What Determines The Credit Score

How the credit score itself is determined is one of the best-kept secrets of the modern age! I still don’t know how they have managed to keep the formula such a secret. We do know the different categories that contribute to the overall credit score:

Let’s take a closer look at these aspects and how they affect your credit score.

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

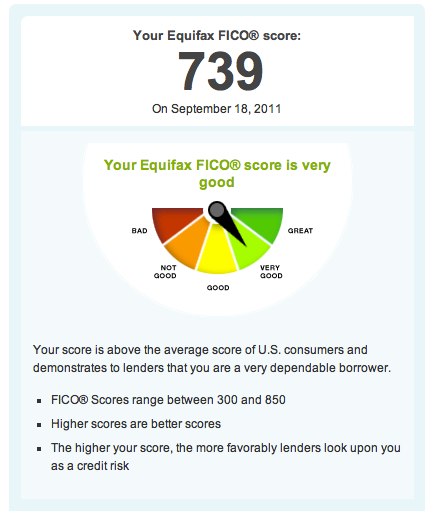

What Is The Average Credit Score

Data provided by Experian revealed that the average FICO credit score for Americans was 716 in 20212.

According to Experian, this average FICO score may be a result of credit scoring factors such as fewer late payments or delinquencies on credit cards, shrinking debt , and a decrease in credit utilization.

There are other credit scoring models such as VantageScore, but the majority of lending decisions are made using FICO scores, so this review is focused only on FICO scores.

Read Also: Is Credit Karma Score Accurate

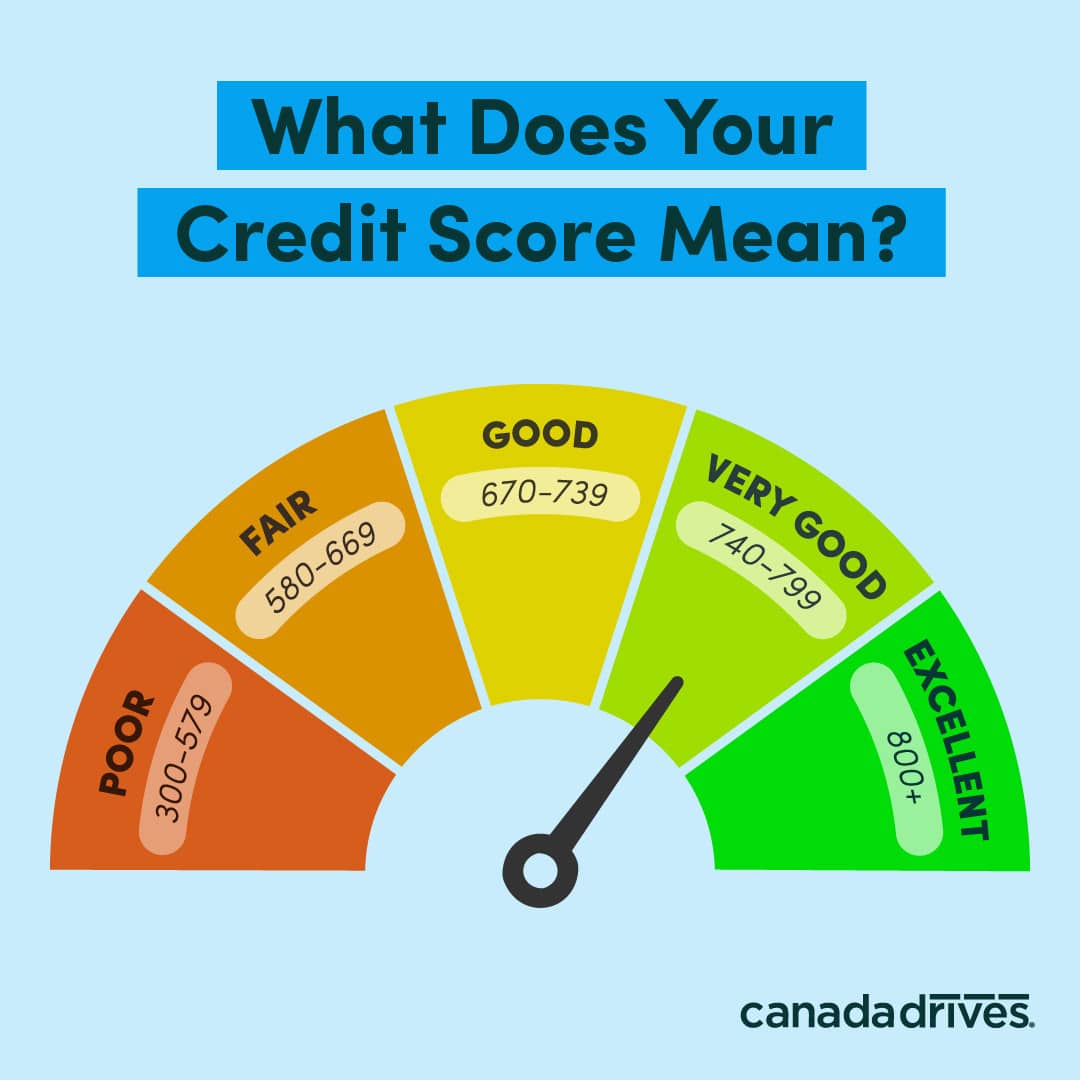

What Is A Good Credit Score In Canada

To have what is considered a good credit score in Canada, you want to aim for a credit score above 700. Even though good technically starts at 660, getting your credit score above 700 is going to open up many new options for you. People with a good credit score in Canada have access to far better interest rates across all credit products, plus a better chance of getting approval for the credit products you apply for.

How To Choose The Best Business Credit Card For Fair Credit

If you have fair credit and you want a credit card for your business, you probably will not have too many options. The Capital One® Spark® Classic for Business* is likely to be your best unsecured bet. You can also consider secured business cards, or you may be able to find a local or regional bank with additional options not available nationwide.

If you do have fair credit, you should work to improve your credit score so you can choose among a wider range of credit cards. Many great business credit cards exist and youll be more likely to find a great fit if your credit is good or better.

Also Check: How To Get A Mortgage With A Low Credit Score

How To Improve A Bad Credit Score

If you have bad credit, take some time to review your credit score and identify the cause. Perhaps you’ve missed payments or carried a balance past your bill’s due date. In order to achieve a fair, good or excellent credit score, follow the below.

- Make on-time payments. Payment history is the most important factor in your credit score, so it’s key to always pay on time. Consider setting up autopay to ensure on-time payments, or opt for reminders through your card issuer or mobile calendar.

- Pay in full. While you should always make at least your minimum payment, we recommend paying your bill in full every month to reduce your utilization rate, which is the percentage of your total credit limit you’re using. To calculate your utilization rate, divide your total credit card balance by your total credit limit.

- Don’t open too many accounts at once. Every time you submit an application for credit, whether it’s a credit card or loan, and regardless if you’re approved or denied, an inquiry appears on your credit report. Inquiries temporarily reduce your credit score by roughly five points, though they rebound within a few months. Try to limit applications as needed and shop around with prequalification tools that don’t hurt your credit score.

How Can I Increase My Credit Score

A good Credit Score is built over time. There are no quick and easy tricks to game the system, but with perseverance, you can build a great credit score. I always mention to people that you can go from literally 0 to a great credit score.

The way to do that is to pay very close attention to your credit and make sure you kill it on the 5 categories listed above. It will take several years, but with discipline and dedication, any credit score can be improved.

Like it? Pin it!

Also Check: When Does Green Dot Report To Credit Bureaus

How To Build Up Your Credit Score

Your FICO® Score is solid, and you have reasonably good odds of qualifying for a wide variety of loans. But if you can improve your credit score and eventually reach the Very Good or Exceptional credit-score ranges, you may become eligible for better interest rates that can save you thousands of dollars in interest over the life of your loans. Here are few steps you can take to begin boosting your credit scores.

Check your FICO Score® regularly. Tracking your FICO® Score can provide good feedback as you work to build up your score. Recognize that occasional dips in score are par for the course, and watch for steady upward progress as you maintain good credit habits. To automate the process, you may want to consider a credit-monitoring service. You also may want to look into an identity theft-protection service that can flag suspicious activity on your credit reports.

Avoid high credit utilization rates. High , or debt usage. Try to keep your utilization across all your accounts below about 30% to avoid lowering your score.

Consumers with good credit scores have an average of 4.9 credit card accounts.

Seek a solid credit mix. No one should take on debt they don’t need, but prudent borrowingin the form of revolving credit and installment loanscan promote good credit scores.

Opening New Bank Accounts

Banks may run a soft credit check when you apply for an account. Your credit score doesnt typically make a difference, but factors including payment history could.

More often, banks use a service called ChexSystems to check your bank account history. Thats mostly to make sure you dont have a habit of overdrawing accounts and walking away. Other marks on your credit report dont factor into that check.

Read Also: Procedural Request Letter To The Credit Bureaus

Read Also: How To Create A Credit Score

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

How To Boost Your Score If Its Lower Than Youd Like

If your credit score is lower than others in your age group, dont fret. Your credit score can vary from month to month. Plus, getting your score at or above that average mark can be relatively simple by following a few credit score tips.

Its not all about constantly increasing your score, either. You want to maintain a good credit score by avoiding mistakes that can lower your score.

Good credit builds a solid financial base, but its just one aspect of a healthy credit profile. Here are some ways to boost your credit score.

You May Like: What Credit Score Does Usaa Use For Credit Cards

You May Like: How To Get 800 Credit Score In 45 Days

What Factors Influence Your Credit Score

FICO Score

VantageScore

How Good Should My Credit Scores Be

To buy a house?A 2019 Credit Karma report found that the average VantageScore 3.0 credit score that first-time homebuyers needed to buy a house in the U.S. was 684 which is at the lower end of the good credit range. But credit requirements vary depending on your state .

To rent an apartment?Prospective landlords may run a credit check before you can sign a lease, but theres no single credit score benchmark you need to hit to be able to rent an apartment. It can depend on the factors the landlord is looking for in a tenant, as well as where youre looking to rent.

To get approved for a credit card?Its possible to get approved for a credit card with poor credit or even no credit at all. Once you know what range your credit scores fall into, you can research cards that suit you and your goals.

If you have no credit, look for secured cards or cards for beginners . If you have limited or poor credit, secured cards or cards advertised for building or rebuilding credit could be a helpful leg up. Once youve improved your credit, you may be able to qualify for more-enticing offers, such as rewards cards or balance transfer cards.

Good credit scores can mean better terms, but its still worth comparison shopping.

Read Also: Is 668 A Good Credit Score

Why Is A Good Credit Score Valuable

Now you know a little more about where scores come from. But that doesnât explain why good credit scores are so valuable. Credit scores are often associated with credit risk, credit cards, loan applications and other lending decisions. And having a good score could help you qualify for more financial products with better rates, terms and credit limits.

But the influence of credit scores goes beyond that. And even when youâre not borrowing money, good credit could help you. Good scores could lead to lower insurance rates and fewer and lower security deposits on things like telecom and utility accounts. And good scores may make it easier to rent a home, too. Your credit reportsâbut not your scoresâcould even impact some job prospects.

Pre-Approval, Pre-Qualification and Comparing Offers

For starters, you may be pre-approved or pre-qualified for more credit offers if you have good credit scores. That may allow you to compare offers and find the best fit for your situationâwhether youâre looking at mortgages, credit cards or auto loans. But if youâre shopping around, be sure to understand how can affect your credit scores.

Interest Rates and Credit Limits

Beyond Credit Cards and Loans

Good credit could affect other parts of your life, too:

What Is Your Credit Score Why Is It Important

Your credit score may be defined as a rating that reflects your creditworthiness. Think of your as a batting average. If your batting average is above 50, then it means that you have a consistent scoring record of 50, and you are a good player. Similarly, when your credit score is high, it shows that you have borrowed and repaid credit responsibly in the past.

Your credit score is important because it showcases how dependable or risky you are as a borrower. Thus, it directly impacts how eligible you are for a loan, what the lender will offer you as a loan amount, and the rate of interest you will be charged. Your credit score allows lenders to judge the potential risk in lending you money. Your credit score is critical when it comes to unsecured or collateral-free loans and can affect your eligibility for personal loans to a great extent.

While you as an individual have a score, even businesses are given credit scores. For a business, the CIBIL score impacts how creditworthy a lender will find the company. A business credit score could also impact its ability to attract investment.

Additional Read: Save 45% on personal loan EMI

Don’t Miss: What Stays On Your Credit Report For 10 Years

What Is A Good Credit Score To Buy A House

The credit score needed for buying a house depends on what type of loan youre applying for. There are general guidelines though for each loan type. A conventional loan will need a score of 620 or higher, FHA loans will need a minimum score of 580, VA loans have no set industry standard but Rocket Mortgage® requires a credit score of at least 580 and most lenders require a minimum score of 640 for USDA loans.

Challenge Mistakes On Your Credit Report

There may come a time where you discover an error on your credit report. Unfortunately, reporting mistakes can take a good credit score and put it into a lower range. In fact, significant enough mistakes could cause a bad credit score. This makes it essential to check your report for errors a couple of times a year.

So if youre wondering if your credit score can be wrong, the answer is yes if the credit bureaus have faulty information.

There is also the possibility that something fraudulent could take place on your account. If you find any errors or fraud, you need to file a dispute with the credit agencies right away. Getting credit report problems corrected will help ensure you maintain a good credit score.

If you wonder why credit scores go down, it is because you dont follow the practices mentioned here for getting the best results.

Read Also: Does Affirm Report To Credit Bureau

Recommended Reading: Where To Get My Credit Report

You Dont Need A Credit Score Of 850 To Have An Excellent Credit Score

Experts agree that a credit score above 760 is considered an excellent credit score.

In fact, if you already have a score of 770 and are looking for a way to get your score to 800, you are wasting your time.

You are better off making sure you are contributing to your jobs 401k plan or learning how to invest your money.

Having a bullet proof budget wouldnt hurt either.

Heck, almost anything would be a better use of your time than trying to get your score up to 850.

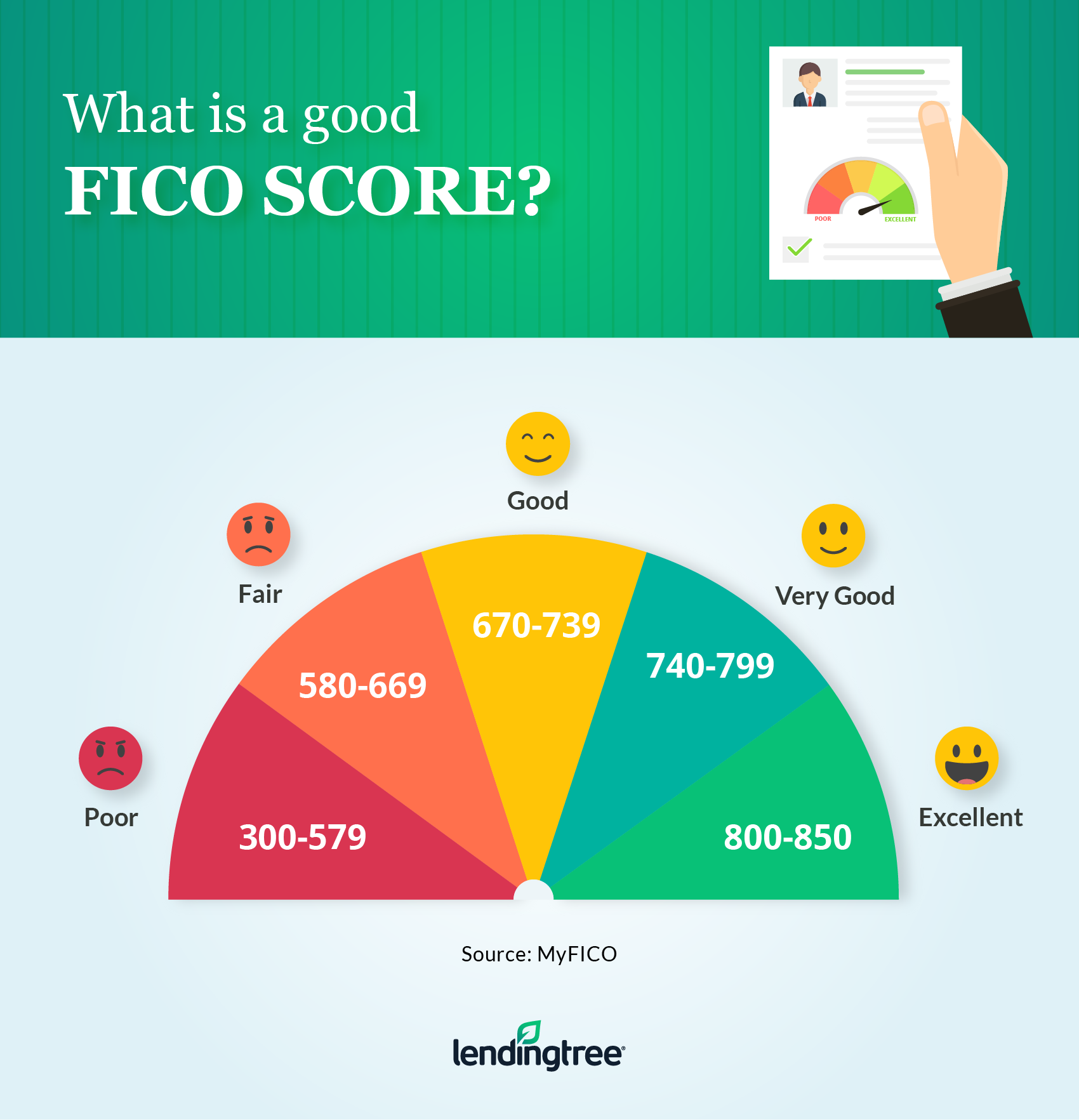

What Is A Bad Credit Score

A bad credit score would be any score in the poor to very poor range. FICO defines credit scores as very poor if they are between 300 and 579. VantageScore defines very poor scores as those that range from 300 to 549 and poor scores as those ranging from 550 to 649.

So, many people wonder if a credit score of 580 is considered good. According to these models, the answer is no a 580 score is not good. It is considered fair by the FICO model , but poor by the VantageScore model. However, you can still get approved for a mortgage with as low as 3.5% down with this score.

While these scoring models can give you a benchmark of what a good credit score is, it can be relative depending on what you are trying to do. For example, you may want to ask, What is considered a good credit score when buying a house or applying for an auto loan?

There are programs in place, such as those for first-time home buyers, that can make it possible to get what you want even without a good score.

Also Check: What Credit Report Does Synchrony Bank Use

Average Credit Score By Income

According to American Express, the average credit score by income are as follows4:

- $30,000 or less per year: 590

- $30,001 to $49,999: 643

- $50,000 to $74,999: 737

The correlation between lower average credit scores and lower-income may be associated with factors like higher-income individuals being able to pay back credit card debts more easily as well as being able to maintain a lower credit utilization ratio.

Those with higher income may also have higher credit limits in comparison to those with lower income.

That being said, income is not the most accurate measurement of scores. Income is only one factor that plays a role in your score. You can still have a low income and have good credit. If you fall into a lower income bracket, dont worry. Your income doesnt determine your score.

Healthy Mix Of Credit Account Types

Having a mix of different types of credit boosts your credit score because it demonstrates your ability to manage different types of debt.

Specifically, a good credit score reflects a mix of these two types of credit accounts:

- Installment loans: This is a type of debt that you repay in installments, usually over a fixed repayment period. Installment loans can be secured loans or unsecured loans. The most common types of installment loans are auto loans, personal loans, mortgages, and student loans.

- Revolving credit accounts: This is a type of credit that you can repeatedly withdraw from up to a certain limit. Credit cards are the most common type of revolving account, although store credit and home equity lines of credit also fall into this category.

Open accounts are another type of credit, but they dont contribute to your . Although credit mix is one of the least influential categories that contributes to your credit score, having at least one revolving and installment account will still give your score a boost.

In general, how many credit cards and loans you should have depends on your financial situation. Its best to only open accounts that you actually need to keep your finances simple and avoid missing payments.

Recommended Reading: Which Credit Score Matters More Transunion Or Equifax