A Good Credit Score Means You’re Rich

False. Credit scores are just a measure of your risk . “A good credit score means you’re a good credit risk,” Ulzheimer says. “A low score means you’re a poor risk. That’s all they mean.”

Having a high salary doesn’t guarantee a higher line of credit, but if you update your income with a card issuer to a higher amount, you may see an increase in your credit limit, which could be positive for your credit utilization ratio . Also some cards, like the American Express® Gold Card, have no preset spending limit, which means there is no assigned credit limit.

Next Steps: What To Do If Theres An Inquiry Or Account You Dont Recognize On Your Credit Reports

If youre digging around trying to find out why a name like CREDCO is showing up on your credit reports, youre practicing good credit hygiene. Congrats! Identity theft and fraud are things to take seriously, and we commend you for doing the research to stay on top of your credit.

Then again, you shouldnt assume an inquiry or account is fraudulent just because you dont immediately recognize the name. In some cases, lenders may partner with third-party services and companies like CoreLogic Credco. So its worth doing a bit of extra research before you take steps to dispute it as a credit report error.

Heres an extra bit of good news: Credit Karma offers a number of free tools and services to help you protect your credit. These include

- Free credit-monitoring This service can alert you to important changes on your credit reports. Along with checking your credit scores regularly, this feature sends you an alert so you can check any suspicious activity and report any instances of identity theft.

- Free identity monitoring This service notifies you when Credit Karma learns theres been a data breach in which your information may have been compromised. Well also give you tips on how to lock your credit with the three major consumer credit bureaus.

Selecting ‘credit’ While Using My Debit Card For A Purchase Helps Raise My Credit Score

False. If you choose “credit” instead of “debit” next time you’re at the cash register, know that your credit score will not be affected in any way since your debit card activity does not get reported to the credit bureaus. Debit cards have no effect on your credit history nor credit score, so whether you use your debit card as debit or credit, the money is still withdrawn directly from your checking account.

Don’t miss:

Don’t Miss: Does Rent A Center Report To The Credit Bureau

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

Hard And Soft Credit Inquiries

It seems likely that, in most cases, CREDCO will appear on your credit reports because its associated with a credit inquiry . There are two types of credit inquiries, and the distinction between them is important.

A hard credit inquiry generally occurs when a financial institution checks your credit when making a lending decision. These commonly take place when you apply for a mortgage or loan, and you typically have to authorize them.

If you applied for a mortgage or other type of loan recently and had to provide authorization for a hard inquiry, you may have provided that authorization to CoreLogic Credco rather than the lender itself.

A soft credit inquiry typically occurs when a person or company checks your credit as part of a background check. In the case of CoreLogic Credco, each of the Instant Merge PreQual and Instant Merge Soft Touch credit reports involves a soft credit inquiry.

Unlike hard inquiries, soft inquiries wont affect your credit scores. And you may or may not see them in your credit reports, depending on the credit bureau. To learn more, check out our article on hard and soft credit inquiries and how they impact your credit.

Don’t Miss: How To Remove Debt From Credit Report

Why Its Important To Remove Inaccurate Hard Inquiries

If you spot a hard credit inquiry on your credit report and its legitimate , theres nothing you can do to remove it besides wait. It wont impact your score after 12 months and will fall off your credit report after two years.

However, if you spot a hard credit inquiry you dont recognize, its vital to remove it. There are a few reasons for this. First, it means that youre being unfairly penalized for that error, even if it only has a small impact. Second, it could be a sign of fraud, so its important to investigate it further and to get it removed.

Types Of Inquiries That Credit Plus Can Make On Your Credit Score

So any investigation by Credit Plus can affect your credit score? No, not just any investigation! There are different types of inquiries It is important to know them and be aware of when your score could drop. They are the following:

- First of all, there are the so-called soft inquiries. These occur when a creditor verifies your financial health without you having yet agreed to a loan or mortgage. That is, to know a little more about you, make a so-called soft consultation with Credit Plus and thus find out what your credit score is, should you, in the future, be interested in renting or buying, or requesting a loan.

- And secondly, there are the so-called hard or exhaustive inquiries, which are the ones that Credit Plus makes for creditors when you have already formally requested a loan. In this case, we can say that this company makes an official credit verification inquiry, which is reflected on your score.

If you have been a worried by these exhaustive consultations, lets put your mind at ease! Because in these cases, the drop in your credit score will be only a few points, and it will not be permanent. As soon as you are granted the loan and you start repaying it on time, your credit score will rise again and exceed what you originally had.

In what situations can Credit Plus make a hard inquiry? When you want to buy a house, a car, rent an apartment, and even if you request a specific job.

Read Also: Does Minimum Payment Affect Credit Score

Contact A Credit Repair Company

The credit repair industry is saturated with companies, and it can be overwhelming to know which one is the best for your needs. has a proven track record of success in helping consumers like you remove bad items from their credit reports. We start by reviewing your report, then we work diligently on removing any negative information so that lenders will approve loans at competitive rates. Call us now today for more details!

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Recommended Reading: How To Find Credit Rating Of A Company

What Is A Credit Report And What Does It Include

Reading time: 3 minutes

Highlights:

- A credit report is a summary of how you have handled your credit accounts

- It’s important to check your credit reports regularly to ensure the information is accurate and complete

A credit report is a summary of how you have handled credit accounts, including the types of accounts and your payment history, as well as certain other information thats reported to credit bureaus by your lenders and creditors.

Potential creditors and lenders use credit reports as part of their decision-making process to decide whether to extend you credit and at what terms. Others, such as potential employers or landlords, may also access your credit reports to help them decide whether to offer you a job or a lease. Your credit reports may also be reviewed for insurance purposes or if youre applying for services such as phone, utilities or a mobile phone contract.

For these reasons, it’s important to check your credit reports regularly to ensure the information in them is accurate and complete.

The three that provide credit reports nationwide are Equifax, Experian and TransUnion. Your credit reports from each may not be identical, as some lenders and creditors may not report to all three. Some may report to only two, one or none at all.

Your Equifax credit report contains the following types of information:

- Identifying information

- Inquiry information

There are two types of inquiries: soft and hard.

- Collections accounts

What To Do If You Have Bad Credit

No one wants to have bad credit. It can make it harder to get a loan, a credit card, or even a job. But if you have bad credit, there are things you can do to improve your credit score.

First, check your credit report to make sure there are no mistakes. If you find any, dispute them with the credit bureau. Second, start paying your bills on time. This includes not only your credit card bills but also things like your rent or mortgage, car payment, and utility bills. Third, keep your debt levels low. This means owing less money on your credit cards and loans.

Fourth, use a mix of different types of credit. This could include a mortgage, a car loan, and a few different types of credit cards. Fifth, dont apply for new credit cards or loans too often. Every time you do, it shows up on your credit report and can hurt your score.

Last, try to build up a savings account so you have money to pay your bills if you lose your job or have some other emergency. By following these steps, you can improve your credit score and get back on track financially.

Read Also: How To Get Collections Off My Credit Report

Checking My Credit Score Lowers My Credit Score

False. Though 93% of millennials are aware of their credit score, this is probably the most common myth. Monitoring your score helps you track progress when building credit, but it is important to check it the right way.

Checking your credit score is considered a “soft pull,” which doesn’t affect your credit score. Actions, such as applying for a credit card, which requires a “hard pull,” temporarily dings your credit score.

“If you’re checking it from a legit source, like the credit bureaus themselves, then it won’t hurt,” Ulzheimer tells Select. “If you have a buddy who works for a car dealership or a mortgage broker, and they pulled your credit as a favor, everyone is going to think you’re applying for credit and the inquiry could lead to a lower score.”

You can check your credit score for free with most card issuers, using apps such as Discover’s Credit Scorecard and Chase’s Credit Journey, which are available to everyone.

Read more:How to check your credit score for free and Here’s how often your credit score updates.

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Also Check: How Long Does Something Stay On Your Credit Report For

Get In Touch With Your Card Issuer

If you cant resolve the issue by checking your physical card or online account, youre going to unfortunately have to endure the dreaded hold-music by which we mean, contact your card issuer. Be sure to ask them for the specifics on exactly why your card was declined, and what you can do to get the issue resolved as fast as possible. Plug your card issuers customer service number into your smartphone now. This will make it easier to call ASAP if your card is declined.

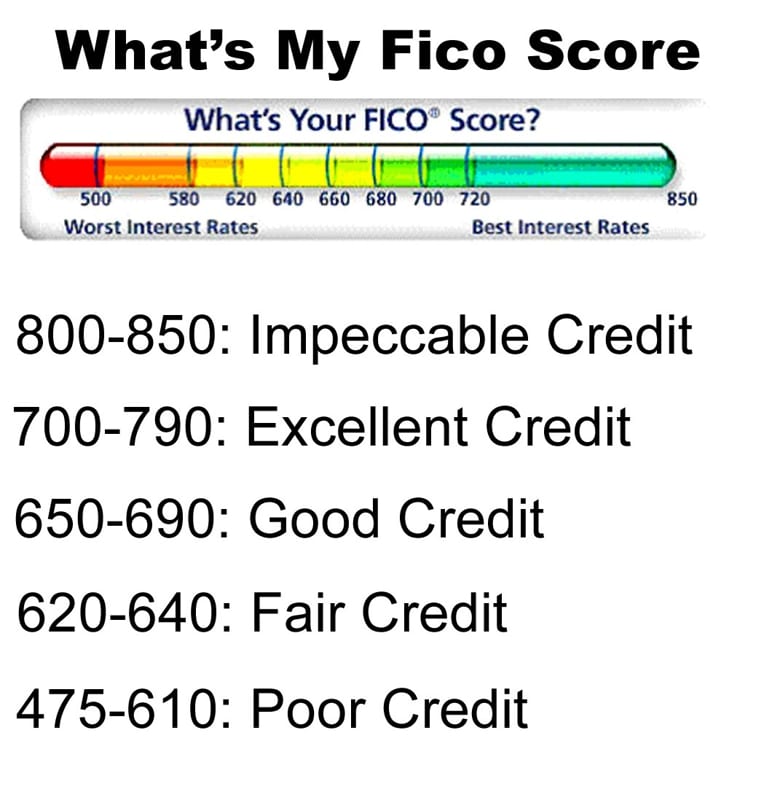

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Score plus tools, tips, and much more. Learn how to access your FICO Score.

You May Like: When Disputing Credit Report What Reason

Look For Any Inaccurate Hard Inquiries

Once youve received your credit report, there will be a section for Hard Inquiries. Youll want to scan over the entire report to make sure its accurate, but pay close attention to the inquiry section. If there are any hard inquiries listed here, make sure that you recognize them.

Its important to note that sometimes the company listed that made the inquiry doesnt match exactly with who you did business with. This often happens if a retailer partners with a bank to manage its credit card program.

For example, while you may have thought you were applying for a card with Victorias Secret or Sportsmans Warehouse, you may have a credit inquiry from Comenity Bank, which manages the credit cards for these two retailers. Thus, you may have to do a bit of Google sleuthing to make sure an inquiry is legitimate.

Dispute The Hard Inquiry With Credit Plus And The Bureaus

An inaccurate inquiry is likely the result of:

- A basic reporting error

Identity theft can wreak serious havoc on your credit, so its important to get to the bottom of questionable activity on your credit report. According to The Fair Credit Reporting Act, credit bureaus must investigate the situation if you dispute a hard inquiry on your report.

You should start by contacting a representative at Credit Plus. Explain the situation and get details on the mortgage application that set the inquiry in motion. After youve learned why the company opened the inquiry on your report, you can take your dispute to the credit bureaus.

You can file a claim one of three ways:

Phone: 800-258-3488 Email: support@creditplus.com

The bureaus have 30 days to investigate the inquiry. If the bureaus find that its an error, those companies delete the fraudulent entry from your report.

With certain credit monitoring companies, such as Credit Karma, youll also get a lot of resources for improving your score and receive information about new offers on credit cards and loans that allow customers to reach their financial goals.

Don’t Miss: Can You Remove Inquiries Off Credit Report

Combining Multiple Inquiries For Auto Mortgage And Student Loans

When you shop around for a mortgage, auto loan, or student loan, you may end up with multiple hard inquiries. However, youre not looking to take out 10 loans. Youre rate shopping for the best deal on one loan.

For this reason, credit scoring models are designed to include special rules for these certain types of loans in an effort to prevent your scores from being penalized for multiple inquiries for the same loan.

With FICO® scoring models, all auto, mortgage and student loan inquiries that are fewer than 30 days old are completely ignored. After 30 days, the model breaks those three types of inquiries into a 45-day de-dupe period. Multiple inquiries during a 45 day period are grouped together and counted as one inquiry. This process is called collapsing.

Getting Married Will Merge My Credit Score With My Spouse

False. When you get married, your credit report stays unique to you and only you. “Credit reports are always individual at the consumer level,” Ulzheimer says.

When it comes to applying for new credit with your partner, such as filling out a joint application for a mortgage, each partner’s credit score is taken into consideration by the lenders. Once a joint loan is opened, the positive and negative actions both you and your spouse take are reflected on both of your reports.

Also Check: What Credit Score Do You Need To Get A Mortgage

What Is Freedom Plus

FREEDOM PLUS is shorthand for Freedom Financial Asset Management, LLC., with the company name being Freedom Financial Asset Management, LLC. LLC

FREEDOM PLUS is a Creditor. They could be on your report for a number of reasons, for example:

-

You missed a repayment.

-

You opened an account with Freedom Financial Asset Management, LLC..

-

You opened a credit card / loan / mortgage with this company.

-

Someone fraudulently opened a credit line under your name.