How Often Is My Credit Report Updated

Erika Rasure, is the Founder of Crypto Goddess, the first learning community curated for women to learn how to invest their moneyand themselvesin crypto, blockchain, and the future of finance and digital assets. She is a financial therapist and is globally-recognized as a leading personal finance and cryptocurrency subject matter expert and educator.

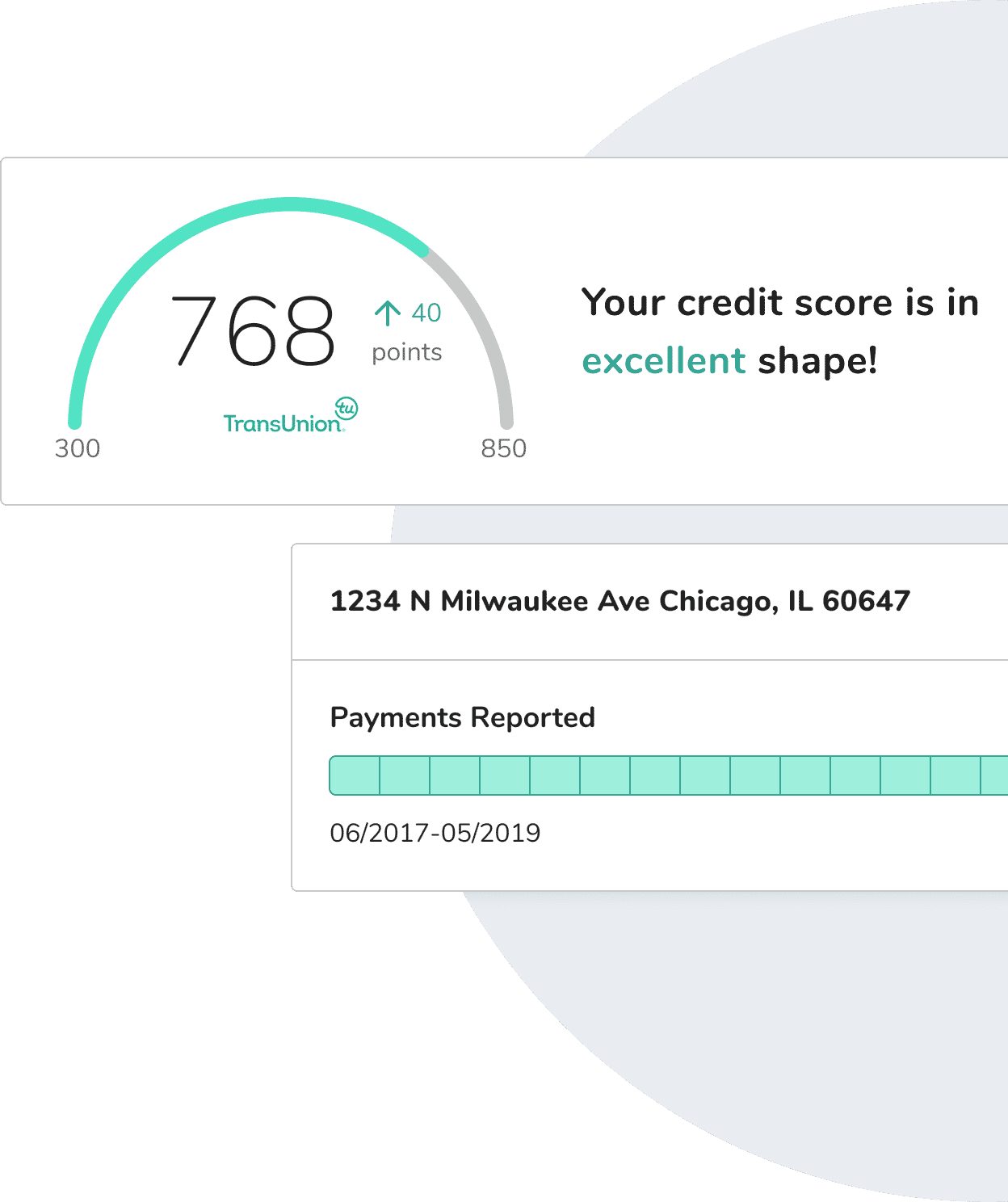

If youre working to improve your credit or watching for a specific change to your , you probably want to know how often your credit report updates. Being able to predict how your credit reportand ultimately your credit scorewill change is a concern for anyone who knows the importance of having good credit or anyone who hopes to be approved for a major loan soon.

The timing of credit report updates largely depends on when lenders, credit card issuers, and other companies you have credit accounts with send your account information to credit bureaus. If you have multiple accounts with several businesses, your credit report could update daily.

Ways To Help Maintain And Improve Your Credit Scores

Remember: Itâs normal for your credit scores to fluctuate a little. And credit scores can change significantly over time. But you can maintain good credit scores and even improve your scores by regularly practicing responsible financial habits.

Here are some ways you can maintain and improve your credit scores:

Speaking of applying for credit: Want a better idea of whether you might be approved? Pre-approval or pre-qualification can help you find out whether you might be eligible for a credit card or a loan before you even apply.

With Capital Oneâs pre-approval tool, for example, you can find out whether youâre pre-approved for some of Capital Oneâs credit cards before you submit an application. Itâs quick and only requires some basic information. And checking to see whether youâre pre-approved wonât impact your credit scores, since it requires only a soft inquiry.

How Quickly Will Paying Off Debt Affect My Credit Score

You were finally able to zero out that credit card balance, thanks to a holiday cash gift and income from your side hustle. Go you!

A week later, you check the credit score posted on your credit card statement â and it doesnât look any different. How long should it take for your credit score to go up after paying off debt?

That depends. Again, it can take up to 45 days for a creditor to give that info to a credit reporting agency. Try not to obsess over seeing the number change right away. Instead, wait at least one month to check, and prepare to wait up to an extra couple of weeks. If youâre not able to pay back your debt as quickly as youâd like, check out a as an alternative to building your credit.

Recommended Reading: How Long Does High Balance Stay On Credit Report

Fico Scores Not Updating

I signed up and paid for this website so that I could access my FICO scores but I’m not impressed. My scores are not updating, my auto, credit card, mortgage and other scores are all based on data from 3/10/21. The simulation score is based on data from when I first signed up with this site. I really don’t understand how we are supposed to progress and be successful with increasing and managing our credit scores when we don’t have valid, updated data? Based on the data from this site, I applied for a CC, only to be denied because the FICO credit score they used was totally different from what I saw on this site. And guess what?? My score decreased because of the credit check, ugh I am super annoyed.

Why Is My Credit Score Not Updating

Cindy_FICO, the most recent three threads in this forum relate to this problem in some way, there is something going on that’s systemic at least with some of the accounts on your s

Cindy_FICO, the most recent three threads in this forum relate to this problem in some way, there is something going on that’s systemic at least with some of the accounts on your service. What are the chances this could be looked into? On mine, Experian and Equifax haven’t moved a single point since I subscribed almost a month ago, while Transunion has gone from 754 to 779, which is pretty significant, in response to some credit card utilization changes that also alerted on Equifax for me.

I guess I will call and sit on the phone to see what can be done about it but based on other users’ postings on here, that often doesn’t accomplish anything. This is too expensive of a service for this to be broken for what appears to be numerous people.

To the OP, your mortgage and auto scores aren’t going to update other than when you actually pull a credit report, which is once a month or once every three months depending on what plan you have. But the FICO 8 scores on the user dashboard should update frequently as far as I’ve been led to believe, and experienced in the past.

You May Like: What Credit Score Is Needed For A Home Depot Card

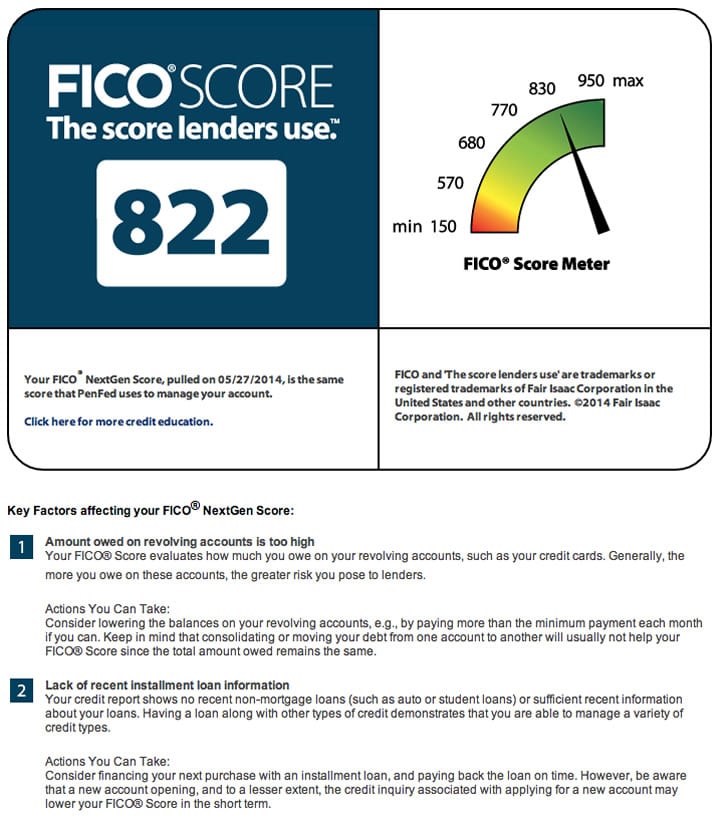

Why Is Wells Fargo Providing Access To A Fico Score 9 Version

Wells Fargo is providing you with access to your FICO® Score 9, which is one of the newest versions available. This score is for educational purposes and provided to you as a benefit to help support your understanding of FICO® Credit Scores and how theyre calculated. It may or may not be the score Wells Fargo uses to make credit decisions.

How To Check Your Credit Reports

It’s wise to periodically check your credit reports to make sure they’re accurate. Consumers have free weekly access to their reports from all three bureaus through the end of 2022 request them by using AnnualCreditReport.com.

While waiting for improvement can seem like watching paint dry, there are habits aside from checking credit that will help you build good credit and maintain it.

-

Pay on time every time.

-

Use credit cards lightly, keeping balances no higher than 30%.

-

Keep cards open unless you have a compelling reason to close them.

-

Space credit applications at least 6 months apart if you can.

-

Consider using both loans and credit cards.

Also Check: What Credit Score For Care Credit

Why Is There A 100 Point Difference Between Transunion

If you have an installment loan that reports only to Experian, your Experian credit score may be very different Equifax and TransUnion. Delinquencies reported on a loan reported on one credit report, but not the others, is the most common reason why you’ll see wide credit score discrepancies, like 100 points.

Why Is My Equifax Score Not Updating On Credit Karma

Asked by: Leonor Rath

If you’ve recently made a change, like opening or closing a line of credit, or paying down a credit card balance, your lender may not have reported this information to the credit bureaus yet. You can check when the individual accounts were last reported with the bureau through Credit Karma.

You May Like: What Should Credit Score Be To Buy A House

Why Is This Fico Score Different Than Other Scores Ive Seen

While Wells Fargo uses FICO® Score 9 for some credit decisions, there are many different credit scores available to consumers and lenders. FICO® Scores are the credit scores used by most lenders, but different lenders may use different versions of FICO® Scores. Scores are pulled from a specific credit bureau on a certain date and reflect the information at the bureau as of that specific date. The differences in your credit files and the timing may create variations in your FICO® Scores. When reviewing a score, take note of the date, bureau credit file source, version, and range for that particular score.

How Do I Force My Credit Score To Update

4 tips to boost your credit score fast

Don’t Miss: Does Medical Debt Affect Your Credit Score

What Day Of The Month Does Your Credit Score Update

Again, your credit score could potentially update on any day of the month, and possibly more than once a month. It depends on how many creditors you have and when they report.

In other words: You canât always time your credit card or loan payments to a specific day of the month for maximum impact. What you can do is make sure you donât miss the deadline, since on-time payments make up 35% of your credit score. This way you can avoid having to search for ways on how to remove late payments from a credit report as a penalty.

Make payment in full whenever possible contrary to popular belief, carrying a balance is not good for your score and could eventually get you into a tough situation where you might be going. You should use no more than 30% of your available credit.

Why Does Transunion Update Slower Than Equifax

The credit bureaus may have different information. And a lender may report updates to different bureaus at different times. So, it’s possible that Equifax and TransUnion could have different credit information on your reports, which could lead to your TransUnion score differing from your Equifax score.

Recommended Reading: Do School Loans Affect Credit Score

Whether You Have Recent Missed Payments Or Defaults On Your Report

Missed payments can stay on your credit report for seven years and bankruptcies for 10. You will more than likely need to re-establish a history of making payments on time, as well as reducing your principle debt every month, by paying more than the minimum payment due. Although missed payments stay on your report for seven years, their impact fades over time. All may not be lost if you’ve missed your payment by a few days. If the missed payment is an exception rather than the rule, then pay the bill as soon as you can and ask the lender if they could refrain from reporting the late payment to the bureaus this one time. There’s no guarantee this will work, but it mightyou could set up automatic payments in return, as a goodwill gesture. Just be sure that you catch that missed payment as soon as possible, because its impact on your credit score will get worse with every day it’s in default.

When Do Credit Reports Update

Your scores may change when your file is updated. Credit bureaus regularly add to your report to ensure that all information pertaining to your current credit and credit history remains relevant.

Your credit score isnât included on any weekly reports generated by the three bureaus, but is updated about once a month. Credit reports differ from credit score checks in that they describe details pertaining to your financial habits that help compose your credit score. Such details include:

One: Payments you’ve made. Credit bureaus consider if youâve made timely or late payments, or if youâve missed payments completely.

Two: Changes in your credit card balances. While most of us have many regular expenses such as car payments, rent, and utility bills, we may spend more at different times of year, like during the holidays. Having a higher credit utilization ratio, as a result, will impact your score. Pay attention to your credit limit to avoid getting flagged for strange behaviour.

Three: Your total outstanding debt.

Four: New credit applications you’ve made or new loans or credit accounts you’ve opened.

Recommended Reading: How To Get Credit Rating Up Fast

What Should I Do If The Information On My Credit Report Is Incorrect

Most lenders update their account information with the credit bureaus once a month. Even if you pay your credit card balance off before you get your statement, the balance reported by the lender is typically what is listed on the billing statement at the end of the billing cycle. Depending on when you make the next purchase on your card, you may still see a balance reflected.

If you are seeing an account on your report that has not been updated in several months, you should dispute the account directly with Experian using the online Dispute Center. If you have documentation showing that the balance has changed, you can submit a copy online along with your dispute. Experian will contact your lender and ask them to verify the information they have reported.

You may also wish to contact your lender to verify that they have been reporting your account information to the credit reporting companies and request that they send updated balance information. For more information, see How to Dispute Credit Report Information.

When And How Often Are Credit Scores Updated

They are updated monthly. As the receives new information from a credit-reporting agency, it gets added immediately to your credit report. This new information could impact your overall credit score positively or negatively depending on how it affects your finances.

Data from your current and previous financial lenders are used to form your overall credit report. These reports are typically updated as new lenders provide the nationwide credit reporting agencies with new information. This occurs on a monthly basis or every 45 days. Although your credit score isnt included in the general free reports you can sign up for online, having the information and understanding it can help you better determine your credit movements.

Getting into the habit of making more consistent payments as well as keeping your overall balances low are examples of ways you can keep your credit in check. Your score should gradually improve over time if you make use of the examples listed above.

You May Like: Do You Have A Credit Score Without A Credit Card

How To Check My Credit Score For Free Cibil Experian Crif Equifax Credit Score Fintalks

We’ve rounded up everything you need to know about checking your credit score. Struggling to get your credit score from poor to excellent? My scores are not updating, my auto, credit card, mortgage and other scores are all based on data from 3/10/21. Not all lenders report information to the three nationwide cras equifax, transunion and experian.

It can change within days or even hours as different lenders send information to the credit bureaus. This is because any changes . Even though your credit report gets updated every month, it doesn’t mean that your score will always change. Struggling to get your credit score from poor to excellent?

Here’s everything you need to know. We’ve rounded up everything you need to know about checking your credit score. It’s up to each individual . What exactly is a credit score and why is it important?

Why Can I See My Fico Score But Others On My Account Can’t See Theirs

You can see your FICO® Score because you are the primary account holder of an eligible account. Others may not be able to view their scores if:

- They recently opened a new account

- They’re an authorized user on someone else’s account

- They have a billing statement in someone else’s name

- They do not have an eligible account in Wells Fargo Online®

Read Also: Who Determines Your Credit Score

Why Does Transunion Take So Long To Update

Asked by: Miss Muriel Schroeder

If you look at the account in your TransUnion credit report, you may see a line that reads Date Updated. This would tell you the most recent day the account information was provided to TransUnion. Because lenders don’t all provide updates on the same day, new information may be added to your reports quite frequently.

How Often Do Credit Scores Update Heres How To Track Your Progress

Your is a three-digit numerical representation of your financial health. Banks and other lenders consider this value as part of loan and credit card applications, so it must be updated frequently.

The credit reporting agencies update your file â and by extension, your credit score â whenever they receive new information from lenders. This usually occurs monthly.

Read on to learn more about how credit scores are updated, how often this happens, and what the related process of rapid credit rescoring encompasses.

Read Also: Is Annual Credit Report A Safe Site

If Your Score Isn’t Increasing It Could Actually Be Costing You Money

How? Your credit score directly affects the interest rates youre eligible for. Yet another perk of having great credit, is that when you apply for a credit card, youll be offered a much better interest rate than someone with poor credit. This can have a huge impact on your financial stability, lowering your overall cost of borrowing significantly.

Re: Myfico Score Not Updating

How long have you had monitoring now? If it’s been less than a week, I’d wait a little while. If it’s more than a week, call customer care and find out if there’s an issue with retrieving your scores.

Alerts to balance changes don’t always reflect in a points change. Collections removals could take a month to show up as a score increase.

@jbuddy wrote:I recently started up my monthly monitoring and every update that is coming thru is coming thru as a 0 score change…Things like paying down a cc debt balance, collections removal, collections update to paid in full — all of these things SHOULD be changing my scores. I had 5 alerts come thru today for those things and all show 0 score change. Anyone else have this issue? What should I do? Please help!

Read Also: How To Fix My Credit Score In 6 Months