Boost Your Credit Score

Use a free service, like Experian Boost, to potentially raise your credit score instantly without any effort on your part. Youll get credit for payments made to eligible service providers from utility, phone and streaming services by connecting your bank account used to pay bills and selecting the positive payment history you want to be added to your Experian credit profile.

Its included as a part of the free CreditWorksSM Basic membership, and youll also get access to your Experian credit report, FICO score, credit monitoring and alerts, a dark web surveillance report and more. Visit Experians website to learn more about Experian Boost, learn more about other products, sign up for a free account or get your free credit score.

Hard Hits Versus Soft Hits

Hard hits are credit checks that appear in your credit report and count toward your credit score. Anyone who views your credit report will see these inquiries.

Examples of hard hits include:

- an application for a credit card

- some rental applications

- some employment applications

Soft hits are credit checks that appear in your credit report but only you can see them. These credit checks don’t affect your credit score in any way.

Examples of soft hits include:

- requesting your own credit report

- businesses asking for your credit report to update their records about an existing account you have with them

How To Improve Your Credit

What does your credit score measure? In one word: creditworthiness. But what does this actually mean? Your credit score is an attempt to predict your financial behaviors. That’s why factors that go into your score also point out reliable ways you can build up your score:

-

Pay all bills on time.

-

Keep credit card balances under 30% of their limits, and ideally much lower.

-

Keep older credit cards open to protect the average age of your accounts, and consider having a mix of credit cards and installment loans. Space out credit applications instead of applying for a lot in a short time.

There are several ways to build credit when you’re just starting out, and ways to bump up your score once it’s established. Doing things like making payments to your credit card balances a few times throughout the month, disputing errors on your credit reports, or asking for higher credit limits can elevate your score.

Don’t Miss: How Long Does Rental History Stay On Your Credit Report

Problems Getting New Accounts And Contracts

A lower credit score can also cause problems when you attempt to open new accounts. Whether its a contract for a new cell phone , a utility account or a cable/internet service connection request, you could get denied if your credit score is low. Or the service provider may require you to make a large security deposit to start service.

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

Recommended Reading: Does Applying For Paypal Credit Affect Score

What Causes A Bad Credit Score

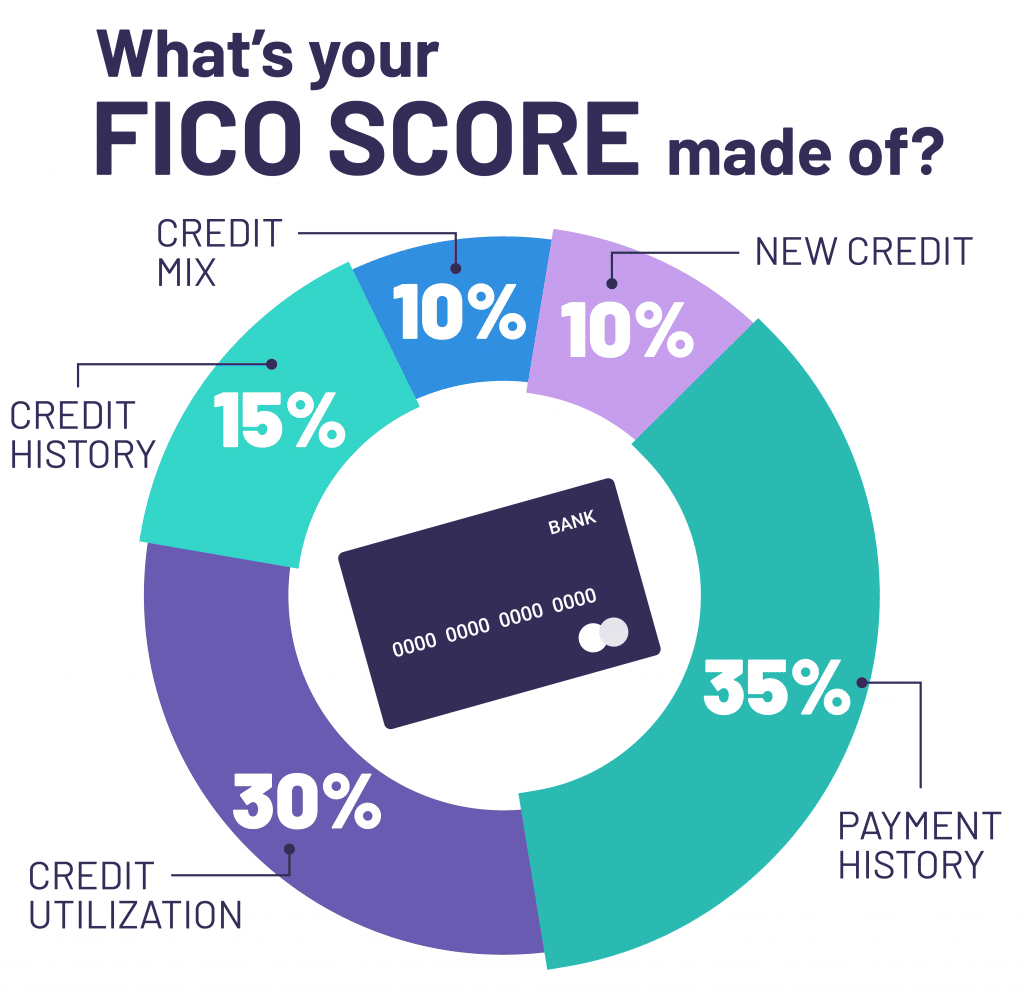

There are various factors that make up your credit score, all of them unique to you and as an accumulation of your financial habits. Typically, bad credit scores are due to factors such as:

Poor Payment History

Your payment history is the biggest factor that impacts your credit score, making up around 35% of your score.Missing one bill payment can decrease your credit score by as much as 150 points, according to Borrowell internal data. A single late payment could prevent you from qualifying for prime credit cards, low-interest loans, and attractive mortgage rates.

Lenders look at your credit score when qualifying you for products. Late payments will impact your credit score and raise red flags to lenders. In order to keep your credit score healthy and maintain your financial reputation, itâs important that you stay on top of your bill payments.

The key takeaway is that the longer a bill goes unpaid, the more potential damage it can have on your credit score.

High Credit Utilization Rate

Credit utilization is another important factor that affects your credit score. Your credit utilization rate determines around 30% of your overall score. Simply put, your credit utilization rate is how much credit you have used up compared to the total amount of credit available to you.You should always aim to keep your credit utilization rate below 30%.

Here is a four-step process you can take immediately to calculate your credit utilization rate:

What Factors Will Not Affect Your Credit Score

There are also a number of factors which do not play a role in calculating your credit score. These include:

- Your account balance, investments, and any debit card usage.

- Your income, occupation, employer, or employment history .

- Your age, marital status, education level, nationality, religion, where you live, and other demographic factors.

- Payment of utility bills, like rent, or phone, electricity, water, and internet bills.

- Being denied credit, or rejected for loan or credit card applications.

- Soft inquiries, when you check your own credit report, or inquiries by others .

Read Also: What Credit Score Do You Need For Affirm

Dont Cancel Your Credit Cards

If you have a hard time curbing spending because of your credit cards, you may feel tempted to cancel them. This isnt recommended as your credit card accounts are tied to credit history. When you cancel a card, your credit utilization ratio goes up. This is because your available credit has gone down. You may have paid the credit card off but you dont get the benefits if you decide to cancel the card.

The credit history youve built up from having that card will be removed from your credit report. This shortens your credit history. Its best to keep the credit card out of your wallet and dont have it set up as an automatic payment online.

If youre able to keep a good amount of credit, TransUnion and Equifax will label you as a low-risk borrower. Credit Utilization Ratio does place different values on types of debt. For example, if you have a government-backed loan, they have a smaller impact on your score compared to products like a credit card.

While youre working towards gaining good credit, one of the main factors is paying your bills on time. This is something that TransUnion and Equifax pay attention to when theyre evaluating your credit score. If you dont have good credit, its likely because you havent paid bills on time and in full. Make it a rule of thumb to change the way you manage your bills and pay them on time. You can do this by setting up automatic payments or using phone reminders to pay bills before their due date.

What Is A Credit Score

Reading time: 2 minutes

Highlights:

-

A credit score is a three-digit number designed to represent the likelihood you will pay your bills on time

-

There are many different credit scores and scoring models

-

Higher credit scores generally result in more favorable credit terms

A credit score is a three-digit number, typically between 300 and 850, designed to represent your credit risk, or the likelihood you will pay your bills on time.

- 740-799: Very good

- 800-850: Excellent

There are many different scoring models, and some use other data, such as your income, when calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or a credit card.

Why are credit scores important?

Why is it important to strive for a higher credit score? Simply put, those with higher credit scores generally receive more favorable credit terms, which may translate into lower payments and less paid in interest over the life of the account.

Remember, though, that everyones financial and credit situation is different. Different lenders may also have different criteria when it comes to granting credit, which may include information such as your income.

Don’t Miss: What Makes Up Your Credit Score

What Is A Bad Credit Score In Canada

300 574

Credit scores have a range of 300 and go as high as 900. If your credit score is between 300 and 574, youre considered to have bad credit. A credit score of 574 or less puts you at a disadvantage as banks, lenders, and landlords consider you to be a liability for money lending. This means youre less likely to get loans and if you do, theyll be at higher interest rates. To understand further what a credit score is and what you can do to improve it, check out this essential guide to credit scores in Canada.

The Vantagescore Credit Score Model

While FICO may be the mortgage-industry standard, the VantageScore credit score model is actually used fairly widely. In fact, according to VantageScores website, approximately 12.3 billion VantageScore credit scores were used by more than 2,500 users between July 1, 2018 and June 30, 2019. Additionally, many free credit score sources use the VantageScore credit score.

Watch on

As with the FICO credit score model, the VantageScore model has had several variations over its lifetime. The current model, VantageScore 4.0, was released in 2017 and changed the scoring structure to include trended data, which reflects patterns in borrower behavior, among other things.

Unlike FICO, the VantageScore models ignore paid collection accounts. It also puts less emphasis on unpaid medical debt compared with other types of collection accounts.

For the older VantageScore 1.0 and 2.0 models, the credit score scale ran from 501 to 990. The VantageScore 4.0 scale is the same as the FICO Score 8 scale, going from 300 to 850. As with the FICO scales, a higher number indicates lower credit risk.

Also Check: Why Did My Credit Score Go Down When Nothing Changed

What Affects Your Credit Scores

Common factors can affect all your credit scores, and these are often split into five categories:

- Payment history: Making on-time payments on your credit accounts can help your scores. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores.

- : How many of your accounts have balances, how much you owe and the portion of your credit limit that you’re using on revolving accounts all come into play here.

- Length of credit history: This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

- Types of accounts: Also called “credit mix,” this considers whether you’re managing both installment accounts and revolving accounts . Showing that you can manage both types of accounts responsibly generally helps your scores.

- Recent activity: This considers whether you’ve recently applied for or opened new accounts.

FICO® and VantageScore take different approaches to explaining the relative importance of the categories.

What Is The Average Credit Score In Canada And How Do You Compare

What is the average credit score in Canada, and how do you rank among average Canadian credit scores? More so, what is a good credit score in Canada?

Often, Canadians want to know how they measure up to other people when it comes to their credit score. Is your credit score better than the average credit score? Maybe its worse?

First, let’s answer the question you are here to find out:

Also Check: How To Make Your Credit Score Go Up Fast

How Do I Improve A Bad Credit Score

Raising your credit score and improving your financial health is like exercising: the results take time, discipline, and consistency. Itâs possible to see your credit score start improving within one to two months after taking recommended actions. That said, there are several factors that ultimately determine this timeline, including what financial incidents you are recovering from and what steps youâre taking to recover.

Here are some key steps you can take to improve your credit score.

Use a Secured Credit Card

The responsible use of a credit card and managing payments is critical to rebuilding your credit score. This means keeping note of your credit utilization and paying your bills on time, every time. A secured credit card is a great option for rebuilding your credit score

A secured credit card is backed by a cash or security deposit from the card owner. How much money youâre required to put on the card is based on your unique credit profile and the card issuerâs requirements. Letâs say the credit limit youâre approved for is $1,000. Youâll give the lender a cheque for $1,000 as a security deposit and they in turn give you a card with $1,000 on it to spend. If you donât make your payments, the lender will claim that security deposit against any outstanding charges.

A secured credit card can be an excellent option if:

Pay your Bills On Time

Pay Down Debt

Paying down debts plays a critical role in helping build your credit score.

What Is A Bad Vantagescore

Like the FICO score, the VantageScore typically uses 300 to 850 as its range. The newer VantageScore models show that a score of 300 to 499 is considered very poor, while a score of 500 to 600 is considered poor.

VantageScore calculations work a bit differently from FICO calculations. The VantageScore figures your score using the following categories:

- Total credit usage, balance and available credit: Extremely influential

- : Highly influential

- Payment history: Moderately influential

- Age of credit history: Less influential

- New accounts opened: Less influential

Don’t Miss: Is 588 A Good Credit Score

What To Do If You Dont Have A Credit Score

While having no credit history and no credit score doesn’t mean you have bad credit, it can make it difficult to build a good credit score.

If you have never used a credit card, or you have never taken a loan, you will not have a credit history. This is because most credit scoring models use these credit reports to determine your score. Thus, if this information is not there, they can’t create a score or report.

In such situations, here is what you can do to start building credit:

Since a persons credit score is used to assess their creditworthiness, having a low or bad score can affect your approval for loans, interest rates, repayment times, and more. While this can have a serious impact on your personal finances, luckily, there are many steps you can take to improve your creditworthiness.

When you take the time to understand how your credit scores work, and what causes bad credit, you will be in a better position to improve your credit score, manage your credit responsibly, and get many additional opportunities.

The Average Credit Scores Across The Country

The average score of the Americans has been on the rise for the past few years. This proves that the economy of the United States is swinging up. In 2018, the average score of the age group 33 to 52 years is 655. A study by WalletHub shows that the average age for a bad credit score is 52 years. This figure, however, is contrary to the general thought of younger people defaulting more than the experienced.

Geographically, Mississippi has the lowest average with 642 points.

Don’t Miss: When Does Your Credit Score Start

Vantagescore 40 Scale: 781

As with the FICO model, the highest possible credit score attainable with the VantageScore 4.0 model is 850. However, VantageScore has a slightly broader range of scores it considers excellent, including scores above 780. Approximately 27.9% of the population has excellent VantageScores, according to December 2021 data from VantageScore.

Become An Authorized User

Have a close family member with good credit add you as an authorized user on their credit card. Although this strategy isnt likely to cause a massive jump in your score, it could have some impact, especially for individuals with a shorter credit history. Make sure the card issuer reports authorized users to the credit bureaus or this wont help you.

You May Like: What Is The Highest Credit Rating

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

Why A Bad Credit Score Matters

A credit score is a crucial metric in your financial life. It determines if you are a worthy candidate to lend money. It is a constantly changing number, and it can increase or decrease based on your everyday financial decisions. A bad credit score typically describes your past failures in keeping up with the payments and impairs the approval of the lending companies for your new credits. Although variations exist, generally, a bad credit score falls below 630, based on FICO and VantageScore the two most widely used measures. Below the 630 level, there are three categories Low , Poor , and Bad .

Also Check: Can You Remove Inquiries From Your Credit Report