There Are 9 Requirements To Get A Car Loan

Most lenders require some or all of the following criteria to get approved for a car loan:

1. Strong credit

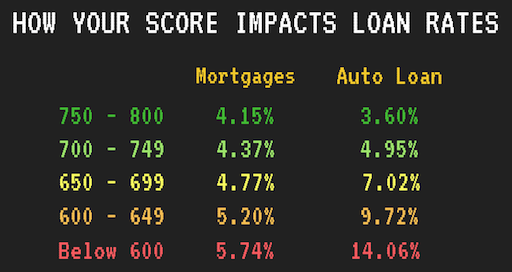

The credit score you need to get a car loan depends on which lender you apply with. While there are car loans available to all credit types, youre more likely to get approved with at least good credit thats a 670 credit score or higher.

If you have a 600 or even 500 credit score, its still possible to get a car loan. But youll have less of a selection and higher rates.

2. Regular income

You cant get a car loan without showing that your income can support the monthly repayments. Some require you to work full time, while others accept part-time work or government benefits. And youll need at least one of the following documents as proof:

- Most recent pay stub

- Social Security or government benefits statement

- Bank statements

- Most recent tax return

If youre self-employed, theres a chance youll need to submit more documents to prove your income if you can qualify at all.

3. Low DTI ratio

Lenders generally look for a debt-to-income ratio under 43%. This means your monthly debt payments and bills are less than 43% of your monthly income before taxes.

While lenders often dont advertise this as a requirement, most consider it and have maximum DTI criteria for all applicants.

4. Eligible vehicle

Usually, the vehicle cant have more than 100,000 miles or be more than 10 years old, though it varies by lender.

5. State-issued ID

Dos And Donts For Good Cibil Score

Like with everything else even CIBIL Reports require constant maintenance. There are certain activities that you can indulge in to keep credit scores looking good. There are also some activities that need to be avoided in order to prevent negative effects to the credit score.

- Dos

- The simplest thing to do to avoid damaging your credit history is to ensure all payments are made on time.

- Keep loans to a minimum because too many lines of credit can strain your income and result in rejection of subsequent loans.

- Make sure you check your CIBIL score yourself, because, if too many financial organisations check it on your behalf, it lowers the score.

- Make sure you pay credit card bills in full. Paying just the minimum amount doesnt prevent the remaining amount from being considered as overdue.

Ways To Increase Your Chances Of Getting A Car Loan

Even if you think youll qualify, these steps can increase your odds of getting a good deal:

Is it easier to get approved for a personal loan?

Not necessarily. Personal loans usually dont require collateral, which is more of a risk to the lender. Thats one of the reasons why they tend to have higher rates and shorter terms than your typical car loan. While you can use a personal loan to buy a car, it might not be your best option.

Also Check: Fedup-4u

Having A Car Repossessed

If you go too long without making a payment, the lender is allowed to repossess your car as long as it doesnt disturb the peace. A disruption of peace occurs when a repo man uses force to enter a locked building.

Your car is used as collateral in the loan, meaning that once you stop paying it off, it becomes the property of the lender. Repossession is a huge negative mark on your credit score, with only declaring bankruptcy hurting your credit more.

If youve reached the point of repossession, your credit score may have already taken some heavy hits. However, there are some steps you can take to recover from a repossession:

- Find out why it was taken and if you can get it back. Sometimes a car is repossessed by mistake.

- Gather your belongings from inside the car the repo men do not have a right to hold your personal property.

- Ask if you still owe money if the car is sold.

- Work on improving your credit by making on-time payments.

When a negative item hits your credit score, it can take time to remove that impact. Its important to remain patient and work on improving your credit score while waiting for the negative mark to fall off your report.

Before you take on the extra debt of a car loan, make sure you have the money to pay for it. Account for other current debts and bills, including student loans, rent, cell phone bills, and groceries, and create a budget.

Need help fixing your credit?

Clean up your credit report.

Learn More

How Big Of A Credit Limit Or Loan Do You Need Do You Really Need That Much Or Would It Be Wiser To Apply For A Smaller Amount

When many people decide they are going to buy something, they automatically think of something brand new rather than considering other alternatives. Many times a smart alternative can be buying a used car, an older home, a used appliance or a used bookshelf rather than buying something brand new. You should first look at your budget to see what you can truly afford and then evaluate how much cheaper something used is rather than something brand new. Many times it can make a lot more sense to save some money and buy something that is used. This can dramatically reduce the size of the loan that you need to purchase the item, and it can possibly save you a huge amount on interest payments. Brand new stuff is always nicer, but it isnt always the smartest choice for everyone.

Also Check: Care Credit Hard Inquiry

How To Get A Car Loan

To get a car loan, you should know your credit score and have a budget in mind. It can be easy to overspend if you have only a vague idea of how much you want to pay. And the worst time to find out that there is an error on your credit report is when youre applying for a car loan. Its a good idea to request copies of your credit report and check your credit score.

When you apply, lenders will ask how much you want to borrow for how long in order to provide a loan offer to you, so its smart to use a car affordability calculator to see whats in your budget. An auto loan preapproval will let you know if youll be approved for that amount and at what interest rate. Go directly to a couple of auto lenders or fill out a single online form at LendingTree and receive up to five loan offers from lenders, depending on your creditworthiness.

How To Improve Your Credit Score Before Buying A Car

If you dont have a perfect credit score just yet, dont worryyoure not alone. There are plenty of steps you can take to improve your credit score before applying for an auto loan. Here are some things you can do that will increase your score relatively quickly:

- Catch up on paying off any past-due debts.

- Check your credit report and dispute any inaccurate marks on your file.

- Pay down as much revolving debt as possible.

- Avoid any hard credit checks, such as those from applying for new credit or services.

- Avoid closing old credit cards you dont use, as long as they dont carry an annual fee.

- Request credit limit increases on your credit cards (and dont use that extra credit if its not needed.

Here are some things you can do to improve your credit score in the long run:

- Always pay your bills on timeset up autopay so youre worried you might forget.

- Open new types of loans and credit as you need them, such as student loans or credit cards, to diversify the types of credit you have.

Building your credit score to a level that qualifies you for an affordable car loan can take a long time in some cases. But its well worth it because youll be able to get the best car possible at a price that wont drain your bank account.

Also Check: When Does Open Sky Report To Credit Bureau

Apply For A Loan With A Cosigner

If your score is in the nonprime to deep subprime range, you might consider applying for a car loan with a cosigner. A cosigner is someone, such as a family member, who is willing to apply for a loan with you and, ideally, has good to excellent credit. A cosigner shares responsibility for the loan, reducing the lenders risk. Youre more likely to qualify for a loan and get a lower interest rate than if you applied on your own. But if you’re unable to make the loan payments, your cosigner will be stuck with the bill.

You Can Get A Car Loan With A Low Credit Score

To be clear, you can get a car loan with a low credit score. Although the subprime mortgage market has virtually disappeared since the financial crisis about a decade ago, the subprime auto loan market has exploded in recent years. Roughly 1 of every 4 car loans made in the U.S. is made to a subprime or deep-subprime borrower.

While the exact definitions of these terms vary depending on who you ask, the Consumer Financial Protection Bureau, or CFPB, defines subprime as borrowers with credit scores of below 620 and deep subprime as borrowers with scores below 580.

Also Check: When Does Wells Fargo Report To Credit Bureaus

Understanding Auto Loan Credit Scores

Your credit score is how lenders measure your financial stability and determine how well you can pay back debt. Credit scores are broken into tiers. Experian gives the following tiers and score ranges for auto loans.

Your FICO Auto Score, which most lenders use to evaluate car loan applications, may be lower or higher than your regular credit score depending on your previous auto loans – how much you borrowed and how well you made the payments.

Your exact FICO Auto Score can even vary from lender to lender. Each lender reviews your credit report information and weighs it according to what they think is the most important.

Example Credit Score Ranges Interest Rates And Monthly Payments For A $32000 New Car Loan

Note: Average interest rates based on Experian datafor Q2 2019 monthly payments estimated using FICO online calculator, based on five-yearloan term.8,9

Used car loans. American car buyers reportedly financed more than 55% of used vehicles in the second quarter of 2019, with loans averaging a little over $20,000. On average, people who bought used cars had lower credit scores than new-car buyers: the average credit score was 656 for all used cars, or 680 for used cars acquired from a franchised car dealer.10 The accompanying table shows how buyers credit scores could translate into interest rates and monthly payments for paying off the average $20,000 used-car loan over five years.

Read Also: Comenity Capital Mprc

Shop Around For A Preapproval

Each lender can look at your credit history in slightly different ways and offer you a different loan APR. Thats why its best to shop around for any type of loan you want. Dont rely on a dealership to do this for you. As the middleman, car dealers can raise your APR up to two percentage points. Instead, look at the best auto loans for bad credit and especially consider applying at your local credit union.

| Lender | |

|---|---|

| $7,500 or more | Refinance loans |

It does not hurt your credit to apply to multiple lenders the major credit bureaus allow consumers a two-week window to rate-shop. If you do all loan applications within 14 days, your credit isnt harmed any more than it is when you apply for one loan.

Borrower Beware:

Pay Down Your Existing Auto Loan

Paying off some of your current loan can provide multiple benefits. First, it can significantly improve your chances of securing a new car loan because your LTV will decrease. Second, it reduces your loans total interest and your monthly car payments. You save more money and lessen the financial burden on your income. Think of it as a down payment on your new auto loan.

If youre strapped for cash though, this isnt the best route to take you dont want to jeopardize your financial stability.

Don’t Miss: Carmax Financing With Bad Credit

Credit And Banking History

When you apply for a car loan, youll need to provide lenders your Social Security number, as well as your name, address and date of birth so they can pull your credit. Auto lenders may utilize different , including FICO auto scores.

They also may review your credit history, including the type of credit accounts you have, when you opened them, the credit limit or loan amount, your account balance and payment history.

Debt-to-income ratio

Lenders are looking at your history to determine if you have late payments or unpaid bills, as well as your total debt obligations to determine if you have a low enough debt-to-income ratio to support an auto loan.

In addition, lenders may also look at public records and collections in your credit history, including bankruptcies, foreclosures, lawsuits, wage garnishment and liens. A past history of unpaid bills and collections, especially related to an auto loan, will adversely affect a lenders confidence in your ability to repay the loan.

What Credit Score Do I Need For A $8000 Loan

Most lenders require a credit score of 580 or higher to qualify for an $8,000 personal loan. If you are concerned about qualifying for a personal loan, you can add a cosigner to increase your chance of approval.

Can I get a personal loan with a 585 credit score?

Youll be able to get a personal loan with a credit score between 580 and 669, but you might not be able to get the deal you want. A credit score between 580 and 669 is considered fair. It wont be hard to get a loan, and youre likely to have several offers from credible lenders.

What is considered fair credit? Fair credit is considered 630 to 689. A good score starts at about 690. Credit scores arent fixed, so theres always an opportunity to build yours. The time it takes to move your fair credit to good credit depends on your score, the negative information on your credit report and what steps you can take.

What are the disadvantages of credit unions? The Cons of Credit Union Membership

- Potential membership fees and restrictions. When joining a credit union, prospective members might have to pay a small membership fee, which can range from $5 to $25.

- Limited locations.

Don’t Miss: Usaa Credit Card Approval Odds

Be Sure The Terms Are Final

If you finance through a dealer, always make sure the terms are final before you sign. If you dont, you may face higher monthly payments or an increased down payment in the future.

Its known as a yo-yo scam: Dealers tell car buyers their financing is not complete and they must accept a higher interest rate.

What Is A Fico Auto Score

Its smart to have some idea what dealers will see when they check your credit profile by checking your credit score. Chances are, however, that your dealer might use a FICO automotive score instead of a traditional FICO score or VantageScore.

Your FICO auto score is a specialty score ranging from 250 to 900 that weighs past car-loan payments more heavily than the traditional FICO score does. It also gives more weight to any repossessions or auto-loan bankruptcies you might have previously filed. To check your automotive score, you can buy a full set of FICO scores at myFICO.com and then cancel the service rather than pay the fairly steep monthly fee.

Also Check: Syncb Zulily Credit Card

What Credit Score Do I Need For A Car Loan

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

A better credit score can increase your chances of approval for loans and credit cards and can also get you better interest rates and other terms. With some types of loans, like mortgages and credit cards, you simply cannot get approved if your credit score is below a certain amount.

Auto loans are a different story. There isn’t a set FICO® Score floor for auto lending, and a good percentage of auto loans made in the U.S. are to borrowers with ultra-low credit scores.

With that in mind, here’s a rundown of how to check and interpret your own , what it means to you as a potential auto loan borrower, and a few money-saving tips that you should use in the auto-buying process, regardless of your credit score.