What’s The Highest Credit Score You Can Have

If your goal is to obtain the highest credit score possible, you’ll have to aim for a score of 850. For most credit-scoring models, including VantageScore and FICO®, this is the highest score you can achieve. While achieving a perfect credit score may seem like a challenge, it’s not impossible.

Making your way to an 850 credit score is rewarding, but isn’t necessary. Having a credit score that’s in the upper 700s or low 800s shows lenders and other financial institutions that you’re a responsible borrower and may help you qualify for the same terms that you would’ve with an 850.

As long as your credit score is considered good or very good by the three credit bureaus, then you may be eligible for loans you apply for.

Why Is A Good Credit Score Valuable

Now you know a little more about where scores come from. But that doesnât explain why good credit scores are so valuable. Credit scores are often associated with credit risk, credit cards, loan applications and other lending decisions. And having a good score could help you qualify for more financial products with better rates, terms and credit limits.

But the influence of credit scores goes beyond that. And even when youâre not borrowing money, good credit could help you. Good scores could lead to lower insurance rates and fewer and lower security deposits on things like telecom and utility accounts. And good scores may make it easier to rent a home, too. Your credit reportsâbut not your scoresâcould even impact some job prospects.

Pre-Approval, Pre-Qualification and Comparing Offers

For starters, you may be pre-approved or pre-qualified for more credit offers if you have good credit scores. That may allow you to compare offers and find the best fit for your situationâwhether youâre looking at mortgages, credit cards or auto loans. But if youâre shopping around, be sure to understand how can affect your credit scores.

Interest Rates and Credit Limits

Beyond Credit Cards and Loans

Good credit could affect other parts of your life, too:

What Is A Bad Credit Score Exactly

A bad credit score is a general term for a credit score that is below average. There are actually several levels of credit scores that you should be aware of. A truly bad credit score is one that falls between the 300 to 629 range.

300 is the lowest credit score you can possibly have. This score is actually so bad that it is very difficult to get stuck with this score. You would have to miss every single payment, use far too much of your credit, and have far too much debt to ever get your credit score anywhere near this number.

Many people with bad credit scores have their scores in the 500s or low 600s. Whatever the case, having your score in this range is not a good thing. The finance industry will not want to have anything to do with you if you have this kind of credit score.

This is because having such a bad credit score shows that you are not responsible when it comes to paying off your debts. Besides your debts, other things may cause your credit score to drop so low such as filing for bankruptcy. Whatever the case, youll never be able to get approved for loans, credit cards, or anything else if your credit score is so low.

Also Check: What Is The Highest Equifax Credit Score

Over 1000 Five Star Reviews

I was very pleased that they were able to fund me money when I really needed it for the holidays. They made it easy and quick for me to do.

Jackie

The staff at Wise Loan is awesome! Olga is very professional with a very strong work ethic and is always willing to go the extra mile.Martha V

Its quick. Theres no hidden fees. No penalty for paying it off early. Its easy to apply for online and get funding in no time!Jaymi M

Jaymi M

Benefits Of Having A Good Credit Score

Good credit is crucial when applying for loans, lines of credit and credit cards. Approval is much easier when you have good credit, and you’re more likely to qualify for a low-interest rate.

Here’s how much a good credit score can help you. Let’s say you want to take out a $200,000 mortgage, and you have a credit score between 620 and 639. You may qualify for a 6.788% interest rate on a 30-year mortgage. If you had a credit score between 680 and 699, however, you would qualify for a 5.598% interest rate and end up saving $55,565 in total interest.

Having good credit can also make it easier to set up utilities for a house or apartment. If you don’t have good credit, you may have to provide a refundable deposit. Car insurance companies will also run a credit check, and those with good credit may pay lower premiums than those with poor credit.

Recommended Reading: How To Report Rent Payments To Credit Bureau For Free

Do I Have A Good Credit Score

There are a few ways to see if you have good credit. The best way is to check your latest credit score, which you can easily do for free on WalletHub. WalletHub offers free credit scores that are updated on a daily basis, and signing up takes just a couple of minutes. In addition to telling you which credit rating describes your score, well grade each component of your credit score to pinpoint areas that need improvement and illustrate how to get results.

Alternatively, you can get a rough sense of how good your credit is by seeing which of the qualifications in the table above best describes you. You can also get a free estimate from our anonymous Credit Check tool.

Finally, you can always consider the statistics. Roughly 14% of Americans with credit scores have good credit, according to WalletHub data, and that figure swells to 43% if you include the excellent crowd. So if you think your credit score is above average, you may just have good or excellent credit.

Look Better To Potential Employers

Some companies may look at your credit reports during a background check when you apply for a job. Your credit scores are calculated based on the information in your credit report. It’s possible to get a job with less-than-perfect credit, but some employers may view it as a potential red flag if they see things like late payments or bankruptcies. Checking your credit reports before looking for a job may also help you find any inaccurate information.

Don’t Miss: How To Print Credit Report From Credit Karma

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

What Are The Factors That Affect Your Cibil Score

Given the significance of your CIBIL score, it is important to ensure that its always towards the higher side. To do this, it is vital to be aware of the factors that affect your credit score and control them accordingly. Here are the factors that affect your CIBIL score:

- Any defaults, delays, or lapses in previous credit repayment

- Rejections for loans that you have applied for

You May Like: How Long Do Hard Inquiries Stay On Credit Report

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

What Is Considered As A Poor Credit Score

According to Capital One, a FICO score that falls below 580 is considered to be a poor credit score. Lower credit scores can make it difficult to get approved for credit cards or loans as approximately 61 percent of those with low credit scores fall behind on their loans11.

Come up with a credit card debt or loan repayment plan to reduce debt and credit utilization, look for accounts that build credit, and find other ways like Experian Boost to improve your score if you have negative items contributing to your bad credit.

Experian also offers free credit score checks to help you stay on top of your score and payment history. Your credit card balance doesnt have to stop you from moving forward financially.

You May Like: What Is Your Credit Score When You Turn 18

How Do I Get The Highest Credit Score

While it is theoretically possible to achieve a perfect 850 score, statistically it probably wont happen. In fact, about 1% of all consumers will ever see an 850, and if they do, they probably wont see it for long, as FICO scores are constantly recalculated by the credit bureaus.

And its not like you can know with absolute certainty what is affecting your credit score. FICO says 35% of your score derives from your payment history and 30% from the amount you owe . Length of credit history counts for 15%, and a mix of accounts and new credit inquiries are factored in at 10% each. Of course, in actually calculating the score, each of these categories is broken down even further, and FICO doesnt disclose how that works.

The credit bureaus that create credit scores may also change how they make their calculationssometimes for your benefit. Changes were made in 2014 and 2017, for example, to reduce the weight of medical bills, tax liens, and civil judgments. However, changes made in January 2020 for FICO 10 involving trending data, credit card debt, personal loans, and delinquencies may make getting a higher score more difficult.

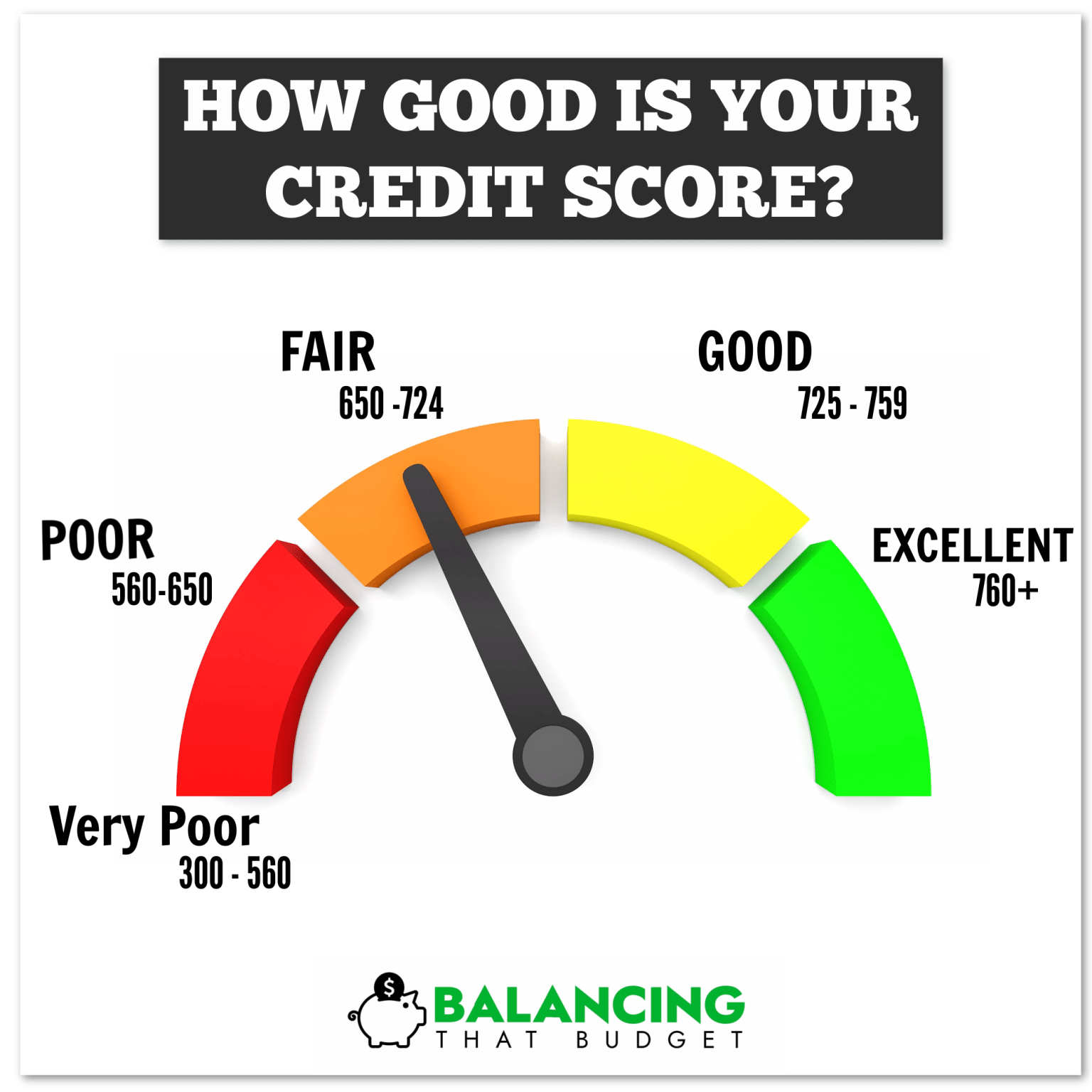

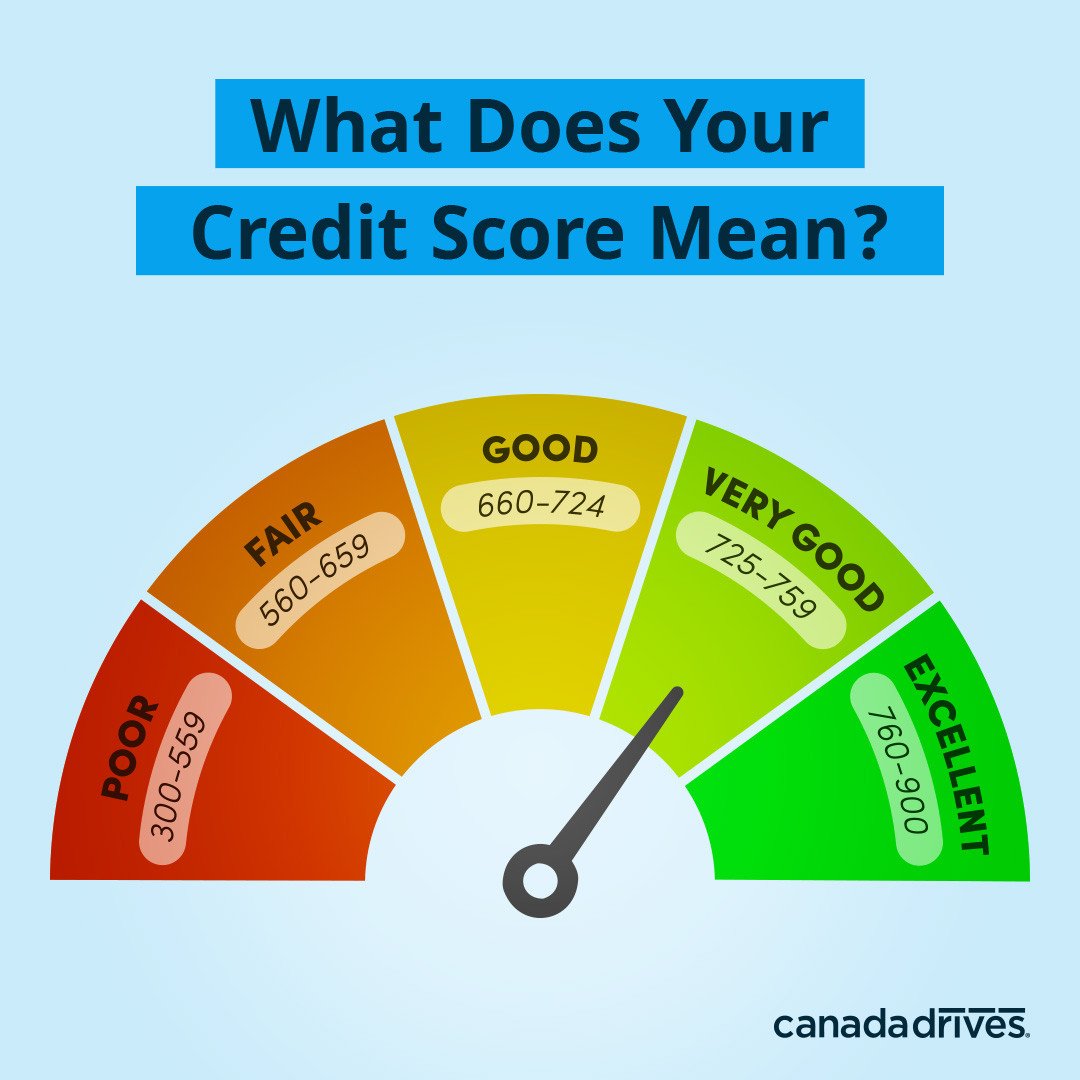

Learn About Credit Score Ranges From Fico And Vantagescore And How They Classify Excellent Good Or Poor Credit Scores

7 Min Read | January 31, 2020 in

Figuring out what a credit score of 640 means isnt really as tough as cracking the Da Vinci Code. But by the time youve considered the various credit score scales , it can certainly feel that way.

Fortunately, you dont need to be the hero of the Da Vinci Code to make sense of your . Thats because the different scales are more similar than different, and the scales are divided into credit score ranges whose names are simple and easy to remember .

Although cracking the credit code wont help you save the world, knowing the credit score range where your score lands can help you understand how lenders may view you in terms of credit risk. That could help you plan various aspects of your life, including the likely success of credit card, loan and rental applications, and whether you can expect to be offered favorable interest rates. And if you dont like the implications of your credit score range, you can take actions that could change it.

The two most commonly used credit scoring models, FICO and VantageScore, both rank credit scores on a scale from 300 to 850 and divide the scale into five credit score ranges. The ranges differ somewhat between the two models, and also have different names. If youve heard of higher scores, its either based on old information or industry-specific scoring models.

You May Like: Does A Closed Account Affect Credit

Also Check: When Does Credit Karma Update Score

A Good Credit Score Range

A good credit score is between 670 to 739.

Scores can fall into the categories of poor, fair, good and excellent. The difference between each credit score tier can result in what sort of credit card or loan is available to you, as well as the terms and rates of whichever product you apply for.

Why does your credit score matter?

Credit scores are important because a higher score generally indicates that you can wisely manage your finances. For instance, if your FICO Score is between 670 and 739, a lender will see you as less likely to become delinquent on your payments. Their research has confirmed that within this group, only 8% of consumers will become delinquent in the future.

Being categorized as someone with good credit makes you less of a credit risk, meaning youre more likely to get approved for a loan or credit and pay less because of a better interest rate.

Tips For Getting A Good Credit Score

The fundamentals of credit building are the same no matter your starting point. But if youre beginning with bad credit, your first order of business should be to stop the bleeding. If youre delinquent on an account, for example, making the payments necessary to become current will prevent further credit score damage.

Finally, there are more tips and tricks of the trade to discover once youve nailed down the basics. You can learn more about those strategies in our .

You May Like: Is 715 A Good Credit Score

Vantagescore Credit Score Ranges

Launched in 2003, VantageScore is a joint venture between the three major credit reporting agenciesEquifax, TransUnion and Experian. Although FICO Scores are the most popular choice among lenders, VantageScore credit scores deserve your attention too.

VantageScores use a 300 to 850 credit score range. Just like FICO Scores, the higher your credit score on the VantageScore scale, the lower the risk you represent to lenders.

Why Are Credit Scores Important

A credit score helps lenders anticipate how likely you are to repay the loan on time. It is an important decision-making tool for lenders. They are also known as risk scores since they help lenders assess the risk that you might not be able to pay the debt as agreed.

It is important to have good credit as it will decide whether you will qualify for a loan and if you do, it will decide the interest rate you qualify for. This means you can save thousands of dollars with a good credit score.

Your credit score is a lot like a report card which you might review time and again. Credit scores are not stored as part of the credit history. Instead, your score is generated every time a lender asks for it, as per the credit scoring model of their choice.

Did you know: It is possible to have unauthorized inquiries on your credit report. Learn how to write a credit inquiry removal letter to get such adverse items removed.

Whenever you set financial goals like buying a new car, the credit will be a part of the financing and your score will help the lender decide whether you qualify for the loan or not.

A credit score is not the only thing that the lender will look at when deciding if they should extend credit or not. The credit report also has other details they take into consideration like the total amount of debt you have, the length of your credit accounts, and the types of credit in the report.

Don’t Miss: How Do You Get A Perfect Credit Score

Have More Housing Options

Many landlords check your credit history when you apply to rent an apartment or house as part of the screening process. A lower score could negatively impact your chances of getting approved. A good score may save you the time and hassle of finding a landlord that will look past the damaged credit. Good credit can also help you get a mortgage on a house.

What Affects A Credit Score

While every credit scoring model is different, there are a number of common factors that affect your score. These factors include:

- Payment history

- Balances on your active credit

- Available credit

- Number of accounts

Each factor has its own value in a credit score. If you want to keep your number at the higher end of the credit score scale, its important to stay on top of paying your bills, using your approved credit, and limiting inquiries.

However, if you are in the market to purchase a house or loan, there is an annual 45-day grace period in which all credit inquiries are considered one cumulative inquiry. In other words, if you go to two or three lenders within a 45-day period to get find the best rate and terms available for a loan, this only counts as one inquiry. This means that they are not all counted against you and will not affect your credit score.

Also Check: How To Correct Credit Report