreet, Experian and Equifax business credit report

- Receive business credit grades for each score, plus your personal Experian credit score

- Tools to help you build business credit

What’s missing: You don’t receive your full business credit reports and scores with the free version. But you can upgrade to a paid version, starting at $29.99 per month for Nav Business Manager, to receive your full report and score with Dun & Bradstreet, Experian and Equifax, plus the ability to dispute errors on business credit reports and more. Compare Nav business credit products. There are alternative paid options to view your actual score, which we break down below.

Recommended Reading: Does Paypal Credit Show On Credit Report