Your Overall Relationship With Td Canada Trust

The objectivity of the credit granting process has not eliminated the importance of your one-to-one relationship with TD Canada Trust.

In conjunction with the other credit granting factors, we will consider your borrowing history with us.

In the event that your credit application is not approved, we’ll help you to understand the reasons why. We can also recommend a strategy for improving your credit rating.

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Score plus tools, tips, and much more. Learn how to access your FICO Score.

Pay Your Bills On Time

The frequency of your on-time payments is the factor that influences your scores the most.

Setting up automatic payments on your credit card bills can be a helpful way to avoid forgetting a payment, but make sure you have enough money in your accounts to cover automatic payments. Otherwise, you may have to pay fees.

Also Check: What Is A Bad Credit Rating

Vantagescore And Fico Are The Two Main Credit

But even if you have pretty good credit habits, dont be surprised if you check your scores and find that youre below 850.

Perfect credit scores can seem to be inexplicably out of reach. Out of 200 million consumers with credit scores, the average FICO score is 704. And FICO says that as of April 2019, just 1.6% of Americans with credit scores had perfect FICO scores.

What Is A Good Credit Score

Quick Answer

A credit score is a three-digit number that is calculated from information on a credit report and generally ranges between 300 and 850. A good credit score is 670 to 739 on the FICO® Score range, while a credit score of 661 to 780 is good on the VantageScore® range.

In this article:

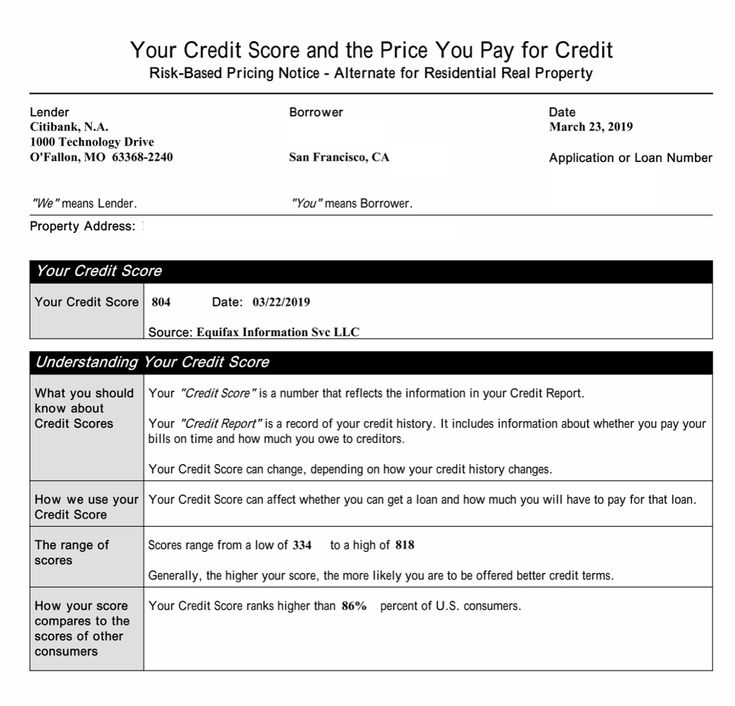

A credit score ranges from 300 to 850 and is a numerical rating that measures a person’s likelihood to repay a debt. A higher credit score signals that a borrower is lower risk and more likely to make on-time payments. Credit scores are often used to help determine the likelihood someone will pay what they owe on debts such as loans, mortgages, credit cards, rent and utilities. Lenders may use credit scores to evaluate loan qualification, credit limit and interest rate.

For a score with a range between 300 and 850, a credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent. Most consumers have credit scores that fall between 600 and 750. In 2021, the average FICO® Score in the U.S. reached 714an increase of four points from the previous year. Higher scores can make creditors more confident that you will repay your future debts as agreed. But creditors may also set their own definitions for what they consider to be good or bad credit scores when evaluating consumers for loans and credit cards.

Don’t Miss: How To Fix My Credit Score In 6 Months

What Is An Excellent Credit Score Range

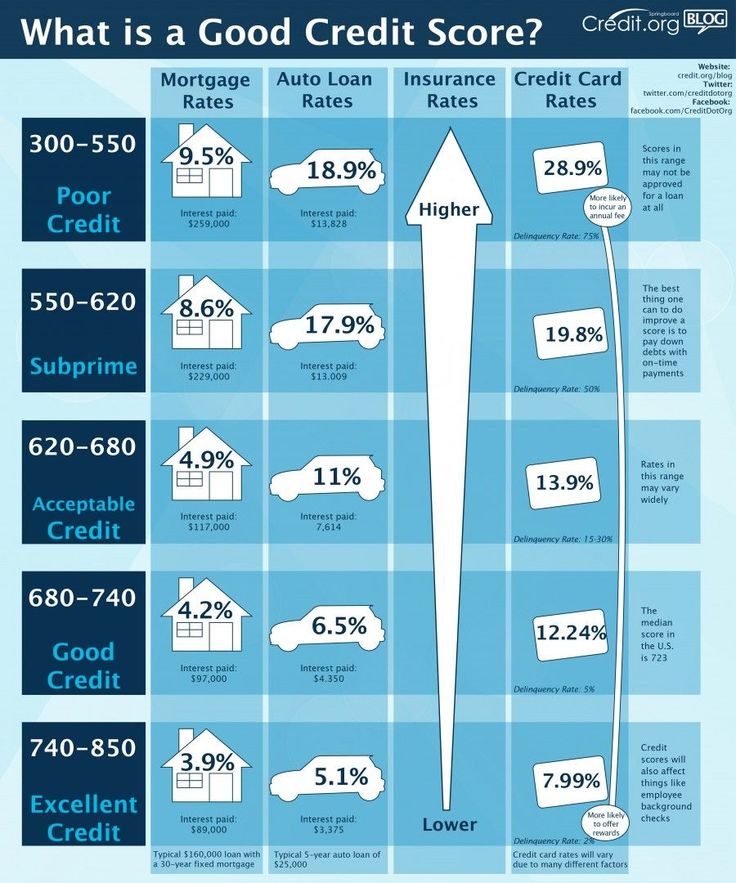

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Recommended Reading: Why Did My Credit Score Drop 20 Points

Make Sure There Are No Negative Marks On Your Credit Report

Even if youve never missed a payment, there could be illegitimate negative marks on your credit reports. Be sure to check your Transunion and Equifax credit reports for free from Credit Karma and make sure there are no errors.

If you find incorrect marks on your reports, you can dispute them. Upon receiving a dispute, the credit-reporting companies are required to investigate and fix errors in a timely manner.

Even if you have legitimate negative marks on your credit reports, they will affect your scores less over time and should eventually fall off your reports completely.

Average Credit Score By Year

Americans actually have better credit than ever. The average score has increased by about 10 points in the past seven years. Here’s how it’s risen, according to FICO data from October of each year:

| Year | |

| 2021 | 714 |

Americans have more consumer debt than ever before, holding a total of $14.3 trillion in debt in the first quarter of 2020. But at the same time, credit scores are rising. The period spanning from June 2009 until early 2020 became America’s longest-running period of economic expansion, and brought low unemployment rates. This could have contributed to America’s rising credit scores, with more people borrowing money and paying bills on time.

Recommended Reading: How Often Should A Person Check Their Credit Report

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Historic S& p Global Rankings

| State |

|---|

- This page was last edited on 9 September 2022, at 11:03 .

- Text is available under the Creative Commons Attribution-ShareAlike License 3.0 additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy. Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization.

Don’t Miss: How Do Student Loans Affect Credit Score

How Credit Scores Work

A credit score can significantly affect your financial life. It plays a key role in a lenders decision to offer you credit. For example, people with credit scores below 640 are generally considered to be subprime borrowers. Lending institutions often charge interest on subprime mortgages at a rate higher than a conventional mortgage to compensate themselves for carrying more risk. They may also require a shorter repayment term or a co-signer for borrowers with a low credit score.

Conversely, a credit score of 700 or higher is generally considered good and may result in a borrower receiving a lower interest rate, which results in their paying less money in interest over the life of the loan. Scores greater than 800 are considered excellent. While every creditor defines its own ranges for credit scores, the average FICO Score range is often used.

- Excellent: 800850

Your credit score, a statistical analysis of your creditworthiness, directly affects how much or how little you might pay for any lines of credit that you take out.

A persons credit score also may determine the size of an initial deposit required to obtain a smartphone, cable service, or utilities, or to rent an apartment. And lenders frequently review borrowers scores, especially when deciding whether to change an interest rate or on a credit card.

What Is A Credit Score?

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

You May Like: How Long Does A Hard Inquiry Last On Credit Report

What Is A Poor Credit Score Range

Poor credit score = 550 619: Credit agencies consider consumers with credit delinquencies, account rejections, and little credit history as subprime borrowers due to their high credit risk. Although it is possible to qualify for credit, it is often at very disadvantageous terms you will pay much higher interest rates and penalty fees.

If you find yourself in this range, you should begin to address any specific credit problems you have to try to boost your score before applying for credit. Subprime borrowers typically become delinquent 50% of the time.

Average Credit Score By Income

The higher ones income level, the higher their average credit score tends to be.

While debt-to-income ratio doesnt play a direct role in determining one’s credit score, it does have an indirect one. One of the factors lenders consider when modeling an individual’s credit risk is their credit utilization the percentage of total available credit a consumer is using month to month.

To improve one’s credit score, credit utilization should generally be kept below 30%. The lower one’s income is, the more a consumer may rely on their credit for their expenditures.

Another way income may play into credit utilization, and ultimately one’s credit score, is by determining one’s . Credit issuers look at borrowers incomes when deciding on the amount of revolving credit that should be issued.

The lower one’s income, the lower their line of credit is likely to be.

In turn, by having significantly lower credit limits, it becomes easier for lower-income individuals to eat up a larger portion of what’s available, increasing their credit utilization.

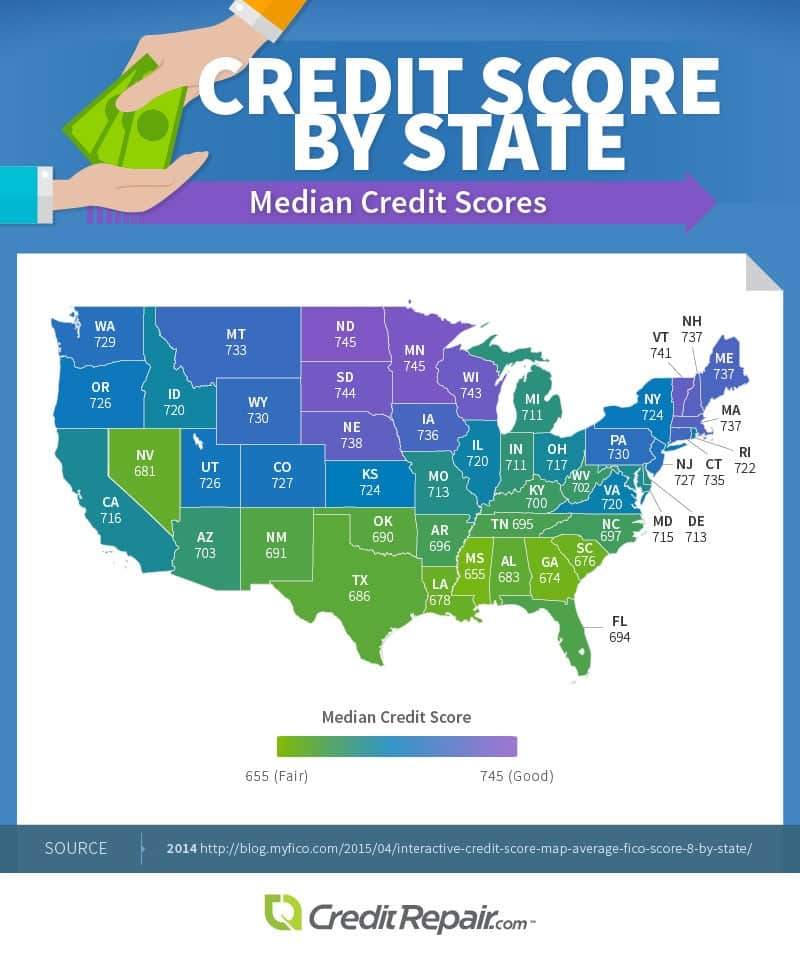

The graphic belows shows that median credit scores are highly correlated to income.

For context:

- Low income: Up to 50% of the area median income

- Moderate income: Greater than 50% and up to 80% of the area median income

- Medium income: Greater than 80% and up to 120% of the area median income

- High income: More than 120% of the area median income

You May Like: Does Paypal Credit Affect Credit Score

The Main Factors That Affect Your Scores: Fico Vs Vantagescore

While VantageScore and FICO scoring models have differences, both make it clear that some factors are more influential than others.

For both models, payment history is the most important factor, followed by the total amount of credit you owe .

FICO uses percentages to indicate the importance of each factor to your credit scores.

| FICO |

|---|

|

Less influential |

What Is A Bad Credit Score Range

Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of credit every time. If your score has fallen into this range, improving your score is going to take some work.

Filing for bankruptcy can bring a score down to this level. Statistically, borrowers with scores this low are delinquent approximately 75% of the time. But if you continue to make your payments on time, your score should improve. There are certain types of loans, like home loans, that are hard to get with a score in this range, but there are still options for getting a mortgage with bad credit.

Don’t Miss: Does Cancelling Credit Card Hurt Credit Score

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

What Was The Average Credit Score In 2021

The average FICO credit score in the U.S. rose from 710 in 2020 to 714 in 2021, according to data from an annual study by Experian®.

The Experian 2021 Consumer Credit Review uses FICO scores nationwide to determine averages by age, state and more. FICO is a credit-scoring company that provides some of the most commonly used credit scores in America. Read on for more of the studyâs findings and see what they could mean for you.

Recommended Reading: A Credit Score Is Based In Part On

Bank Of America Corporation

| A-1 | F1+ |

| – | – |

Rating applies to payment obligations under issuance program. There is no assurance that individual notes issued under the program will be assigned a rating.

Moodys currently reports long-term ratings for certain issuances of Merrill Lynch S.A. . MLSA merged into Merrill Lynch B.V. on January 1, 2013 leaving MLBV as the surviving entity. All notes or certificates previously issued by MLSA, including both rated and unrated issuances, are now obligations of MLBV.

This website uses cookies to ensure you get the best experience on our website.

Investing in securities involves risks, and there is always the potential of losing money when you invest in securities.

This material does not take into account your particular investment objectives, financial situations or needs and is not intended as a recommendation, offer or solicitation for the purchase or sale of any security, financial instrument, or strategy. Before acting on any information in this material, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only correct as of the stated date of their issue.

| Are Not FDIC Insured | |

| Are Not Insured by Any Governmental Agency | Are Not a Condition to Any Banking Service or Activity |

How Does A Credit Scoring System Work

- Have you paid your bills on time? If your credit report shows that youve paid bills late, had an account put in collections, or declared bankruptcy, thats likely to affect your score negatively.

- Are you maxed out? Many scoring systems look at the amount of outstanding debt you have compared to your credit limits. If the amount you owe is close to your credit limit, its likely to hurt your score.

- How long have you had credit? Generally, scoring systems consider your credit track record. A short credit history may hurt your score, but paying bills on time and having low balances can offset that.

- Have you applied for new credit lately? Many scoring systems look at inquiries on your credit report to see whether youve applied for credit recently. If youve applied for too many new accounts recently, it could hurt your score. Not every inquiry is counted: for example, inquiries by creditors who are monitoring your account or making prescreened credit offers arent counted against you.

- How many credit accounts do you have, and what kinds of accounts are they? Although its generally considered a plus to have established credit accounts, too many credit card accounts may hurt your score. Also, many scoring systems consider the type of credit accounts you have. For example, under some scoring systems loans to consolidate your debt but not loans for buying a house or car may hurt your credit score.

Recommended Reading: How Can Your Credit Score Impact Your Financial Situation