Youve Probably Heard Of Fico Scores But Do You Know What They Are And How Yours Compare To The Average Americans

According to FICO, the average FICO® score in the U.S. as of August 2021 was 716, but that probably needs a little more explanation.

FICO® scores are based on FICO® credit scoring models and are widely used by banks, credit card companies and other lenders throughout the United States. FICO® scores may help a lender determine whether youre approved for new credit. And if you are approved, the scores can influence the interest rates youre offered.

Average Age By Credit Score Tier

| West | 687 |

The South has the worst credit, on average , whereas the Midwest has the best . In fact, three of the five states with the highest average credit scores are in the Midwest. With that being said, every region has at least one state whose residents boast good credit, on average.

So, while job opportunities, living costs and other local factors definitely affect credit-score averages, its also true that credit scores can flourish anywhere.

How Did The Pandemic Affect Credit Scores

I think there was a perception that if a score was going to go up during this period it was going to be largely about people not having missed payments on their file but instead they were in payment accommodation and therefore temporarily getting a reprieve from missed payments hitting their credit file,” said Ethan Dornhelm, FICO’s vice president of scores and predictive analytics.

“I think the thing that the analysis really made clear to us was that, no, these borrowers genuinely are in a better financial state than they were pre-pandemic. They genuinely have materially lower revolving debt levels.

Dornhelm added that credit accommodations may have led consumers to check their credit reports and scores: “I dont want to undersell the fact that we have seen a meaningful uptick in the desire of consumers to learn about credit scores and credit reports.” He said traffic to FICO’s consumer website nearly doubled during the pandemic, suggesting an increased interest in learning about credit.

Recommended Reading: Get Repo Off Your Credit Report

Pay Your Bills On Time

It may seem like a no-brainer, but a 2018 study showed that 25% of Americans dont consistently pay their bills on time. Why is that an issue? Your payment history accounts for 35% of your FICO score, so every time you become delinquent on a payment, youre lowering your credit score.

Just how much your credit score is lowered depends on several personal factors, like how late you paid and how often you tend to miss payments. Obviously, if you are a regular offender, your credit score will suffer more.

What Exactly Is A Credit Score

What is a credit score? Most people know it is a number that determines if you can obtain the goods that you prefer not to purchase with cash on hand, but most people dont know what it is comprised of.

Your credit score is fundamentally based on your own spending and paying habits. How do you spend money? How do you re-pay your debts? Those are the questions that answered through the credit score formulas.

The most commonly used score is FICO, or Fair Issac Corporation score. The three most-used credit reporting agencies are TransUnion, Experian, and Equifax. Because there are three CRAs, you can have three different scores that lenders use for creditworthiness.

FICOs consumer site, myfico.com indicates that your credit report is made up of different criteria which culminates into your credit score. The pie is divided into categories, with the highest percentage given to categories of the most importance.

Your credit score is largely determined by how well you pay and how much you owe. If you pay your bills on time, youre positively contributing to 35% of a good score. If you owe substantially less than your credit limit, then you are positively contributing to 30% of your credit score.

The amount of new credit and your credit mix contribute 10% each. New credit is any new financed/refinanced account of open line of credit. Your credit mix includes having revolving or installment credit .

Don’t Miss: 688 Credit Score Credit Card

Learn About The Average Credit Score In The Us Including By Age And State

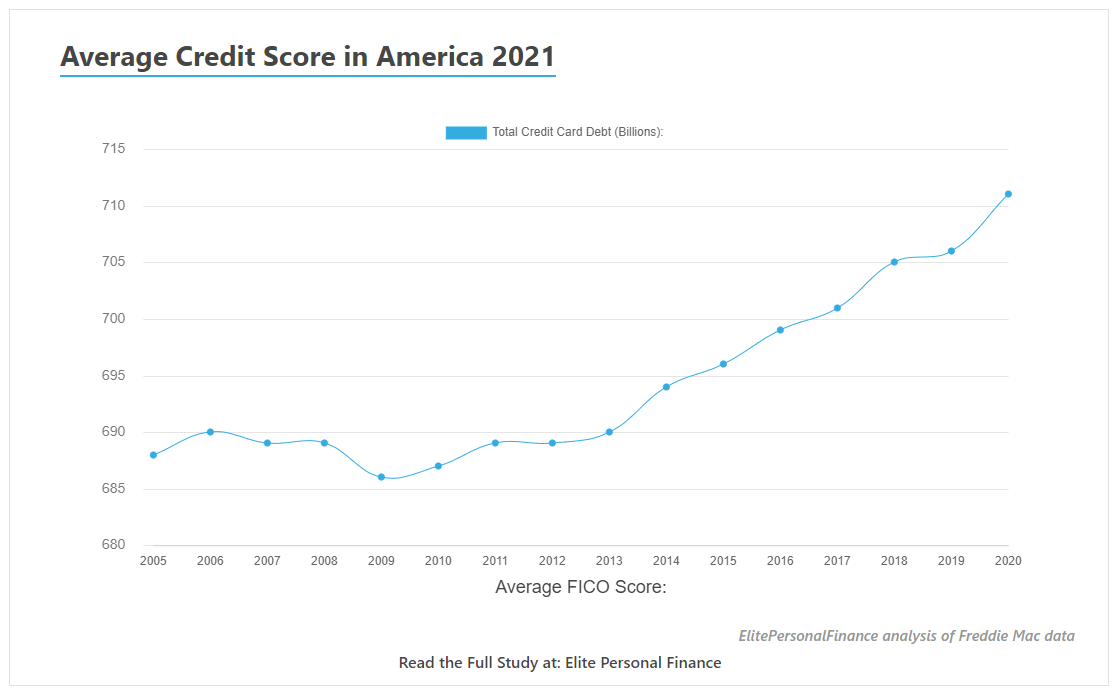

The average FICO® credit score in the U.S. was 710 in 2020. Thatâs according to data from an annual study by Experian®.

The Experian 2020 Consumer Credit Review uses FICO scores nationwide to determine averages by age, state and more. FICO is a credit-scoring company that provides some of the most commonly used scores in America. Read on for more of the studyâs findings and see what they mean for you.

Number Of Americans With No Credit History

According to the Consumer Financial Protection Bureau , approximately 26 million adults are considered to be credit invisible, meaning they have no credit history as theyre without credit cards, loans, and other lines of credit.1

Of course, if you have a credit card, that doesnt necessarily mean you will have a credit score. Around 19 million adults lack a score altogether due to credit reports with minimal credit usage or out-of-date credit history. Nows the time to open a credit card or loan to build your history.

You May Like: Notifying Credit Bureaus Of Death

Why Your Credit Scores Matter

Your credit scores are a big deal when it comes to your finances. Think of your credit scores as a grown-up grade point average. In high school, your GPA can help you get into the best universities. As an adult, your credit scores can help you access the best loans and interest rates.

So depending on your credit scores, you could be approved for competitive credit cards and loans, or you could get denied. Better credit scores could help you get a lower interest rate too, which can help you save big on a large loan like a mortgage or car loan.

If you were to buy a home for $200,000, with a 4% interest rate, 30-year fixed mortgage, you would pay $955 per month, or $343,739 over 30 years . At 5% interest, youd pay $1,074 per month and $386,512 in total. That is a $119 difference in the monthly payment and a total of $42,773 more over the life of the loan. Thats huge!

The Average Credit Score By Age State And Year

Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective. Terms apply to offers listed on this page. Read our editorial standards.

- The average American has a credit score of 711, according to data from Experian. That’s considered ‘good’ by FICO’s score ranges.

- People over 50 have average credit scores higher than the national average. Scores in some states, including Minnesota, Wisconsin, and Vermont, tend to exceed the US average, too.

- Get your free credit score with CreditKarma »

The average credit score in the US is 711, according to credit reporting company Experian, calculated using the FICO scoring model.

Credit scores, which are like a grade for your borrowing history, fall in a range of 300 to 850. The higher your score, the better people with higher credit scores tend to get better interest rates on loans, have access to credit cards with better perks and lower interest rates, and could even pay less for insurance.

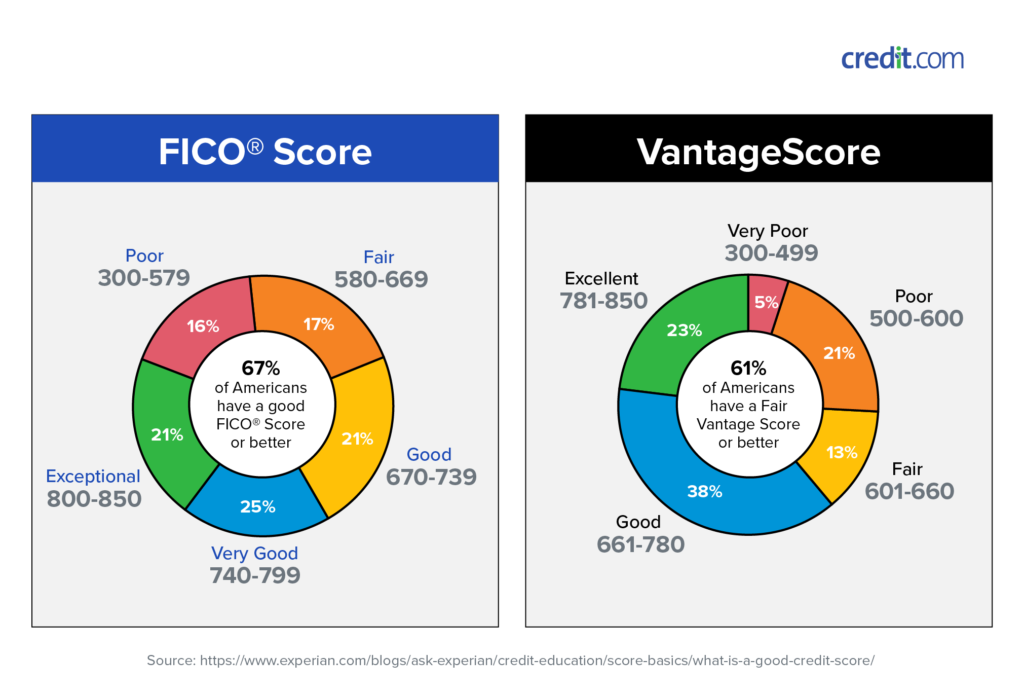

The FICO model of credit scoring puts credit scores into five categories:

- Very poor: 300-579

- Very good: 740-799

- Exceptional: 800-850

Based on this scoring system, the average American has a good credit score. But, the average credit score is different by demographic.

Recommended Reading: Care Credit Pulls From Which Bureau

When To Get Help From The Experts

For consumers who still need help getting that number up closer to the average credit score, a respected credit repair company can be a good resource in getting outdated and incorrect items removed from your credit report.

You can certainly go down that road on your own, but a professional company knows all of the laws and regulations to make sure your interests are fully represented.

Plus, dealing with creditors and credit bureaus can feel like a full-time job, and you probably already have one of those. Its often a wise choice to work with a professional for the fastest, most comprehensive results.

No matter where your credit score lays in comparison to everyone elses, just remember that personal finance is called that for a reason: each individual has personal reasons for spending and saving money as they do.

As long as you do your best to stay on top of your money and employ smart strategies to boost your credit score, you could see positive results in as little as 30 days. And thats something worth bragging about.

Use Different Types Of Credit

Keeping your balances low isnt the only key to maintaining a good score and building a strong credit history. Having a diverse credit mix will also bode well for you in the long run. This should include both revolving and installment credit. Credit cards are revolving, while car loans and mortgages are installment credit. Your credit score considers how you handle both types of credit, which is why just having a fistful of credit cards wont help you as much as a credit card or two and a mortgage or other installment loan.

You May Like: How To Get Car Repossession Off Credit Report

Does Higher Education Mean Higher Credit Scores

Education matters, at least in regard to your credit score. We found a moderately positive correlation between a states average credit score and the percentage of the adult population in each state with a bachelors or higher. In short, the higher the proportion of a states population with a bachelors degree or higher, the higher the credit score.

A notable exception is Washington, DC: While not a state, the nations capital is home to a far higher percentage of people with a bachelors degree when compared to the rest of the US, and yet its average credit score is 703 in line with the nations average.

| % with bachelors degree or higher education | Education rank |

|---|---|

| 40 |

Keep Old Accounts Open

The last factor in credit scoring is the length of your credit history. This one takes time. But everyone has to start somewhere. What you do want to avoid is closing an account because you dont use it often or dont want it anymore. Killing your oldest account and removing that card from the mix could work against you by shortening your credit history. If you can avoid it, try to keep your oldest accounts open and in good standing.

Don’t Miss: Ccb On Credit Report

Keep Your Credit In Check

Though the trends highlighted in the State of Credit report are certainly interesting, Griffin emphasized that the most important takeaway is that good credit is key to our financial lives.

The most important thing you can do to protect your credit, according to Griffin, is to be proactive. You can start by requesting free copies of your credit reports through AnnualCreditReport.com, which will give you an idea of where you stand. You can also review your reports for errors and dispute any inaccurate information, which will give your score an instant boost.

If possible, continue to make your bill payments on time. Late payments are the most damaging items in your credit history and will drag down your credit scores and slow your recovery, Griffin said.

However, if youre having trouble keeping up on payments, talk to your lender before you are late. They likely have resources available under the current circumstances to help you weather this rough patch.

Finally, keep your credit card balances as low as possible. High credit card utilization how much you owe compared to your total available credit is the second most important element in credit scores. Paying down your outstanding debt will help improve your score over time. Using a credit card as a stopgap measure to get through a financial downturn is OK as long as you dont overdo it and have a plan to repay the debt when you get back on your feet, Griffin said.

If You Think The Uptick In Average Fico Score Is Coming From The Prime Lower Risk/higher Scoring Segments Guess Again

The upwards trend in the average FICO Score is actually most pronounced in the lower score ranges. For example, for those consumers who had a FICO Score value between 550-599 as of January 2020 , their average score has gone up from 581 as of April 2020 to 601 as of April 2021. In contrast, those consumers who had a FICO Score value between 750-799 as of January 2020 have seen virtually no movement in their average score between April 2020 and today.

Figure 2. Average FICO® Score During COVID-19 Has Increased More for Lower Scoring Population

Though it might sound obvious, the drivers of the continued improvement in the average FICO® Score are continued improvements in key metrics considered by the score: fewer missed payments, lower consumer debt levels, and reduced credit seeking behavior. Lets dive into each of these in a bit more depth:

Figure 3. FICO Scorable Population Shows Significant Improvement in Key Credit Metrics During the Pandemic

Read Also: Raise Credit Score 50 Points In 30 Days

Review Your Credit Reports

Your credit score is based on information listed in your . If your creditors report negative information to one of the three major credit bureausExperian, Equifax or TransUnionit can damage your credit score. To catch and fix any errors, check your credit reports at least once a year.

Due to Covid-19, you can view all three reports for free weekly through April 20, 2022 by visiting AnnualCreditReport.com. If you see any errors, dispute them with each credit bureau that lists it on your report.

What Is The Average Credit Score In America

The average credit score in the U.S. is at an all-time high of 711. This coincides with what the Consumer Financial Protection Bureau defines as “prime.”

About 1 in 5 American adults either have no credit history or are unscorable. As a result, these individuals will have difficulty obtaining new lines of credit.

In the eyes of lenders, credit scores fall into several buckets, which indicate how risky it may be to extend credit to an individual. Outside of playing a role in approvals for a loan or credit, these scores can also impact an individual’s lending terms. Perhaps the most important terms among those are interest rates.

The higher an individual’s credit score, the lower their quoted APR will typically be.

FICO credit scores break down in the following manner:

- 800 to 850: Exceptional

- 300 to 579: Very poor

This means the average credit score of 711 is in the good range.

Though the average credit score has generally improved since 2005, slight dips were seen around the Great Recession that ended in 2009. A large number of people declaring bankruptcy or defaulting on their loans would have caused their credit scores to plummet, which in turn would have affected the overall average.

You May Like: How To Get Rid Of A Repo On Your Credit

Getting Approved For A Loan

Getting approved for a car loan typically requires a score in the low- to mid-600s, although its not unheard of for someone in the mid-500s to get approved. It depends on the lender and of course, the lower your credit score, the higher your interest rates will be.

Be careful with your credit applications, though. Each new credit inquiry for a credit card or loan type can dock your score anywhere between 5 and 10 points. That drop lasts for a year and the inquiry itself is listed on your credit report for two years.

If your credit score is just above 700, you could quickly dip back into the fair category and receive a higher interest rate offer on your next financial product. Bottom line: only apply for credit if you need it. If youre looking for a loan, do all of your rate shopping within a few weeks and youll only have a single inquiry impact your credit.

Tips For Boosting Your Credit Score

Now that you know how your credit score compares to those of other Americans, its time to break out the competitive spirit and raise your credit score.

To become eligible for the very best credit cards, loans, and mortgages, youll need a credit score of 740 or above. Thats right at the top of the good credit category, just ten points shy of excellent. So how can you do it? Here are a few simple tips.

Recommended Reading: How Long Repo Stays On Credit Report

What Is The Average Credit Score By Age Group

The average credit score across various age groups in the U.S. reveals an upwards trend in the average credit score, with each age group experiencing a minor credit score increase in comparison to average credit scores reported in 2019.3

Here is the following average score breakdown by age group:

- Ages 18-23: 674

The Fico Score Is A Broad

The FICO® Score is the lingua franca, or common language, for the credit scoring industry. It serves as a broad-based, independent standard measure of credit risk. It is relied upon by stakeholders across the entire lending ecosystem from regulators, investors and boards to consumers, lenders, and brokers as a baseline metric for assessing credit risk that is fair to both lenders and consumers.

The FICO® Score model is based on data in an individuals credit report, housed by the three primary U.S. consumer reporting agencies . There are also FICO Score versions available that utilize alternative data, based on Fair Credit Reporting Act compliant sources such as landline, mobile and cable payments these scores can help address populations that were previously unable to be scored due to their sparse traditional CRA credit data.

FICO Scores, which range from 300-850, are dynamic and evolve based on continually changing consumer behavior reported to the CRAs.*

Read Also: How To Get Rid Of Serious Delinquency On Credit Report