Shopping For Credit Cards With A 679 Credit Score

When shopping for credit cards, make sure you explore all of your options. In other words, dont just sit down with one potential creditor and decide to accept their deal or not. Sit down with multiple potential creditors and compare and contrast them to find out what works best for you.

If you already have a credit card, but have been shopping for one that is cheaper, you can then go to your existing creditor and request them to either match or beat an offer from another credit card company. Tell them that you believe you are paying too much money in fees and interest, and ask them if they are willing to lower their rates and fees down to the other credit card company that you are thinking about switching to.

If they refuse, then you can switch accounts, but dont close your existing account immediately. You still want to make the minimum payment on. it while you are waiting for your balance to transfer to your new account. You only want to close a credit account when your balance is at zero.

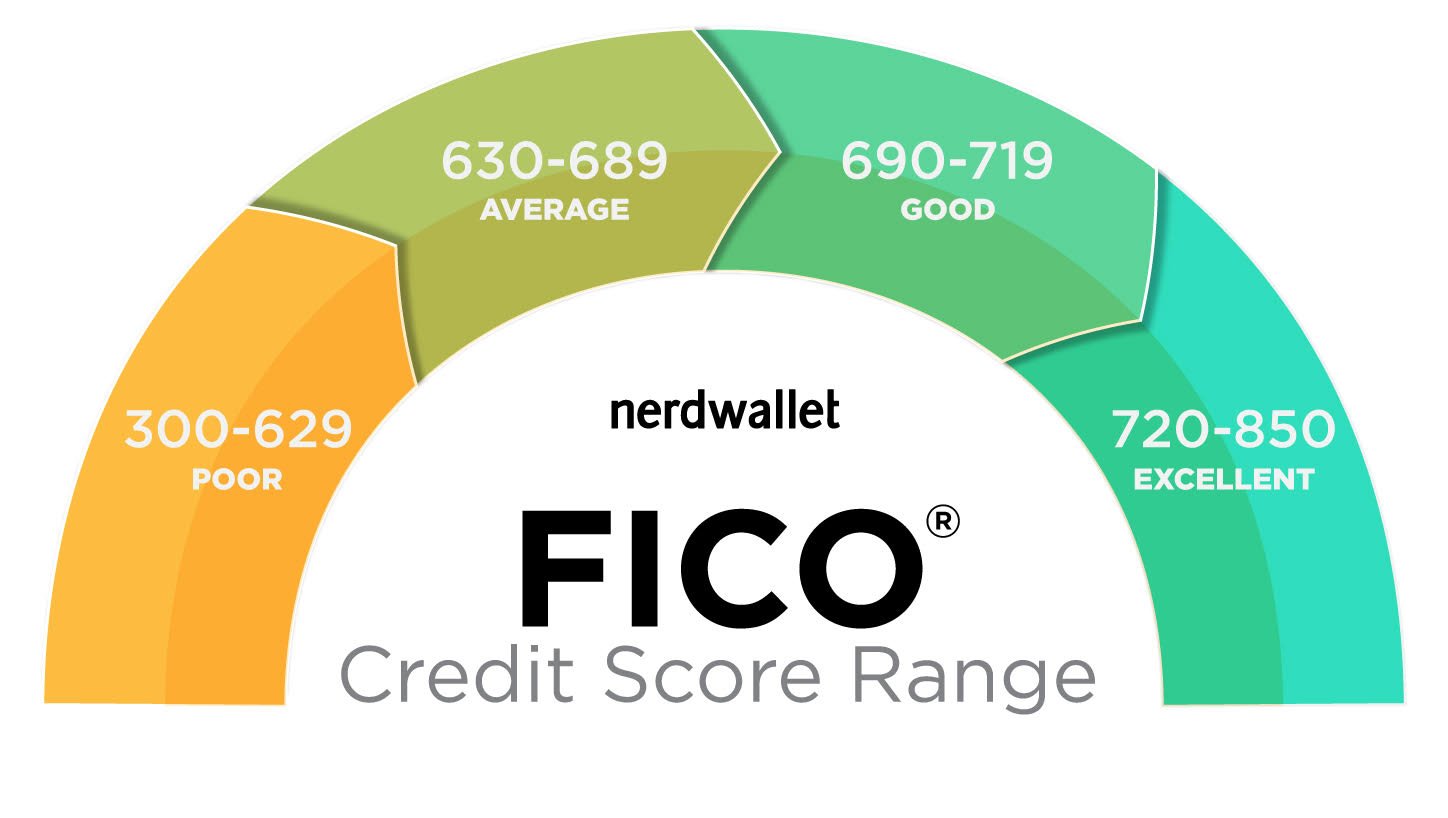

Credit Score: Good Or Bad

At a glance

679 is a good credit score. Scores in this range are high enough to get most types of credit, but you wont qualify for the best interest rates. Well explain what financing you can get with a score of 679 and what you can do to improve your credit score.

Get all 3 credit reports and FICO score monitoring, or instantly boost your credit score for FREE with Experian Boost.

Fresh advice you can trust

We promise to always deliver the best financial advice that we can. That’s our first priority, and we take it seriously. Our writers and editors follow strict editorial standards and operate independently from our advertisers and affiliates. Learn more about how we make money.

What Does A 679 Credit Score Mean And How It Affects Your Life

While being in the fair credit range is not the worst, it still has cons. Because many with a 679 credit score may be deemed a potentially risky borrower, it is not uncommon for folks with this credit score to be offered credit cards and loans with higher interest rates. If one wishes to have any increased shot at a low interest rate loan, approval for a credit card or a home rental, and better car insurance rates, having the best credit possible is a must.

On the bright side, a credit score of 679 is not the end of the world. Typically, it is individuals with scores lower than 630 who have a lower shot of approval and fair interest rates on loans, credit cards, and the like, that is, if they get approved at all. Being in the poor or very poor credit score range means that one may only be approved for secured loans: money borrowed that must be backed up with an expensive possession in exchange for borrowed finances in case you fail to pay back your dues.

What happens if you improve your 679 credit score by 50 or 100 points?

What happens if your 679 FICO score goes down?

You May Like: Can You Remove Charge Off From Credit Report

Can You Pay Off Your Balance Each Month

Never apply for a loan or credit if you dont first believe that you can afford to pay off the balance at the end of each month. This may sound obvious, but youd be surprised at how many people apply for credit or loans without asking themselves this question.

Ask yourself how you will use the credit card. Will you carry a balance, or can you indeed pay it off each month? Will you pay it off some months and not in others?

Roughly three fifths of all Americans who possess a credit card have a balance on that card. Despite this, you may want to pay off your balance at the end of each month so you can definitively avoid additional interest charges.

Can I Get A Mortgage With A Low Credit Score

It is possible to get a mortgage with a low credit score, but youll pay higher interest rates and higher monthly payments. Lenders may be more stringent about other aspects of your finances, such as your DTI ratio, if your credit is tarnished.

Keep in mind that credit requirements vary from lender to lender. Shop around with multiple lenders to find one that will work with you.

Also Check: How To Increase Your Credit Score Quickly

Shopping For The Best Rates On Loans And Credit Cards For A Credit Score Under 679

If you are ever on the market for high-priced items, such as home appliances, it is very common for people to walk into the store and get offered a discount or an otherwise excellent financing deal.. .but only if they open up a credit card account with that store.

Why do stores offer these credit cards? The reason why is because theres usually a high interest rate or multiple fees that go along with them. Those rates and fees can be found on the small fine print of the credit card deal, but of course, the store doesnt tell you.

A golden rule of credit cards is that you should only apply for credit that is a necessity for your financial life. When applying for a credit card from a retail store, youre probably only going to use it once, twice, or three times maximum. You could just as easily be using an existing credit card that you already have.

Heres why this is so critical: applying for multiple credit cards within a few months of each other will be very harmful to your overall credit score. Never apply for a credit card that you dont need.

Now, when you do decide to apply for credit cards and loans in general, there are a few factors that you will want to remember, including:

What Is A Poor Credit Score Range

Poor credit score = 550 619: Credit agencies consider consumers with credit delinquencies, account rejections, and little credit history as subprime borrowers due to their high credit risk. Although it is possible to qualify for credit, it is often at very disadvantageous terms you will pay much higher interest rates and penalty fees.

If you find yourself in this range, you should begin to address any specific credit problems you have to try to boost your score before applying for credit. Subprime borrowers typically become delinquent 50% of the time.

Also Check: How To Freeze Your Credit Report

Can I Get A Credit Card With A 679 Credit Score

If you have a good credit score, you might qualify for some great credit cards with perks like cash back, travel rewards, or an introductory 0% APR offer. However, the very best and most-exclusive credit cards are usually reserved for people with excellent credit scores. So if that’s your goal, there’s still room for improvement. A credit score of 679 would still give you access to some good travel rewards credit cards, though you usually need an excellent credit score to get a luxury credit card. You can get even better terms on your loan or credit card by repairing your credit and waiting a few short months until your score improves.A 679 score means you likely have a few negative items on your report. Removing any outstanding negative items is usually the quickest way to fix your report.

Benefits of improving your score to:

Check Your Credit Report And Correct Any Errors

Before applying for a mortgage, request a copy of your credit reports from the three major credit agencies: Experian, Equifax andTransUnion. Normally you can access your credit reports from each bureau for free once per year, but due to the COVID-19 pandemic, youre entitled to a free credit report from each of the agencies once a week through the end of 2022.

If you find inaccurate or missing information, file a dispute with the credit reporting agency and the creditor. Clearly identify each item youre disputing and be sure to include supporting documents.

Don’t Miss: What Credit Score Do You Need For A Conventional Loan

Getting A Credit Account With A 679 Credit Score

With a credit score of 679, youll have plenty of options when looking for a new credit card. However, you might not qualify for the top rates that card issuers reserve for people in higher credit score ranges.

The types of credit cards you can get with a credit score of 679 generally fall into two categories:

- Secured credit cards: These cards require a security deposit, which your lender will use as collateral. The amount you put down will usually be your credit limit. Secured cards are a low-risk option if you want to build credit while ensuring that you dont spend beyond your means.

- Unsecured credit cards: These cards dont require a deposit. Your card issuer will set your credit limit according to how creditworthy they perceive you to be. In many cases, these cards offer cash back on certain purchases and other rewards.

Which type of credit card is best ultimately depends on your financial situation and your reason for opening a new credit account. If youre good at controlling your spending, then its a good idea to use your good credit score to take advantage of the potential rewards and higher credit limit that come with an unsecured card.

On the other hand, if your main goal is to build credit and youre worried about overspending, then a secured credit card may be your best bet.

Takeaway: 679 is a good credit score, but its not in the top scoring range.

What Is A Good Credit Score In Canada

Good credit scores in Canada are usually 660 or higher. Of course, there are many different types of credit scores and scoring models. This means that what one lender considers to be a good credit score will not be the same for another lender. Furthermore, the credit scores a lender sees are different from those that you might have access to. Additionally, your Equifax credit scores might be different from your TransUnion scores.

Is 600 A Good Credit Score?

A 600 credit score falls under the fair credit score range. With a 600 credit score, you may be able to qualify for a loan with a bank, however, you wont get the most competitive rate. Borrowers with a 600 credit score may have better luck qualifying for a loan with alternative lenders whose lending criteria are much more lax than banks.

Is 620 A Good Credit Score?

If you have a 620 credit score, it usually means you have fair credit. While you may be considered higher risk by lenders, you can usually still qualify for loans, though it may be difficult. Moreover, youre likely to get charged much higher rates than those with good or excellent credit.

Is 750 A Good Credit Score?

A credit score of 750 is considered very good . In fact, with a credit score of 750, youre only 10 points away from excellent as credit scores that fall between 760 and 900 are considered excellent. With a 750 credit score, youll be able to qualify for loans at great rates.

Is 800 A Good Credit Score?

Don’t Miss: How Much Does A New Credit Card Affect Credit Score

How To Improve Your 679 Credit Score

A FICO® Score of 679 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 679 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

35% of consumers have FICO® Scores lower than 679.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

Know What Information You Need To Look At

You also need to know what information you should look at when looking at credit cards. When you are offered a credit card, you will be given a variety of information, such as the APR . Sometimes the credit card offer will offer a variety of rates, and you wont know what rate you will get until after you have been approved. You would be foolish to assume that you will get the lowest rate possible.

Another piece of information to look at is the credit limit. Your potential creditor will tell you that your card is limited up to a certain point, but again, you may not qualified for the maximum limit. When you do max out a credit card that has a low credit limit, it can harm your credit score.

Some credit card companies will also have a penalty APR. Always find out what the penalty rate is before applying for a card, what causes you to have the penalty, and how long the penalty will last.

Finally, look at any fees that come with the credit card. Examples of fees include late payment fees, cash advance fees, annual fees, and transfer fees. Again, dont apply for a credit card until after you have found out exactly what these rates are.

Read Also: How To Get Free Credit Report From All 3 Agencies

Fha Loan With 679 Credit Score

FHA loans only require that you have a 580 credit score, so with a 679 FICO, you can definitely meet the credit score requirements. With a 679 credit score, you should also be offered a better interest rate than with a 580-619 FICO score.

Other FHA loan requirements are that you have at least 2 years of employment, which you will be required to provide 2 years of tax returns, and your 2 most recent pay stubs. The maximum debt-to-income ratio is 43% .

Something that attracts many borrowers to FHA loans is that the down payment requirement is only 3.5%, and this money can be borrowed, gifted, or provided through a down payment assistance program.

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

Read Also: How To Dispute Credit Report Online And Win

A Quick Guide Explaining Credit Scores Including How They Work What Range Is Considered Good And Why Theyre Valuable

- FICO says good credit scores fall between 670 and 739. Thatâs on a scoring range from 300 to 850.

- VantageScoreâs good scores are reported to fall between 661 and 780. And like FICO, VantageScore also uses a scoring range of 300 to 850.

But thereâs a lot more to it than that. So keep reading to take a closer look at credit scores, including how theyâre determined, whoâs looking at them and what you can do to monitor and improve yours.

How Do You Improve Your Credit Score

Start early. The sooner you establish a reliable repayment history, the better so if you plan to apply for a mortgage in the next few years, or take out a major loan, you should manage your credit health now by ensuring there are no negative information such as a default listed against you for not making your debt obligations and by ensuring that you pay your bills on time.

The way in which you manage your repayments on your credit and loan accounts is one of the top factors in most credit scoring models. If you have been making repayments on your existing accounts on time, this is factored into your score and it will impact your credit score positively.

Your credit score will change over time as your credit behaviour changes e.g. if you apply for and/or take on more debt, default on your account or if your repayment behaviour changes by skipping your monthly account payments.

Lenders subscribe to one or more of the credit reporting bodies, sharing their customers comprehensive credit reporting information for inclusion in your credit report. So, not all credit reporting bodies have the exact same information, it all depends on which credit reporting body your lender shares your credit reporting information with.

Recommended Reading: How To Print Credit Report From Experian

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

Vantagescore Vs Fico Credit Score Calculation Methods

VantageScore and FICO take the same factors into account to produce your score, but they weigh them slightly differently . Here are just a couple of the differences between FICO and VantageScore: 3

- VantageScore groups the length of your credit history and your credit mix into one category called Depth of Credit.

- In addition to your credit utilization , VantageScore also looks at your current balances and your remaining available credit .

The tables below show how the models weigh your financial decisions to produce your score:

| -19 | 688 |

Given time, you can get your credit score into the top ranges. This can mean developing your credit profile if you dont have much of a credit history or recovering from negative marks that brought your score down.

Regardless of your circumstances, there are steps that you can take immediately to increase your credit score.

You May Like: Is 760 A Good Credit Score