Your Credit Score Doesn’t Start At Zero

Starting with no credit score doesn’t mean your score is zero. Rather, your score simply doesn’t exist. That’s because your credit score is calculated only at the moment that a lender, credit card issuer or other entity requests it to check your creditworthiness. If you haven’t yet built a credit history, there’s no information on which to base that calculation, so there’s no score at all.

Once you begin to establish a credit history, you might assume that your credit score will start at 300 . But it’s highly unlikely your first credit score will be that low, unless you start off with very poor credit habits. Nor will your first credit score be the highest level . When you’re new to using credit, you simply don’t have a robust enough credit history to earn the highest score.

The Start Of The Credit Score

A credit scoring system that used personal traits to determine a borrowers likelihood of debt repayment would be overtaken by a more statistical approach.

In 1956, engineer Bill Fair teamed up with mathematician Earl Isaac to create Fair, Isaac and Company, with the goal of creating a standardized, objective credit scoring system. In theory, a standardized rubric would eliminate the prejudice that was inherent in the credit evaluation and lending practices that had been used for many years. Today, Fair, Issac and Company goes by a different name: FICO.

In the 1950s, the credit industry was resistant to adapt to the new, standardized method, as character assessments had been foundational to consumer lending up until that point. Only one company, American Investments, took up Fair Isaac’s system when it began selling its statistical scorecard in 1958.

National department store chains were early adopters of the system when it debuted in the late 1950s, but credit card issuers, auto lenders, and banks soon followed. They needed a dependable, efficient, and quick way to gauge a borrowers creditworthiness, and the Fair Isaac system provided this for them.

FICO Score 9 debuted in 2014 and is widely used by the three major credit bureaus. In this credit scoring model, rent payments are included, medical debt isnt weighed as heavily, and collection accounts that have been paid arent included in the calculation of your score.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Recommended Reading: How Do You Dispute Stuff On Your Credit Report

Are You A Score Star Test Your Knowledge Of The Fico Score With This Video Quizvideo Quiz

The FICO® Score is a three digit number ranging from 300-850 that summarizes your credit risk, based on a snapshot of your credit report at a particular point in time. It helps lenders predict how likely you are to repay your debts on time. Its important to know and manage your FICO® Score because it affects whether you can get credit and what kind of interest rate you will pay for credit cards, auto loans, mortgages and other kinds of credit. The video quiz below will test your knowledge of the FICO® Score. After viewing the quiz, you can go to www.myfico.com to learn more facts and fallacies about the FICO® Score as well as tips and tricks for maintaining and improving your FICO® Score.

What Does It Mean To Have No Credit

Having no credit doesnt mean you have bad credit or a bad credit score. It simply means youve never applied for a loan, credit card or any other form of financing. Thus, you dont have credit history with any of the three major credit reporting agencies Equifax, Experian or TransUnion.

People with no credit are sometimes considered credit invisible because of their limited credit history and lack of score. Some people believe they can build credit by making payments to utility companies or rental agencies. However, these payments are rarely reported to the bureaus, so they dont affect your score.

According to a report from the Consumer Financial Protection Bureau , around 26 million Americans are credit invisible. Another 19 million people have a credit report but dont technically qualify for a credit score. This is because you need at least one account on your profile to start building credit.

For FICO, you must have an account thats 6+ months old to establish a credit history. VantageScore simply requires you to have an account. Unfortunately, without a credit history, you wont meet the minimum requirements to have a VantageScore or FICO credit score.

To learn more about starting credit scores, check out this video:

Also Check: How Long Is A Credit Report Good For Mortgage

Build A Good Credit Mix

Its better to have different types of credit, such as auto loans, installment loans, and student loans, than it is to have multiple credit cards. Having a good mix of credit from the get-go can help improve your credit score more quickly. However, dont try to take out multiple new loans at once. Also, only apply for financing you can afford.

How Often Does Your Credit Score Update

Your FICO score recalculates every time someone checks it. Whether or not it changes depends on if any creditors have added new information to your credit report.

Most lenders have a regular schedule when they report information to the credit bureaus, and that may not necessarily be when you make changes. For example, if you pay off a credit card, you might not see it reflected in your credit score until a month later.

Don’t Miss: How To Bring Up Credit Score

What Is Insufficient Credit History

Its not uncommon to have an insufficient credit history when youre just starting out. Having an insufficient credit history simply means that your credit profile isnt old enough to satisfy the requirements of a certain lender. If youre told that you have an insufficient credit history, there are several strategies that you can take to help overcome this:

- Apply for a secured credit card

- Apply for a credit builder loan

- Ask your landlord to report your monthly rent payments

- Add an authorized user to your credit card, or become an authorized user on someone elses account

If you have an insufficient credit history, its important to know that youre not alone. Lets take a look at the number of people who are currently credit invisible:

Americans who are credit invisible

| Generation |

|---|

As you can see, an overwhelming majority of Gen Zers are considered credit invisible. This number continues to drop as the generations get older. For instance, only 24% of Millennials are considered credit invisible, and a mere 10% of Baby Boomers are.

To learn more about insufficient credit history and the steps you can take to help build your credit profile quickly, check out these articles.

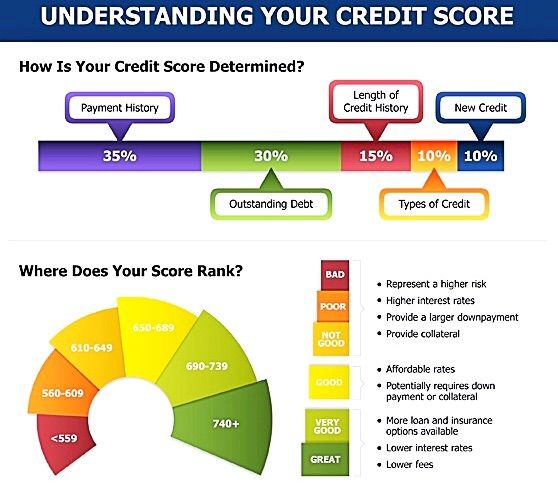

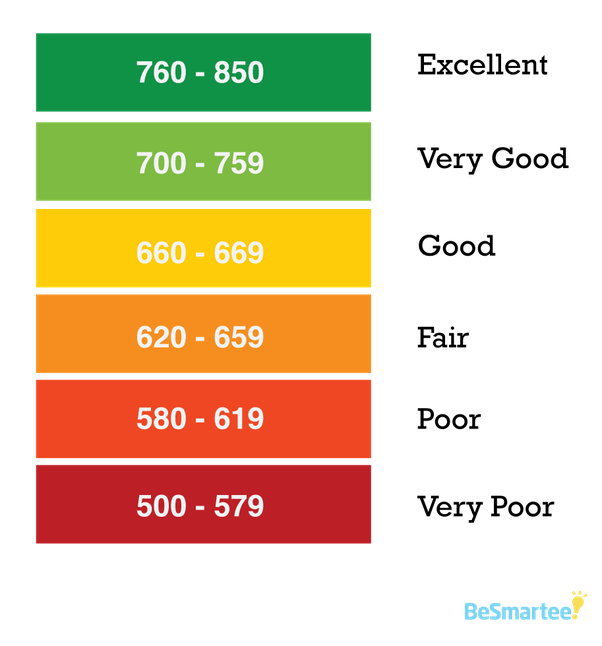

What Are The Fico Credit Score Ranges

In addition to understanding how a FICO credit score is calculated, its a good idea to know the FICO credit score ranges. FICO scores range from 300 to 850, and are divided into the following categories:

- Exceptional: 800-850

- Very Poor: 300-579

Your goal should be to get your FICO score above 670 as quickly as possible. Once you have good credit, youll be able to apply for some of todays best credit cardsplus, itll be easier to take out a mortgage, rent an apartment, buy a car, sign up for a new smartphone plan and more.

Read Also: Does Requesting A Credit Limit Increase Hurt Score

Keep Your Credit Utilization Low

First, you want to try to keep your credit utilization ratio as low as possible. Typically, you want to keep your credit utilization ratio no higher than 30%. Your credit utilization refers to how much you have in available credit compared to your general income. Some factors that may be considered in your credit utilization are:

- How much money you are using on your current credit card limit.

- How much you are using on credit limits for other financial products.

- Your gross income.

- The amount you owe on bills or loans like a pay day loan.

- Funds in your savings account.

- Value of stocks or other investments.

What Does Your Credit Score Start At

One of the most common questions young adults ask about credit is: What does your credit score start at? In other words, when you first turn 18 and have no or other debt, what is your credit score?

Personal finance education isn’t universally taught in the U.S., and as a result, many people understand little about credit scores and building credit.

Jump To

You May Like: How Often Is The Credit Report Updated

Debt Compared To Income

How much a person owes in various debts compared to how much income they bring in regularly accounts for 30% of their credit score. To calculate your debt-to-income ratio, add up your current balances for your credit cards, student loans, car loans, mortgages, or any other loans you have. Next, add up how much money you bring in regularly. Calculate this amount by totaling up your yearly salary and other income you may have. Lastly, compare how much you owe with how much you bring in. This comparison is your debt-to-income ratio.

Fico : What You Need To Know About The Latest Credit Score

A Discover credit card now gets you free access to your latest FICO credit score. It’s a new service Discover Financial Services is offering to all of its cardholders.

A Discover Financial Services credit card © Scott Eells/Bloomberg via Getty Images Barclaycard US and First Bankcard began providing FICO scores to their customers in November… Continue Reading

You May Like: Is 830 A Good Credit Score

How Do Credit Score And Credit Limit Relate

Lenders view your credit score as a measure to gauge the risk you pose as a borrower. If a lender looks at you as someone with minimal risk, it might be willing to offer you a higher credit limit than it would have if you had less-than-perfect credit. You might qualify for a higher credit limit than someone with the same income if you have a better and longer credit history that results in a higher credit score.

Your , on the other hand, may have an effect on your credit score through your credit utilization ratio. This refers to the amount youve borrowed from your total available credit and should ideally be 30% or lower. If you have a total available credit limit of $10,000 through different credit products and have borrowed $5,000 so far, your current credit utilization ratio stands at 50%, which is significantly higher than the desired limit.

Become An Authorized User On A Family Members Account

If someone in your family has good money management habits and a high credit score, ask to become an authorized user on their account. This will add the account to your credit history and give you access to their credit card. As long as you and the account owner use the card responsibly, you can build credit.

Some card issuers charge a small annual or service fee, but becoming an authorized user is usually free. Check with the issuer about their policy.

Dont Miss: What Is My Business Credit Score

You May Like: How Long Does Delinquency Stay On Credit Report

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Does Your Credit Score Start At The Age Of 18

Your credit score will not start at the age of 18. It begins when you apply for a credit card or a loan, which is only possible once you turn 18, so your credit scores and reports will not exist. When you are capable of borrowing money on your own, and get a credit card or a loan, then you will see a credit report in your name.

When you start building your credit at 18, this means you are starting to build your credit. When you open a credit card, at this age you will not require an annual fee.

While building your credit, the length of your credit history is short and will negatively impact your credit score. If you are good at money management, then you will improve your credit score to a perfect one.

You must get a credit card that gets easily approved and proceed to build your credit with that. For example, you may apply for a secured card which will be easier to use. Eventually, you may move on to unsecured cards once you understand credit scores. It depends upon the users to switch from secured to unsecured credit cards.

You May Like: Does Drivetime Affect Credit Score

Whats The Best Way To Check Your Credit Score For Free

Most of the time you can check your credit report for free. There are four main ways to check your credit score, according to the Consumer Financial Protection Bureau.

Components Of A Credit Score

A credit score isnât a random number assigned to a person. Itâs actually a complex formula that takes into account several factors, including your payment history, amounts owed on debts, credit history, new credit and your credit mix. Combined, these five components help determine the credit score youâre assigned.

You May Like: Will Increasing My Credit Limit Help My Score

Check Your Credit Report

The three major credit bureaus are TransUnion, Equifax and Experian. They gather information related to your credit and financial history and use it to compile a credit report. Prospective lenders and other entities can then use that information to determine your creditworthiness.

Its a good idea to check your credit report regularly. For the average consumer, this means once a year. But if youre applying for a large form of financing like an auto loan or mortgage check it more frequently.

You should also get your report from all three agencies. This is because lenders and creditors arent required to report to all of them. Additionally, the agencies dont share consumer information with one another. Because of this, your credit score and report information could be different.

Around 20% of credit reports contain at least one error in personal or credit information. Some of these errors can hurt your credit score, so review your report for anything that doesnt look right. If you find an error, dispute it with the corresponding credit reporting agency or the entity that reported it.

Also check your credit report for information regarding payment activity, credit utilization, hard inquiries and any other recent activity. These factors can help or hurt your overall score. For example, any time a lender checks your credit report, it results in a hard inquiry. Each hard inquiry can cause your score to temporarily drop by up to 5 points.

The Start Of Modern Credit Bureaus

The modern credit economy wouldnt have been possible without these credit bureaus,says Josh Lauer, an associate professor at the University of New Hampshire who studies consumer and financial culture. Credit scores and credit reports help people who dont know each other make calculations to determine who they can trust.

Businesses started the nations first consumer credit bureau. Credit bureau agents collected credit and personal information from landlords and employers about individuals . They would also collect newspaper clippings and public records from courthouses.

The information collected in these files was primarily qualitative. So, in the 1930s, department stores decided to move in a more quantitative direction – based on this information, they started to assign points to individuals to gauge their creditworthiness. But this credit scoring system was anything but research-based. Individuals would earn points based on characteristics such as their race, income, neighborhood, and employment status, all in an attempt to determine someones morals.

Read Also: Does Apple Card Show Up On Credit Report

Your Starting Score Isnt Your Forever Score

As you start your credit journey, remember there are ways to start positive financial habits right away to help you continue building to a better credit score.

Consider monitoring your credit to see how your most recently reported balance impacts your scores. from Capital One is a free tool that lets you monitor your VantageScore® 3.0 credit score. Using CreditWise to keep an eye on your credit wonât hurt your score. And itâs free for everyone, not just Capital One customers.

You can also get free copies of your credit reports from all three major credit bureausâEquifax®, Experian® and TransUnion®. Call 877-322-8228 or visit AnnualCreditReport.com to learn more. Keep in mind that there may be a limit on how often you can get your reports. You can check the site for more details.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.