Check For Mistakes On Your Credit Report

Additionally, he said make sure there are no errors on your credit report.

To check for mistakes and get a sense of what lenders would see if they pull your credit report, you can get a free copy from each of the three big credit reporting firms. Those reports are available for free on a weekly basis through the end of next year.

You Have A Lot Of Credit Scores And They May Not Match Each Other

Its important to understand that every consumer has many credit scores. So bad is really a relative term depending on how the score is calculated and the type of financing that youre applying for.

For example, the credit score that your credit card issuer provides with your credit card statement may be slightly different from the score you receive from a credit-monitoring tool like Credit Karma.

So why arent all your credit scores identical? Here are three common variables that can affect the credit scores you see.

Increase Your Available Credit

Once you get a better handle on things and have started improving your score, increasing your available credit can help raise it a little faster. You can do this by either paying down balances or making a credit limit increase request. This effort helps increase your credit score because you will decrease your credit utilization, which is a huge factor in determining your score. Remember, its best to have a higher and apply for mortgages.

And guess what: Most credit card companies allow you to request as many increases as you like without it causing a hard pull on your credit.

Also Check: What Is A Credit Freeze On My Credit Report

How Is Your Credit Score Determined

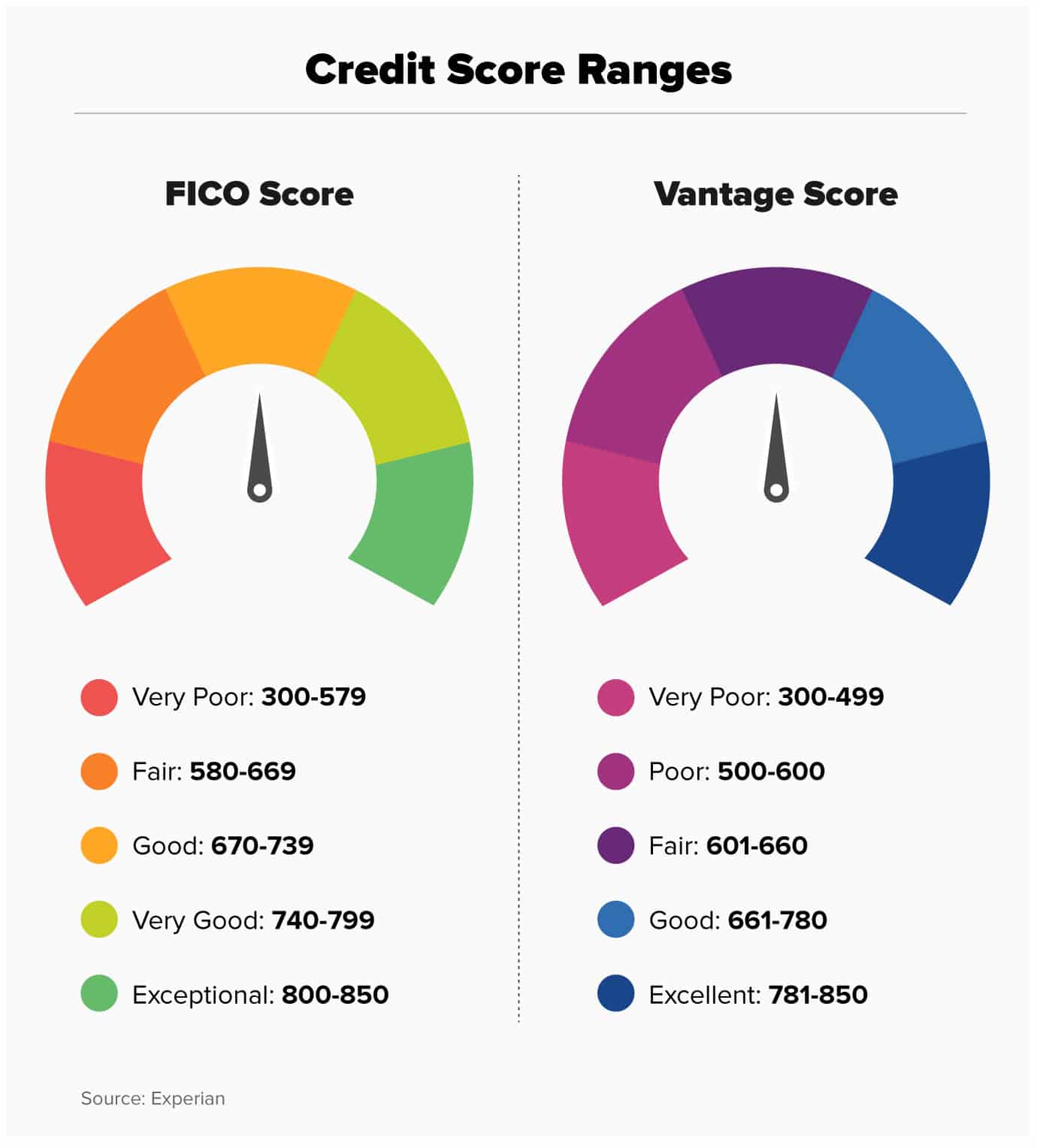

Two common credit scoring systems determine your credit score by using a collection of data gathered by credit collection agencies. You may have heard the term FICO and VantageScore tossed around when speaking about credit reports. Though the two scores are similar, they are compiled by different agencies and feature a slightly contrasting scoring method. Both scoring systems range from 300850, with 850 being the highest credit score possible. FICO scores are gathered by the Fair Isaac Corporation using information from the three most common credit data collection agencies Experian, Equifax, and Transunion. VantageScores utilize internal financial data gathered by these collection agencies themselves. You can access your VantageScore through services provided by Turbo and Mint.

A bad score is never determined by the credit reporting agencies themselves. These agencies simply gather information from financial institutes that lend you money. Their systems collect important data from your credit card companies, banks, and public records to build a report readable by you and your potential lenders. The lenders themselves make the call on what is considered a good or bad credit score depending on your inquiry. The data is used to determine how likely and how quickly youll be able to pay back the requested loan.

How Do I Find My Credit Score

Youre entitled to one free credit report per bureau every 12 months, but in order to get your credit score youll most likely have to pay a fee. Certain banks offer free credit scores with memberships. You can purchase your score directly from FICO, or find a credit report monitoring service you like and purchase a subscription to get your credit score included for free.

It is important to monitor your credit report and immediately dispute any fraudulent or incorrect information. The Federal Trade Commission lays out that process here.

If you have a checkered credit history, fixing a bad credit score is possible, but it is a lengthy process. FICO provides a list of tips for repairing a credit score. The most important word for those working to improve their scores is patience.

You May Like: Is 815 A Good Credit Score

Lending Products And Industries

As if things werent complicated enough, there are special scores for different types of lenders, too. For example, in addition to its most widely used FICO Score 8, FICO has the following industry-specific scores:

- FICO Auto Score: Used in the auto industry

- FICO Bankcard Score: Used in the credit card industry

- FICO Score 2, 4 and 5: Used in the mortgage industry

For its base scores, FICO uses a range of 300 to 850. But it uses a range of 250 to 900 for its industry-specific scores.

While there are various ways to see your base FICO Score for free, youll need to pay a subscription fee to access your industry-specific FICO Scores.

Definition And Examples Of Bad Credit

Having bad credit means that negative factors appear in your credit history, indicating that you’re a risky borrower. Several factors can contribute to bad credit, including previous delinquencies, high debt balances, and recent bankruptcies.

Bad credit is usually indicated by a low credit score, the numerical summary of the information in your credit report. FICO scores are one of the most widely used credit scores. They range from 300 to 850, with higher scores being more desirable.

The FICO credit score range is broken up into five ratings:

- Exceptional: 800 and above

- Poor: Below 580

Read Also: What Is Considered A Good Credit Rating

How Can You Improve Your Credit Score

Here is how you can improve your credit score:

- Check the report for errors: Check your credit report for errors. Verify if any account has been incorrectly updated or if the information is not accurate. Dispute those errors with the credit bureau or your creditor reporting the information.

- Build a credit file: When you open new accounts, your score report will be reported to credit bureaus. Many major lenders and card issuers report them. This is the first step to building your credit file. Bureaus recommended having an active credit account. These will be helpful in building a credit score.

- Dont miss out on payments: The most crucial factor in determining your credit score is your payment history. Having a long history of making payments on time can help your credit score. For this, you will need to make sure dont miss out on any payments. Your score will hurt when there are 30 days late payments.

- Only apply if you need credit: An inquiry is pulled on your report after you use a new line of credit. This kind of inquiry lowers your score temporarily. Also, it is not a great idea to apply for credit just to see if you get approved or because you received a pre-qualified offer.

What Affects A Credit Score

While every credit scoring model is different, there are a number of common factors that affect your score. These factors include:

- Payment history

- Balances on your active credit

- Available credit

- Number of accounts

Each factor has its own value in a credit score. If you want to keep your number at the higher end of the credit score scale, its important to stay on top of paying your bills, using your approved credit, and limiting inquiries.

However, if you are in the market to purchase a house or loan, there is an annual 45-day grace period in which all credit inquiries are considered one cumulative inquiry. In other words, if you go to two or three lenders within a 45-day period to get find the best rate and terms available for a loan, this only counts as one inquiry. This means that they are not all counted against you and will not affect your credit score.

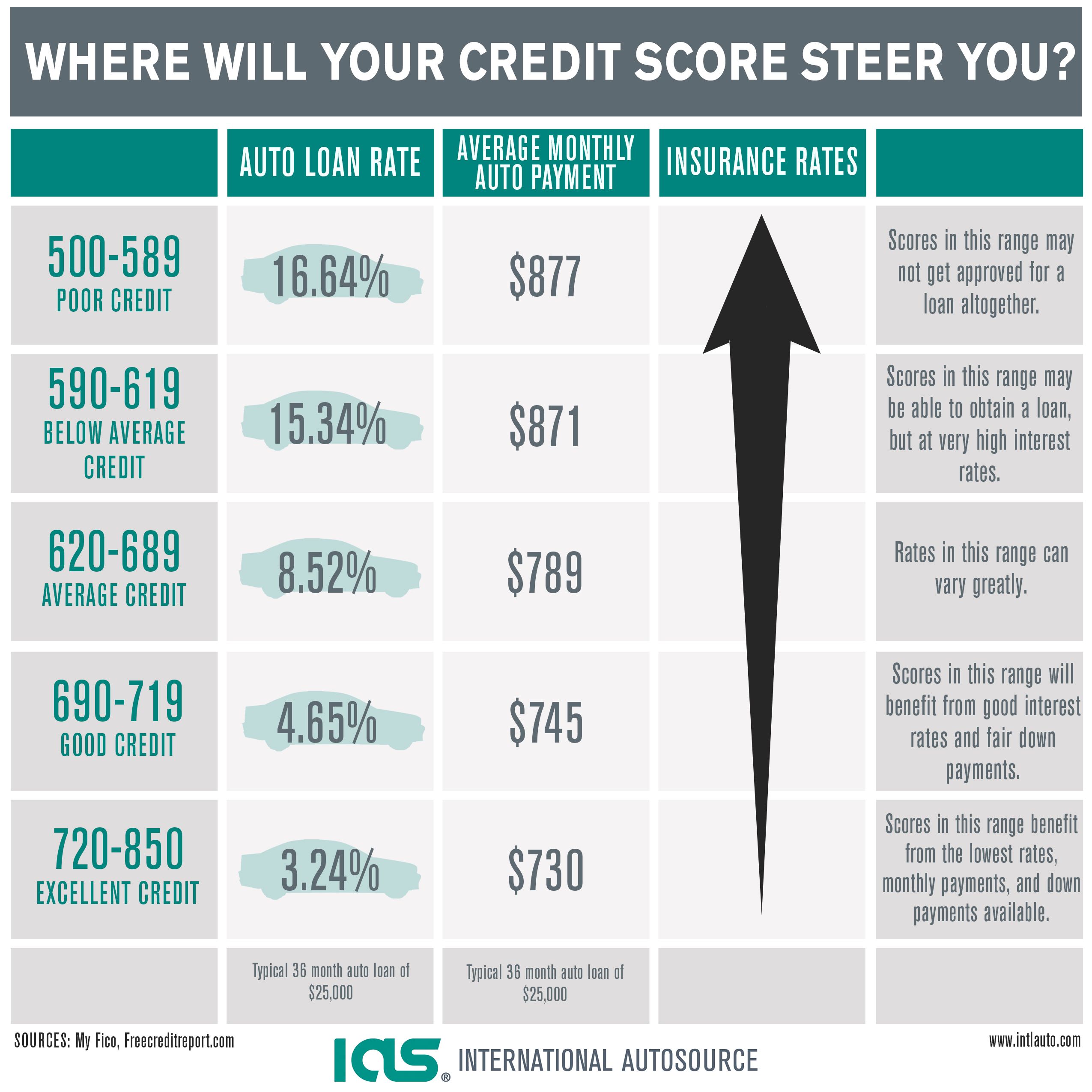

Recommended Reading: What Should My Credit Score Be To Buy A Car

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Await The Lenders Decision

No one likes to wait, but you should receive an initial decision within three days. Remember, according to the equal housing lender rules, the lender cannot discriminate against you based on your personal characteristics.

If the lender provides conditional credit approval, it will send you the terms and conditions and arrange for the homes appraisal.

Read Also: Is 642 A Good Credit Score

Whats Considered A Bad Credit Score

The average credit score in Canada is around 753, but what exactly constitutes a good score or a bad score? Having a bad credit score, of course, is not a good thing, because youll end up struggling to accomplish various financial tasks. Those with very bad scores will have a hard time getting an apartment, getting loans, mortgages, opening bank accounts, and so on.

On the other hand, those with good credit scores would be able to open credit cards, bank accounts, apply for huge loans and mortgages, and so on. But what exactly is a bad credit score and what can you do to improve yours? Keep reading and learn more about it below.

Undergo The Home Appraisal

This step is out of your hands. The lender will arrange for an appraiser to inspect your property, and you need only agree to an appointment date and time.

Not all appraisals require entry into the home. With so-called drive-by appraisals, the appraiser literally looks at the property from their car. Some appraisers may want to go through your home to assess its value.

You should receive a copy of the completed assessment document. Based on the results, the lender will provide a final credit approval decision and terms for the HELOC, including closing costs.

You have three days to consider the offer and review the documentation. If youre OK with the loan terms, you can work out a closing date and time with the lender.

Don’t Miss: Is 734 A Good Credit Score

What Do Mortgage Lenders Consider A Bad Credit Score

Most borrowers dont know this, but many lenders dont require a specific minimum credit score to buy a house. The catch-22 is that a conventional mortgage lender is free to set their own requirements when it comes to your credit score. Although government-backed loans give mortgage lenders some peace of mind, they still have credit score requirements, even if they are usually much lower.

If you have a credit score lower than 500, you might find getting a mortgage a bit hard and will probably need to focus on increasing your score first.

Does Emergency Loan Bad Credit Guaranteed Approval Help Build Credit

Many think taking out an emergency loan can only hurt your bad credit score. While it’s true that you will be charged interest on the amount borrowed, it can be a good thing in the long run because it means that you have enough money to pay off the loan.

Many people find themselves in situations where they have no choice but to take out an emergency loan. If you’re in one of these situations, there’s no reason for you to feel embarrassed about applying for one. On the contrary, one of the best things about taking out an emergency loan is that they are available virtually at any time of day or night, so if you need some extra cash right away, there’s no reason why you shouldn’t apply today!

You May Like: Is 628 A Good Credit Score

Benefits Of Guaranteed Loans For Bad Credit

Bad credit loans are available to people with low credit ratings. It is not necessary to have a good credit score before applying for a guaranteed loan. Guaranteed loans are designed to help people get out of their financial problems and live debt-free lives. These loans are also bad credit personal loans, which can be applied online by filling out simple application forms.

Guaranteed loan providers offer a quick approval process for secured and unsecured loans, and fast funding facility, which makes it easier for borrowers to repay their debts on time. The primary benefit of guaranteed loans for bad credit online is that you will access money even if you have a poor credit score or no income!

Commonly Asked Questions

Will getting a loan hurt my credit score?

Getting a loan can be a great way to get the money you need, but it can also have some drawbacks. One of them is that it could hurt your credit score. The higher your score, the better your chances of getting approved for a loan and the lower interest rate theyll offer you. But if you apply for too many loans at once or make late payments on previous loans , this can impact your credit score and make it harder for you to get approved for new loans.

Could bad credit lenders guarantee me a loan?

Do cash advances have a high APR?

What happens if I can’t give back the money I borrowed?

Check Your Credit Report For Errors

Under the Fair Credit Reporting Act, you have the right to dispute and remove inaccurate information from your credit report. Start by requesting a copy of your three credit reports for free at annualcreditreport.com. If you find any errors, you can dispute them for free with the bureau in question.

Don’t Miss: How Can You Increase Your Credit Score

Knowing Your Credit Score Could Really Pay

When it comes to credit scores, knowledge is power. Knowing your credit score could be an important first step in managing your money and setting yourself up for the future.

Your credit score is how companies decide how financially reliable you are. Its based on your credit report which is like your financial footprint. It provides a record of how youve spent, borrowed and managed your money in the past.

A bad credit score can make it more challenging to get a loan or credit card, and could cost you more in financing rates on major purchases. A very poor credit score could even get in the way of getting a mobile phone contract. So it could really pay to stay on top of your credit score. Itll give you a good sense of where you stand with potential lenders and service providers. It also gives you a glimpse into what banks, utility companies and other companies know about you.

Requesting your credit report is also a good way to catch any mistakes that may have wormed their way on there. After all, you cant fix a problem if you dont know it exists. Heres how to check your credit score. So check your credit score and credit report at least once a year. Its free. Its your right. And you can do it in a few simple steps.

Whats The Magic Number That Says You Have Bad Credit

The primary credit scoring system in the U.S. is the FICO system, which was developed in the 1970s. It uses a range between 300 and 850 points, with the higher score reflecting better credit.

The different credit rating agencies all use a slightly different way of determining this score, so it can vary a little from one agency to the next. The average credit score for Americans is around 700, although that fluctuates a bit with economic conditions.

This average or median score is used by many lenders to determine the preferred or best interest rate they give to borrowers.

So if your credit score is below 700, you might expect to pay a higher interest rate on a loan. If your rate is below 600, you might have trouble getting credit at all.

So the answer to the question of what is bad credit can be given in two ways:

Contact a credit repair firm if you need professional assistance with your credit and finances.

Read Also: Does Checking Fico Score Hurt Credit

What Do I Do With My Credit Report

Read it carefully. Make sure the information is correct:

- Personal information are the name and address correct?

- Accounts do you recognize them?

- Is the information correct?

The report will tell you how to improve your credit history. Only you can improve your credit history. It will take time. But if any of the information in your report is wrong, you can ask to have it fixed.

How To Fix Your Bad Credit Score

If you have a bad credit score, dont worry, because you can certainly improve it. A bad credit score is often defined as anything below 629. If youre worried about your credit score, you can easily improve it by paying off your debt on time, using only a small portion of your available credit, and even getting a small loan or credit card.

You May Like: How To Get My Experian Credit Score

Guaranteed Approval Loans Discovered: Apply Now

Bad credit report is a tricky thing to deal with. It’s hard to find a job when you have a bad credit score, but it can be even more difficult if you’re trying to get a bad credit personal loan.

If you need help paying for college or buying a car but can’t get approved for conventional loans from a bank or a credit union because of your low credit score, it can feel like there’s no way out of the cycle of debt.

But there is help! If you’ve got a bad credit score or want to start building credit from scratch, check out these top 3 companies for November 2022: