Now You Qualify For The Lowest Interest Rates And Best Credit Cards

Thomas J. Catalano is a CFP and Registered Investment Adviser with the state of South Carolina. He is a CFP, registered investment advisor, and he owns his own financial advisory firm. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

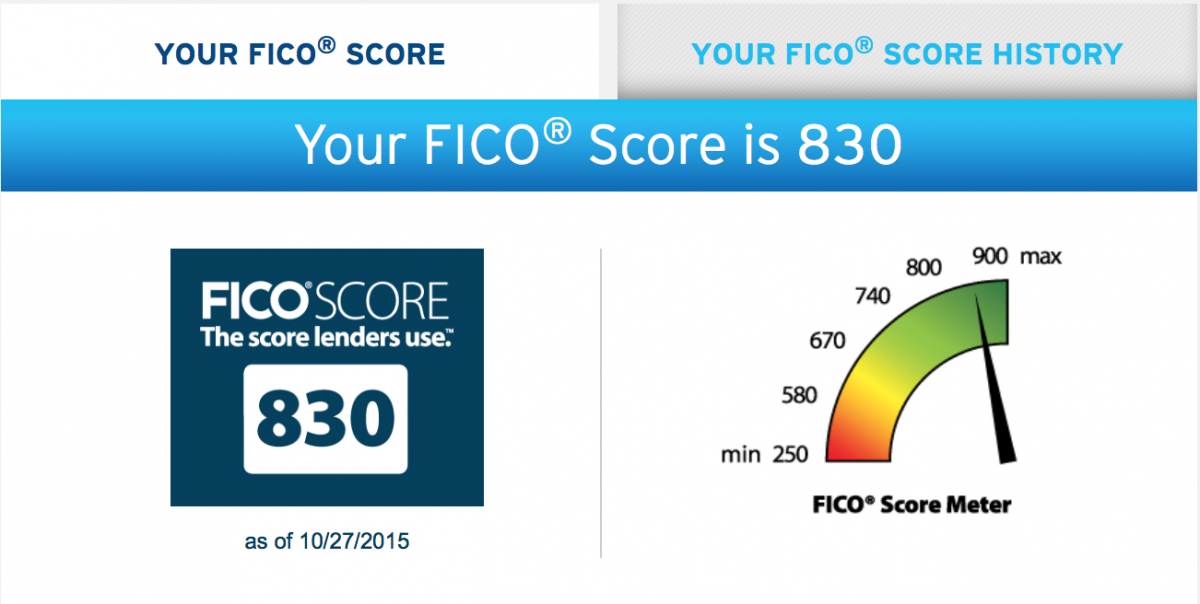

If youve earned an 800-plus credit scorewell done. That demonstrates to lenders that you are an exceptional borrower and puts you well above the average score of U.S. consumers. In addition to bragging rights, an 800-plus credit score can qualify you for better offers and faster approvals when you apply for new credit. Heres what you need to know to make the most of that 800-plus credit score.

Why Having A Good Credit Score Still Matters And How To Check Yours For Free

It’s OK if you haven’t yet reached a 760 credit score. The national average FICO score has steadily risen over the years and hit a record high of 703 in 2019, so many are in the same boat. The good news is that, whether you have a good credit score or even an excellent one, you will most likely qualify for some of the best cards and even cards with the best rewards.

The American Express® Gold Card was voted CNBC Select’s best overall rewards card for giving cardholders 4X points per dollar spent at restaurants and at U.S. supermarkets . Plus, the option to earn 3X points on flights booked directly with airlines or on Amextravel.com. Applicants can qualify with good or excellent credit.

And the Blue Cash Preferred® Card from American Express ranked as the best rewards credit card for groceries, as cardholders earn 6% cash back at U.S. supermarkets on up to $6,000 per year in purchases . This card also offers 6% cash back on select U.S. streaming subscriptions, 3% cash back at U.S. gas stations, 3% cash back on transit and 1% cash back on other purchases. Applicants can qualify with good or excellent credit.

To track your own credit progress, make sure you routinely check your credit score. It’s smart to monitor your credit, and your score will not be affected by doing so . You can check your score for freewith most card issuers, using apps such as Discover’s Credit Scorecard and Chase’s Credit Journey, which are available to all card users.

Importance Of Higher Credit Scores

While having a credit score of 800 seems lofty, even scores in the 700s can help home buyers get lower mortgage rates.

Many loan programs have a minimum credit score requirement to get approved for a mortgage. For example, most lenders will require a credit score of 580 to get approved for an FHA loan. Other programs, like USDA mortgages and conventional loans, will require scores of at least 620.

Even though aspiring borrowers only need the minimum amount, a credit score thats well above the minimum requirement can save you money and stress. Your credit history isnt the only criteria that mortgage lenders consider when determining your interest rate, but its a big one.

Your mortgage rate will be determined by the size of your down payment, your debt-to-income ratio, current mortgage rates and your credit score.

For example, a potential homeowner with a credit score of 760 who is planning on making a down payment of 20 percent will have a lower mortgage rate than someone with a score of 620 putting down 10 percent.

The size of the mortgage rate you can get depends on other factors as well, but keeping a high credit score is the best way to ensure buyer-friendly rates.

Don’t Miss: How To Make Your Credit Score Go Up Fast

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

The Three Credit Reporting Agencies And Different Types Of Credit Scores

Equifax, Experian, and TransUnion are three major credit reporting bureaus. Each credit agency provides you with a credit score, and these three scores combine to create both your 815 FICO Credit Score and your VantageScore. Your score will differ slightly among each agency for many reasons, including their unique scoring models and how often they access your financial data. Monitoring of all five of these credit scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Don’t Miss: How To Unlock My Experian Credit Report

You Can Receive The Best Insurance Premiums

It might come as a surprise, but when you apply for some types of insurance, such as auto insurance or renter’s insurance, some insurance providers will check your credit score, using your rating to help determine the premium. This may seem unfair and unnecessary, especially since we don’t finance insurance. But the way you manage your credit cards and loans is a pretty good indicator of how you’ll manage your insurance payments and your overall riskiness. From an insurance company’s standpoint, people with the highest credit scores are usually more responsible with their credit and money, and this level of responsibility justifies a cheaper premium.

Do you have an 800 credit score or higher? How is your life easier because of it? Humblebrag about it in comments!

Credit Score Is It Good Or Bad How To Improve Your 815 Fico Score

An 815 credit score is excellent. Before you can do anything to increase your 815 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to identify what needs to be improved, you should probably be aware of all the things that count and dont count towards your score.

Also Check: 877-392-2016

Is Your Credit Score Brag

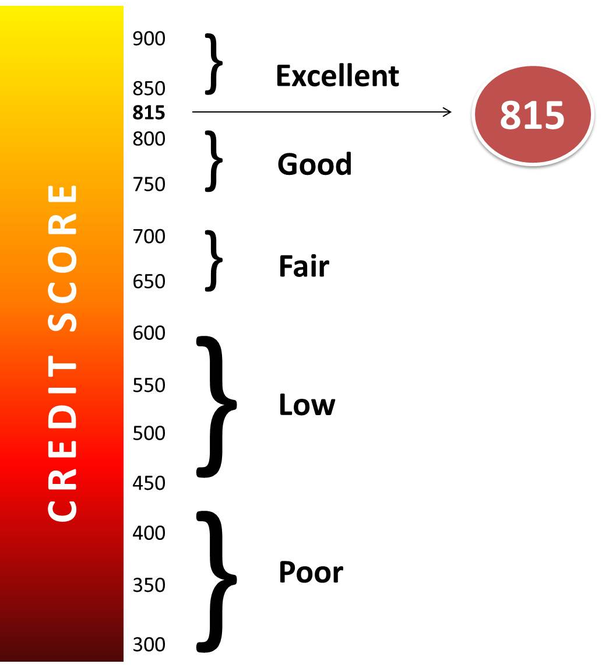

Where you land on the 300-850 credit score scale can have a major impact on your finances. Lenders use the score to decide whether to lend you money, and at what interest rate.

“A strong credit score is integral to borrowing at the most attractive terms,” said Greg McBride, chief financial analyst at Bankrate. That means a high credit score can save you thousands of dollars in interest.

While any score above 700 tends to be considered “good,”an elite group of people have excellent scores that will snag them the most favorable rates.

Only about 20% of Americans that have a credit score land above the 780 mark, which is considered the top tier, according to credit reporting agency TransUnion.

Even fewer are above the 800 mark.

Anyone can attain a strong credit score simply by practicing the tried-and-true methods of good credit management: pay your bills on time and keep your debts modest.

But there are some habits people in the 800-plus club tend to have in common, experts said:

How Your Credit Score Affects Your Mortgage Rate

Although its up to specific lenders to determine what score borrowers must have to be offered the lowest interest rates, sometimes even the difference of a few points on your credit score can affect your monthly payments substantially. For example, the difference between a 3.5 percent interest rate and a 4 percent rate on a $200,000 mortgage is $56 per month. Thats a difference of $20,427 over a 30-year mortgage term.

A low credit score can make it less likely that you would qualify for the most affordable rates and could even lead to rejection of your mortgage application, says Bruce McClary, spokesman for the National Foundation for Credit Counseling. Its still possible to be approved with a low credit score, but you may have to add a co-signer or reduce the overall amount you plan to borrow.

You can use Bankrates loan comparison calculator to help you see interest rates for credit scores.

Using myFICO.coms loan savings calculator, heres how much youd pay at the current rates for each credit score range. These examples are based on national averages for a 30-year fixed loan of $300,000.

| Source: myFico. APR rates as of Nov. 5, 2021. Assumes a $300,000 loan principal amount. |

| How your credit score affects your mortgage rate |

|---|

| FICO score |

| If your score changes to 640-659, you could save an extra $34,017. |

Read Also: How To Remove Repossession From Credit Report

Canadian Credit Ratings And What They Mean

Lenders and creditors typically use a credit score to determine youre likelihood of making payments on time. Its important to note that your is only one of the factors that lenders will evaluate when approving you for new credit.

- Excellent Individuals with a rate of 780 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan.

- Very Good This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available.

- Good An individual who has a credit score that falls within this range has good credit and will typically have little to no trouble getting approved for the new credit.

- Average While this is still a good range, individuals with this score may receive slightly higher interest rates than those with higher scores. According to Equifax, at the end of 2012, the average national credit score was 696.

- Poor Scores in this range indicate that the individual is high risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates.

- Very Poor Scores in this range are rarely approved for anything, but credit can be repaired.

- Terrible Individuals whose credit scores are less than 500 may not get approved for new credit and should seek credit improvement help.

Loans Canada Lookout

Strive To Achieve And Maintain Excellent Credit

Leveling up to the excellent range of credit takes time and effort, but it is totally attainable. Just do the common-sense things like consistently pay your bills on time and keep balances low, says Griffin.

Theres no big mystery or secret. In time, the scores will take care of themselves. And then instead of being a hindrance, your credit score will become a powerful tool for opening up the financial marketplace to better opportunities.

Don’t Miss: Does Snap Report To Credit Bureaus

Your Credit Report Contains The Following Information

Personal Information

- Identity verification

Each of your credit accounts will be given a rating that includes a letter and a number.

Letters

| Installment | Accounts that receive an I are installment style accounts that are paid off in predetermined fixed amounts. For example, a car loan. | |

| Open | Accounts that receive an O are open, which means they can be used up to a preset limit. An example of an open credit account is a line of credit. | |

| Revolving | Accounts that receive an R are considered revolving credit because your payments change based on how much of your limit you borrow. A credit card would receive an R. | |

| Mortgage | Depending on the credit bureau you pull your report from, your mortgage may or may not show up. If it does, it will be represented by an M. |

Numbers

| Account is in collections or bankruptcy |

Did you know that bad credit can affect your daily life? Learn more here.

Like This Article Pin It

Disclaimer: The links and mentions on this site may be affiliate links. But they do not affect the actual opinions and recommendations of the authors.

Wise Bread is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.

My wife and I, both, have scores north of 800. To be honest, I don’t see any extra benefits. That’s probably because we have no debt other than our mortgage and don’t pursue more debt. I imagine others with similar scores have similar attitudes. I’m going to look into the insurance part of that though.

Disclaimer: This site contains affiliate links from which we receive a compensation . But they do not affect the opinions and recommendations of the authors.

Wise Bread is an independent, award-winning consumer publication established in 2006. Our finance columns have been reprinted on MSN, Yahoo Finance, US News, Business Insider, Money Magazine, and Time Magazine.

Like many news outlets our publication is supported by ad revenue from companies whose products appear on our site. This revenue may affect the location and order in which products appear. But revenue considerations do not impact the objectivity of our content. While our team has dedicated thousands of hours to research, we aren’t able to cover every product in the marketplace.

Recommended Reading: How To Unlock My Experian Credit Report

Why Experts Say 760 Is The Credit Score To Aim For

While it might be exciting for some to aim to join the 850 club, it comes with no additional benefits that you likely won’t already get with a 760 score.

“The best published interest rates for auto loans are 720+ and for mortgages 760+,” financial expert John Ulzheimer, formerly of FICO and Equifax, tells CNBC Select. “As such, I always tell people, shoot for 760 or better. That way, they’re safe for all loan types and cards.”

For Jim Droske, president of the credit counseling company Illinois Credit Services , the threshold is 760 as well. But he says aiming for 780 is even better to be “the safest” in any type of lending situation. Anything higher, though, won’t be more beneficial, nor would it get you a better offer with more favorable terms.

“If you’re above 760, or 780, certainly you’re already getting the best you can get,” Droske tells CNBC Select. “You’re already hitting that pinnacle of what care about.” A high enough credit score shows lenders and credit card issuers that you are less of a risk and more likely to pay back the loan, versus if you had a lower credit score.

“Anything above that is really just maybe a little pride,” says Droske. “When you have already reached the summit, no need to look for a ladder.”

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

Don’t Miss: How To Take A Repo Off Your Credit

Re: What Are The Highest Fico Scores Ever Reported On This Forum

Greetings psychic,

Many thanks for your reply. I am awestruck and blown away by your amazing FICO achievement.

I read an article by a loan officer who said in his long career working with thousands of people he never saw a FICO over 825. Other sources have said any score over 835 is purely theoretical and does not exist in the real world. So we now have proof that such scores really do exist.

Are you familiar with John Ulzheimer who wrote the article linked above? He is a former employee of both FICO and Equifax. I have a book he wrote about credit scores. Do you have any idea where he could have gotten his information about 834 being the highest score of anyone in the U.S.

If it’s not being too forward, would you mind sharing your credit profile similar to what I gave above and bulbisaur gave on his post you linked to? It’s very instructive to see what kind of credit profile rates the historically high scores that you and bulbisaur have achieved.

Are There Any Other Rejections That Happen By Association

Yes, if you work in a location where a large number of your co-workers have defaulted on loan payments in the past and/or have bad , the lender will reject your application as you are associated with these people. The lender will assume that since so many of them defaulted on their debts, the company may not be stable in their monthly salary disbursements, or there may be some issue with the company as all the defaulters have only their employment details in common with each other.

Also Check: How Long Foreclosure On Credit Report

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3