Whats The Difference Between A Credit Report And A Credit Score

Your credit report and credit score are separate, but related, entities. Your credit report lists your borrowing and payment history. Your credit score quantifies this information into a three-digit score. Bear in mind that there is not just one credit score. Each credit reporting agency will score your credit history differently depending on the information in your credit report, and your score will likely fluctuate from month to month based on several factors, like taking on more debt or paying off loans.

Does Discover Scorecard Hurt Your Credit

The FICO® Score and other credit information we provide will never hurt your credit score. In fact, you can check as often as you like it will never affect your score. … We want you to check your Credit Scorecard without worry, which is why we offer it for free even if you’re not a Discover customer.

Discover Pull Myfico Forums 5588586

Apr 25, 2019 · 10 postsWhich bureau did Discover pull from for you? planning to pull my reports before pulling the trigger, just to get a rundown before I do.Discover approval without hard pull? myFICO 10 postsJan 31, 2018Which Credit Reporting Agency Does Discover Use 10 postsMay 9, 2017Discover pull myFICO® Forums 545145210 postsDec 31, 2018Who does Discover pull for CLI? myFICO® Forums 10 postsSep 10, 2015More results from ficoforums.myfico.com

Oct 11, 2016 Table Key & Combined Stats · 112 or ~25% of all applications pulled an Experian credit report · 233 or ~52% of all applications pulled an Equifax

Don’t Miss: Does Spectrum Report To Credit Bureaus

What Credit Score Is Needed For A Discover Card

Weve taken a hard look at the FICO score you need to obtain a Discover card. Our findings suggest that you need a minimum score of 648, according to at least one source. Most sources indicate a FICO score in the range of 680 to 720 will be enough to get a Discover card.

You may need a score of 680 or above to be approved for a Discover card unless its a secured or student card designed for lower credit ratings.

That being said, credit card companies usually dont write a minimum score in concrete. A lot can depend on the particulars of your credit history, your income and expenses, and whether the card is secured.

Its widely reported that Discover carefully reviews your overall credit profile rather than just your FICO score when considering your card application. This can work both ways.

For example, if you have certain red flags in your credit history, Discover may reject your application even if you have an acceptable score. On the other hand, if your derogatory items are old, Discover may be willing to give you the benefit of the doubt even if your score is on the low side.

If you dont qualify for an unsecured Discover card, you can apply for the Discover it® Secured Credit Card to rebuild your credit. This card reports your payment activity to all three credit bureaus, so its your opportunity to boost your FICO score by making all payments on time.

Calculating Your Credit Score

The information credit card companies report to the three credit bureaus is a part of your credit history and helps to make up your credit score. Your credit report and score collectively show future creditors how responsibly you use debt.

Credit bureaus use the following criteria to calculate your credit score based on the information they receive from credit card companies and other creditors:

- Payment history. Whether you make your monthly payments on time.

- The percentage of your available credit youre using at any given time.

- Length of credit history. The average length of your credit report, as well as your longest and shortest credit accounts.

- The types of credit that appear on your credit reports.

- New credit. Whether youve recently applied for or opened a new credit account.

Fortunately, you dont have to calculate your own credit score changes, though its best practice to keep an eye on it. To quickly know when your score changes, you may want to consider using a credit monitoring service. Not only will these services let you know when something new appears on your credit report, but theyll also offer advice to help you boost your credit score.

Also Check: How To Get Credit Report Mailed

Re: Discover Approval Without Hard Pull

Its apparently normal for Discover to only soft pull some applications for its credit products. I was approved for a $10K SL last August without any hard pulls. Then in November I got a $3K CLI again with no hard pulls. I obtained hard copies of my credit reports from annualcreditreport.com in December and noticed that Discover had been make soft inquiries monthly into my credit long before I got their card. Then I also remembered that for a while I had received invitations in the mail to apply for a card so obviously they already had some information about me in their system.

Should You Use Discover Credit Scorecard

Discover Credit Scorecard is a great way to keep an eye on your FICO score and the factors that go into determining it. We like Discovers free FICO credit score checker so much that were sorry to see the company make this service available only to its Discover customers. If youre in the market for a new credit card, the free Discover FICO score tool might be enough to make you take a closer look at what this credit card company has to offer.

However, the Discover Card free credit score is not the only free credit check tool available. If you arent a Discover customer and dont plan to become one, take a look at some of the other good free credit score websites instead. Each of these services takes a different value-added approach to free credit monitoring, with extras available, such as personalized credit offers, financial calculators and tools, credit score simulators, and credit repair tools. So check out our picks for the best free credit check sites, and choose one or two that deliver the most value for you.

After all, theyre free! And using them to monitor your credit wont negatively impact your credit score. But because these monitoring tools can help you improve your credit score, theyre definitely worth your time.

For more information on credit scores, check out some of our other resources:

Read Also: Can You Remove Inquiries From Your Credit Report

Will Discover Always Prefer To Use One Credit Bureau Over Another

Yes, Discover will lean more towards Equifax just under half of the time, at 48.2%.

The data has been gathered from consumers who have applied for credit and have decided to share the information found in their credit report.

Unfortunately, Discover does not disclose information regarding the credit bureau from which they pull for certain credit card applications.

Therefore, the information provided here should only be used as an indication of historical credit pulls, and should not be misconstrued as being true for all scenarios.

The heatmap below displays the states where Discover has historically pulled from Equifax. The darker colors indicate larger numbers of credit pulls.

US states where Discover pulls from Equifax the most

Compare this to credit reports pulled from Experian and TransUnion below. Whats evident is that the areas covered by all the maps are quite similar, which indicates that Discover still pulls credit reports from Experian and TransUnion for all states, but at slightly smaller numbers.

US states where Discover pulls from TransUnion the most

US states where Discover pulls from Experian the most

On the other hand, North Carolina and Wisconsin, both of which have a sample set of around 30-50 consumers, have indicated that TransUnion is the clear favorite.

Again, the underlying motive for Discover to pull from TransUnion in this case as opposed to Equifax or Experian for these states, is unknown. Perhaps it may be more cost effective in those cases.

How Does A Security Deposit Work

Cardholders must deposit at least $200 to their Discover it® Secured Credit Card account. Your credit limit will be equal to the amount of money you deposit.

Afterwards, this card will operate just as any other credit card. Youre not allowed to use your security deposit towards your monthly payments. Instead, the security deposit will be used to pay off your balance in the event that you become delinquent in your obligations. As long as your account remains in good standing, and you pay off all your debts, you can always get the security deposit back by closing your account.

Don’t Miss: How To Remove Negative Credit From Your Credit Report

How Does Discover Gauge Your Creditworthiness

According to Discover, the Discover it Cash Back credit card is for people with established credit, which means its looking for people who have built a positive credit history. What does that mean? Essentially, Discover wants to make sure you practice responsible credit habits, such as making on-time payments every month and keeping your balances low.

In addition to evaluating your payment and balance history, Discover will also take a look at your length of credit history to ensure you have a long track record of using credit responsibly. Discover will also check to make sure you havent applied for a lot of new credit recently. Having a lot of recent credit card applications on your credit report suggests you might be preparing to take on a lot of new debt and credit card issuers dont want you to carry more debt than you can pay off.

Why Is My Fico Credit Score Different Than Other Credit Scores I’ve Seen

The score Discover provides may be different than other scores youve seen for several reasons:

Recommended Reading: How To Report To A Credit Bureau Landlord

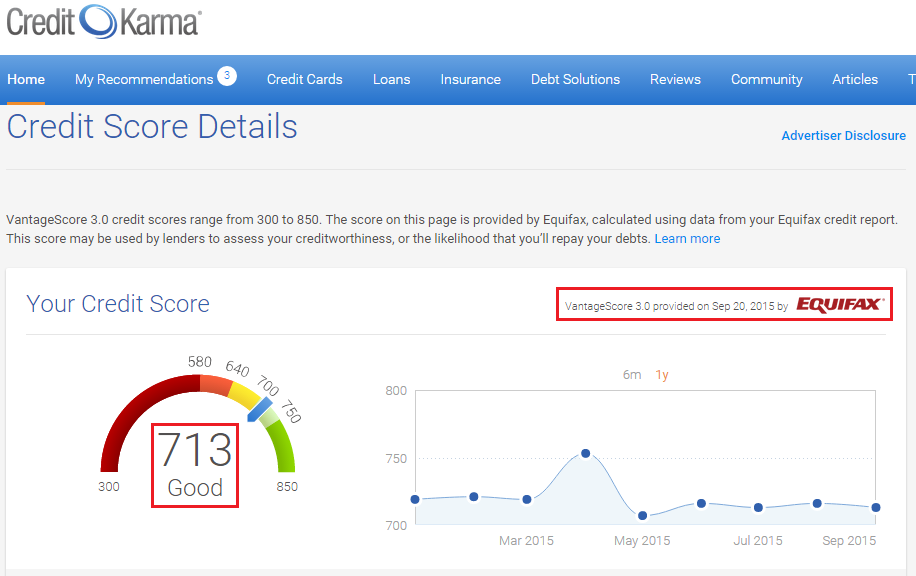

Once People See That Credit Karma Offers Access To Your Credit Scores For Free They Usually Follow Up With Questions Like Is Credit Karma Accurate Or Whats The Catch

Whether its your first time visiting Credit Karma or youve been a member for years, you might want some more insight into where Credit Karma gets your credit scores and why you should trust a company that claims to offer something for free.

Heres the short answer: The and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

This means a couple of things:

- The scores we provide are actual credit scores pulled from two of the major consumer credit bureaus, not just estimates of your credit rating. This, by the way, is one of the reasons why we ask for your Social Security number and other personal information in order to create a Credit Karma account so that we can match you up to what the bureaus have on file for you.

- We dont gather information from creditors, and creditors dont report information directly to Credit Karma.

Understandably, you may still have some questions about how Credit Karma gets your credit scores and why your scores from Credit Karma might look different from scores you got somewhere else.

Well dig into some of those questions below. Well also explain how Credit Karma can offer free credit reports from TransUnion and Equifax along with your free credit scores from each of those credit bureaus.

Does Discover Do A Hard Pull For Credit Increase

Asked by: Gavin Klocko

A Discover automatic credit limit increase requires a soft pull of your credit, which does not affect your credit score. However, if you request a credit limit increase on your own, Discover will conduct a hard pull on your credit report, but they cannot do so without your permission.

Read Also: What Is The Highest Credit Score You Can Receive

How To Dispute Information On Your Credit Report

If you find an error on your credit report, you can open a dispute. Prepare your personal information and supporting documentation before submitting your dispute. Dispute errors with each credit bureau online, by mail, or by phone. The bureau you filed a dispute with will typically investigate your claim and release its findings after about 30 to 45 days.

In the event results lead to a change in your credit report, you should receive a free, updated copy. If unhappy with the results of the dispute, you can resubmit your dispute with additional supporting information to help your case.

Whats The Mystery Behind Which Bureaus Are Used By Card Issuers

While it would be nice if credit card issuers would disclose which credit bureaus they use most often ahead of time, credit expert John Ulzheimer says he understands why some card issuers might balk at divulging which credit bureaus they rely on.

I can see some card issuers being hesitant to disclose which bureau they use for card underwriting because consumers are often coached to apply with a lender that pulls the credit report where their score is the highest. Its a rudimentary way to game the system, to some extent, he says.

This isnt national security. But they are certainly not required to disclose that information to a potential applicant, Ulzheimer adds.

A card issuer typically picks one report from one bureau when deciding on a credit card application, he says. Why? Pulling reports from all three credit bureaus for every application would be too costly.

Ulzheimer says a card issuer chooses a bureau based, in part, on what type of agreement it has with that bureau. These contracts almost always include a commitment to buy a certain number of reports from it, he says.

Also note that the information the card issuer requests and receives can vary. When a card issuer buys a credit report, it might pull all of an applicants available data or only certain data, such as an applicants credit score, according to Ulzheimer. A card issuer instantly receives this data electronically.

Also Check: How High Can A Credit Score Go

List Of Which Credit Bureau Each Bank Pulls

05/09/22

There are lots of reasons why people may want to submit several credit card applications at the same time . When a credit card issuer sees too many recent credit inquiries on your credit report then they may decline your credit card application due to too many recent inquiries. If youre planning to apply for several credit cards at the same time you need to do it smartly so you dont get declined due to the new credit inquiries.

Years ago, it was possible to apply for multiple credit cards by submitting the applications within the same second using different browsers. This used to help avoid the banks from seeing each others credit inquiries. This trick is now dead. The credit bureaus update files within the microsecond and it is impossible for you to act faster and submit a second application before the first credit inquiry shows up.

Thankfully most credit card issuers only pull one of your three credit reports. So you can apply for multiple credit cards by making sure you split up the credit inquiries between the three credit bureaus by choosing the right banks.

Heres a list of which credit bureau each credit card issuer usually pulls. Alternatively, you can check out our database where users report real-time information on which credit bureau was pulled on their recent applications.

Col trick on how you can trick the bank to pull a different credit bureau

Re: Does Discover Typically Pull Equifax

Not 70% chance but over 90% chance they will pull equifax for approvals. and true if they pull you for a cli it will be Tu. in most cases they don’t pull anything for a cli. they simply use the soft pull on file that is used to give you your tu fico score. If you really want to know simply go to the creditpulls data base. Type in your state and you will see what they pull in your area. If you have 7 open disputes i would not app anything with them until that stuff is resolved.

Also Check: What Information Is On A Soft Pull Credit Report

Dispute Credit Report Errors

Not everything on a credit report may always be true.

It could be outdated information, such as a past delinquent debt that youve since paid up an extra zero that makes your credit card debt look like $10,000 instead of $1,000 or someone elses negative information that showed up on your report.

Take the chance to dispute these errors with the credit bureaus that could compromise your credit score, by following one of these links:

How To Find Out Which Credit Bureau Will Be Pulled

The truth is that all we have are imperfect tools to work with to determine which credit bureau will be pulled.

With that said, we also have certain trends that we can base our predictions on. These trends and tools can at least help us make an educated guess as to which bureau will be pulled.

Ill start by identifying which credit card issuers are known for pulling certain bureaus and then get into the different methods for figuring out which bureau will be pulled by using databases.

Recommended Reading: Can A Person Report To Credit Bureau