Inquiry Date/date Of Request

Dates that someone reviewed your credit information may be important, depending on the type of inquiry. Inquiries fall into two categories: those that affect your credit scores and those that dont . All are reported for 24 months. And since soft inquiries dont impact your scores, they arent important on that front. But for hard inquiries, the date of inquiry is important because most credit scoring models will ignore those that are more than 12 months old.

And in case youre wondering, hard inquiries in the past 12 months generally have the same impact regardless of whether they are one month old or 11 months old.

What Is A Credit History

Sometimes, people talk about your credit. What they mean is your credit history. Your credit history describes how you use money:

- How many credit cards do you have?

- How many loans do you have?

- Do you pay your bills on time?

If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and credit cards.

Companies also collect information about how you pay your bills. They put this information in one place: your credit report.

What Is Open Credit

Open credit is a pre-approved loan between a lender and a borrower. It allows the borrower to make repeated withdrawals up to a certain limit and then make subsequent repayments before the payments become due.

Borrowers prefer open-end credit because it gives them greater control over the amount they can borrow and the repayment period. Interest is only charged on the credit that the borrower has used, and the borrower does not incur costs on the unused credit.

An open credit can take the form of a loan or . Credit cards are the most common forms of open credit, and they provide flexible access to funds whenever needed. A credit card allows the holder to access funds in the form of cash advances, whose limits are predetermined by the issuer based on several factors, such as the borrowers credit rating and .

The credit card holder can continually use the card to make purchases online and in-store, and if the cardholder makes a payment before the credit limit is exhausted, funds are made available immediately. In the consumer market, home equity loans are an example of an open-end credit, which allows homeowners to access funds based on the level of equity in the homes.

You May Like: What Credit Report Does Target Pull

What Do I Do With My Credit Report

Read it carefully. Make sure the information is correct:

- Personal information are the name and address correct?

- Accounts do you recognize them?

- Is the information correct?

The report will tell you how to improve your credit history. Only you can improve your credit history. It will take time. But if any of the information in your report is wrong, you can ask to have it fixed.

Disadvantages Of Open Credit

1. Higher interest rate and maintenance fee

Open credit accounts are unsecured credit, and no collateral is attached to them. Therefore, an open-end credit tends to attract a higher interest rate than secured loans from banks and . Also, the lender charges a monthly or annual maintenance fee for keeping the credit account open, adding to the overall cost of running the open-end account.

2. Unexpected changes in credit terms

Another limitation of the open credit is that the terms of the credit can change at any time. The lender can decide to increase the maximum credit limit if the borrowers credit rating improves. Also, the credit limit can also be reduced at any time if the lender believes that there is an increase in credit risk or a decrease in the credit score.

Also Check: What Credit Score Do Home Lenders Use

What Does A U Stand For On A Credit Report

The U on your credit report stands for unclassified, meaning that the account hadnt been updated at the time the report was pulled. Its one of many status codes that can appear next to an account on your credit report. Codes like this usually indicate a problem with the account, like it being past due or sent to collections.

You might also see a U if the account is new and you havent made any payments on it yet. Again, if you didnt open the account, thats a warning sign you need to look into.

Why Do Credit Accounts Get Closed

- You closed the account yourself: If you decide that you dont want to keep an account open , you can tell your creditor you want them to close it. Before they do so, theyll expect you to pay off your remaining outstanding balance on the account, so accounts closed for this reason usually have no debt associated with them.

- You finished paying off a loan: When you pay off an installment loan, such as a student loan, auto loan, or mortgage, the account will close automatically. As youd expect, an account like this will also have a zero balance when its closed.

- The account was inactive: If you go for a long time without using one of your credit cards , your card issuer may close it automatically. For an account to go unused for that long, it generally also has to have a zero balance.

- Your creditor closed a delinquent account: If you consistently fail to pay off an account on time or otherwise violate the terms of your agreement with your creditor , they may punitively close the account. In this case, youll continue to owe whatever balance remained on the account when they closed it.

Recommended Reading: How Does A Personal Loan Affect Credit Score

How A Closed Card With A Balance Impacts Credit Reports & Credit Scores

Credit card issuers regularly furnish the three major credit reporting agencies TransUnion, Equifax, and Experian with details about your account activity. Therefore, if you closed the account yourself, it may read as account closed by consumer. If the issuer took that action, it may be noted as account closed at credit grantors request.

Neither notation is factored into a credit score and will have no impact on your credit scores.

The credit issuer will continue to report the accounts history as well as your current payments. If you made all your payments on time while the account was active, that information will usually show up for 10 years. But there is no statute preventing that information from remaining longer or even indefinitely after the balance is repaid.

If your credit reports do show late payments or other derogatory information, the account can only show up on your report for seven years, as per the Fair Credit Reporting Act set forth by federal law.

But the balance you have on the card, and therefore your credit reports, can have a damaging effect on your credit scores when the account is closed. Thats because FICO and VantageScore, the two largest credit scoring companies, factor in the amount you owe on your credit cards relative to your total available credit limits.

Wait Until It Falls Off

When the debt in question is legitimate and you cant convince the debt collector to delete it from your report, your only remaining option is to wait. After seven years from the date the account first became delinquent, the collection should fall off of your credit report.

Although this means the collection will continue to impact your credit score its impact will lessen as time passes.

Read Also: Does It Hurt Your Credit To Check Your Credit Report

What Happens When An Account Goes Into Collections

Step by step, heres what happens when you have an account go into collection:

Virtually any type of unpaid debt can be sent to collection, including:

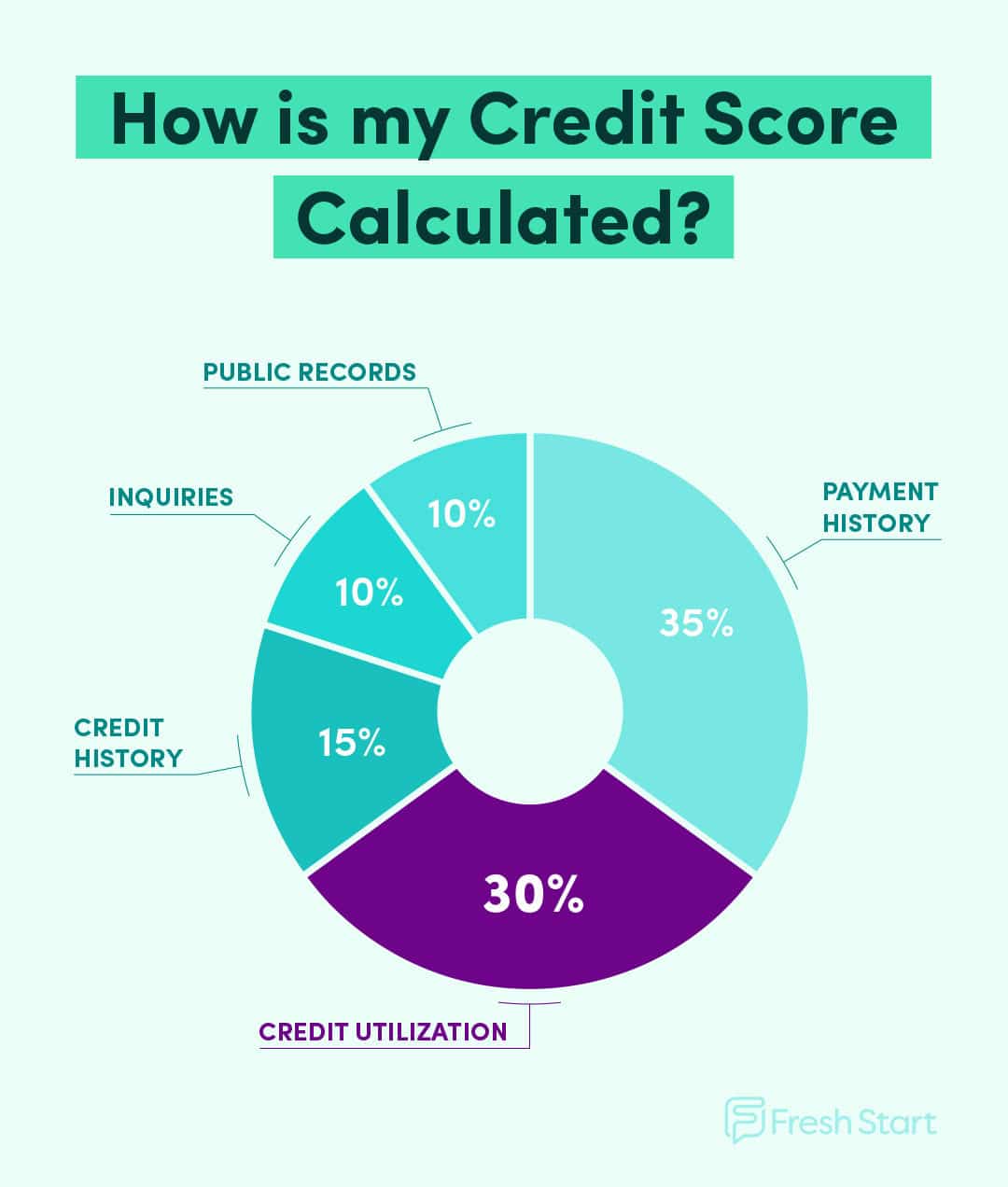

What Is A Credit Score

A credit score is a number. It is based on your credit history. But it does not come with your free credit report unless you pay for it.

A high credit score means you have good credit. A low credit score means you have bad credit. Different companies have different scores. Low scores are around 300. High scores are around 700-850.

Also Check: Does Bankruptcy Stay On Your Credit Report

If You Find Errors Dispute Them

If you find incorrect or outdated information on one of your credit reports, you can file a dispute with the credit bureau to get it updated. Mistakes happen and its important to catch them as incorrect information can affect your credit score, as well as any application processes that consider your report.

Does This Method Work

Some credit card issuers also report the nature of your relationship to the primary account holder to the credit bureaus. Lenders may take this relationship into consideration when youre applying for credit.

Buying tradelines doesnt always work. Lenders and credit reporting agencies view this practice as deceptive, so theyve reworked the scoring model to try to reduce the impact of bought tradelines. If youre still interested in buying a tradeline as a last resort, do your due diligence. Companies that sell tradelines may try to scam customers. The benefits of buying tradelines are temporary and unreliable.

Rather than going through a company and paying hundreds of dollars for a tradeline, you can ask a relative or friend to make you an authorized user on one of their accounts. That would be more likely to have a positive effect on your credit score, and it wouldnt cost you any money.

Also Check: How Long Does It Take To Improve Your Credit Score

How Do I Check My Credit Report

This is easy to do by phone:

- Answer questions from a recorded system. You have to give your address, Social Security number, and birth date.

- Choose to only show the last four numbers of your Social Security number. It is safer than showing your full Social Security number on your report.

- Choose which credit reporting company you want a report from.

That company mails your report to you. It should arrive 2-3 weeks after you call.

How Does A Tradeline Work

Your , the three-digit number that measures your creditworthiness, is calculated using tradeline information from your credit report. If youve made your payments on time, kept your balances low, and otherwise been responsible with your credit obligations, then your tradelines will contain positive information, and youll have a high credit score to show for your efforts.

Without a tradeline, you cant have a credit score. For the credit scoring calculation to work, your credit report must have at least one tradeline thats been open and active in the past six months.

Also Check: How To Check Credit Score With Itin Number

Understanding Your Credit Report

More than half of consumers never checked their scores in 2019, according to a report in USA Today. This likely means they never checked their credit reports as well. One reason for that could be that credit reports can seem difficult to understand.

While your credit report may appear complicated at first, after you break it down section by section it will become much easier to understand. Well go over the sections of your credit report with in-depth descriptions.

Additionally, credit reports have codes along with identifying information for both you and the companies you have done business with. When you read over your report, youll want to understand what those codes mean and how they are used to record your credit history. You can also find a guide to those codes below.

Understanding your credit report is the first step to repairing your credit. When you understand and monitor your credit reports, you can increase your credit rating. In fact, 34% of subprime consumers who followed their credit raised their score to near-prime or above credit risk.

How Your Three Credit Reports Differ From One To The Next

Many people will order their credit reports and wonder why there are three credit reports and why they have differences. One of the main reasons for the disparity is that not all creditors report to all agencies. The result is that your credit data may not be the same in all three major agencies.

Another main reason is that while the three major have similar business models, they are separate businesses. They report and record information differently and do not share information, so their data about consumers does not always match.

Some of the significant differences that youll see on your credit report include:

Read Also: How Do You Get Your Credit Report

Will Paying Off A Closed Account Help My Credit Score

Paying off a closed account usually wont directly benefit your credit score. However, as you know, unpaid closed accounts often lead to charge-offs and collection accounts, and those do hurt your score.

This means that paying off a closed account before its charged off can protect your score from damage in the future.

Whats more, future lenders will look at your full credit history in addition to your numerical credit score. Having a debt thats labeled paid in full is better than having one thats marked as unpaid or settled. The latter might be a dealbreaker when you apply for credit in the future, but the former is less likely to be.

File A Dispute Directly With The Creditor

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Lenders are required to investigate and respond to all disputes.

Remember to include as much documentation as possible to support your claim. Including a copy of your report marking the error is also helpful.

The address you should mail the letter to is usually listed on your report, under the negative item you’d like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file.

Don’t Miss: Do Late Fees Affect Credit Score

Summary Of Moneys Guide For Getting Negative Items Removed From Your Credit Report

- Order a copy of your credit report through AnnualCreditReport.com and search for inaccurate information, like missed payments or accounts that don’t belong to you.

- If you find any, file a dispute online or through the mail with the credit bureaus Equifax, Experian and TransUnion.

- You should also notify your bank or credit card issuer. They can help you verify that the information in your report is, in fact, erroneous and notify the bureau.

- Be on the lookout for a response from the bureau. It should arrive in around a month or less. If they accept your dispute, request your credit report again to make sure the negative information was removed.

- If your report is riddled with errors or you’re finding the dispute process difficult, consider hiring a .

When Are Tradelines Removed

Credit bureaus are allowed to report any information thats accurate, complete, and within the , and that includes any negative or delinquent accounts you may have.

Open tradelines with positive information will remain on your credit report indefinitely. Closed tradelines with positive information will stay on your credit report for a time determined by each credit bureaus internal reporting guidelines. Closed tradelines with negative information like delinquencies or bankruptcies will fall off your credit report within seven to 10 years.

For example, Experian keeps positive closed tradelines on your credit history for up to 10 years, but negative closed accounts will be removed after seven years.

Read Also: How To Add A Tradeline To Your Credit Report

Slow And Steady Wins The Race

It can be tempting to treat the goal of building business credit like a race. Yet you should view the process more as a marathon and less as a sprint.

Not only do you need to establish credit accounts for your business, you need to manage those credit obligations properly. Some corporate credit scoring models base your business credit score 100% on your payment history. Even with scoring models that consider other factors, you can be sure that your business payment history on credit obligations will remain very influential over your credit scores.

As your business grows older, more profitable, and as you manage your credit obligations the right way, your business credit scores should improve over time. It wont happen overnight, but if you monitor your credit consistently you should be able to track the improvement in your commercial credit scores .

Your goal with business credit is ultimately to know you can get affordable financing when you need it . Following the steps outlined above in this guide can help give you a great head start toward business credit success.