What People Who Score 800 Or Higher Do

According to FICO, those who achieve ultra-high credit scores pay on time, use credit lightly, have a long credit history and rarely open a new account. Heres what they tend to have in common:

-

A of about 25 years.

-

Owes less than $3,500 on credit cards.

-

Uses only 7% of credit limit.

-

No late payments on credit reports .

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

Dont Cancel Cards Needlessly

As you can see, both models look favorably on consumers who have longer credit histories and lower credit utilization ratios.

Unfortunately, you cant magically create 10 years of credit history. What you can do is choose one or two credit cards to keep active and never cancel. Not only will this help you build a longer credit history, but it can also help you keep your credit utilization rate low, since more active credit cards in your name means more available credit.

You May Like: Why Did Credit Score Go Down

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be one reason peopleâs credit scores tend to increase as they get olderâtheir accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just the age of your accounts.

What Is An Excellent Credit Score

You probably already know that your credit score is a three-digit number based on the information in your credit report, which includes items like your loan payment history and credit card balances. Multiple companies have models that calculate credit scoresFICO and VantageScore, for example, which both operate on a scale from 300 to 850.

Generally speaking, a higher credit score can translate to cost savings, perks and more. Your credit score is a key factor considered by lenders, so a better score can help you get more credit at attractive interest rates . Landlords and employers can also check your credit score as part of their due diligence process. And some of the best reward credit cards are only available to those with the highest scores.

So how high should you aim? Getting a perfect score is extremely difficult, so many credit overachievers strive for a score in the high 700s or 800+. That puts you squarely in the highest range for most credit scoring models .

If youre nowhere close, dont worrythe tips below will still help you improve your credit score over time. You can actually reap many of the benefits listed above with a score thats considered good. But if good doesnt cut it, read on for your roadmap to excellent credit.

Recommended Reading: Is 637 A Good Credit Score

Limit Your Hard Credit Inquiries

When you apply for credit of any kind, it generates a hard credit inquiry. Since applying for new credit can be an early sign that someone is dealing with financial troubles, hard inquires will have a slight negative effect on your scores temporarily.

If you want to get a really high score, youll want to limit your hard inquiries meaning you should only apply for new credit when necessary.

How Do I Get The Highest Credit Score

While it is theoretically possible to achieve a perfect 850 score, statistically it probably wont happen. In fact, about 1% of all consumers will ever see an 850, and if they do, they probably wont see it for long, as FICO scores are constantly recalculated by the credit bureaus.

And its not like you can know with absolute certainty what is affecting your credit score. FICO says 35% of your score derives from your payment history and 30% from the amount you owe . Length of credit history counts for 15%, and a mix of accounts and new credit inquiries are factored in at 10% each. Of course, in actually calculating the score, each of these categories is broken down even further, and FICO doesnt disclose how that works.

The credit bureaus that create credit scores may also change how they make their calculationssometimes for your benefit. Changes were made in 2014 and 2017, for example, to reduce the weight of medical bills, tax liens, and civil judgments. However, changes made in January 2020 for FICO 10 involving trending data, credit card debt, personal loans, and delinquencies may make getting a higher score more difficult.

Read Also: How To Get My Free Credit Score

Why Your Credit Score Matters

When you understand your credit score, how its calculated and how you can improve it, you start to think a little more deeply about the debt you might be considering. Not only that, but working to improve your credit score develops strong financial habits. It’s building a foundation will help you as you continue your journey towards financial well-being.

When it comes to credit, the most important rule is this: dont bite off more than you can chew. If you’re worried about taking on more debt or if you’re aware that you struggle to pay down your credit cards and you’re concerned a higher credit limit might be more harmful than beneficial these are valuable flags to pay attention to.

If you are struggling with debt and are concerned that your only options to dig your way out seem to be to take on more debt, talk to an expert. We are here to help you find the best option available to you and give you peace of mind.

We want to help you make the best decision for you and your family and to make a plan to become debt-free.

Get Your Credit Utilization In Check

Amounts owed makes up the next largest chunk of your credit score at 30%, and your is a significant piece of this puzzle. By paying your credit cards and lines of credit down to below a 30% credit utilization rate, you can boost your credit score.

Using the debt avalanche or debt snowball method, you can pay off your credit card debt as quickly as possible without straining your monthly budget. Once you get a low credit utilization rate, you may start seeing your credit score tick upward.

You May Like: Is 686 A Good Credit Score

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

Don’t Miss: How Much Does A Hard Inquiry Affect Your Credit Score

What Are The Benefits Of Having Higher Credit Scores

Thankfully, you dont need a perfect score to qualify for some of the best rates on loans and mortgages. Scores in the 700s can qualify you for great interest rates from lenders. Get your scores anywhere above 760 and youll likely be offered the best rates on the market.

Why is this the case? Because banks and credit card companies care less about the specific numbers on your credit reports and more about the broad credit score range where your scores fall.

For example, FICOs score bands look like this.

- Very good: 740-799

- Excellent: 800+

Improving your scores from 740 to 790 will likely have little effect on your interest rate offers since both scores fall in the very good range. But moving your scores from 650 to 700 could mean getting lower interest rate offers.

If you want to improve your scores and get as close to 850 as you can, youll need to understand what causes your scores to go up or down.

Your Credit Score Can Fluctuate

You may see some short-term movement in your credit score. This happens as information is added or falls off your report, which can happen frequently. Our latestConsumer Pulse revealed one-third of consumers monitor their credit at least weekly. Its encouraging to see people take an active approach to managing their credit health. But when it comes to your credit score, theres no need to obsess over minor, day-to-day changes. Nor is it necessary to achieve a perfect score. Trying to stay within a certain credit range is a smart, less stressful way to monitor your score.

Also, your credit score may not be the only thing a lender looks at when making a lending decision. For example, if you apply for a mortgage, lenders may also verify your income, personal assets and employment history. Because lenders look at multiple factors, its important to strive for overall financial wellness in addition to any credit score goal you may have. Building an emergency savings account and creating a plan to pay down debt, if you have any, will help you be more financially secure and can reflect positively in your credit health.

Also Check: Is 530 A Bad Credit Score

How An Excellent Credit Score Can Help You

An excellent credit score can help you receive the best from lenders and give you a higher chance of being approved for credit cards and loans.

Many of the best cards require good or excellent credit. If you want to benefit from competitive rewards, annual statement credits, luxury travel perks, 0% APR periods and more, you’ll need at least a good credit score. And if you have an excellent credit score, you can maximize approval odds.

For instance, if you’re looking to earn generous rewards on groceries and dining out, the American Express® Gold Card offers cardholders the chance to earn 4X Membership Rewards® points when you dine at restaurants and shop at U.S. supermarkets but you’ll need good or excellent credit. Terms apply.

And if you want to finance new purchases or get out of debt with a balance transfer card, such as the Chase Freedom Unlimited®, you’ll also need good or excellent credit.

Take note that even if your credit score falls within the excellent range, it’s not a guarantee you’ll be approved for a credit card requiring excellent credit. Card issuers look at more factors than just your credit score, including income and monthly housing payments.

Check out Select’s best credit cards for excellent credit.

An Excellent Credit Score Is Good Enough

You don’t need a perfect credit score to get the best deals. A score of 720 or higher is generally considered excellent. And scoring 800 or above qualifies you for the best terms offered.

Thats pretty great news if you aspire to get into the group of people who have top-tier credit but you dont want to obsess over every single point in an effort to get the highest score possible.

You May Like: How To Find Your Credit Score

Tips For Achieving A Perfect Credit Score

No negatives. Just as the word perfect implies, there cannot be a single blemish on your credit report. This includes late or missed payments. If you have a dozen accounts between credit cards and loans, none can have a late payment ever. Payment history is the most important factor when calculating a FICO credit score with a weight of 35%, although its less important for a VantageScore.

No balances. There is a myth that people have to use their credit cards to earn a credit score but this isnt true. This is the most important factor for a VantageScore and the second most important factor for a FICO credit score.

To achieve a perfect credit score, balances need to remain at zero, if not close to it. Higher credit utilization means a lower credit score, and the number may continue a downward spiral over time if balances stay high.

The average length of credit history for an 850 credit score is 30 years. If a person begins establishing credit the day they turn 18, they may be 48 before achieving a perfect score.

And that only happens if the person is responsible with their finances early in life. Many consumers stumble through their twenties as they figure out the best ways to utilize credit and make payments responsibly. This can lead to lower credit scores later in life.

Fico Credit Score Ranges

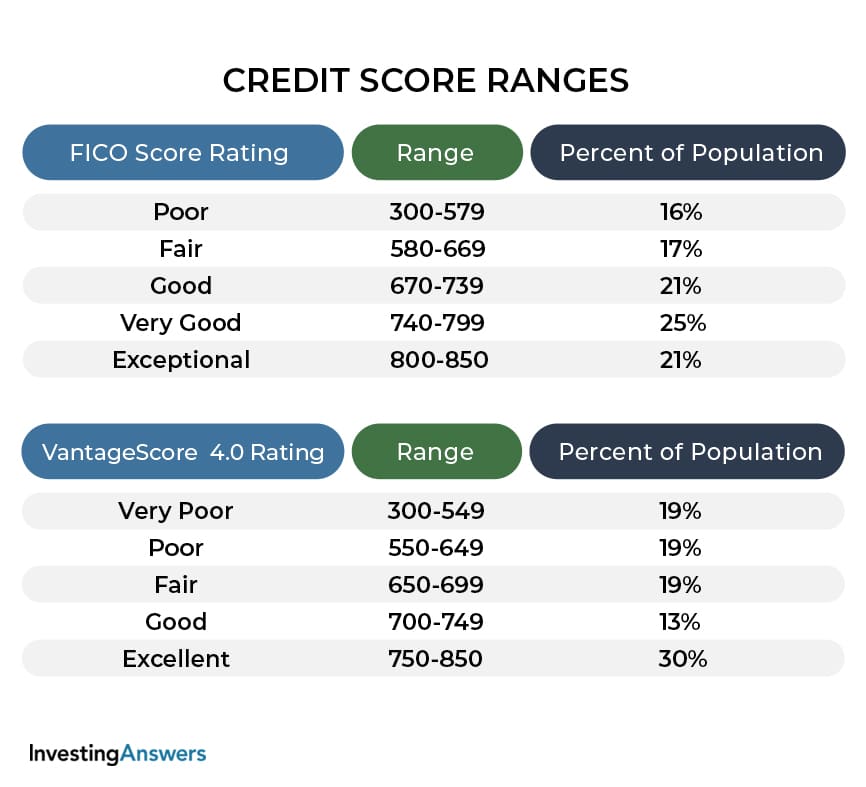

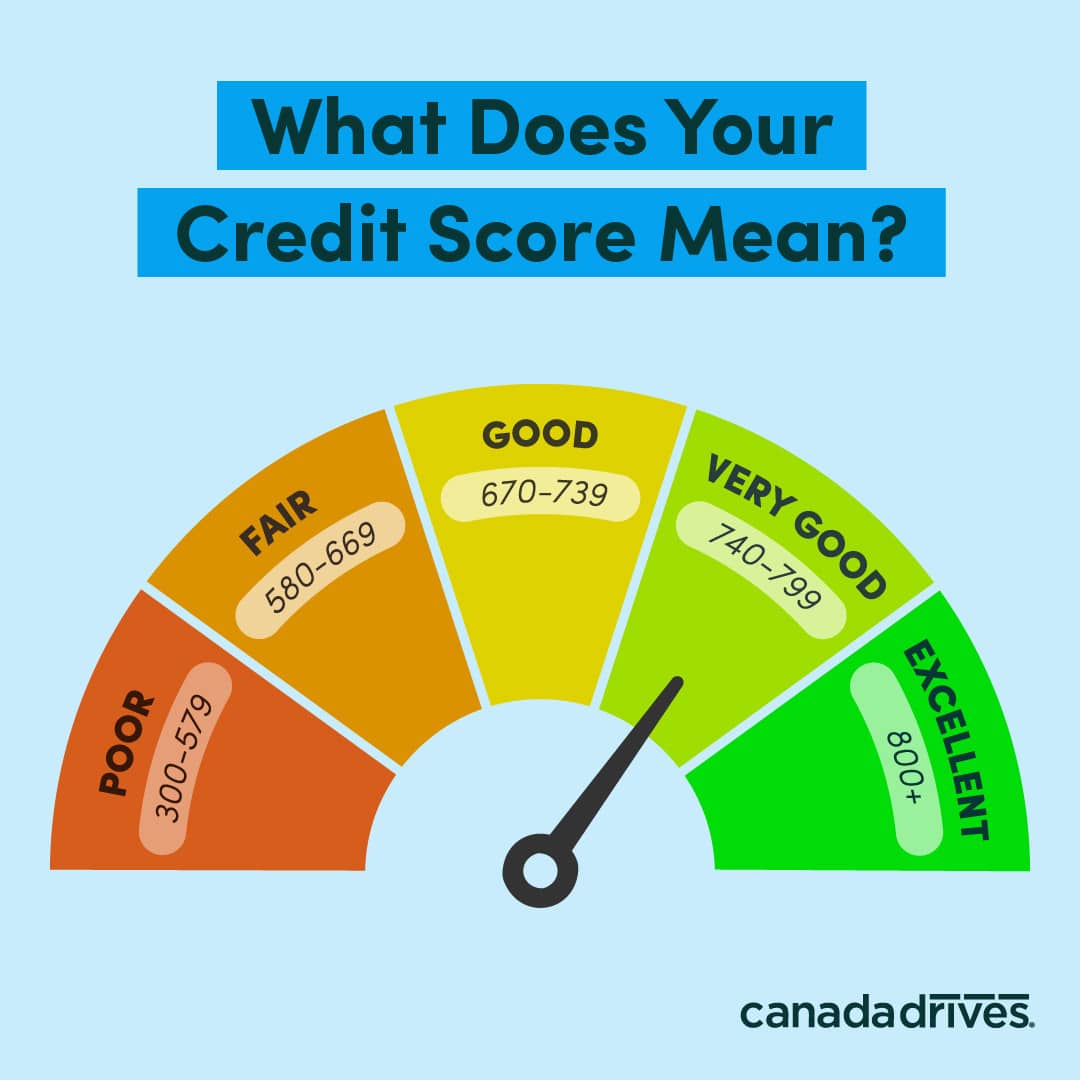

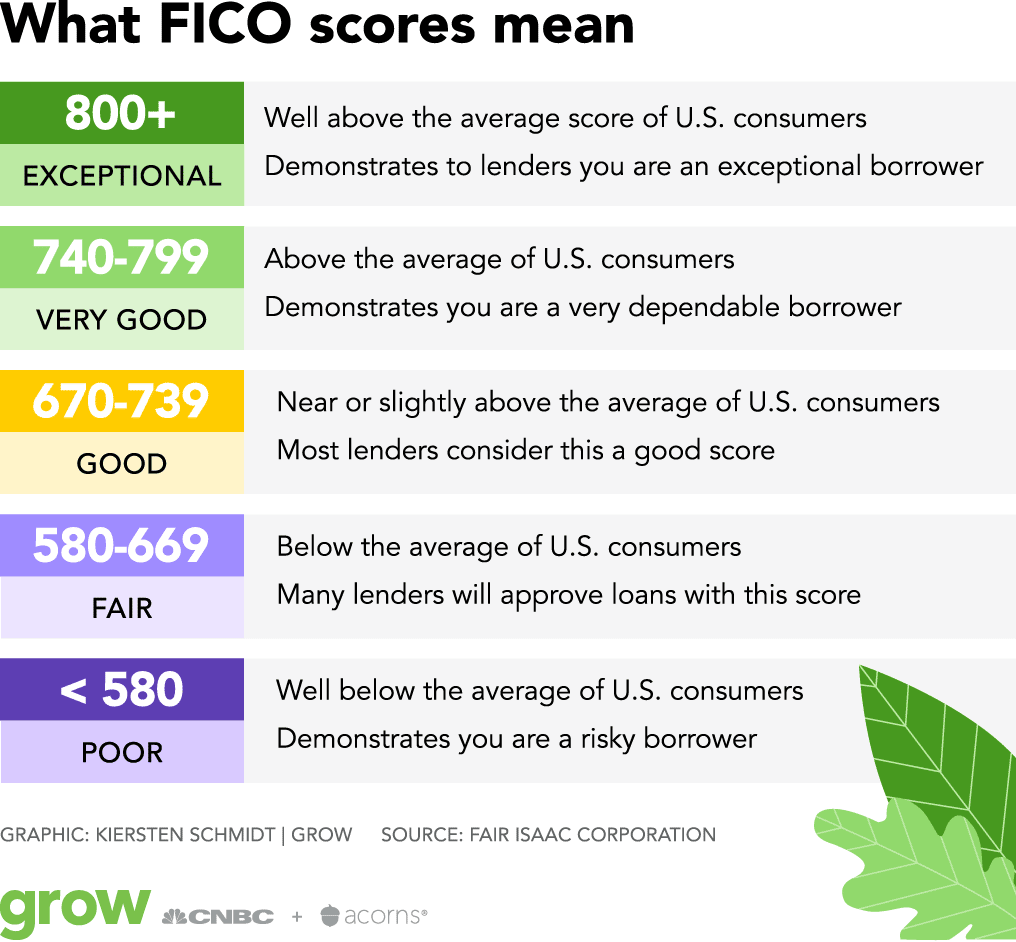

FICO scores range from 300 to 850. Heres how theyre categorized:

- Poor credit 300 to 579

- Fair credit 580 to 669

- Good credit 670 to 7399

- Very good credit 740 to 799

- Exceptional credit 800 to 850

Below is a breakdown of how FICO scores are calculated:

- Payment history 35% of your FICO score

- Amounts owed 30% of your FICO score

- Length of credit history 15% of your FICO score

- New credit 10% of your FICO score

Recommended Reading: How Long Are Late Payments On Credit Report

What Fico Says About Having The Perfect Credit Score

Even a representative at FICO the scoring model most lenders use to check applicants’ creditworthiness says that having a credit score in the top 2% of the U.S. population won’t further benefit you, so there’s no need to stress. It’s also important to remember that it’s impossible to earn a credit score above 850.

“The reality is that, from the standpoint of qualifying for credit, it doesn’t matter whether you have a perfect 850 or a score just below that,” Ethan Dornhelm, VP of FICO® scores and predictive analytics, tells Select. “To lenders, a consumer with a score in the 800s is a sparkling applicant.”

Percent Of Adults Who Check Their Score Monthly

Data regarding how many adults check or dont check their scores will vary from study to study due to the nature of the sample population. Research offered by CreditCardInsider.com found that only 21 percent of their respondents check their credit score on a monthly basis9.

This low number can be supported by data in other studies, such as a LendingTree survey that found only 33 percent of adults checked their score within the past year in 202010.

Recommended Reading: Do Cell Phone Companies Report To Credit Bureaus

The Average Fico Score Increase In The Last Decade

Between 2010 and 2020, the average FICO score has increased by approximately 24 points. The average FICO score in 2010 was 687, while todays average FICO score in the United States is 711.

This trend increase in credit score statistics also seems to appear in different age brackets, as illustrated in the data above in Experians and The Ascents reports.

What Percent Of The Population Has Over An 800 Credit Score

About 20% of Americans have a credit score over 800 points. If you have a credit score of 800 or higher, you will be able to manage your debt and never miss a loan payment. You will be an ideal borrower because of this and you will be able to get more offers and lower interest rates.

Don’t Miss: What Is Aoc’s Credit Score

Building Great Credit: What Is The Highest Credit Score You Can Have

According to Equifax, one of the major credit bureaus in the United States, the average American credit score is 698. What does this mean for you? If you have begun the process of buying a house, leasing a car, or renting an apartment, you may have been informed that your lender ran a credit check and compared your score to a standardized chart that rated the number anywhere from excellent to poor.

What is the highest credit score you can have and does yours need to be raised? Discover answers to these questions and more in this guide. Well help you understand the basics of credit, how this number may be affecting your life, and what you can do to raise the score to the highest number possible.