If That Fails Wait For The Collection To Drop Off Your Report

Generally speaking, negative information is removed from your credit report after seven years. The clock starts from the first date your delinquent accounts are reported. This means if you miss one or more payments, then the account is sent to collection, the late payment information will be removed seven years after the first date of delinquency, not when it gets to collections.

Be aware, however, that just because a debt disappears from your credit report doesnt mean you dont have to pay it. If its not past the statute of limitations or the time frame when a creditor can sue you for a debt, then a creditor still has the right to pursue payment and even take you to court to recoup it.

Each state has its own laws that govern the statute of limitation on debt. Make sure you understand your responsibility to pay old debts based on your states laws. If necessary, seek counsel from a lawyer to make sure you are compliant with your debt obligations and will not end up paying more than required.

Should you negotiate a pay-for-delete agreement?

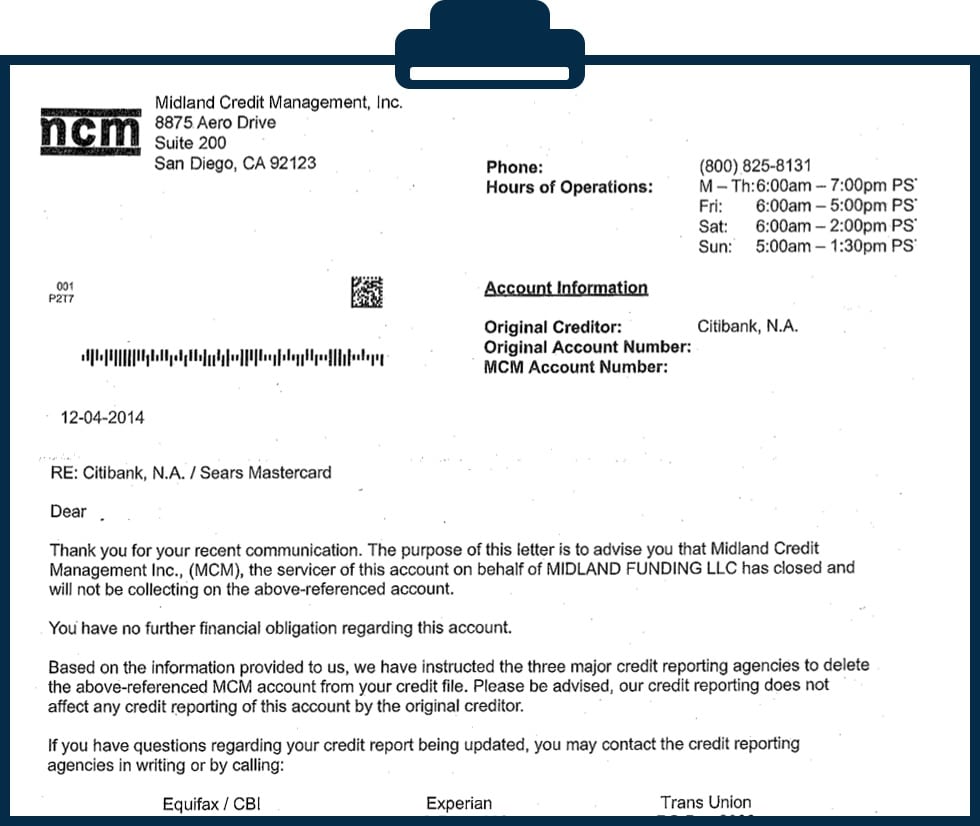

In some cases, you can negotiate what is called a pay-for-delete arrangement. With pay-for-delete, you pay all or a portion of the debt in exchange for the collection agency removing the account from your credit report.

Is The Bureaus Inc Hurting My Credit Score

Any derogatory item on your credit report, including a collections account, may harm your credit score.

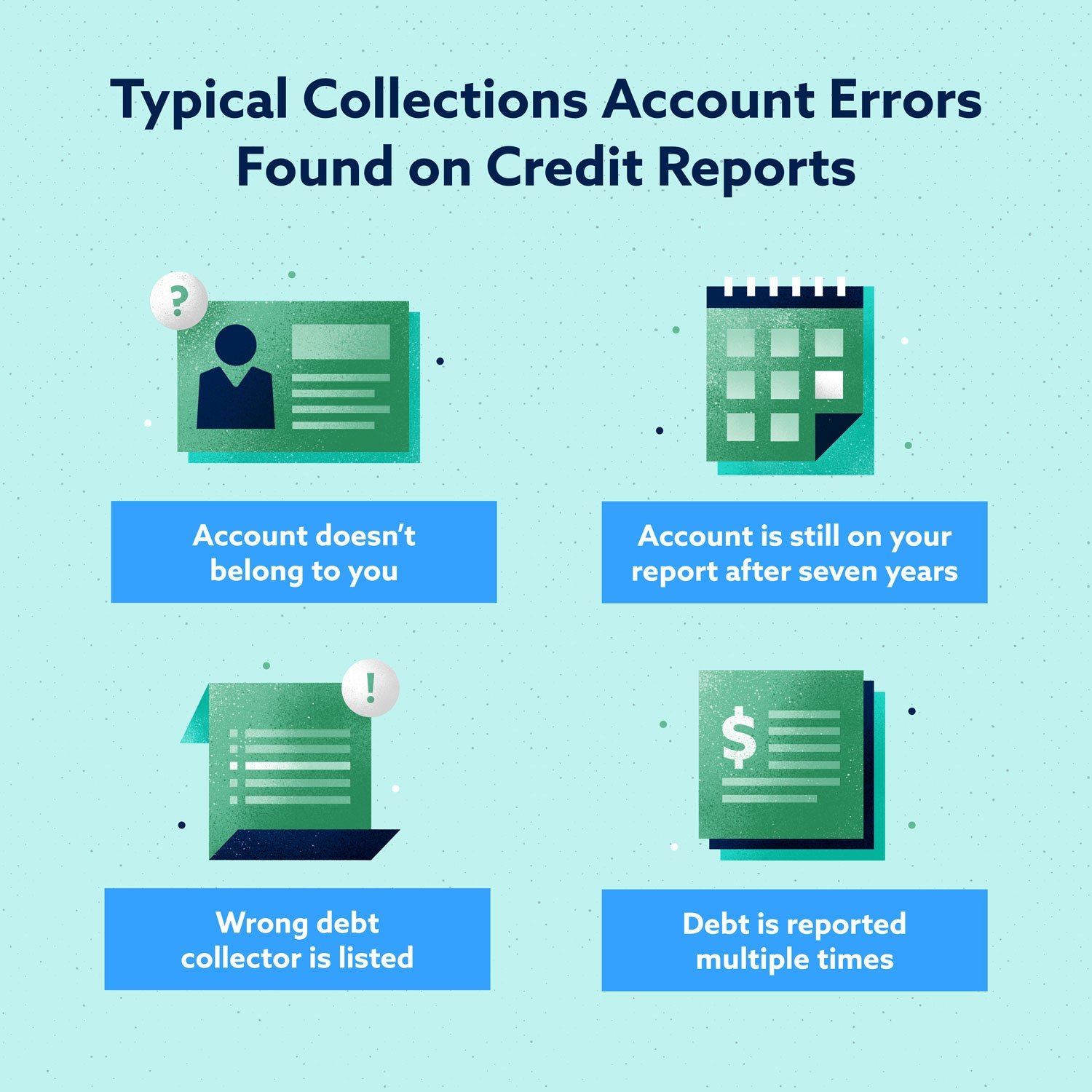

Debt collectors often buy and sell debt from one another. This can lead to multiple collections on your credit report for the same account.

If you dont dispute each account with the credit bureaus and get them removed, they can damage your credit score.

When Will Your Debt Go To Collection

If you ignore a creditor’s letters and phone calls, your account will most likely be turned over to a collection agency or sold to a debt buyer. If the creditor continues to own the debt but turns it over to a debt collection agency with a contract to collect, this type of arrangement is called “assigned debt.” Instead, the creditor might sell the debt to a collection agency, which is called “purchased debt.”

The types of debts most likely to go to a collection agency or debt buyer are credit card and phone debts, followed by other utilities, auto, government, and medical debts.

Read Also: How Long Will Judgement Stay On Credit Report

How Do Collections Affect Credit

Some lenders use older versions of both credit scoring systems that still count paid collection accounts, however, and there’s no way to know ahead of time which credit scoring method a lender will use when deciding to approve a loan application. So while paid collections on your credit report may still hurt your chances of approval, paying off the account gives an opportunity to do the least possible damage.

Your Legal Right To Dispute And Verify The Debt

Under the FDCPA, you get the right to dispute the debt. The debt collector then has to verify it. You may also ask the collector to identify the original creditor.

Either in its first contact with you or within five days of that contact, the debt collector is required to give you a notice that includes the following information:

- the amount of the debt

- the name of the creditor to whom the debt is currently owed

- that you have 30 days to dispute the validity of the debt

- that if you don’t dispute the validity, the debt collector will assume it is valid

- that if you dispute the debt’s validity in writing within 30 days, the debt collector must send you verification of the debt, and

- that if, within that 30 days, you send a written request for the name and address of the original creditor, the debt collector must provide it . ).

Effective November 30, 2021, this debt validation notice must contain additional information as well.

Even if the debt collector doesn’t provide this notice, you can still dispute the debt, ask for debt validation, and request the original creditor’s name. It’s a good idea to always validate the debt if a debt collector contacts you. The amount of the debt could be inaccurate, or the debt might be against someone else.

Generally, once you dispute a debt or request the original creditor’s identity, the debt collector has to cease collection efforts until it verifies the debt or identifies the creditor, and sends this information to you.

You May Like: What Does Written Off Mean On Credit Report

Know Your Rights: Learn What Collectors Canand Can’tdo

The federal Fair Debt Collection Practices Act limits what collectors can and can’t do. For instance, this law prohibits debt collectors from using obscene language or threatening you with violence if you don’t pay. Some states have similar laws that provide even more protections than federal law.

If a debt collector violates your rights under the FDCPA or state law, you:

- can use the debt collector’s violations to your benefit when negotiating a settlement

- sue the collector for damages, or

- file a complaint with the CFPB, which monitors debt collectors with more than $10 million in annual receipts, or with the FTC.

The FDCPA also gives you the right to tell a debt collector to stop contacting you.

Does The Open Date Of A Collection Account Determine When It’s Removed

It sometimes takes a year or more between an account’s charge-off and its sale to a collection agency, and collection agencies that fail to collect their debts sometimes resell them to still other agencies. That means multiple collection account entriesall related to the same unpaid debtmay appear on your credit reports.

While that’s not great news, you need not worry that each new entry has its own seven-year countdown to expiration. Any collection entries related to the same original debt will disappear from your credit report seven years from the date of the first missed payment that led up to the charge-off.

Recommended Reading: Is 517 A Good Credit Score

The Bureaus Inc Complaints

Most collection agencies have numerous complaints filed against them with the Consumer Financial Protection Bureau and the Better Business Bureau . Most consumer complaints are about inaccurate reporting, harassment, or failure to verify a debt. If a debt collector is harassing you, you may want to consider filing a complaint.

You have many consumer rights under the Fair Credit Reporting Act and the Fair Debt Collection Practices Act . Lexington Law knows that you have rights, and The Bureaus, Inc. does too.

When Contacting Other People

If you have an attorney, the law prohibits a collection agency from contacting anyone other than your attorney. If you do not have an attorney, the agency can contact other people only to find out where you live or work. The collector cannot tell these people that you owe money. In most cases, the collection agency can contact another person only once. These same rules apply to contact with your employer.

Read Also: Why Did My Credit Score Drop For No Reason

If Youve Neglected To Pay Off A Medical Or Credit Card Bill A Collection Account May Appear On Your Credit Reports

This typically happens when the original company owed writes off your debt as a loss and sells it to a debt collection agency. Generally speaking, companies only sell your debts after you become severely delinquent on a payment. This is known as a charge off, and it typically happens after 90 to 180 days of nonpayment.

If a collection account appears on your credit reports, the last thing you should do is ignore it. Collections can have a significant negative impact on your credit, so its important to know how to handle them.

Collection Agency Reporting Practices

- An account is usually sent to collections once its 90-120 days delinquent.

- The collection agency will attempt to confirm the debt. This can be done by speaking with you directly or by successfully delivering a written notice electronically or by mail. Once the agency has satisfied its obligation to contact you, it may report the account to the credit bureaus.

- You can dispute the debt by sending the collection agency a written notice within 30 days of their initial attempt to contact you. If the debt is in fact yours, the agency will respond with a validation letter within an additional 30 days.

- Collection agency debt can remain on your credit report for up to 7 years plus 180 days from the date the debt became delinquent. After that, the account falls off your credit report.

- As of July 2022, medical debt under $500 in collections will no longer be reported by the credit bureaus. Medical debt over $500 will be reported after one year. Once its paid, medical debt will be removed from your credit report entirely.

Recommended Reading: Is 623 A Good Credit Score

How These Changes Will Affect Your Credit Score

Medical debt is not included as part of your credit report if it remains with your original service provider, but once it goes to collections it likely affects your credit score. These debts can linger on your credit report for up to seven years, although the new rule will now remove them if they are paid off. An instance of collection debt in your credit report can decrease your credit score by as much as 110 points. Your credit score is what lenders use to determine whether you’ll qualify for loans, as well as the rate of interest on those loans.

Already, some of the newer FICO and VantageScore algorithms disregard paid medical collections and place a lower emphasis on unpaid medical debt compared to other types of debt, Ted Rossman, asenior industry analyst at Bankrate, said in a statement.

“The CFPB has been poking around this issue even further, and that seems to have encouraged the credit bureaus to completely remove paid medical collections from all credit reports,” said Rossman.

This removal will help people who have paid medical collection debt increase their credit scores, especially for older FICO models that are required for federally-backed mortgages, he added.

“There seems to be an acknowledgment that medical care is essential and should not be penalized by the credit bureaus,” Rossman said.

Find Out How Debt Collection Agencies Operate Use The Law To Your Advantage

If you have a debt that’s sent to a debt collector, it pays to learn how collection agencies operate. You can expect to hear from a collection agency as soon as the original creditor transfers your debt. Professional debt collectors know that the earlier they contact you, the higher their chance of collecting agencies have many ways of locating you. Also, collection agents get paid for results. So, you might get calls or angry texts from a stressed-out, rude collector who doesn’t much care what the law allows.

Once you know that the collector is likely to strike fast and possibly use illegal tactics, you can get a game plan in place. Generally, your strategy should involve learning the law and using this knowledge wisely. The federal Fair Debt Collection Practices Act limits what collectors can and can’t do. If a collector violates this law, you can sue them or report the collector to a federal agency, like the Consumer Financial Protection Bureau or the Federal Trade Commission . State law might protect debtors from unscrupulous debt collectors, too.

You might also be able to use legal violations as leverage when trying to negotiate a favorable settlement. Debtors who know the lawand use it to their advantageoften get more time to pay, have late fees dropped, settle debts for less than the full amount they owe, and get negative information removed from their credit reports.

Don’t Miss: How Much Does A Late Payment Affect Credit Score

Do All Collection Agencies Report To Credit Bureaus

While there’s no law requiring collections agencies to report debts to all three credit bureaus, most do. Some may offer you a deal before they report it, but before making any payments, have the agency verify the debt. If they can’t prove the debt is yours, disputing it with help from Credit Glory is your best option.

Collection Agencies That Purchase Debt Might Not Have Good Information

Buying debts has become a massive business for collection agencies. Especially if your debt is old, you’re likely to find yourself dealing with someone who has bought a bundle of debts for pennies on the dollar. Because the collector might not have any of the original credit documents and only a screenshot with information about the debt, the information it has might very well be incorrect. The collector might even have bought the debt from another collector, not the original creditor, which increases the likelihood that the collector doesn’t have accurate information about the debt.

Don’t Miss: Do Collections Drop Off Credit Report

Time Frame For Disputing A Debt

The Fair Debt Collection Practices Act provides you with 30 days to dispute a debt in writing and request an investigation after a collection agency’s initial contact with you. Until the collection agency provides you with proof that the debt is legitimate, it may not conduct any further collection activity. Consumers often mistakenly believe that the prohibition on collection activity includes reporting the debt to the credit bureaus thus giving them 30 days in which to pay the debt and prevent credit damage. Unfortunately, this is not the case.

According to the Federal Trade Commission, credit reporting does not constitute collection activity. Because a collection agency can opt to report your debt at any time after purchasing the account, it is imperative that you act quickly to pay your debt and avoid further credit consequences.

What Happens To Your Credit Score

Once your creditor transfers your debt to a collection agency, your credit score will go down.

A low credit score means:

- lenders may refuse you credit or charge you a higher interest rate

- insurance companies may charge you more for insurance

- landlords may refuse to rent to you or charge you more for rent

- employers may not hire you

You May Like: What Does Bankruptcy Petition Mean On Credit Report

The Steps Collection Agencies Must Take To Report To A Credit Bureau

There are a few steps that collection agencies are required to take before they report to the major credit bureaus. They must first send you a validation notice, also called a debt validation letter. A validation notice has detailed information about the debt, including details on the original creditor, itemization of charges, current balance, etc. As long as a credit bureau reports or sends the validation notice in one of the following ways, they can then report your account:

- Mail you notice about your debt and wait around 14 days for a failure to mail notification.

- Send you an electronic notification about the debt and wait 14 days for a failure to communicate.

- Speak to you in person.

- Speak to you over the phone.

Once the validation notice is sent or relayed to you, the agency can move forward with reporting to all three major credit bureaus. Keep in mind that if the debt is invalid, you also have the right to dispute it! One reason why checking your credit reports often is so important.

What Are Debt Collection Agencies Vs Credit Reporting Companies

If you have a debt in collection, you are sure to want to know who you are dealing with.

Collection agencies and lawyers who regularly collect debts that are owed to others are categorized by the CFPB as debt collectors. So too are companies that buy past-due debts from other businesses or original, first-party creditors. They are also known as debt buyers and debt collection companies.

Don’t Miss: What Credit Score Do You Start Out With

When Does The 7

Regardless of who the debt was transferred to or when it was transferred, the Fair Credit Reporting Act allows collections to legally be reported by the credit bureaus for up to seven years after the date of the first delinquency .

What does this mean exactly? How do you figure out the date of the original delinquency of an account?

According to Experian, the date of the original delinquency is the first reported late payment. As an example, if you have a 30-day late reported and never catch up on payments, then the delinquency would later get reported as a 60-day late and eventually as a 90-day late.

The seven-year rule for collections begins on the date of first delinquency.

The seven-year period after which the delinquency falls off begins with the first missed payment, the 30-day late. If the debt is sold to a collection agency, the original account and the collection account will both be removed from your credit report seven years after the initial delinquency, says Experian.

Medical collections are slightly different in that a 180-day grace period must be provided to allow insurance benefits to be applied. Therefore, the seven-year timeline starts after 180 days, not after a 30-day late.

The date that a collection account is charged off or transferred to another company does not change the DOFD and therefore should not change the date that the delinquency falls off of your credit report.

What To Do If You Have A Collection Account On Your Credit Report

If you see a collection account on your credit report, the first thing to do is determine whether or not the debt is really yours. If you dont recognize the account, call the collection agency for more information or file a dispute. If you determine the debt is yours, pay it off in full, or call the collection agency to arrange a payment plan or settle the debt for a lower amount. Once the debt is paid, some collection agencies may be willing to remove the account from your credit report, saving you many headaches down the road.If you are like the many Americans who have made mistakes with their credit, it is never too late to start rebuilding your credit score and developing a . Reach out to TDECU today to find out how we can help you achieve your financial goals.

You May Like: Is 797 A Good Credit Score