Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

What Factors Affect Your Credit Score

The two main credit scoring models, FICO and VantageScore, consider much the same factors but weight them somewhat differently. For both scoring models, the two things that matter most are:

-

Paying bills on time. A misstep here can be costly, and a late payment that’s 30 days or more past the due date stays on your credit history for years.

-

How much you owe. Credit utilization, or how much of your credit limits you are using, is weighted almost as heavily as paying on time. It’s good to use less than 30% of your credit limits lower is better. You can take several steps to lower your credit utilization. Scores respond fairly quickly to this factor.

Much less weight goes to these factors, but they’re still worth watching:

-

The longer you’ve had credit, and the higher the average age of your accounts, the better for your score.

-

Credit mix: Scores reward having more than one type of credit a traditional loan and a , for example.

-

How recently you have applied for credit: When you apply for credit, a hard inquiry on your credit report may result in a temporary dip in your score.

Understanding Your Credit Profile

Determining your score is more complicated than just weighing the different aspects of your credit history. The credit scoring process involves comparing your information to other borrowers that are similar to you. This process takes a tremendous amount of information into consideration, and the result is your three-digit credit score number.

Remember, no one has just one credit score, because financial institutions use more than one scoring method. For some agencies, the amount owed may have a larger impact on your score than payment history.

You May Like: Cbcinnovis Hard Inquiry

Why Should I Get My Credit Report

An important reason to get your credit report is to find problems or mistakes and fix them:

- You might find somebodys information in your report by mistake.

- You might find information about you from a long time ago.

- You might find accounts that are not yours. That might mean someone stole your identity.

You want to know what is in your report. The information in your report will help decide whether you get a loan, a credit card, a job or insurance.

If the information is wrong, you can try to fix it. If the information is right but not so good you can try to improve your credit history.

What Doesn’t Impact Your Credit Score

There are many common misconceptions about what does affect your credit score. “Consumers sometimes focus on things that simply don’t matter to their scores. The most common is information about your wealth,” says Ulzheimer.

“Income, balances in retirement accounts, equity in your home, net worth … anything that defines how much money you have or how much you’re worth are not considered by your credit scores.”

Other factors that don’t affect your credit score include race, religion, nationality, gender, marital status, age, political affiliation, education, occupation, job title, employer, employment history, where you live or your total assets.

Learn more: Can employers see your credit score? How to prepare for what they actually see when they run a credit check

Also Check: Can You Remove Hard Inquiries Off Your Credit Report

Your Credit Card Provider

Many credit card providers also offer cardholders the ability to check their credit scores for free. Oftentimes, these tools include access to view your score history and see what led to recent changes. Some providers also let customers forecast how their scores would react to variables like on-time payments, credit limit increases and taking out a mortgage.

Keep in mind, however, that most providers require cardholders to opt in to this service, so make sure you sign up if you want to access your score.

Heres a look at popular credit card providers with credit score tools.

What Exactly Is A Credit Score

A credit score is a number used by lenders to determine whether you qualify for credit, such as a loan or credit card.

Your credit score is based on your credit report, which is a record of your credit history and how youâve managed your finances in the past. This allows lenders to assess your level of risk when you apply for credit.

You May Like: Carmax Minimum Credit Score

What Is A Credit Score Or Credit Rating

A , also known as a , is a number calculated by a credit bureau to represent how trustworthy your reputation is as a borrower. Your credit score will typically be on a scale of 0-1,200 or 0-1,000 depending on the bureau you use. The higher your credit score, the better your position currently is.

Your credit score is one of the factors lenders may use to decide whether or not you are eligible for a credit product, and when deciding what interest rate to charge you.

- How often can you check your credit score? As often as you like typically, but there may be a limit on the number of free checks you can do.

- How long does it take? The response is usually instant after you have provided some identification information.

- What does it cost? Usually you can do a credit score check for free, but there may be an upper limit on the number of free checks you can do.

Whats The Best Site To Get A Free Credit Report

The best site for free credit reports depends on what you need.

If you want to take a look at your credit reports from Equifax and TransUnion, you can do so on Credit Karma.

The Fair Credit Reporting Act entitles you to one free copy of your credit report from each of the three major consumer credit bureaus every 12 months. You can order them online at annualcreditreport.com.

Also Check: Does Paypal Bill Me Later Report To Credit Bureau

Its Simple Its Free It Wont Affect Your Credit File

Canstars Credit Score Information Hub is designed to help you understand your credit score and credit report. It covers topics including:

- What your credit score and credit report are

- Checking your credit report and credit score

- What a good credit score is

- What affects your credit score

- How to work on improving your credit score

- Applying for loans or credit cards with a poor credit history or no credit history

Other Products & Services:

Chase, JPMorgan, JPMorgan Chase, the JPMorgan Chase logo and the Octagon Symbol are trademarks of JPMorgan Chase Bank, N.A. JPMorgan Chase Bank, N.A. is a wholly-owned subsidiary of JPMorgan Chase & Co.

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC , a registered broker-dealer and investment advisor, member FINRA and SIPC. Annuities are made available through Chase Insurance Agency, Inc. , a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. . JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

“Chase Private Client” is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking account.

Bank deposit accounts, such as checking and savings, may be subject to approval. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Member FDIC.

Recommended Reading: Speedy Cash Card Balance

What Is A Fair Credit Score Range

Fair credit score = 620- 679: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

Million Canadians Trust Borrowell

Courtney M.

Love this! I was a little skeptical at first but it tells you who you still owe and how much. Currently using this to view my credit and pay off what I owe.

Andrea B.

I have been using Borrowell for over a year now and I am a happy customer. I get the real deal on my credit and good advice also!

Ashvin G.

Excellent service. Recommend to understand your finance and banking accounts, debt control, loan utilization to build a good credit score for lending purpose.

You May Like: How To Remove Repo Off Credit Report

Limits Your Requests For New Creditand The Hard Inquiries With Them

There are two types of inquiries into your credit history, often referred to as hard and soft inquiries. A typical soft inquiry might include you checking your own credit, giving a potential employer permission to check your credit, checks performed by financial institutions with which you already do business, and credit card companies that check your file to determine if they want to send you pre-approved credit offers. Soft inquiries will not affect your credit score.

Hard inquiries, however, can affect your credit scoreadverselyfor anywhere from a few months to two years. Hard inquiries can include applications for a new credit card, a mortgage, an auto loan, or some other form of new credit. The occasional hard inquiry is unlikely to have much of an effect. But many of them in a short period of time can damage your credit score. Banks could take it to mean that you need money because youre facing financial difficulties and are therefore a bigger risk. If you are trying to improve your credit score, avoid applying for new credit for a while.

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

Request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Read Also: Does Wells Fargo Business Credit Card Report To Bureaus

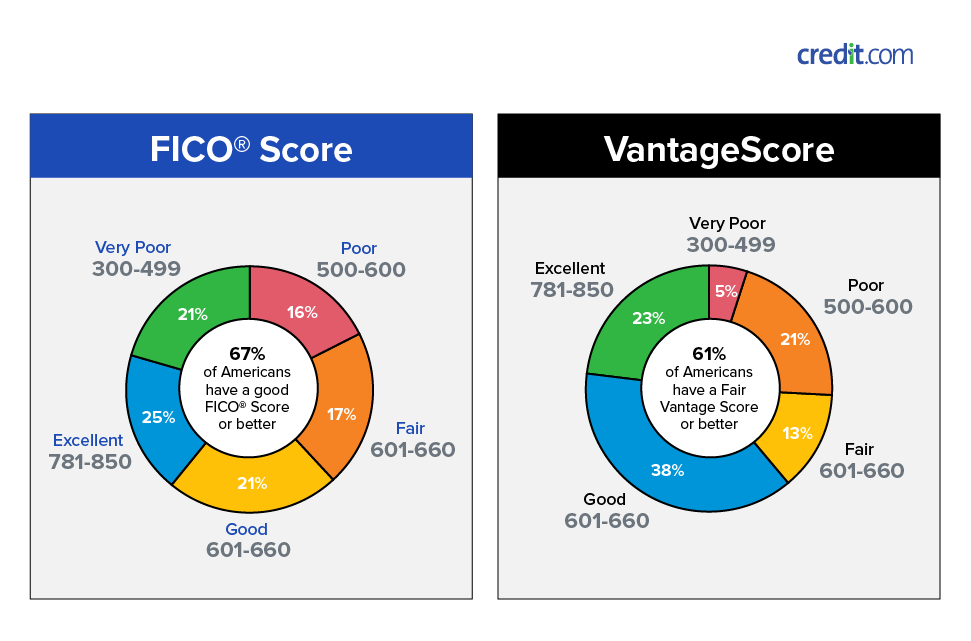

Vantagescore 30 Credit Score Ranges

vary by scoring model, and lenders can view ranges in different ways. VantageScore 3.0 credit scores range from 300 to 850. Think of them in terms of four basic categorizations: Excellent, Good, Fair and Poor. Heres how they break down.

Excellent :You may qualify for the best financial products available, and youll likely have several options when it comes to choosing repayment periods or other terms. But excellent credit scores arent the only factor in a lending decision a lender could still deny your application for another reason.

Good :Youre less likely to have an application denied based solely on your credit scores, compared to having scores in the fair or poor range, and youre more likely to be offered a low interest rate and favorable terms.

Fair :You may have several options when it comes to getting approved for a financial product, but you might not qualify for the best terms.

Poor :You may find it difficult to get approved for many loans or unsecured credit cards. And if youre approved, you might not qualify for the best terms or lowest interest rate.

What Is A Good Credit Score Range

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

Read Also: Navy Auto Loans

Where Do I Get My Free Credit Report

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone: 1-877-322-8228.

You get one free report from each credit reporting company every year. That means you get three reports each year.

The Importance Of Checking Your Credit Score

Regularly checking your credit score is important because it:

Helps you better understand your financial situation. Without knowing your credit score, its impossible to fully understand your financial circumstances. Having a comprehensive understanding of your score can help you decide whether its a good time to buy a home, apply for an auto loan or make other large purchases.

Makes it easier to improve your score and qualify for better rates. By understanding your score and how it was calculated, you can take strategic steps to improve your credit score over time, or build it for the first time. In fact, many scoring websites let users simulate changes to their score based on various factors like on-time payments, extra payments and new credit applications.

Lets you compare financial products based on eligibility requirements. Knowing your credit score can give you an idea of whether youre likely to qualifyand whether its worth applying. Whats more, lenders typically offer a personal loan prequalification process that lets prospective borrowers see what kind of interest rate they might qualify for based on income and creditworthiness.

May include red flags of fraud. Regularly checking your credit score makes it easier to spot out-of-the-ordinary activity that could indicate fraud. By recognizing a large and unexpected increase in your credit usage soon after it happens, you can file a dispute and get your credit back on track more quickly.

Don’t Miss: How To Clear A Repossession From Your Credit

Factors That Affect Your Credit Scores

The individual components vary based on the credit-scoring model used. But in general, your credit scores depend on these factors.

Most important: Payment historyFor both the FICO and VantageScore 3.0 scoring models, a history of on-time payments is the most influential factor in determining your credit scores. Your payment history helps a lender or creditor assess how likely you are to pay back a loan.

Very important: Credit usage or utilizationYour is calculated by dividing your total credit card balances by your total credit card limits. A higher credit utilization rate can signal to a lender that you have too much debt and may not be able to pay back your new loan or credit card balance.

The Consumer Financial Protection Bureau recommends keeping your credit utilization ratio below 30%. This may not always be possible based on your overall credit profile and your short-term goals, but its a good benchmark to keep in mind.

Somewhat important: Length of credit historyA longer credit history can help increase your credit scores by showing that you have more experience using credit. Your history includes the length of time your credit accounts have been open and when they were last used. If you can, avoid closing older accounts, which can shorten your credit history.

What Is A Good Score

Typically, the higher the score the better. Each lender decides which credit score range it considers a good or poor credit risk. The lender is your best source of information about how your credit score relates to their final credit decision. Your credit score is only one component of the information that lenders use to evaluate credit risks.

Also Check: 1?800?859?6412

What Is A Credit Report

A is a summary of how you pay your financial obligations. It contains information based on what you have done in the past. Lenders use it to verify information about you, see your borrowing activity and find out about your repayment history. Some of the information on your credit report is used to determine your credit score.

Top 5 Reasons Why Canadians Love Borrowell

As Canada’s leading credit education company we offer more than just free credit scores!

Free weekly credit score and report monitoring.

Bank level security with 256-bit encryption.

Personalized financial product recommendations.

Free credit improvement tips and education.

Checking your score with Borrowell won’t hurt it!

Don’t Miss: Old Credit Report

Why Are My Fico Score And Vantagescore Different

A score is a snapshot, and the number can vary each time you check it.

Your score can vary depending on which credit bureau supplied the credit report data used to generate it. Not every creditor sends account activity to all three bureaus, so your credit report from each one is unique.

Each company has several different versions of its scoring formula, too. The scoring models used most often are VantageScore 3.0 and FICO 8.

Also, FICO and VantageScore weight scoring factors slightly differently.