What Is The Credit Score Rating Scale

A scale used by creditors to assess an individuals creditworthiness, i.e. a persons likelihood of whether the company will be able to pay the debt obligation fully on time or no is known as a credit score rating scale. Credit rating is provided by different credit rating agencies.

A rating is given to any issuer, i.e. an individual, corporate, state, the sovereign government who seeks to borrow the money.

A rating does not say whether an investor should really buy that bond, but it is just one of the most important parameters an investor should consider before investing in any bond.

A rating suggests both the present situation and the impact of future events on credit risk.

Climbing Up The Credit Score Chart With Good Credit Habits

Now that you know your credit score and the range it falls into, lets take a brief moment to explore the kind of healthy financial habits that lead to good credit and the improved financing and lending terms that accompany it:*

- Timely payments

- Only use the credit you really need

- Total length of credit history

- Instill a proactive approach to credit and personal finances

Standardised Rating And Symbols For Issuer Rating Or Corporate Credit Rating

The circular of standardisation of rating scales has standardised the symbols and provided the definitions for Issuer rating or Corporate Credit Rating. An issuer rating or corporate credit rating determines the degree of safety of a rated entity or the issuer in regard to its ability to timely pay off all its debt obligations.

Moreover, below-mentioned is the list of new symbols or ratings that the CRAs shall use for issuer rating or corporate credit rating.

AAA- Issuers with this rating have the highest degree of safety in terms of paying off all their debt obligations and carry the lowest debt risk.

AA- Issuers with this rating have a high degree of safety in terms of paying off all their debt obligations and carry very low credit risk.

A- Issuers with this rating have an adequate degree of safety in terms of paying off all their debt obligations and carry low credit risk.

BBB- Issuers with this rating have a moderate degree of safety in terms of paying off all their debt obligations and carry moderate credit risk.

BB- Issuers with this rating have a moderate risk of default in terms of paying off all their debt obligations.

B- Issuers with this rating have a highrisk of default in terms of paying off all their debt obligations.

C- Issuers with this rating have a veryhighrisk of default in terms of paying off all their debt obligations.

D- Issuers with this rating are in default or expected to be in default.

Also Check: How Many Years Does Debt Stay On Your Credit Report

Very Good And Excellent/exceptional: Above Mid

A lender could deny anapplication for another reason, such as having a high debt-to-income ratio, butthose with top credit scores likely wont have their applications deniedbecause of their credit scores.

People in this score range are also most likely to get offered a low interest rate and may have the most options when it comes to choosing repayment periods or other terms.

Who Evaluates Credit Ratings

A credit agency evaluates the credit rating of a debtor by analyzing the qualitative and quantitative attributes of the entity in question. The information may be sourced from internal information provided by the entity, such as audited financial statements, annual reports, as well as external information such as analyst reports, published news articles, overall industry analysis, and projections.

A credit agency is not involved in the transaction of the deal and, therefore, is deemed to provide an independent and impartial opinion of the credit risk carried by a particular entity seeking to raise money through loans or bond issuance.

Presently, there are three prominent credit agencies that control 85% of the overall ratings market: Moodys Investor Services, Standard and Poors , and Fitch Group. Each agency uses unique, but strikingly similar, rating styles to indicate credit ratings.

Read Also: How To Get Car Finance With Poor Credit Rating

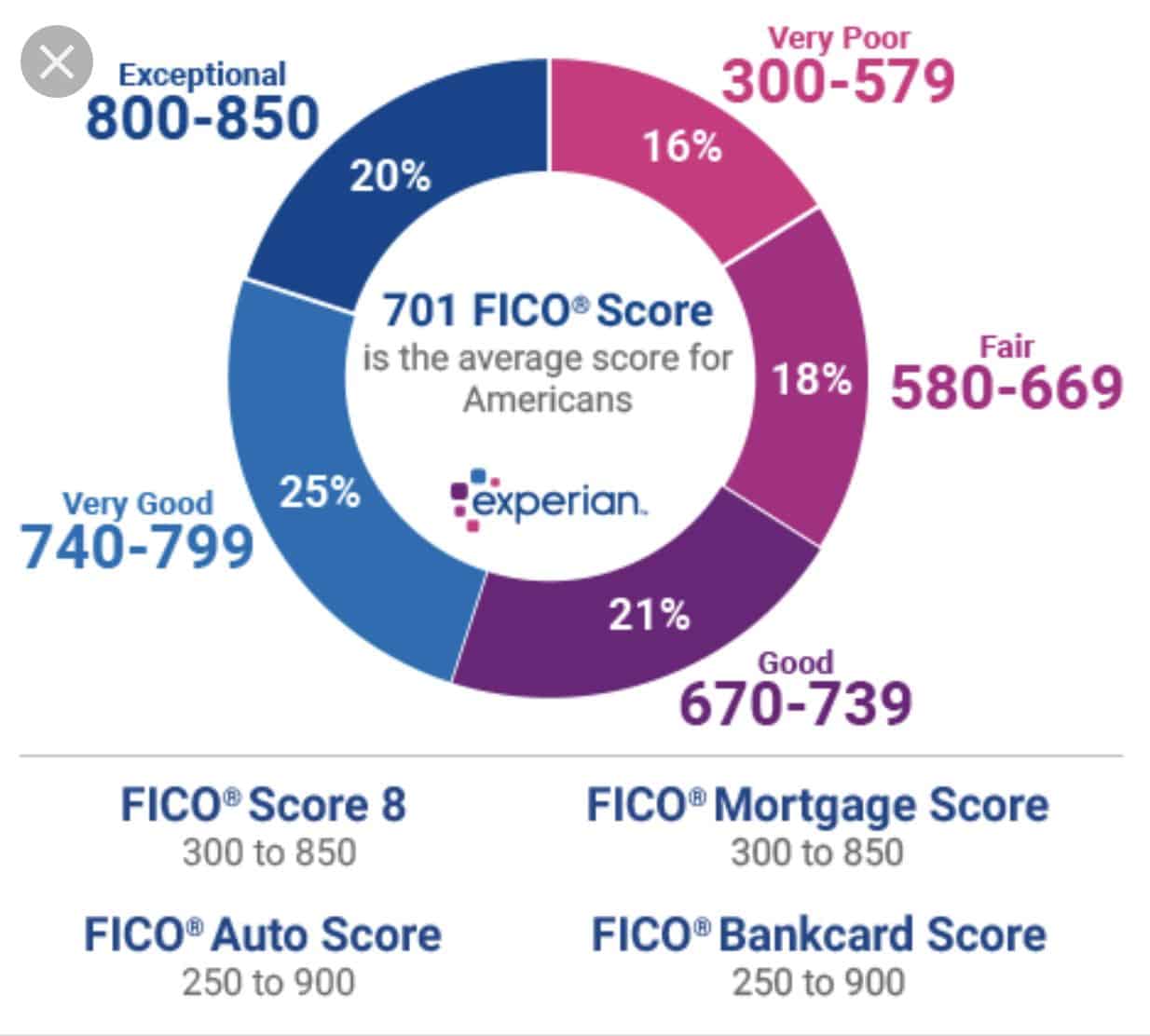

Fico Score Scale: 800

Under the FICO model, the most exceptional credit scores are 800 or better, up to the highest credit score possible, 850. Though the industry-specific models score on a different scale, it is probably safe to assume a FICO Score 8 in the excellent range will equal a respectable score under the Auto or Bankcard Score models, as well.

Attaining an excellent FICO Score requires consistently meeting credit obligations, in full and on time, as well as keeping total debt levels low.

Why Credit Rating Keeps On Changing

For example, consider a new technology coming in which was not expected and so it was not considered while assigning a rating to a company. This new technology might lead to a negative impact on the financials of the company. This may impact on the downgrading of the current rating.

Finally, Mr Ram got a clear picture of what is credit score rating scale is and what did his friend mean by the word Higher the rating better for you.

Don’t Miss: How To Repair Your Credit Score

Criticism Of Corporate Credit Ratings

A key criticism is that the issuers themselves pay the credit rating agencies to rate their securities. This became particularly important as the surging real estate market peaked in 2006-2007, and a significant amount of subprime debt was being rated by the agencies. The potential to earn high fees created competition between the three major agencies to issue the highest ratings possible.

During the financial crisis of 2008, companies that had received glowing ratings previously from various credit rating agencies were downgraded to junk levels, calling into question the reliability of the ratings themselves.

The lingering criticism that has plagued rating agencies is that they are not truly unbiased because the issuers themselves pay the rating agencies. According to critics, to secure the job to conduct a rating, a rating agency could give the issuer a rating that it wanted or could sweep under the rug anything that would negatively impact a positive credit rating. Credit agencies came under intense fire, for good reason, when the post-mortem on the was performed.

What Is An Excellent Credit Score Range

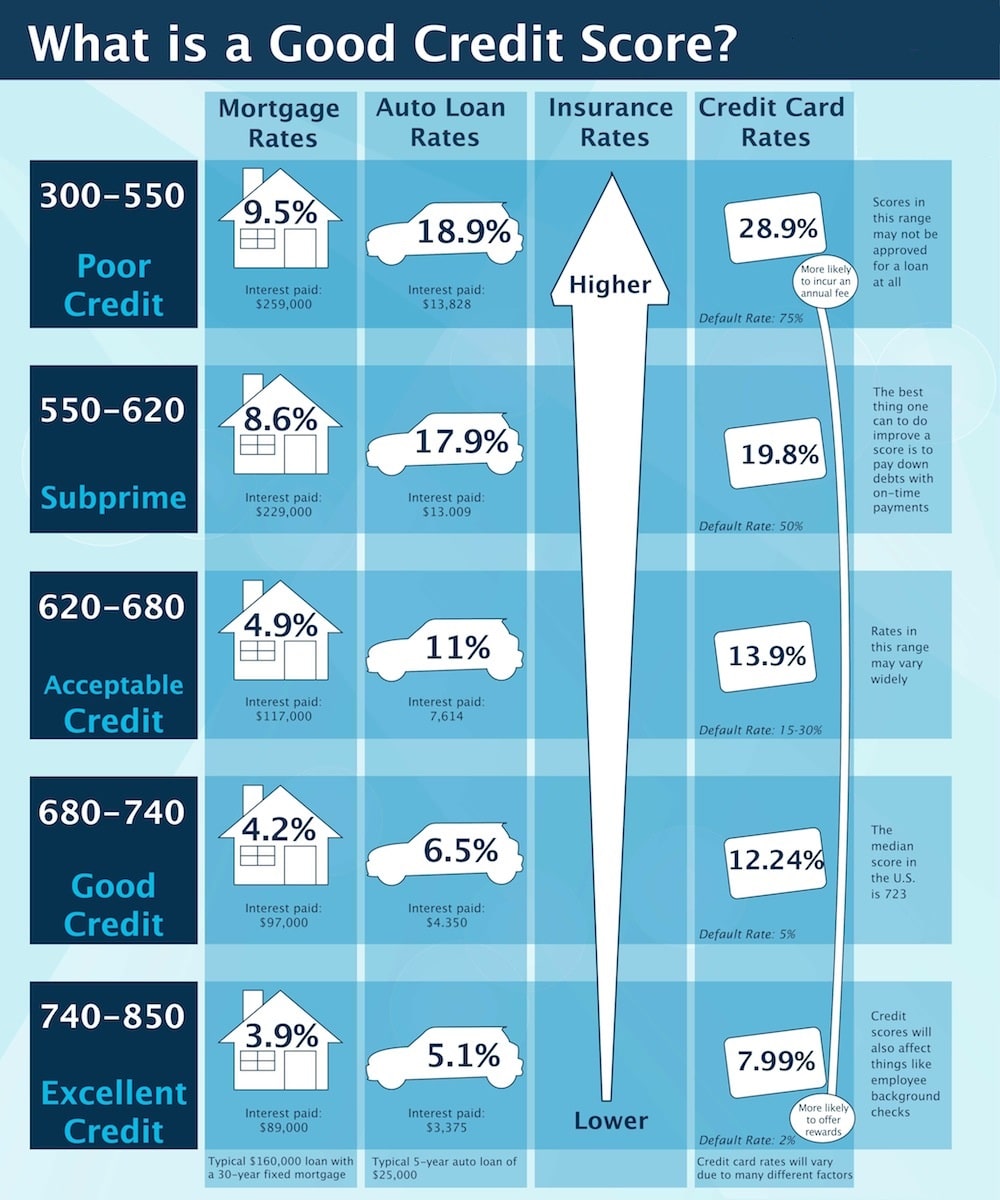

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

Recommended Reading: What’s The Highest Credit Score A Person Can Have

Importance Of Credit Ratings

Credit ratings for borrowers are based on substantial due diligence conducted by the rating agencies. Though a borrowing entity will strive to have the highest possible credit rating because it has a major impact on interest rates charged by lenders, the rating agencies must take a balanced and objective view of the borrowers financial situation and capacity to service and repay the debt.

A credit rating determines not only whether or not a borrower will be approved for a loan but also the interest rate at which the loan will need to be repaid. As companies depend on loans for many startup and other expenses, being denied a loan could spell disaster, and a high-interest-rate loan is much more difficult to pay back. A borrower’s credit rating should play a role in determining which lenders to apply to for a loan. The right lender for someone with great credit likely will be different than for someone with good or even poor credit.

Considering how important it is to maintain a good credit rating, it’s worth looking into the best credit monitoring services and perhaps choosing one as a means of ensuring your information remains safe.

Modifiers In Credit Rating

The modifiers are appended in front of some rating symbols to allow comparison of instruments which have the same rating. For example, hundreds of instruments could be rated AA. The comparators: + or – can indicate the ranking of such instruments within AA category. So, these can be thought of as separate categories within the main category.

Example: B can be further broken down into B+, B, B-. Where B+ is considered safer than B, which in turn is safer than B-.

Don’t Miss: Why Would My Credit Rating Go Down

What Is A Corporate Credit Rating

A corporate credit rating is an opinion of an independent agency regarding the likelihood that a corporation will fully meet its financial obligations as they come due. A companys corporate credit rating indicates its relative ability to pay its . It is important to keep in mind that corporate credit ratings are an opinion, not a fact.

India Ratings And Research Pvt Ltd

India Ratings and Research, a subsidiary of the Fitch Group and the headquarters are in Mumbai. It provides timely and accurate credit opinions on Indias . Also, this rating agency provides corporate credit ratings.

The company covers financial institutions, project finance companies, structured finance companies, corporate issuers, managed funds, and urban local bodies. Also, India Ratings and Research Pvt Ltd has other branch offices in Ahmedabad, Bengaluru, Chennai, Delhi, Hyderabad, Kolkata, and Pune.

You May Like: Does Easy Financial Report To Credit Bureaus

What Is The Previous Guideline On The Standardisation Of Rating Scales

The SEBI, to standardise the rating scales in the securities market, issued a circular on 16th July 2021 wherein it was stated that:

- The Credit rating agencies are required to undertake the activity of rating the financial instruments under the guidelines of different financial sector authorities or regulators and according to Regulation-9 of SEBI Regulations, 1999.

- The Credit rating agencies must align their rating scales with the rating enumerated under the guidelines of financial sector authorities and regulators to standardise the rating scales usage.

Climbing The Credit Score Chart

Generally, people with a good credit score have a long history of making their credit card and other loan payments on time. Payment history typically makes up 35% of the total calculation. Amounts owed typically makes up about 30%. Other considerations are length of , about 15% credit mix , about 10% and new credit about 10%.

You May Like: Is 742 A Good Credit Score

What Does A Very Poor Credit Score Mean

These lowest level credit score tiers show signs of either a newcomer to credit building or a long-time credit user who got sidetracked from best practices. Its not a great position for getting credit at a competitive rate, but its a perfect starting point for building better credit.

Ranking at the bottom of the credit score scale can mean more than a low point in your credit history. Its also a springboard for you to work toward improving your credit score. This challenge can become an opportunity to learn more about your credit score and gain skills to earn a higher rank.

What Is A Good Credit Score Range

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

Read Also: How To Request A Copy Of My Credit Report

What Affects A Credit Score

While every credit scoring model is different, there are a number of common factors that affect your score. These factors include:

- Payment history

- Balances on your active credit

- Available credit

- Number of accounts

Each factor has its own value in a credit score. If you want to keep your number at the higher end of the credit score scale, its important to stay on top of paying your bills, using your approved credit, and limiting inquiries.

However, if you are in the market to purchase a house or loan, there is an annual 45-day grace period in which all credit inquiries are considered one cumulative inquiry. In other words, if you go to two or three lenders within a 45-day period to get find the best rate and terms available for a loan, this only counts as one inquiry. This means that they are not all counted against you and will not affect your credit score.

What Is My Credit Score

A helpful first step on the road to better credit is to check your credit score. Contrary to popular belief, you can check your credit score without harming it. So, even if you sense that your score might be on the low end of the spectrum, checking it can help you achieve clarity about your credit standing.

Chase Credit Journey® can provide your credit score for free. Knowing where your credit score stands on the spectrum can help guide you forward with a clear understanding of where you are and where you want to go. Chase Credit Journey® can also provide ongoing resources for monitoring your credit score over time to help you meet your goals.

Don’t Miss: Does Acima Report To Credit

Factors That Dont Affect Your Credit Scores

There are some things that are not included in credit score calculations, and these mostly have to do with demographic characteristics.

For example, your race or ethnicity, sex, marital status or age arent part of the calculation. Neither is your employment history which can include things like your salary, title or employer nor where you live.

What Is A Good Credit Rating

All agencies set different scales, but the most popularly used scale is the one produced by S& P Global. This scale uses AAA ratings for corporations or governments that have the highest likelihood to meet their financial commitments. This is followed by AA, A, BBB, BB, B, CCC, CC, C and D. Pluses and minuses may be added to the rating to differentiate between ratings from AA to CCC.

A triple-A rating is considered the best. It shows that the borrower is extremely capable of meeting its financial commitments. Ratings of BB or lower are considered junk” ratings. Agencies with scores that fall between the two categories are average but may be under observation by the credit rating agencies. Ratings lower than BBB are considered non-investment grade,” while those between BBB and AAA are considered investment grade.”

A credit rating of D may be given when financial obligations aren’t met and payments aren’t made. This low rating is also used when filing for bankruptcy or if the company has defaulted on their debt. Maintaining a good credit rating can improve your likelihood of banks and lenders approving you for financing. A poor credit rating may show that you’re unable to repay debt and limit your financing options.

You May Like: How Long Does Mortgage Default Stay On Credit Report

What Is The Credit Score Range

Knowing your credit score is important, but it might not mean much if you don’t know the credit score range. Given how indispensable this measurement is for your financial health and creditworthiness, you should have some idea of what the credit score chart looks like and what the difference is between poor, good and great credit. Most credit scores range from about 300 to about 850, and the higher, the better.

The minute you apply for a credit card or submit your information to a mortgage lender or bank, you are agreeing to financial scrutiny in the form of both a credit report and a corresponding credit score. Depending on where you get ranked, you can either be treated to some of the most attractive rates on the market or denied a loan entirely. Scores matter.

While some individuals may feel uneasy at the prospect of fintech software dissecting and assessing their entire credit history, they should take comfort in the notion that this is all done to create a fair and transparent playing field for both the consumer and the lender. If youve made sure to pay bills on time and keep credit utilization under control, you may be in for a pleasant surprise when you check your . Conversely, if you have neglected payments and exceeded card limits, then your score will be lower. But with a clear, disciplined approach, you can take steps toward rehabilitating your credit over time.

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

Read Also: Is 655 A Good Credit Score

Understanding Corporate Credit Ratings

Standard & Poor’s , Moodys, and Fitch are the three main providers of corporate credit ratings. Each agency has its own rating system that does not necessarily correspond to the other agencies’ rating scale, but they are all similar. For example, Standard & Poors uses “AAA” for the highest credit quality with the lowest , “AA” for the next best, followed by “A,” then “BBB” for satisfactory credit.

These ratings are considered to be investment grade, which means that the security or corporation being rated carries a quality level that many institutions require. Everything below “BBB” is considered speculative or worse, down to a “D” rating, which indicates default or “.”

The following chart gives an overview of the different ratings that Moody’s and Standard & Poor’s issue:

| Bond Rating |

| In Default |

Corporate credit ratings are not a guarantee that a company will repay its obligations. However, the long-term track record of these ratings is reflective of the variations in creditworthiness among rated companies, especially when compared within the same industry. In 2020, the default rate for speculative-grade bonds was 5.5% and investment-grade default rates were at 0%.

Since the ratings are opinions, ratings of the same company can differ among rating agencies. Investment research firm Morningstar also provides corporate credit ratings that range from AAA for extremely low default risk to D for payment default.