Should You Cancel A Credit Card After Paying It Off

Once your card account is paid, you might feel tempted to cancel the card to prevent yourself from accruing another high balance. Canceling your card may not be the best idea, though. An established credit account helps your credit score in a few ways, even if you don’t use the card frequently.

One major reason not to cancel a credit card is that your card accounts contribute to your total available credit, which affects your credit utilization ratio. To calculate this ratio, divide your total credit card balances by your total available credit. Your credit utilization is one of the most important factors in your FICO® Score, and a ratio of 30% or higher can affect your scores negatively. Keeping your paid-off account open is a way to help keep your overall credit utilization down.

Another reason is that a credit account you’ve had open for a while helps increase the average age of your accounts and the length of your credit history, which accounts for 15% of your FICO® Score.

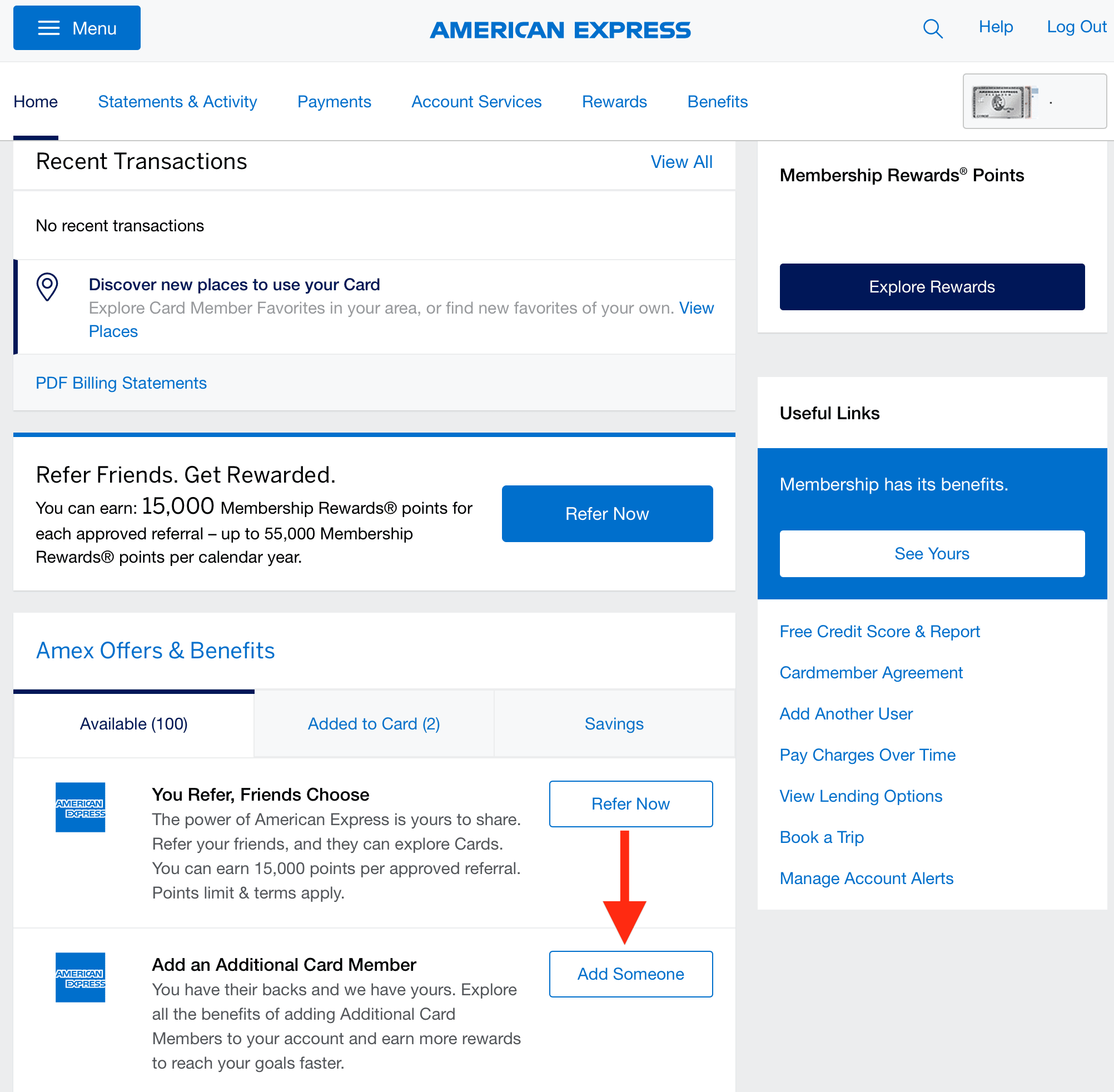

How Old Does An Authorized User Need To Be

Every bank and financial institution makes their own rules just as you set your own rules for your kids, from when bedtime is to whether your child should be an authorized user on your credit card.

American Express and U.S. Bank, for instance, require authorized users to be at least 13. Discover, requires authorized users be 15. Some credit card issuers, including Chase, Capital One and Bank of America, among others, dont have a minimum age.

In some cases, banks wont report to the credit bureaus until the authorized user reaches 18 years old, so keep that in mind. Still, If you add your 18-year-old to a credit card youve had for 20 years, your childs credit report could reflect a history longer than they are old. Remember, though, that removing them as an authorized user will also remove that lengthy history.

Whether You Have Recent Missed Payments Or Defaults On Your Report

Missed payments can stay on your credit report for seven years and bankruptcies for 10. You will more than likely need to re-establish a history of making payments on time, as well as reducing your principle debt every month, by paying more than the minimum payment due. Although missed payments stay on your report for seven years, their impact fades over time. All may not be lost if you’ve missed your payment by a few days. If the missed payment is an exception rather than the rule, then pay the bill as soon as you can and ask the lender if they could refrain from reporting the late payment to the bureaus this one time. There’s no guarantee this will work, but it mightyou could set up automatic payments in return, as a goodwill gesture. Just be sure that you catch that missed payment as soon as possible, because its impact on your credit score will get worse with every day it’s in default.

Don’t Miss: How To Dispute A Hospital Bill On Credit Report

Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free credit report if

- you get a notice saying that your application for credit, employment, insurance, or other benefit has been denied or another unfavorable action has been taken against you, based on information in your credit report. Thats known as an adverse action notice. You must ask for your report within 60 days of getting the notice. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

If you fall into one of these categories, contact a credit bureau by using the below.

How Often Can I Get A Free Report

Federal law gives you the right to get a free copy of your credit report every 12 months. Through December 2022, everyone in the U.S. can get a free credit report each week from all three nationwide credit bureaus at AnnualCreditReport.com.

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get atAnnualCreditReport.com.

Also Check: What Does A Good Credit Score Mean

When Does Capital One Report Credit Utilization To Bureaus

The three biggest consumer national credit bureaus — Experian, TransUnion, and Equifax — don’t calculate your credit score from thin air. To do that, each credit bureau needs data. And one source of that data is your creditors.

If you’re a Capital One credit card holder, you might be wondering when this creditor sends your data to the credit reporting agencies.

To understand when Capital One reports credit utilization to the bureaus, we’ll:

- Discuss what the issuer reports

- Look at the hows, whens, and whys of issuer reporting

- Explore what’s important about your payment history and your credit utilization — and what you can do to improve them

Jump To

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Recommended Reading: How To Run A Credit Report On Someone

Can I See My Credit Report

You can get a free copy of your credit report every year. That means one copy from each of the three companies that writes your reports.

The law says you can get your free credit reports if you:

- go to AnnualCreditReport.com

Someone might say you can get a free report at another website. They probably are not telling the truth.

Why Is It Important To Know When Credit Card Companies Report To Credit Bureaus

Staying abreast of when credit companies report to the bureaus can help clear up â and avoid â any doubts or confusion about your credit balances and whether youâre making payments on time.

Your credit report is essentially a snapshot of your financial health. If you want to repair or boost your credit, understanding the relationship between credit companies and credit bureaus is a smart first step toward making those improvements.

Don’t Miss: How To Start A Credit Score

Building And Maintaining Good Credit

Paying off a credit card is a milestone to celebrate, as is the bump to your credit score that could result. You can more closely track the changes to your credit scoresand keep an eye on your score moving forwardby signing up for free credit monitoring with Experian. You’ll have access to your Experian credit score and report and can set up alerts to let you know when changes occur to your credit file. Paying down debt, monitoring your credit and using your credit wisely will all help set you on a path toward building and maintaining good credit.

When Do Credit Card Payments Get Reported

At Experian, one of our priorities is consumer credit and finance education. This post may contain links and references to one or more of our partners, but we provide an objective view to help you make the best decisions. For more information, see our .

In this article:

Read Also: How To Get Rid Of Inquiries On My Credit Report

Reasons You May Not Have A Medical History Report

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days

- online at AnnualCreditReport.com youll get access immediately

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request

It may take longer to get your report if the credit bureau needs more information to verify your identity.

Read Also: How To Get A Credit Rating

How Does It Affect Your Credit Utilization

Lets say you buy a big-ticket item using one of your credit cards. You know that the purchase is going to put you over the recommended 30 percent utilization rate, but your plan is to pay the purchase off when you get the bill . So far, so good.

However, if your credit card company, as many do, reports at the close of your billing cycle , your score is going to be negatively affected until you make the payment and it is reported to the bureaus in the next billing cycle. This is because your purchase has affected your credit utilization in a negative way.

Of course, if you stick to your plan, this will be a temporary problem and your score will bounce back once the payment is made and reported. But if you need to access new credit in the meantime, this could be a problem for you.

Even if you dont access new credit, others might look at your credit report while this factor is bringing your score down, like insurance providers or even potential employers or landlords. You may have an explanation ready, but the chances of them asking and you being able to explain yourself are probably pretty slim.

Why Do I Have A Credit Report

Businesses want to know about you before they lend you money. Would you want to lend money to someone who pays bills on time? Or to someone who always pays late?

Businesses look at your credit report to learn about you. They decide if they want to lend you money, or give you a credit card. Sometimes, employers look at your credit report when you apply for a job. Cell phone companies and insurance companies look at your credit report, too.

Also Check: What Is Revolving Debt On A Credit Report

How Credit Is Reported If You’re An Individual Apple Card Account Owner

Your Apple Card account information, such as payment history and credit utilization, will be reported to credit bureaus and shown in credit reports as your individual Apple Card account.

If you choose to add a participant to your Apple Card account

- There is no direct negative impact to the account owners credit report when adding or removing a participant.

- Participants are reported as Authorized Users to the bureaus, which means they are not liable for making payments on that account.

- Adding one or more participants to your Apple Card account may lead to higher credit utilization, because multiple people can now spend on the same account. Higher credit utilization may negatively impact your credit score.

If you want to close your Apple Card account

- Account owners can close the account at any time, which may negatively impact their credit score.2

- Closing your Apple Card account will remove any participants from the account, and it will show up as closed on both the owner and participants credit reports.3

How Do I Check My Credit Report

This is easy to do by phone:

- Answer questions from a recorded system. You have to give your address, Social Security number, and birth date.

- Choose to only show the last four numbers of your Social Security number. It is safer than showing your full Social Security number on your report.

- Choose which credit reporting company you want a report from.

That company mails your report to you. It should arrive 2-3 weeks after you call.

Don’t Miss: Does An Overdraft Affect Your Credit Rating Ireland

Do Authorized Users Build Credit

Yes, generally. It would behoove you to make sure by checking the fine print or calling customer service that your credit card issuer will report your authorized users information to the credit bureaus, but most do. Still, sometimes there are exceptions. For instance, some credit cards wont report information to the credit bureaus if the authorized user is a minor. In that case, the authorized user wouldnt be building credit.

And remember: It goes both ways. An authorized user can see their credit score drop if the primary cardholder isnt making timely payments every month.

How Credit Is Reported For Apple Card Account Participants

Participants 18 years or older can opt in to be credit reported and build credit history.6 Participants will be reported to the credit bureaus as Authorized Users, which means they can spend on the account but are not required to make payments.

If you’re added as an Apple Card participant

- If a participant opts in to be credit reported, the Apple Card account will appear on their credit report.

- Participants inherit all positive and negative credit reporting from the account owners Apple Card account.

- The account owners payment history and account age is reported on the participants credit report.

If youre removed as a participant from an Apple Card Family account

- Account owners, the participant themselves, or Goldman Sachs can remove a participant at any time.

- Upon removal, Goldman Sachs will stop reporting the participant on that account to the credit bureaus.

- The participants credit history with Apple Card remains on their credit report unless the account is closed for a specific reason, such as an account owner filing for bankruptcy.

If youre a participant and want to open your own Apple Card account

Also Check: Is 737 A Good Credit Score

How Long After Paying Off A Credit Card Will My Credit Score Go Up

At Experian, one of our priorities is consumer credit and finance education. This post may contain links and references to one or more of our partners, but we provide an objective view to help you make the best decisions. For more information, see our .

In this article:

Bravo! You’ve paid your entire credit card balance. So when should you expect your credit score to reflect that? Reducing card balances improves your credit utilization ratio, which is an important scoring factor, but score calculations can’t consider paid balances until your credit reports are updated.

Card companies typically send monthly updates to the major credit bureaus after the end of your billing cycle. Depending on where you are in that cycle, your payment may not be reported for weeks. You may see some difference as quickly as a few days or weeks, but it can take months for your score to fully adjust to a change in your card balances.

Allow a few billing cyclesone to two monthsfor the credit card company to report your new information and for credit scoring models to see that you aren’t immediately taking on new debt. Once your information is updated and a new score is calculated, you may see an increase in your credit score.

Business Credit Cards That Do Not Report Personal Credit:

As long as you are using a business credit card and not a personal credit card, most will not report to a consumer credit bureau, meaning it wont show up on your personal credit report.

But each card will have its own rules, so you need to be careful when choosing a card. Make sure you understand exactly what each card will and wont report and under what circumstances.

Don’t Miss: How Often Should You Check Your Credit Report

Monitor Your Credit For Free With Creditwise From Capital One

Whether youâre trying to maintain your credit or improve your credit scores, itâs important to monitor your credit regularly. Why? Because monitoring your credit can help you see exactly where you standâand how much progress youâve made.

is one way you can monitor your credit. With CreditWise, you can access your free TransUnion credit report and weekly VantageScore 3.0 credit score anytimeâwithout hurting your score. And with the CreditWise Simulator, you can explore the potential impact of your financial decisions before you even make them.

You can also get free copies of your credit reports from all three major credit bureaus. Call 877-322-8228 or visit AnnualCreditReport.com to learn more. Keep in mind that there may be a limit on how often you can get your reports. You can check the site for more details.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

The CreditWise Simulator provides an estimate of your score change and does not guarantee how your score may change.