How To Boost Your Credit Score The Traditional Way

The best way to improve your credit score is to focus on its two most important factors: payment history and amounts owed. Consistently paying your bills on time is the most important way to improve your credit score.

Thankfully, most lenders won’t report delinquencies less than 30 days old and many won’t even report payments that are 30 to 60 days late. But once you get beyond 60 days, each late payment will have a dramatic effect on your credit score.

That’s why it’s vital that you use every necessary resource to make all of your payments on time. This includes setting up alerts and reminders, as well as implementing automatic payments from credit card issuers and other lenders. Nearly all credit cards offer these features.

Related: 6 things to do to improve your credit in 2021

Next, you want to lower your debt-to-credit ratio. This is the total amount of debt you have, divided by the total amount of credit that you’ve been extended, across all accounts. The two ways to decrease your debt-to-credit ratio are to decrease your debt and to increase your credit.

Related:

Myth #: Paying My Utilities Bills On Time Will Improve My Credit

Unfortunately, this isnt the case. Utilities and most cable/Internet providers do not report payment histories to the credit bureaus unless payments are in default. If payments are up to date, they will not influence your credit score. If payments get behind or go to collections, they can be reported and will have a negative affect on the credit score. One exception to this appears to be Rogers Cable, which some have said are reporting to the bureaus regularly. Cell phone companies also report payment histories to the credit bureaus, so keeping your cell phone payments current can help to improve your credit score.

How To Get Your Free Credit Scores

On Credit Karma, you can get your free VantageScore 3.0 credit scores from Equifax and TransUnion.

You can also get your credit scores from the three main consumer credit bureaus, though you may be charged a fee.

You might also be able to get your scores from your credit card company or lender, or from a reputable .

Also Check: What Is A Good Vantage Credit Score

Why Is A Good Credit Score Valuable

Now you know a little more about where scores come from. But that doesnât explain why good credit scores are so valuable. Credit scores are often associated with credit risk, credit cards, loan applications and other lending decisions. And having a good score could help you qualify for more financial products with better rates, terms and credit limits.

But the influence of credit scores goes beyond that. And even when youâre not borrowing money, good credit could help you. Good scores could lead to lower insurance rates and fewer and lower security deposits on things like telecom and utility accounts. And good scores may make it easier to rent a home, too. Your credit reportsâbut not your scoresâcould even impact some job prospects.

Pre-Approval, Pre-Qualification and Comparing Offers

For starters, you may be pre-approved or pre-qualified for more credit offers if you have good credit scores. That may allow you to compare offers and find the best fit for your situationâwhether youâre looking at mortgages, credit cards or auto loans. But if youâre shopping around, be sure to understand how can affect your credit scores.

Interest Rates and Credit Limits

Beyond Credit Cards and Loans

Good credit could affect other parts of your life, too:

Does Checking My Credit Scores Affect My Credit

Checking your credit scores and reports on Credit Karma wont hurt your credit its a soft inquiry. In fact, keeping tabs on your credit scores is a good way to spot potential issues early. For example, if your scores suddenly drop, it could be a sign that theres an error in your credit report information or that you may be a victim of identity theft.

You May Like: How Long For Credit Score To Update

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

Increases Your Chances Of Improving Your Score And Qualifying For A Better Rate

When you understand how your credit score is calculated, you can take strategic steps to improve or build it over time. Several scoring websites allow users to simulate changes to their score based on factors such as on-time payments, extra payments, and new credit applications.

Suffice to say, this could save you thousands in the long run.

Also Check: What Day Does Capital One Report To Credit Bureaus

There May Be Red Flags That Indicate Fraud

Keeping an eye on your credit score regularly will allow you to spot unusual activity that may indicate fraud sooner. If you recognize a sudden and large increase in your credit usage right away, you can file a dispute and get your credit back on track.

Besides being frustrating, this can be costly. According to the Federal Trade Commission, the median amount of money lost to credit card fraud in 2020 was $311. Furthermore, To undo identity theft, it usually takes 100 to 200 hours over six months.

What If Im Denied Credit Or Insurance Or Dont Get The Terms I Want

Under federal law, a creditors scoring system may not use certain characteristics for example, race, sex, marital status, national origin, or religion as factors when figuring out whether to give you credit. The law lets creditors use age, but any credit scoring system that includes age must give equal treatment to applicants who are older.

You have the right to:

Know whether your application was accepted or rejected within 30 days of filing a complete application.

Know why the creditor rejected your application. The creditor must

- tell you the specific reason for the rejection or

- that you are entitled to learn the reason if you ask within 60 days.

Learn the specific reason the lender offered you less favorable terms than you applied for, but only if you reject these terms. For example, if the lender offers you a smaller loan or a higher interest rate, and you dont accept the offer, you have the right to know why those terms were offered. Read to learn more.

If a business denies your application for credit or insurance because of information in your credit report, federal law says the business has to

- give you a notice that includes, among other things, the name, address, and phone number of the credit bureau that supplied the information.

- include your credit score in the notice if your credit score was a factor in the decision to deny you credit or to offer you terms less favorable than most other customers get.

If you get one of these notices:

Also Check: How To Find Credit Rating Of A Company

Does Checking Your Credit Score Lower It

The act of checking your own credit score is considered a soft inquiry and will not affect your credit score in any way. You can check your score without affecting your credit. But, when you are getting ready to apply for new credit or loan, it’s a good idea to check your credit score regularly.

Make sure your credit report is accurate at least once a year, in addition to checking your credit score. The appropriate credit bureau can be contacted if you believe something is inaccurate.

Understanding How A Fico Credit Score Is Determined

This video from the Continuing Feducation series provides a short overview of credit scoreshow they are determined and why they are important.

To provide students with online questions following each video, register your class through the Econ Lowdown Teacher Portal.

This video is included in an online booklet for Boy Scouts to earn the Personal Management merit badge, one of the requirements to become an Eagle Scout. Learn more about the badge and other videos featured in the booklet »

You May Like: Is 684 A Good Credit Score

Resist Credit Inquiries Unless Absolutely Necessary

Make sure credit inquiries arent being made on your credit report on a regular basis. Soft credit checksthose in which you or a prospective landlord or employer look at your scoredont affect your credit score. But hard credit checks, like when you want to increase a credit limit or apply for a credit product or loan, always do. You can learn more about the difference between the two inquiries by reading our in-depth article on the effect of checking your credit score.

Some Canadians rack up cash back and rewards points by engaging in , a practice where applicants apply for credit cards to take advantage of sign-up bonuses offered in the first few months and then cancel these cards when the bonus period expires. But this practice is unkind to your credit score, as each time you apply for a new card it can take up to ten points off.

Is Knowing Your Own Credit Score Important

Some people really want to know what their credit score is. However, it changes often, so be prepared. Also, keep in mind that your credit score is intended to reflect the likelihood that you will repay any money that you borrow. Most people dont need a score to know if they will pay themselves back the money they lend themselves. Instead, focus on managing your money carefully with a budget and only apply for credit that you need your score will take care of itself.

Getting a copy of your credit report, however, is important and can be done for free. It will allow you to spot concerns, inaccuracies, or potential fraud.

Recommended Reading: How Long Can A Negative Stay On Credit Report

How Credit Scores Are Created

Your credit reports include information about your and activity. The credit bureaus rely on credit scoring models such as VantageScore and FICO to translate all this information into a number.

While each credit scoring model uses a unique formula, the models generally account for similar credit information. Your scores are typically based on factors such as your history of paying bills, the amount of available credit youre using and the types of debt you have .

Federal law prohibits credit scores from factoring in personal information like your race, gender, religion, marital status or national origin. That being said, its not necessarily true that the American financial system is unbiased or that credit lending and credit scoring systems dont consider factors affected by bias. To learn more about racial justice in lending and initiatives seeking to create change, connect with organizations leading the fight, like the ACLU.

What Does Your Credit Limit Mean For Your Credit Score

While having a good credit score will increase your chances of getting a higher credit limit, a higher credit limit can in turn help your credit score.

One of the major aspects that contributes to your credit score, for example, is your credit utilization. Credit utilization is the percentage of your overall credit — across all of your open accounts — that you’re using.

So if you have an overall credit limit of $10,000 and you have a credit card balance of $5,000, your credit utilization would be 50%.

When it comes to your credit utilization, a good percentage to keep in mind is 30%: Your credit utilization contributes to 30% of your credit score, and staying below 30% credit utilization will have the best impact on it.

Having a smaller line of credit can make it harder to maintain a healthy credit utilization. The higher overall credit line you have, the easier it will be to keep your credit utilization in that 30% range, and the better your credit score will be because of it.

Don’t Miss: Does Amex Gold Report To Credit Bureaus

How Are Fico Scores Calculated

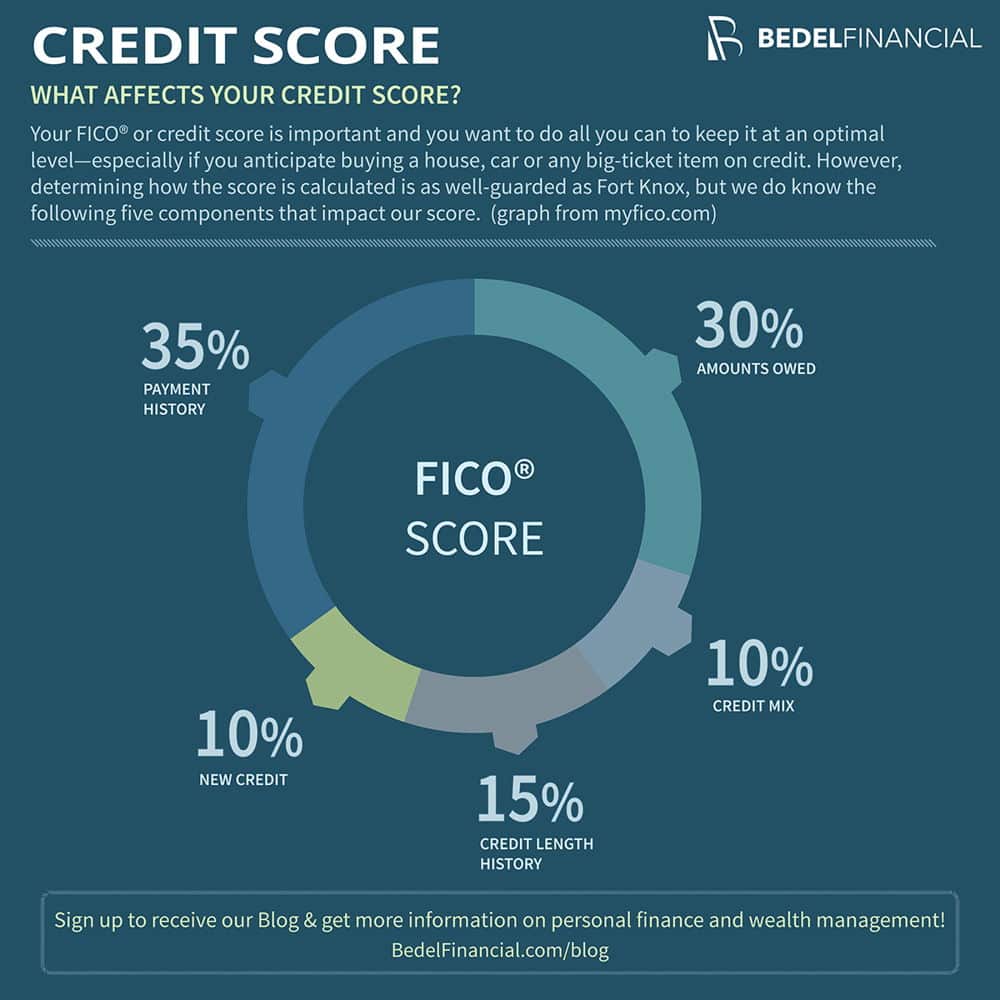

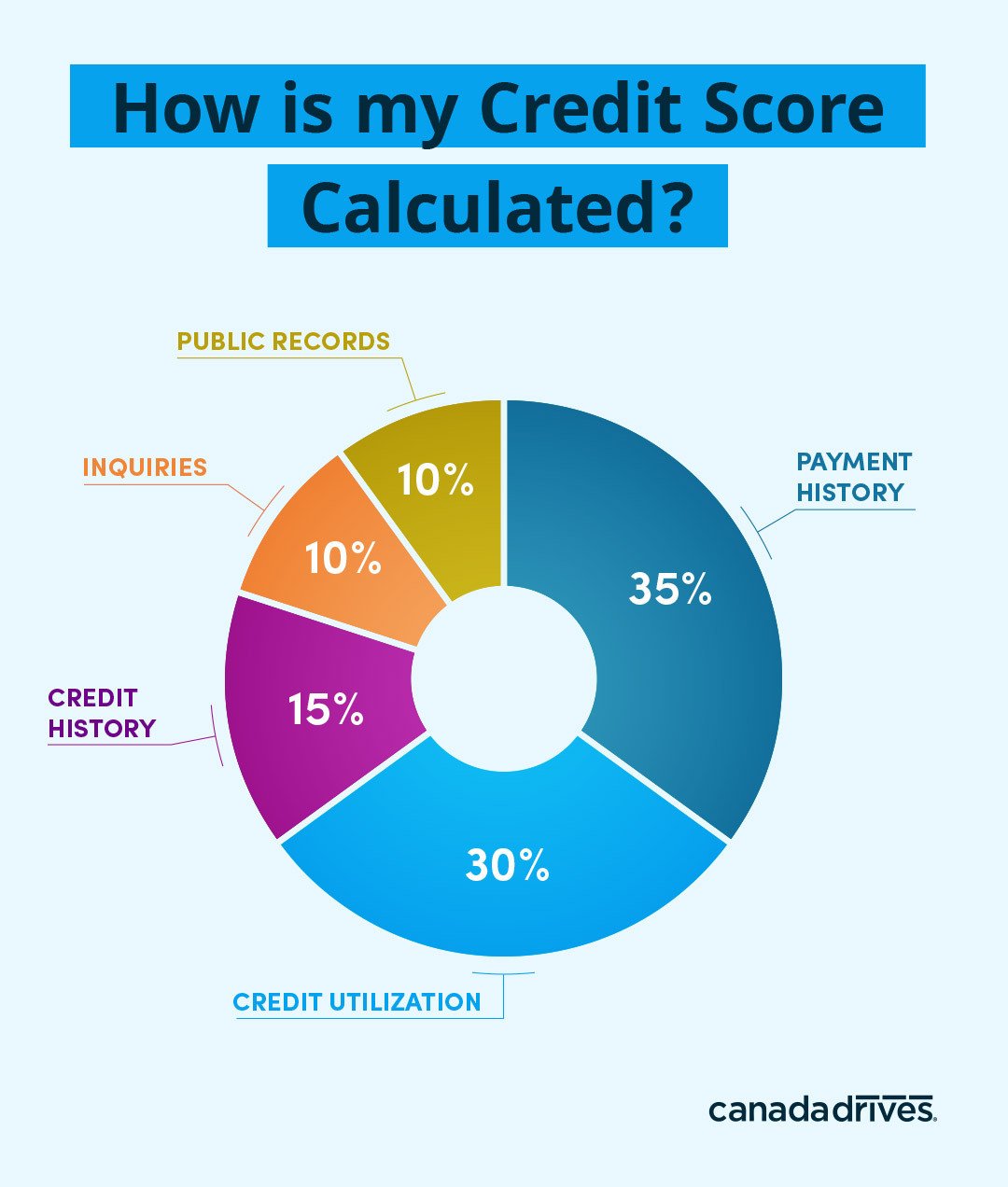

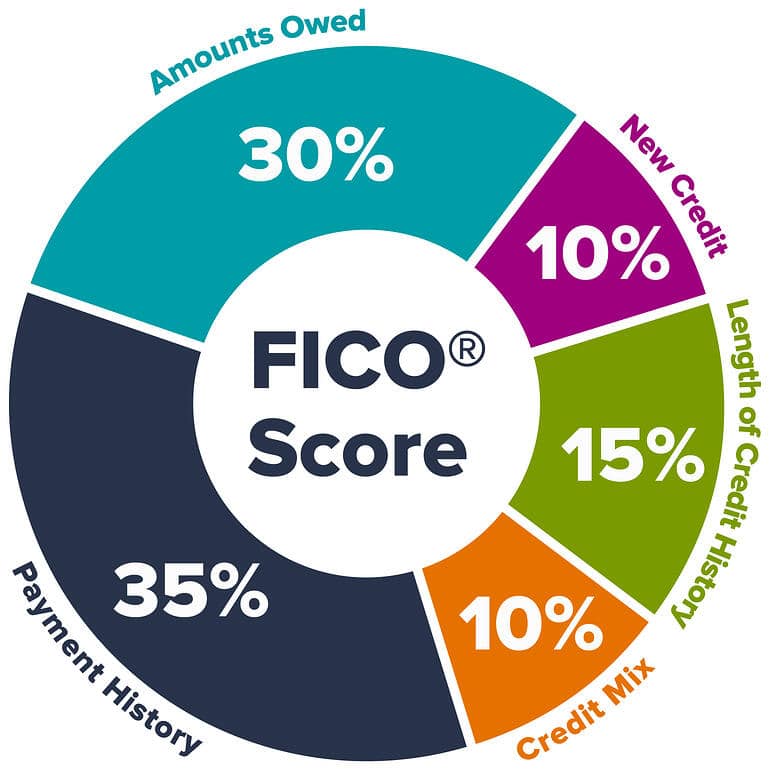

Regardless of which FICO model is used, there are five factors that mostly influence a classic FICO score and help to define your credit score:

There are many sub-categories calculated within each area before arriving at a final score. Here is a look at each category and the weight it carries in determining your score.

Payment History

Payment history counts for 35% of your score. If you make payments on time every month and dont have negative public records for lawsuits, liens, bankruptcies or foreclosure, you will do well in this category. Late payments are a negative. The later the payment a month versus a week the more your score gets penalized.

New Credit

The last category, new credit, is the final 10% of the equation. Its OK to apply for a credit card, but if you apply for several at the same time, it may be an indication youre using one to pay off others and that is a negative. The same logic applies to asking for a car loan at the same time you ask for a home loan. Its better to spread those applications out over time.

What Is A Good Credit Score

If youâre just looking for a quick answer, itâs probably best to start with popular credit-scoring companies FICO® and VantageScore®, which issue two of the many different types of credit scores.

But thereâs a lot more to it than that. So keep reading to take a closer look at credit scores, including how theyâre determined, whoâs looking at them, and what you can do to monitor and improve yours.

Key Takeaways

- People have more than one credit score, and scores can vary based on how theyâre calculated, when theyâre calculated and what information is used to calculate them.

- FICO and VantageScore are two popular credit-scoring companies.

- Scores from FICO and VantageScore typically range from 300 to 850.

- FICO says good credit scores fall between 670 and 739 VantageScore says good scores fall between 661 and 780.

Recommended Reading: How To Update Name On Credit Report

The Ultimate Guide To Credit Scores In Canada

What is a credit score? A credit score is a 3-digit number that allows lenders to determine a potential borrowers credit riskthe risk they run of not paying back their credit cards or loans. Canadians typically cannot borrow money or receive credit of any kind unless they have a solid credit score. Canadas two national credit bureaus, Equifax and TransUnion, create credit scores and credit reports based on the information they receive about each borrower from their lenders.

In This Article:

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

Recommended Reading: How To Get Charge Offs Removed From Your Credit Report

How To Request A Credit Limit Increase

If you’d rather not wait for the issuer to decide on its own, you can request a credit limit increase by calling the number on the back of your credit card. Most issuers also let you request a limit increase online or via the mobile app.

“You probably want to have a credit card for at least 6 to 12 months before requesting that first increase,” Rossman told CNET. “You’re especially likely to be successful if your income has increased, your credit score has increased and/or if your debt-to-income ratio has decreased. Plus, it will also increase your chance of success if you’re a good customer who uses the card frequently and pays on time.”

When requesting an increase, in addition to knowing how much of an increase you’re looking for, it’s important to have at the ready the necessary information the issuer may request. That could include your annual income, employment status and monthly rent or mortgage payment. Keep in mind that requesting a credit limit increase could also result in a hard credit check, which negatively impacts your credit score.

It’s also a good idea to have solid reasoning behind why you’re requesting a higher credit limit, in case the representative asks, and to point out your history of on-time payments with regular card use.

What Makes Up Your Credit Score

For example, your bank account balance doesnt appear on your credit report. Neither does your income or your net worth. None of these factors play a role when a scoring model calculates your credit score.

Factors that do impact your FICO Score fall into one of the following five categories.

- Payment History: 35%

- Length of Credit History: 15%

- New Credit: 10%

In each category, a scoring model will ask questions about your credit report. For example, Does the report show any late payments? These questions are known as characteristics in the credit scoring world. The answers to these questions, called variables, determine the number of points you earn. When the scoring software adds all of those points together, you get your credit score.

Related: Understand The 5 Cs Of Credit Before Applying For A Loan

Don’t Miss: Is 805 A Good Credit Score