What Is A Bad Credit Score

Having a may mean some lenders will be reluctant to give you a loan or other credit product, or, depending on the loan type and lender, they may charge you a higher interest rate compared to someone with a good credit score. This is generally because you would be seen as a higher risk and less likely to be able to repay the credit.

So how low does a credit score need to be to be considered bad? Equifax considers a score of 459 or lower to be below average, while Experian views a score below 549 as below average, and Illion considers a score of 299 or under to be a low score.

How Can You Improve Your Credit Score

Remember, your credit score is not fixed. It is calculated based on what information is available at that point in time, Equifax explains. Therefore, it can fluctuate as new information is added to your file. Negative entries will also drop off your credit file after a certain period of time.

If youre looking to boost your credit score, here are a few things you could do:

- Make sure you make credit repayments and pay bills on time steps such as creating a to manage money coming in and out, and scheduling automatic payments for bills and other repayments, could help with this.

- Limit new applications for credit or loan products where possible.

- If appropriate, consider lowering the limit on any credit cards you have.

- Regularly check your credit report and make sure the information is correct if it isnt, you can ask to have it changed, or for comments to be added to your report. Its free to update your credit report or remove an incorrect listing.

The comparison table below shows some of the savings accounts on Canstars database for a regular saver in NSW. The results shown are based on an investment of $100,000 in a personal savings account and are sorted by Star Rating , then provider name . For more information and to confirm whether a particular product will be suitable for you, check upfront with your provider and read the Product Disclosure Statement or other terms and conditions before making a decision.

Main image source: Valiantsina Halushka/Shutterstock.com.

How To Maintain Your Credit Score

Getting on top is easy staying on top is the challenge. So, make sure you borrow only as much as you need rather than opting for a credit loan amount just because you have been offered one. Ensure that you keep separate savings for repayment, as a dip in your score is possible when you face an emergency or due to unforeseen problems in your income.

Addition read:CIBIL score for personal loan

Now that you know what your credit score says about your behaviour regarding personal finances and credit utilisation, work on improving it or maintaining it. It is worthy to note that acting as a guarantor for someone who defaults on their payment will also hurt your credit score. So, become a co-signor with careful thought and boost your score following the tips mentioned above. With a good score, you can save more money on loans and credit cards and be well on your way to financial independence and security.

*Terms and conditions apply

Recommended Reading: Does Closing A Checking Account Affect Credit Score

Moving Past A Fair Credit Score

While everyone with a FICO® Score of 601 gets there by his or her own unique path, people with scores in the Fair range often have experienced credit-management challenges.

The credit reports of 39% of Americans with a FICO® Score of 601 include late payments of 30 days past due.

Credit reports of individuals with Fair credit cores in the Fair range often list late payments and collections accounts, which indicate a creditor has given up trying to recover an unpaid debt and sold the obligation to a third-party collections agent.

Some people with FICO® Scores in the Fair category may even have major negative events on their credit reports, such as foreclosures or bankruptciesevents that severely lower scores. Full recovery from these setbacks can take up to 10 years, but you can take steps now to get your score moving in the right direction.

Studying the report that accompanies your FICO® Score can help you identify the events that lowered your score. If you correct the behaviors that led to those events, work steadily to improve your credit, you can lay the groundwork to build up a better credit score.

Can I Get A Car / Auto Loan W/ A 605 Credit Score

Trying to qualify for an auto loan with a 605 credit score is expensive. Thereâs too much risk for a car lender without charging very high interest rates.

Even if you could take out an auto loan with a 605 credit score, you probably don’t want to with such high interest.

There is good news though.

This is completely avoidable with a few simple steps to repair your credit.

Your best option at this stage is reaching out to a credit repair company to evaluate your score and see how they can fix it.

Recommended Reading: Who Is Checking My Credit Report

Cibil Assigns You A Score From 300 To 900 Based On Factors Like

- Your timeliness with repaying credit in the form of EMIs or credit card bills

- Your credit utilisation ratio, when it comes to your credit card limit or loan vs. income

- The number of times you have applied for credit in the recent past and been rejected or approved

Heres how your credit score defines your financial habits and how you can proceed from one category to the next.

What Is A Bad Credit Score Range

Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of credit every time. If your score has fallen into this range, improving your score is going to take some work.

Filing for bankruptcy can bring a score down to this level. Statistically, borrowers with scores this low are delinquent approximately 75% of the time. But if you continue to make your payments on time, your score should improve. There are certain types of loans, like home loans, that are hard to get with a score in this range, but there are still options for getting a mortgage with bad credit.

Recommended Reading: What Is The Minimum Credit Score For A Va Loan

What Counts Towards Your 605 Credit Score

In essence, your credit score tells you whether YOU have a responsible credit management and a history showing that you have been financially stable. So what factors contribute to showing that you are fiscally responsible and stable?

The first and most critical factor will be your overall payment history. This is simply whether you have paid all of your bills on time. There are also a variety of aspects of your payment history that your credit rating will include, including how late you were on your payments , how many bills you paid and how many you did not, if any of your accounts have gone into collections and if you have a history of foreclosures, bankruptcies, and debt settlements.

The second biggest factor that counts towards your credit score is the total amount of money that you owe. Again, there is a variety of aspects of this that goes into your 605 credit score. One such example is the amount of your allotted credit that you have used up. Heres a piece of advice: the less you owe on the credit, the better your credit score will be.

Another aspect of your amounts owed is how much money you owe on each of your loans, including your credit cards, your car payments, and your mortgage payment. The best way to have a positive credit rating here is to have a variety of credits and loans and to manage each of them in a very responsible manner.

How To Improve Your 805 Credit Score

A FICO® Score of 805 is well above the average credit score of 711. It’s nearly as good as credit scores can get, but you still may be able to improve it a bit.

More importantly, your score is on the low end of the Exceptional range and fairly close to the Very Good credit score range . A Very Good score is hardly cause for alarm, but staying in the Exceptional range can mean better chances of approval on the very best credit offers.

Among consumers with FICO® credit scores of 805, the average utilization rate is 11.5%.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive a report that uses specific information in your credit report that indicates why your score isn’t even higher.

Also Check: Does Qvc Report To Credit

Negotiating With Your Creditors

Despite what many people believe, your creditors are not your adversaries and they are not working against you. Therefore, you should not treat them as such. Instead, your creditors are working with you in an attempt for both of you to gain a profit.

If you fail to do things, such as pay your bills on time, it negatively impacts the ability of your creditor to do business with you. While they should be understanding of any reasonable financial hardships that youhave undergone in the past few weeks or months, they can tell the difference between short term financial problems that were out of your control and blatant financial responsibilities on your part.

Ultimately, its your responsibility to communicate effectively with your creditor so that you can both benefit equally from your business agreement.

For an example, if you are forced to skip on a payment or to default on an entire loan the very first thing you need to do is to contact your creditor and talk about the Issue in detail with them. This action alone will tell them that what has happened is out of your control and that you are trying to correct the Issue in contrast to them believing that you are just behaving irresponsibly. In addition, this will also strengthen your business relationship.

Examples of how your creditor may be willing to help you after you have discussed your problems with them include the following:

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

Read Also: How Does A Credit Rating Relate To Shopping For Insurance

What Is A Fico Auto Score

Its smart to have some idea what dealers will see when they check your credit profile by checking your credit score. Chances are, however, that your dealer might use a FICO automotive score instead of a traditional FICO score or VantageScore.

Your FICO auto score is a specialty score ranging from 250 to 900 that weighs past car-loan payments more heavily than the traditional FICO score does. It also gives more weight to any repossessions or auto-loan bankruptcies you might have previously filed. To check your automotive score, you can buy a full set of FICO scores at myFICO.com and then cancel the service rather than pay the fairly steep monthly fee.

Where To Go From Here

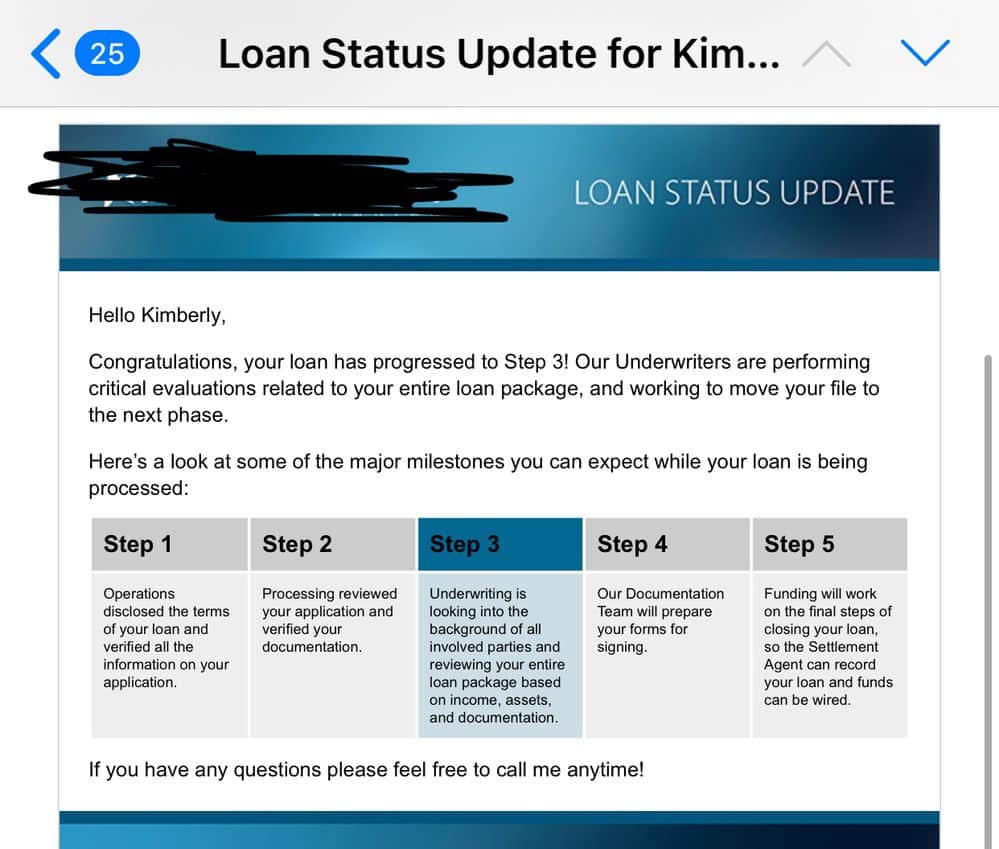

Its important to know which factors make up your credit score. As you can see in the image below, there are 5 factors that make up your credit score.

Pay down your balances and keep your credit utilization under 30%. Its also wise to have different types of credit accounts to establish a solid credit mix because it accounts for up to 10% of your FICO score. So, youll want to have both installment and revolving credit showing up on your credit report.

Of course, you also want to focus on making timely payments from here on out. Even one late payment can be very damaging to your credit.

Length of credit history also plays an essential role in your credit scores. You want to show potential creditors that you have a long, positive payment history.

Building good credit doesnt happen overnight, but you can definitely speed up the process by making the right moves. So give Lexington Law a call for a free credit consultation at and get started repairing your credit today! The sooner you start, the sooner youll be on your way to having good credit.

Categories

Read Also: What Day Does Usaa Report To The Credit Bureaus

Bring Documents Showing Financial Stability

If your credit score is low, potential lenders are less likely to see you as a risk if they can see you have stability in other areas of your financial life. Bringing documentation like your most recent pay stubs and proof of address to show lenders how long you have lived at your current address and worked at your employer could help you seem more reliable.

Learn More About Your Credit Score

A 605 FICO® Score is a good starting point for building a better credit score. Boosting your score into the good range could help you gain access to more credit options, lower interest rates, and fewer fees. You can begin by getting your free credit report from Experian and checking your to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.

Don’t Miss: Who Can Check My Credit Report

What Is A Credit Score

Your is calculated based on the information in your credit report. This report shows a detailed record of your history as a borrower and includes information such as how much you have borrowed in the past and whether you have paid the money back on time, as well as the details of any credit card or loan applications youve made recently.

Your individual credit score will usually sit somewhere on a scale of zero to 1,000 or zero to 1,200, depending on which credit reporting agency you go through. In Australia, there are three main credit reporting agencies: Equifax, Experian and Illion.

Because each agency uses different to categorise consumers scores as well as having different ways of calculating the scores what constitutes a good credit score will really depend on which agency youre asking. Generally, however, a higher credit score is considered better because it indicates a more reliable borrowing track record, and as a result, a lower credit risk.

Better Credit Means Lower Costs

Interest rates differ based on your credit score, so knowing what to expect on average can help you budget for your car. A target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 4.03% or better, or a used-car loan around 5.53% or lower.

|

20.43%. |

Someone with a score in the low 700s might see rates on used cars of about 5.53%, compared with 16.85% or more for a buyer scoring in the mid-500s, according to the data from Experian. Using a car loan calculator illustrates the difference that can make.

For example, on a $20,000, five-year used-car loan with no down payment, thats a monthly payment of about $382 for the buyer with a higher credit score versus $496 for the buyer with a lower credit score. The buyer with better credit would pay about $2,921 in interest over the life of the loan, while the buyer with lesser credit would pay around $9,759. Plus, in most states, bad credit can mean higher car insurance rates, too.

The differences arent quite as steep for new-car loans: Borrowers with scores in the low 700s can expect an average rate of 4.03% compared with 9.75% for borrowers with credit in the mid-500s.

Don’t Miss: What Is My Mortgage Credit Score

Credit Score Car Loan Options

If you have a credit score of 605 or lower, getting approved for an auto loan will be difficult. If approved at all – which may not happen even with high-interest rates- your new car could end up costing double its original price before, depending on age and where in America that particular dealership is located! According to CarsDirect’s statistics about average rates across different States: 10% if buying New Auto Deals 16+Percentage Points More Than Used Car Loans!

People with poor credit who need a new car loan have other alternatives such as:

- Apply for a secured car loan where you provide additional collateral

- Get a cosigner who has excellent credit for your auto loan

605 credit score credit card options

If you want a secured credit card, make sure the deposit is at least as much of your limit. That means if someone wants a $1K secured card with no security features but just enough for today’s essentials – they’ll need to put down 1000 bucks!

If you want a credit card, your score should be at least 600. Cards with high limits and interest rates are only available for people with excellent financial records or who can afford a collateral deposit before approval!

Getting a credit card might be your first step towards building a positive financial history. You can use this wisely by using it responsibly and paying off the balance each month, carefully monitoring how much you spend on what things so that no extra fees come out of nowhere!

What affects your credit score