Can You Pay To Clear Your Credit History

No, you might come across adverts and websites for Credit Repair Companies or Credit Fixers, making payments to these companies is not worthwhile. Its best to keep your money in your pocket and avoid all of these businesses.

None of them have a secret loophole to get credit reference agencies to delete defaults and debt. All they do is provide information and services that you can do yourself.

Default On Credit Report Error

Its important to check your account because errors do occur. If you see a defaulted debt or missed payment on your credit file that you are sure is a mistake or you want to contest, first you should bring the matter up with the lender that placed it there .

For example if its a missed mobile phone contract bill, then you should bring it up with your mobile network provider first.

Reasons to argue a case include:

- The lender didnt try to collect the payments

- Mistaken identity and admin errors

- You were in arrears by fewer than three months

- Duplicate defaults

- The debt was Statute Barred

If they do not agree to remove it for whatever reason, you can then ask the credit reference agencies to do it for you providing evidence of the mistake.

Removing a default from your credit report can be a tiresome process and you may want the help of Step Change or Citizens Advice as you go through the process.

Collections On Your Credit Report

When an account becomes seriously past due, the creditor may decide to turn the account over to an internal collection department or to sell the debt to a collection agency. Once an account is sold to a collection agency, the collection account can then be reported as a separate account on your . Collection accounts have a significant negative impact on your credit scores.

Collections can appear from unsecured accounts, such as and personal loans. In contrast, secured loans such as mortgages or auto loans that default would involve foreclosure and repossession, respectively. Auto loans can end up in collections also, even if they are repossessed. The amount they are sold for at auction may be less than the full amount owed, and the remaining amount can still be sent to collections.

Collections can be removed from credit reports in only two ways:

Recommended Reading: Does Requesting A Credit Increase Hurt Score

Situations When A Default May Be Removed

There are a small number of situations when a default listing can be removed from your credit report. These situations are limited to when the credit provider has made a mistake when listing the default, or the overdue payment happened because of something outside of your control .

In order to work out whether you can ask for the default to be removed, you should get a copy of your credit report from the . Its FREE to get a copy from each credit reporting body, or if you’ve applied for credit and been refused in the last 90 days.

What Is A Default Notice

A Notice of Default letter is a warning from a creditor that you have missed payments on your credit agreement. They typically send the default notice when you have not been paying for three to six months.

They will contact you and ask for full payment, giving you at least two weeks to catch up. If you do not pay the money owed, the account will default and you may:

These notices can only be sent on credit covered by the Consumer Credit Act, such as credit cards, personal loans and mobile phone contracts. If you have paid within the time given, no further action will be taken but you should avoid missing further payments or you will get another letter.

Read Also: How Often Does Capital One Report To Credit Bureaus

Get A Free Copy Of Your Credit Report

The Fair Credit Reporting Act promotes the accuracy and privacy of information in the files of the nations credit reporting companies. Monitoring your credit report is a necessary practice to keep in check any negative information. Consumers should obtain their free credit report and review it at least once a year to catch any irregularities on time and keep track of disputed items.

Consumers are entitled by law to a free annual credit report from each of the three main reporting bureaus: Equifax, Experian, and TransUnion, and you can access all three of them through one single website:

AnnualCreditReport.com is the only authorized website through which you can gain free access to your credit report from the three major bureaus. Be wary of other sites that promise the same, as they may have hidden fees, try to sell something, or collect personal information.

| Mail: Download, print, fill out, and mail to: |

| Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281 |

Equifax made headlines in 2017 due to a massive data breach, but it remains one of the top 3 services to get your credit report. The company provides a few different service levels if you want to monitor your credit score monthly . Monitoring packages start at $14.95 per month, and the $19.95 per month options include, ironically, a host of identity-theft protection options.

Submit A Dispute To The Credit Bureau

The Fair Credit Reporting Act is a Federal law that defines the type of information that can be listed on your credit report and for how long . The FCRA says that you have the right to an accurate credit report and because of that provision, you can dispute errors with the credit bureau.

are easiest when made online or via mail. To make a dispute online, you must have recently ordered a copy of your credit report. You can submit a dispute with the credit bureau who provided the credit report.

To dispute via mail, write a letter describing the credit report and submit copies of any proof you have. The credit bureau investigates your dispute with the business that provided the information and removes the entry if they find that is indeed an error.

You May Like: Does Removing An Authorized User Hurt Their Credit Score

You May Like: What Credit Score Do You Need For Affirm

Can I Get Someone To Remove A Default

You can only get a default removed from your credit report if you can prove that it was an error. Get in touch with the credit referencing agency and explain the situation. The credit referencing agency should then get in contact with the lender to check the accuracy of your claim. Theyll add a Notice of Correction in the meantime to signal to other lenders that the default may be a mistake.

If the lender realises the default is an error, they will update your credit file. If they dont agree however, the default will remain on your credit file.

How To Have A Default Removed From My Credit Report

If you want to get an inaccurate default removed, the first step is to check which credit reports it appears on. You should check Equifax, Experian and TransUnion as any of these could be showing the error. It might even appear on more than one report. Read more on how to check your credit score for free in our guide.

Once youve identified where the error is, follow these steps to have it removed:

-

Contact the credit reference agency to alert them to the error

-

They may ask for extra information about the error, provide them with this as far as you can

-

The CRA should then add a notice of correction to the file to alert lenders the information might be inaccurate

-

You may also be able to contact the lender in question to alert them to the issue

-

If the lender agrees, the default will be removed from your file

-

You should see your score improve when the default is removed

Read Also: What Is A Credit Score Definition

What Happens To Your Credit Score When Derogatory Marks Fall Off Your Report

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

If a negative item on your credit report is older than seven years, you can dispute the information with the credit bureau and ask to have it deleted from your credit report.

Contact The Credit Reporting Agency To Remove The Defaults

If you believe you have an illegitimate default in your account, then you should contact the credit reporting agency in charge of your credit report to have these defaults removed. Defaults should not be ignored, and as soon as you realise you have a default on your credit report, you need to contact the appropriate agencies to sort it out. If left to fester, credit report problems can cause big headaches for you in the long run.

In order to repair credit, you must contact the credit reporting agency. If this does not work and you still feel you have a legitimate claim to clearance of defaults, you can contact lawyers specialised in the field of credit defaults.

Don’t Miss: What Causes Credit Score To Go Down

How Long Does A Collection Account Stay On A Credit Report

The Fair Credit Reporting Act lays out that the collection has to stay on your credit report for up to seven years from the date of default on the original account. This is to give lenders a clear picture of your financial behaviour so they know the risks of lending you money.

However, on a credit report, a paid collection can still stay on your credit report for up to seven years, regardless of whether the account has a $0 balance.

After seven years, the paid collection will automatically drop off your credit report.

Dont Miss: Does Carmax Check Credit

Student Loan Delinquency Or Default

Late student loan payments can start to hurt your credit after 30 days for private student loans and 90 days for federal student loans, and those delinquencies stay on your credit report for seven years.

Federal student loans go into default if you dont make a payment for 270 days. And the government has strong debt-collection powers: It can garnish your wages, Social Security benefits or tax refunds. With private student loans, your lender can term you in default as soon as youre late, but it has to take you to court before it can force repayment.

What to do: If youve paid late but havent defaulted, consider switching to an income-driven repayment plan, putting your loan in deferment or forbearance, or asking your lender for a modified payment plan.

If youve defaulted on your federal student loans, the government offers three options: Repayment, rehabilitation and consolidation.

How long bankruptcy stays on your credit report depends on which type you file.

There are two common types of personal bankruptcy. A Chapter 7 bankruptcy will stay on your reports for 10 years. Chapter 13 bankruptcy sticks around for seven years.

What to do: Begin to re-establish credit. A secured credit card or a credit-builder loan can help people build credit when they can’t qualify for unsecured credit. And note that credit scores can rebound from bankruptcy sooner than you may think.

Don’t Miss: How Often Does Credit Score Update

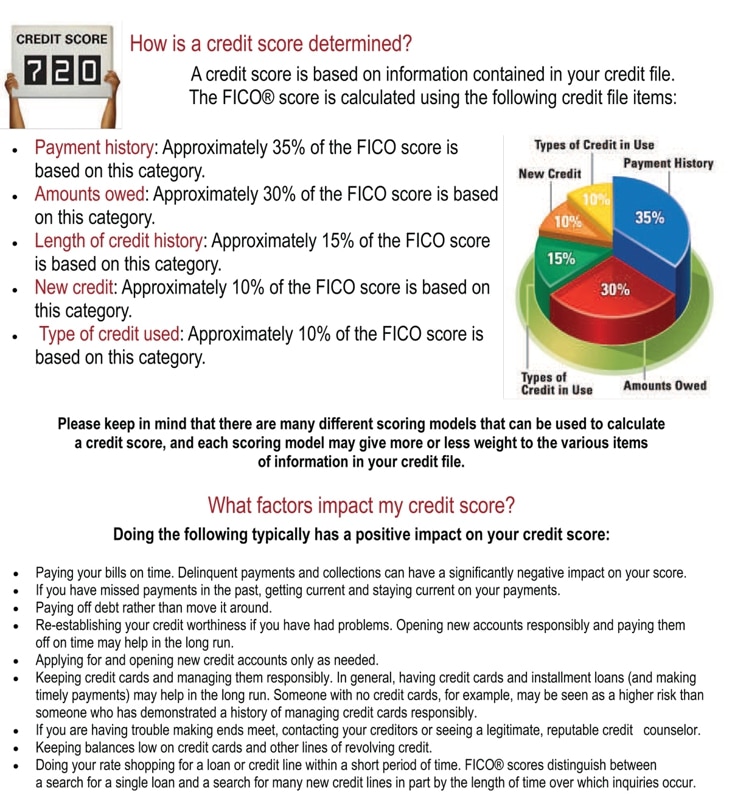

What Are Other Ways To Improve Your Credit Score

You canbuild healthy credit over time by starting with these steps:

- Make on-time payments. This is one of the most important factors that impacts your credit scores. If you think you cant afford a payment, reach out to the lender right away. It may be willing to work out a payment plan and keep your account in good standing.

- Check your credit reports. This will help you understand and track your overall financial health. Also look for errors, such as incorrect credit card balances, trade lines that arent yours and accounts that are incorrectly marked as delinquent.

- Dispute and fix errors. About 20 percent of consumers have an error on at least one credit report, according to a Federal Trade Commission study. Getting an error removed may help your credit score improve.

- Consider a debt consolidation loan. A debt consolidation loan unites all your debts into a single balance, often at a lower interest rate that can save you money. A debt consolidation calculator can help you evaluate whether this type of loan is right for you, as debt consolidation can temporarily hurt your credit.

Sign up for a Bankrate account to analyze your debt and get custom product recommendations.

How Long Does Credit Information Stay On Your Credit Report

Categories

Your credit report is essentially your credit history. It compiles all the information concerning your credit habits and creates a tool that can be used by lenders and creditors to assess your creditworthiness. While your credit report does represent a good portion of your credit history, the information is not saved for the total duration of your credit using life. Your credit information is eventually removed from your to make room for newer information.

Of course, the question on everyones mind is, how long does this credit information stay on my credit report for? This is what were going to take a closer look at so you can know exactly how long specific credit information will affect your credit report.

Dont Miss: Is Creditwise Good

You May Like: What To Look For On Credit Report

Tax Lien: Once Indefinitely Now Zero Years

Paid tax liens, like civil judgments, used to be part of your credit report for seven years. Unpaid liens could remain on your credit report indefinitely in almost every case. As of April 2018, all three major credit agencies removed all tax liens from credit reports due to inaccurate reporting.

Limit the damage: Check your credit report to ensure that it does not contain information about tax liens. If it does, dispute through the credit agency to have it removed.

The Costs Of Ignoring Your Debt Commitments

If you find yourself falling behind on a payment tackle it head-on, otherwise:

- it may lower your chances of being given credit in the future

- it will likely make the cost of credit more expensive

- and it could even affect your chances of getting a job especially if you work in finance or a job that requires you to deal with cash responsibly.

Don’t Miss: How To Fix Credit Report

Dont Worry Heres What To Do

There are several debt solutions in the UK that can be used to improve your finances. Choosing the right way to tackle your debt could save you time and money, but the wrong one could cause even more harm.

Its always best to find out about all your options from a professional before you take action.Fill out the 5 step form to get started.

struggling with debt

Question 1 of 5

Can Lenders See Old Defaults

Lenders have their own internal records Banks can keep data for a very long time PPI claims have been settled for debts that were repaid more than 15 years ago. So a lender may be able to tell if you defaulted on a debt, you went bankrupt or had an IVA, or you settled a debt with a partial settlement.

Read Also: Is 748 A Good Credit Score

Getting A Copy Of Your Credit Record

Privacy Act 2020, s 22, Principle 6, s 1

You have the right to ask for a copy of your credit report. If any of the information isnt correct, you can apply in writing to the credit reporting companies for it to be corrected.

Three credit reporting companies operate in New Zealand. To check your record, or to correct any information, youll need to contact them all .

A credit reporting company must give you a copy of your report within 20 working days after you ask for it. They cant charge you for this unless you ask for them to provide it within five working days, in which case they can charge you up to $10 .

How To Get A Closed Account Off Your Credit Report

Many people close credit accounts they no longer want, thinking that doing so removes the account from their credit report. The Fair Credit Report Actthe law that guides credit reportingallows credit bureaus to include all accurate and timely information on your credit report. Information can only be removed from your credit report if its inaccurate or outdated, or the creditor agrees to remove it.

Recommended Reading: What Should Credit Score Be To Buy A House

The Debt Cannot Be Enforced

No doubt, you have heard of a statute of limitations for crimes, well in the case of credit, old debts, while still owing, cannot receive default after a certain period of time if the creditor has not made appropriate strives to receive the money owing. This is unlikely, but Over six years old and the creditor has not made