Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan term, interest rate types , down payment size, home location and loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. Its estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didnt get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Can You Get A Home Loan With Bad Credit

Its possible to qualify for a mortgage even if your credit score is low. Its more difficult, though. A low credit score shows lenders that you may have a history of running up debt or missing your monthly payments. This makes you a riskier borrower.

To help offset this risk, lenders will typically charge borrowers with bad credit higher interest rates. They might also require that such borrowers come up with larger down payments.

If your credit is bad, be prepared for these financial hits. You may qualify for a mortgage with a low credit score, youll just have to pay more for it.

Why Is It So Important To Get A Low Interest Rate On My Mortgage

You probably already know that a lower interest rate means a smaller monthly payment. But do you know just how big of an effect a smaller monthly payment can have?

Lets look at an example. According to the U.S. Census Bureau, in March 2018 the average sales price of a new home sold in the United States was $366,000. If you were to go to the closing table with a 20% down payment and opted for a 30-year fixed-rate mortgage, heres how much it would cost you over time depending on your interest rates.

Read Also: Why Did My Credit Score Go Up

How To Get Started

If youre ready to begin the homebuying or refinance process but are unsure about your credit situation, check with your bank or credit card issuer to get an idea of your score. You also should download your full report yearly to evaluate your history and ensure there are no errors.

Your credit history might be complicated.

To help you learn more about your situation and improve your score, consider working with your lender or a financial counselor to help you get where you need to be.

When It Comes To Getting A Mortgage There Are Enough Numbers Flying Around To Make Any Mathematician Happy Lenders Will Look At A Number Of Items Which Can Include Your Credit History Your Income And How Much Debt You Have Among Other Things

But one number is perhaps one of the most important numbers of all. Your FICO® scores can impact whether you get a loan or not, and if so, at what interest rate. Thats why its important to understand the nuances of your FICO® scores. Luckily, its not rocket science. Heres the scoop on how your FICO® scores can affect your mortgage.

Recommended Reading: What Happens When You Report Fraud On Your Credit Card

How Mortgage Lenders View Your Credit Score

When you apply for a mortgage, lenders check your credit score, along with your employment history, debt to income ratio and other factors, to determine their potential risk. A high credit score may help you qualify for lower interest rates than someone with low or no credit.

Credit scores can range between 400 and 900 . The two credit bureaus in Canada are TransUnion Canada and Equifax and these bureaus track the credit histories of millions of Canadians.

A strong credit score is especially important if youre applying for an insured mortgage where youre borrowing more than 80 percent of the homes value. Some banks will overlook a lower credit score to some degree if its an uninsured mortgage, meaning youve put down 20 percent or more.

For insured mortgages and best rates, most lenders want to see a minimum credit score of 680. If your score is at 680, the lender may want an explanation of why the credit score isnt higher . A few lenders will grant mortgages to those with low credit scores, but they will do so at a rate premium and a fee to cover their enhanced risk. Coast Capital, for instance, can charge a .5 to 2 percent fee and increase their rates by 1 to 3 percent under their specialty program for buyers with credit issues.

Here are a few tips for raising your credit score before you apply for a mortgage:

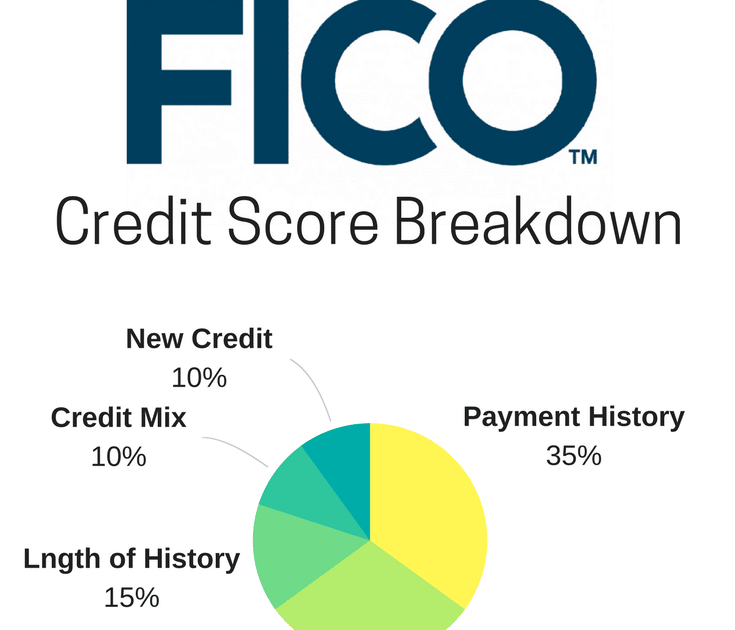

What Indicator Drives A Fico Score The Most

There are a number of different factors that affect your FICO Score. Your payment history is the factor that has the most impact, making up 35% of your total FICO Score. Lenders want to know whether you’ve paid your existing accounts on time, which helps them determine how much risk they will assume by approving your credit application.

Recommended Reading: Does Freezing Your Credit Affect Your Credit Score

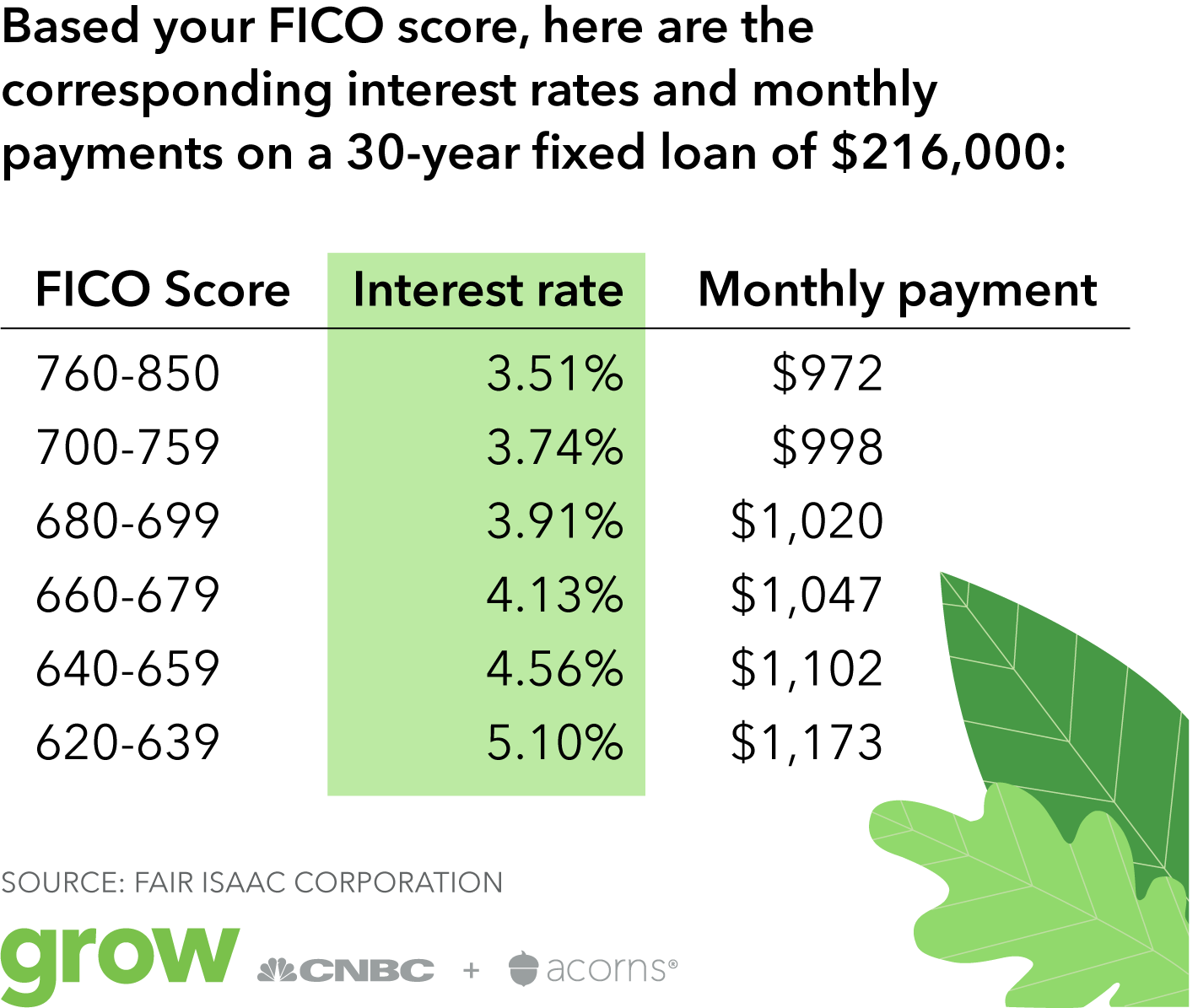

Interest Paid By Fico Score

| FICO Score |

Based on the in August 2021

If your credit score is on the lower end, even a small difference in your mortgage score can make a big difference in the cost of your home loan. You could wind up paying more than 20% more each month, which can make it harder to afford a mortgage.

How Can I Get A Mortgage Without A Credit Score

You just need to find a hand-drawn lender, such as Churchill Mortgage. While it is more difficult to get a mortgage without a loan, it is not impossible. All you need to do is find a lender to handle the manual underwriting. What is manual subscription? The manual acceptance is a practical test of your ability to pay off debt.

Recommended Reading: How Long Are Late Payments On Your Credit Report

How Do I Get The Best Mortgage Rate

Shopping around for the best mortgage rate can mean a lower rate and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If youre not sure about a lenders credentials, ask for its NMLS number and search for online reviews.

Find A Mortgage Lender According To Your Needs

Banks up the street are no longer the only option for joint mortgages for todays borrowers. You may still be able to get a favorable mortgage through these sources, but you may also be able to secure a mortgage through a mortgage banker or broker. You may also be able to find good mortgage products online from many online lenders. Find the right fit by researching several of these.

Recommended Reading: Does Sezzle Report To Credit Bureaus

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Dont Miss: How To Shop For Mortgage Refinance

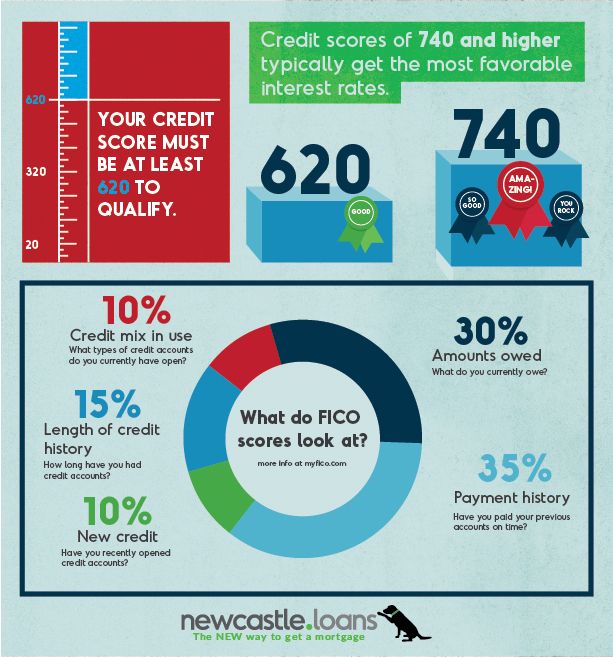

What Makes Up Your Credit Score

The FICO credit scoring model interprets the information found in your credit report. Some parts of your credit history are more important than others and will carry more weight on your overall score.

Your FICO score is made up of the following:

- Payment history: 35% of your total score

- Total amounts owed: 30% of your total score

- Length of credit history: 15% of your total score

- New credit: 10% of your total score

- Type of credit in use: 10% of your total score

Based on this formula, the largest part of your credit score is derived from your payment history and the amount of debt you carry versus the amount of credit available to you. These two elements account for 65% of your FICO score.

To put yourself in the best position to qualify for a mortgage, focus on these areas first. Pay your bills on time whenever possible, and try to reduce your credit utilization ratio.

Your credit utilization ratio compares the total amount of credit available to you against your current balances try to keep it under 30%.

This will improve your FICO scores and mortgage loan terms measurably.

Read Also: How Does A Home Equity Conversion Mortgage Work

Read Also: Does Simm Associates Report To Credit Bureaus

Basics Of Credit Scores

When you apply for a mortgage, lenders consider your credit score to assess whether you’re a risk for a mortgage. They can obtain your credit report from three bureaus Experian, TransUnion and Equifax. With your credit reports in hand, lenders can use credit scoring models such as the FICO credit score or VantageScore.

Both models take into account factors such as your on-time payment history, number of inquiries, type and number of accounts and length of credit history to generate a number from 300 to 850. Generally, a score of 680 or higher will indicate good credit, while a score in the upper 700s or higher would be excellent.

Depending on the bureau from which the lender pulls your residential mortgage credit report, you’ll find that a FICO or VantageScore number derived from one source can differ from that of another bureau. This is due to the fact that some creditors may not report your accounts or credit pulls to all the bureaus. So, it’s possible that your FICO score calculated from Experian’s report is lower than the one from TransUnion’s.

Improving Your Credit Score

If you pull your credit scores and find you won’t qualify for a mortgage or would probably have to pay a high rate, it’s a good idea to take steps to raise your scores. Your payment history and debt owed make up the biggest part of your score, so paying down large debts, avoiding the temptation to open more credit card accounts and avoiding late payments will help you gain points over time. You’ll also want to make sure your credit reports don’t have mistakes, such as incorrect accounts, and avoid closing your long-standing accounts.

To see how positive changes can improve your score, try using a like those you can find on the Credit Karma, TransUnion, myFICO and other banking websites. You can plug in your current score and do simulations to see how your score changes if you take actions, such as decreasing account balances, getting credit limits increased or avoiding late payments.

You May Like: How To Remove Medical Collections From Credit Report

Which Credit Scores Do Mortgage Lenders Use

When you apply for a mortgage, lenders will generally request all three of your credit reports and a FICO® Score based on each report. However, the type of FICO® Scores they request are often older versions, due to guidelines set by government-backed mortgage companies Fannie Mae or Freddie Mac. It can be important to know about these different FICO® Score versions when you’re planning to buy a home.

What Else Do Mortgage Lenders Look At To Determine Mortgage Terms

Your credit scores can be an important factor in getting approved for a mortgage and the rates you’re offered. However, mortgage lenders also go beyond your credit scores when evaluating a potential borrower’s application.

They’ll also take a close look at the information within your credit reportsnot just your scores. For example, even if you have a good credit score, the lender might deny your application if you recently filed for bankruptcy or had a home foreclosed on. Or if you owe too much money to collection agencies.

Mortgage lenders may also request various financial records, including recent bank statements, investment account statements, tax returns and pay stubs. They can use these to determine your income, debts and debt-to-income ratio, which can be an important factor.

Other factors, such as the loan amount, the home’s location, your down payment and loan type can all play into whether you’ll be approved and your mortgage’s terms. Lenders may also have unique assessments, which is one reason shopping for a mortgage can be important.

Recommended Reading: How To Print Credit Report On Experian

How Credit Scoring Models Affect Your Score

In the old days, banks and other lenders developed their own scorecards to assess the risk of lending to a particular person. But these scores could vary drastically from one lender to the next, based on an individual loan officers ability to judge risk.

To solve this issue, the Fair Isaac Corporation introduced the first general-purpose credit score in 1989. Known as the FICO Score, it filters through information in your credit reports to calculate your score.

Since then, the company has expanded to offer 28 unique scores that are optimized for various types of credit card, mortgage, and auto lending decisions.

But FICO is no longer the only player in the game. The other main credit scoring model youre likely to run into is the VantageScore.

Jeff Richardson, vice president for VantageScore Solutions, says the VantageScore system aimed to expand the number of people who receive credit scores, including college students and recent immigrants, and others who might not have used credit or use it sparingly.

What Determines A Credit Score

Several factors contribute to your credit score, with some weighing more than others:

- Payment history: 35 percent

- Total amounts owed: 30 percent.

- Length of credit history: 15 percent

- New credit: 10 percent

- Type of credit in use: 10 percent

In the US, the median credit score is 723. This is higher than the belief that a good credit score ranges from 660 to 700.

You May Like: What Is Your Credit Score Based On

Small Changes That Can Impact Your Credit Score

If you would like to improve your credit score before applying for a mortgage, or if you are planning on making certain purchases during the process of acquiring a home, there are a few things to know. Paying off credit cards on time, not missing payments on debts and not utilizing a significant portion of your credit are powerful ways to boost your credit.

One of the most detrimental things an individual can do during the home buying process is to begin purchasing furniture and other items on a credit card in preparation for moving in. This will increase your debt to income ratio, which can negatively impact not only your credit score but also your overall financial picture evaluated by lenders.

It is not uncommon for inexperienced buyers to be preapproved, begin putting home-related purchases on a credit card, and then find themselves denied during the later parts of the purchase process due to the credit and financial solvency evaluations that ensue.

Whose Score Will Lenders Use

When you make a joint mortgage application, lenders could be evaluating as many as six credit scores three for each of you. While most lenders consider the applicant with the highest monthly income as the primary borrower, they often take the lowest middle credit score of both borrowers as their benchmark. While frustrating, this is just another example of conservative lending policy.

Recommended Reading: Do Utilities Affect Credit Score

Does Paying For Rent Build Credit

There is no definitive answer to this question as it depends on a number of factors, including the landlords policies and the credit reporting agencys guidelines. However, in general, paying rent on time can help build credit, as it is typically reported to credit agencies. Therefore, if youre looking to build credit, paying your rent in full and on time is a good place to start.

Rent payments do not typically build credit, but they can be reported to the credit bureaus on a regular basis to help build credit. Credit score calculations are based on the information contained in your credit reports. Rent payments are typically not reported to Experian, Equifax, or TransUnion. If you pay your rent on time, your rental payment information may be included in your credit report, which may help you establish or strengthen your credit. In general, utility bills are only reported to the bureaus if they are late or in collections. In order to avoid harming your credit score, you must ensure that utility bills are paid on time. If the owner reports the information, it will assist.

If you are late on your payments or are evicted from your home, they may still affect your credit score if they do not. You should not rely on information provided on WalletHub Answers for financial, legal, or investment advice. This site may display ads from third parties, in addition to those of paid advertisers.