Best For Improving Credit: Creditwise

-

Only offers TransUnion report access

-

Sign-up required

You can check your TransUnion credit report and credit score through CreditWise, a credit report and credit score tool from Capital One. Credit Wise is available for free, even for those who arent Capital One customers. Signing up is simple and easy. You wont have to enter any credit card information, theres no trial subscription to cancel, and your credit information is updated weekly. You can access Credit Wise online or use the mobile app to keep up with your credit score.

Can Annualcreditreportcom Be Hacked

While AnnualCreditReport.com takes steps to keep its site secure, hypothetically, your credit report could be accessed if an impersonator had enough of your personal information. Thats what happened in an incident in 2013. Perpetrators were able to illegally access the credit reports of some celebrities using considerable amounts of personal details gathered from other sources, according to TransUnion. As we confirmed at the time, neither AnnualCreditReport.com nor TransUnion was hacked, said David Blumberg, a TransUnion spokesperson.

Keep in mind that even if someone were to obtain your Social Security number, address history, and date of birth, they also would have to answer the identity-verification questions successfully. If they dont know who holds your mortgage or the balances on your student loans, for instance, theyd hit a roadblock.

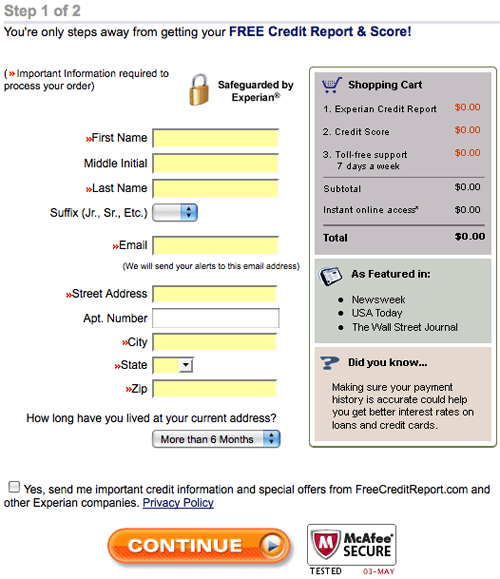

Check Your Credit Report With Experian

While AnnualCreditReport.com is legitimate and safe, you can get free copies of your credit reports from other trusted sources. For example, rather than using AnnualCreditReport.com to request a copy of your Experian credit report, you can go directly to Experian’s website. There, you can get your free Experian credit report, a free credit score based on the report and free credit monitoring.

You May Like: How Long Do Unpaid Loans Stay On Your Credit Report

Reports Are Free But Credit Scores Are Not Included

Users of the system who expect to receive a copy of their credit score along with the free credit report are bound to be disappointed. Thats because the parameters of this government-mandated service do not include the FICO-based credit score that the agencies also compile. Because of this, many users of AnnualCreditReport.com have called it a scam that ends up costing them money in the end.

While the reporting agencies do offer the option of paying to get a copy of your credit score, that service is not required. If you want to access your credit score after receiving your free annual credit report or at any time you can always do so through FICOs official website.

But, you may already have access to your credit score for free through a company youre already doing business with. Before you pay to see your score, check this list of financial institutions and credit card issuers that offer members free FICO scores accessing your credit score could be as simple as logging into your online banking portal.

Tips To Ensure Security

Phishing is a growing trend in the world of cybercrime. It is the act of portraying something legitimate to trick you into giving out your personal identification information, especially your Social Security numbers. Many of these phishing attacks occur through email or websites that look legitimate to the naked eye, but they are really set up to trick you. Here are some ways to protect yourself:

- Never click or proceed to a website from an email, as it will often lead to one of these fraudulent sites.

- Always look at the website’s URL in the address bar. If anything looks suspicious, such as the misspelling of a word, do not proceed.

- Password protect your personal computers, pads, and mobile phones.

- Beware of posting or offering any personal information on social media. Never give out or post your Social Security number or your actual birthday.

You May Like: How Do Student Loans Affect Credit Score

How Do You Dispute Information On Your Credit Report

The Fair Credit Reporting Act gives everyone in the U.S. the right to an accurate credit report. If there are mistakes on your report that you want to dispute, all you have to do is reach out to the credit bureaus. You can call, dispute the information online, or dispute it in writing with a mailed letter. Credit bureaus are legally required to investigate any disputes unless they are “frivolous,” but they won’t remove accurate information from your credit report.

For A Credit Report Review By Email:

-

Email our certified counselors at Education@MoneyFit.org to begin the process.

-

Advise them of your plans to have your credit report analyzed via email.

-

Identify a day or week when you plan to forward your credit report by email.

Pull and print your credit report ahead of time from AnnualCreditReport.com

Remove sensitive personal information with a black marker.

Submit your edited report as a PDF to our certified counselor using:

the online portal your counselor will provide you

the email address provided to you by your counselor

Your counselor will provide an analysis of your report via email and may email you questions, request clarifications, and identify items of concern for your attention.

Read Also: What Credit Score Is Needed For A Conventional Loan

What Is A Fraud Alert

Identity theft is a serious issue that can be detrimental to ones credit. Many credit reporting companies offer with fraud alert services to quickly inform consumers of potential threats to their credit profile.

- Fee: Depending on the credit report company, there may be an additional fee for the fraud alert, or it may be included in a credit management package.

- Unusual charges: Some credit monitoring services will alert consumers if an out-of-character charge appears on their account.

- Account freezing: Some credit report companies assist consumers in freezing their credit at the credit bureaus. This prevents unknown individuals from opening accounts in a customers name.

Do I Have To Pay For My Credit Report

It depends. There are many free credit report resources available, but there are several that also charge fees. With so many free resources available, there really isn’t any need to pay for your credit report. Just make sure you access your credit report through a verified site, such as those listed in this guide and sites that start with “https.”

Don’t Miss: What Is The Highest Credit Score You Can Receive

Should I Use Annualcreditreportcom

AnnualCreditReport.com is the perfect option for anyone who wants a basic, annual snapshot of their credit from year to year. Plenty of specialized credit-reporting services exist, but AnnualCreditReport.com is ideal if you prefer a minimalistic approach to monitoring your credit. You should use this service if you dont want to pay for special features or constant credit monitoring, but be aware that the online identification process isnt always clear and straightforward the first time around.

If you want the added security of identity theft insurance, constant monitoring and a definitive credit score, then AnnualCreditReport.com isnt for you. There are plenty of professional credit repair services that offer these specific add-ons, but AnnualCreditReport.com doesnt have any premium or paid options available. Avoid this service if you take credit monitoring seriously and want to go the extra mile to keep track of your credit.

For what it is, you cant beat AnnualCreditReport.com. This federally mandated provision means that everyone can check their credit report annually. The website does a phenomenal job of providing bare-bones credit reporting to its users at a price that anyone can afford.

It’s Owned By The Three Major Credit Agencies

The three primary credit agencies, Equifax, Experian and TransUnion, own the service. The convenient partnership gives you the option to request an individual report from each of the companies at any time. That way, you can monitor your credit throughout the year instead of getting three reports at one time. Its a smart way to get the most bang for your buck, even though youre technically not paying a cent for it.

Recommended Reading: How To Get Collections Off Credit Report

Who Looks At Your Credit Report

You likely feel like your credit has become either a major tool or a major drag when it comes to your financial success, and with good reason. Over just the past two to three decades, credit scores have been adopted into decision-making processes that go far beyond qualifying for a credit card.

Virtually all consumers know that if you want to qualify for a credit card, the potential card provider will make its decision based largely upon your credit rating. Additionally, most also understand that mortgage lenders, car loan providers, banks, and credit unions also use your credit score when deciding to approve a loan.

In addition to these obvious credit score viewers, many other decision-makers are looking at your credit score:

Finally, you should check your own credit regularly. Exercise your right granted by the 2003 FACT Act to pull your credit report through each of the three major consumer reporting agencies every 12 months. Go to www.AnnualCreditReport.com or call 877-322-8228 to request your report today.

Why Should I Get A Copy Of My Report

![Credit Karma Review: Free Credit Check or Scam? [2021]](https://www.knowyourcreditscore.net/wp-content/uploads/credit-karma-review-free-credit-check-or-scam-2021.png)

Getting your credit report can help protect your credit history from mistakes, errors, or signs of identity theft.

Check to be sure the information is accurate, complete, and up-to-date. Consider doing this at least once a year. Be sure to check before you apply for credit, a loan, insurance, or a job. If you find mistakes on your credit report, contact the credit bureaus and the business that supplied the information to get the mistakes removed from your report.

Check to help spot identity theft. Mistakes on your credit report might be a sign of identity theft. Once identity thieves steal your personal information information like, your name, date of birth, address, credit card or bank account, Social Security, or medical insurance account numbers they can drain your bank account, run up charges on your credit cards, get new credit cards in your name, open a phone, cable, or other utility account in your name, steal your tax refund, use your health insurance to get medical care, or pretend to be you if they are arrested.

Identity theft can damage your credit with unpaid bills and past due accounts. If you think someone might be misusing your personal information, go to IdentityTheft.gov to report it and get a personalized recovery plan.

Read Also: How Do You Clean Your Credit Report

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Do I Get My Full Credit Report

Since the FACT Act went into effect in 2004, American adults have had the right to view their credit report at no cost from each of the three major consumer reporting agencies . Here are the simple steps: Request your free report online at AnnualCreditReport.com.

You will provide your name, social security number, and current mailing address

You will then be directed to each of the CRAs to get your credit reports. Each CRA will ask you four questions to confirm your identity. These multiple-choice questions are based upon information available on your credit report. Do not hesitate to answer, None of the above if you do not see the correct answer or if the questions are not applicable.

It is common for a CRA to deny your online request. However, you should then attempt to get your report by phone or by mail.

When successfully pulled, you will have access to view and print your report immediately and have up to 30 days to dispute the accuracy of any information.

Request your free report by phone at toll-free 877-322-8228.

The recorded instructions will inform you of the requirements, but you should have your full name, social security number, and current mailing address ready to provide.

Request your free report by mail by printing and completing the form available here and sending in a stamped, #10 envelope to Annual Credit Report Request Service, PO Box 105281, Atlanta GA 30348-5281.

You May Like: How To Get Official Credit Report

Generate Your Credit Report Online

You can save reports to your desktop or print them out so youll have access later.

If you need to request a report or reports by mail, send a request form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Your report or reports should be sent within 15 business days.

You can also get your credit reports by calling 877-322-8228. Visually impaired consumers can also call this number to request audio, large-print or Braille reports.

Why Is My Credit Report Free

Your credit report is free because its required by the federal government. The Fair and Accurate Credit Transactions Act was passed in 2003 to create laws which would protect American citizens personal information.

This act states that youre allowed to pull your credit reports every twelve months for free. It also states that any company which uses your credit report must be providing you with the same opportunity to view and correct it for free. This ensures that you can check your reports, correct any mistakes, and dispute any errors at no cost to you.

The Federal Trade Commission is responsible for enforcing these laws while the Consumer Financial Protection Bureau ensures that financial companies treat the consumer fairly.

Also Check: How Do You Remove Hard Inquiries From Credit Report

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Users Report Trouble Accessing Experian Report

One of the more common issues reported by consumers involves trouble gaining access to the Experian credit report. While all three agencies occasionally have technical problems that temporarily affect access, Experian seems to garner the most complaints.

One explanation for this anomaly may have to do with the process that each agency follows when you request your report. You see, when you make your request you are directed to the website of the individual companies to complete the process. After that, handling of the request and the verification procedure is entirely in the hands of each organization. Although Experian has not confirmed internal error rates higher than the other two agencies, it is within the realm of possibility that their procedures result in more access errors.

Don’t Miss: Who Determines Your Credit Score

Monitor Your Credit Regularly

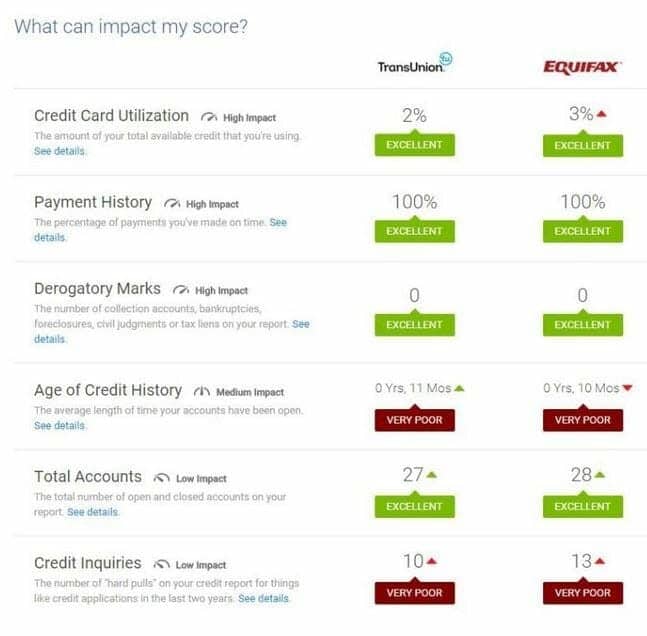

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a free credit report summary and a free credit score, updated weekly.

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

-

Data from one or two credit bureaus

-

A recent history of your credit use

-

Additional information about building and protecting your credit

AnnualCreditReport.com is authorized by federal law and safe to use as long as you ensure you’re on the correct site.

Double-check the URL when you type it, to be sure you have not made a typo. Some other sites have similar-sounding names, so check that the URL matches and the site looks as expected.

Be aware that your credit reports are free, but credit bureaus also use the AnnualCreditReport.com site to sell credit scores and promote paid services, such as . However, monitoring doesnt keep your identity from being stolen it just alerts you after the fact. For best protection, use a

Just get your free credit report. Dont get suckered by the upsell, says Ed Mierzwinski, consumer program director for the U.S. Public Interest Research Group.

AnnualCreditReport.com

Why Do I Need To Get My Credit Report

Whats on your credit report is vital to determining whether or not youll get approved for loans, mortgages, and even jobs. Your credit report is also used by lenders that determine what interest rates they can offer you when it comes time for financing.

If you want the best of the best in terms of interest, then having good credit is a must.

Many people with bad credit dont realize it until theyre turned down for that dream job or loan. These people then spend years and thousands of dollars to try and AnnualCreditReport.com to get back into the positions and circumstances in which they were in before their poor financial choices.

Even worse, some people have good credit but find out their score is much lower than they thought it should be. A poor financial decision made years ago can come back to haunt you and cause your credit score to plummet.

There is no way around the need to be informed about whats on your credit report. If you have bad or good credit, AnnualCreditReport.com lets you know how it affects your life so that you can plan accordingly.

Don’t Miss: How Long Does Payment History Stay On Credit Report