Are Credit Scores Different With Every Credit Checking Website

If you check your credit score with multiple credit reporting websites, you might find that the three-digit number youre given varies considerably between each one. This is because they tend to use different sources.

These sources are known as or credit bureaus, which gather information on your credit history from various lenders and then provide it to credit reporting websites.

You can either check your credit report directly with the CRA , or through a third-party credit checking website .

Correcting Credit Report Errors

You can, and should, check your credit report before buying a house. Normally, consumers can get one free credit report from each of the major credit bureaus each year at annualcreditreport.com.

If you find errors on your credit report, take steps to correct them as quickly as possible. You can dispute errors online, and federal law requires the bureaus to investigate possible errors.

After you get the results of the investigation, check the credit report again to make sure the errors have been removed.

Understand 3 Bureau Credit Reports And Fico Scores

For the soft credit checks, there are bodies and agencies involved in this. They simply go to banks and any other credit institution that you have account with not excluding the local credit institution e.g. Cooperative society, e.t.c. As I said earlier, this check does not affect your credit or your earnings. It is from these agencies the creditors get their soft checks information about your credits reports from. We have three major of these credit score agencies or bureaus:

I said major credits score bureaus because we have numerous credit score bureaus but those are they three major bureaus. The bureaus do not work together meaning so many times credits report of each bureau are not consistent with each other.

The credits report of the same person may be different across each bureau which is not supposed to be so. So how do we maintain balance? This is where FICO score enters.

Fair Isaac Corporation are not another credit bureau that goes about to gather credit reports as other credit agencies does but instead they are just there for check and balancing. Making sure all credits reports from all bureaus are consistent with each other and how did they achieve this? They achieve this basically by going to the credit bureaus to gather reports and they try to bring and juxtapose them together to reach a balance point of consistent credit reports across the credit bureaus. They therefore, come out with FICO score.

Read Also: What Is The Highest Credit Score You Can Get

Best Personal Loans For Fair Credit

Steve Rogers has been a professional writer and editor for over 30 years, specializing in personal finance, investment, and the impact of political trends on financial markets and personal finances.

Getting a personal loan with a fair credit score is possible, but you might not be able to get the deal you want. Here are the best personal loans for fair credit, plus information about what to expect and how to prepare.

A credit score between 580 and 669 is considered fair. It wont be hard to get a loan, and youre likely to have several offers from credible lenders. You wont get the best rates: youre likely to pay close to 20% annual interest and you will probably have an origination fee as well.

A 582 Credit Score Can Be A Sign Of Past Credit Difficulties Or A Lack Of Credit History Whether Youre Looking For A Personal Loan A Mortgage Or A Credit Card Credit Scores In This Range Can Make It Challenging To Get Approved For Unsecured Credit Which Doesnt Require Collateral Or A Security Deposit

| Percentage of generation with 300639 credit scores |

|---|

| Generation |

| 27.3% |

Poor score range identified based on 2021 Credit Karma data.

Most credit scores range from 300 to 850, and lenders tend to look at scores in the 500 to 600 range as less than ideal. Why does it matter what lenders think? Because they use credit scores to help assess the risk associated with lending money to you.

With a poor credit score, you might have trouble qualifying for credit. Maybe youve already been rejected for a credit card youve had your eye on, or maybe you only seem to qualify for loans with high interest rates and fees.

If thats the case, dont lose hope. Understanding what goes into your credit scores and yes, you have more than one credit score is the key to building your credit. Perhaps youve already heard that your scores are calculated based on information in your credit reports, but what does that really mean?

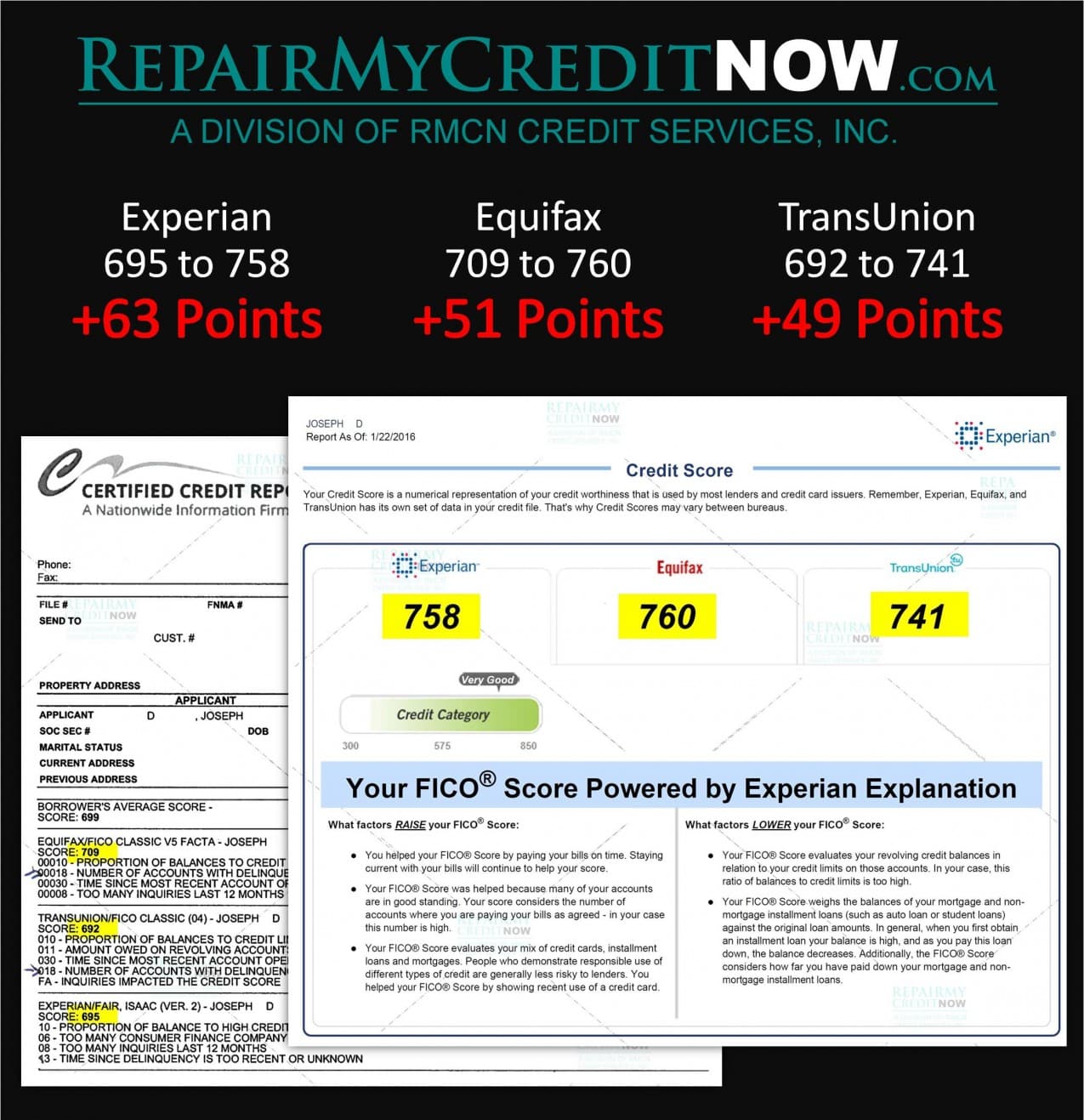

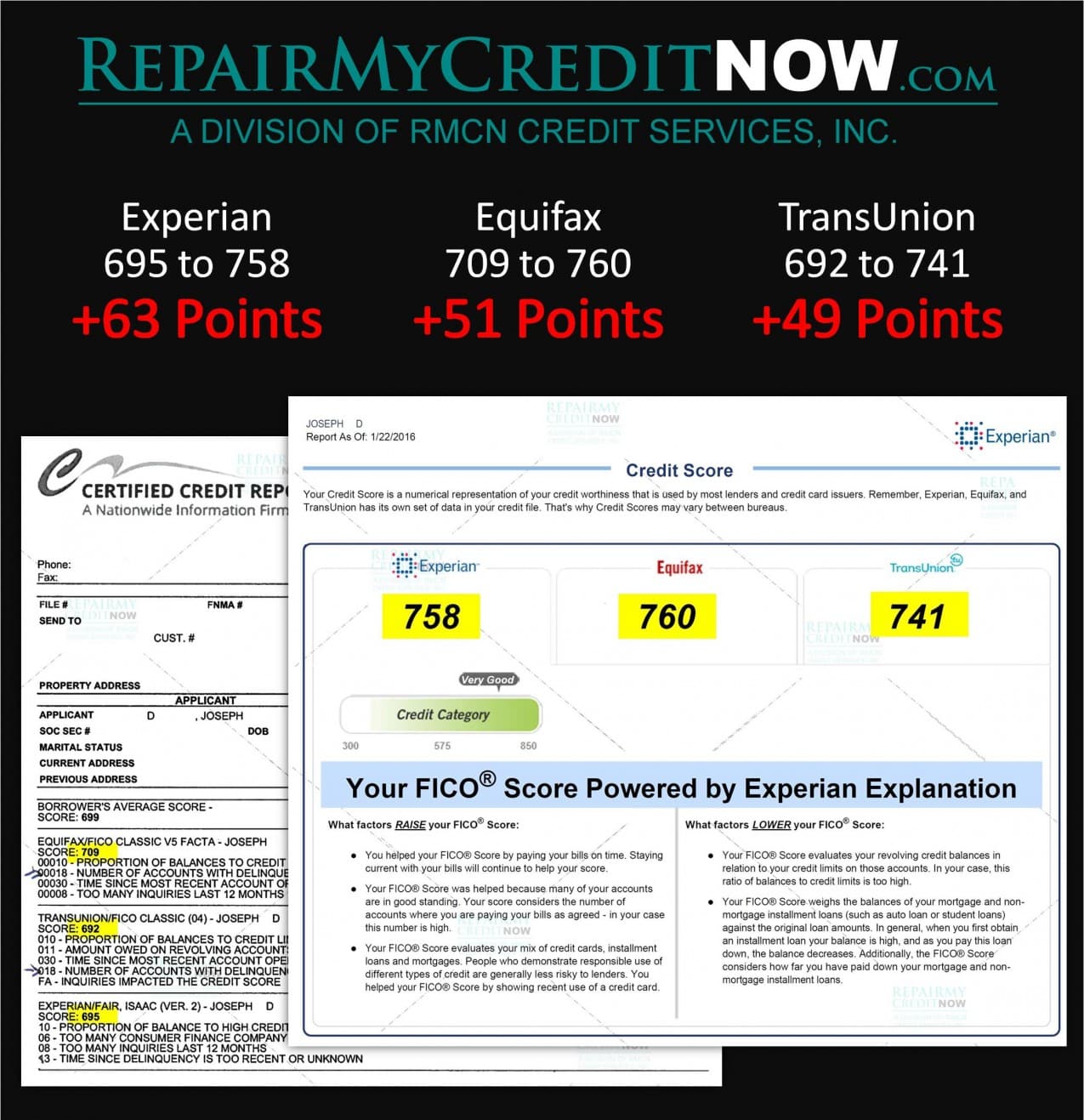

In this article, well show you how important credit information can influence your credit scores. Credit bureaus like Equifax, Experian and TransUnion collect this information from lenders and financial institutions and use it to build your credit reports. The information in those reports is then run through various credit-scoring models and, voilà, your scores come out on the other end.

Read Also: Does Credit Karma Hurt My Score

Vantagescore Vs Fico Credit Score Calculation Methods

VantageScore and FICO take the same factors into account to produce your score, but they weigh them slightly differently . Here are just a couple of the differences between FICO and VantageScore: 3

- VantageScore groups the length of your credit history and your credit mix into one category called Depth of Credit.

- In addition to your credit utilization , VantageScore also looks at your current balances and your remaining available credit .

The tables below show how the models weigh your financial decisions to produce your score:

| 688 |

Buying A House With Bad Credit

Having bad credit is different than having no credit.

If your low credit score comes from collections, write-offs, and late and missed payments, bad credit will get your loan denied.

If your credit score is low because youve failed to make loan payments on time, or you keep all your credit card balances maxed out, a lender isnt likely to overlook these issues.

Youll probably need to take a year or so and work on improving your credit score before you can get serious about buying a house.

Read Also: How To Get My Credit Score To 700

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Check Your Credit Score

So there is great need for credit score check and it is something we should be able to do ourselves not waiting for the creditor to do that because we like it or not, before any lenders can accept our propositions, they will do their own credit score checks on the borrower.

Yes, this is called Hard Check because a thorough check is done on the credit reports by the prospective lenders so as to make decision pertaining to lending out money to the borrower. While we have a hard check, so also is the soft check which is the soft background credit score checks going on without the knowledge of the person. It is usually done when your credit reports are being checked without you knowing about it.

You May Like: Does Checking Your Credit Score On Credit Karma Lower It

Know What Information You Need To Look At

You also need to know what information you should look at when looking at credit cards. When you are offered a credit card, you will be given a variety of information, such as the APR . Sometimes the credit card offer will offer a variety of rates, and you wont know what rate you will get until after you have been approved. You would be foolish to assume that you will get the lowest rate possible.

Another piece of information to look at is the credit limit. Your potential creditor will tell you that your card is limited up to a certain point, but again, you may not qualified for the maximum limit. When you do max out a credit card that has a low credit limit, it can harm your credit score.

Some credit card companies will also have a penalty APR. Always find out what the penalty rate is before applying for a card, what causes you to have the penalty, and how long the penalty will last.

Finally, look at any fees that come with the credit card. Examples of fees include late payment fees, cash advance fees, annual fees, and transfer fees. Again, dont apply for a credit card until after you have found out exactly what these rates are.

Can I Get A Car / Auto Loan W/ A 582 Credit Score

Trying to qualify for an auto loan with a 582 credit score is expensive. Thereâs too much risk for a car lender without charging very high interest rates.

Even if you could take out an auto loan with a 582 credit score, you probably don’t want to with such high interest.

There is good news though.

This is completely avoidable with a few simple steps to repair your credit.

Your best option at this stage is reaching out to a credit repair company to evaluate your score and see how they can fix it.

You May Like: What Does Credit Score Start At

What Is The Minimum Credit Score For A Loan

The minimum credit score required for any loan depends on several factors, including the type of loan and the amount needed. In addition to your credit score, a lender will consider other personal financial information, such as your earnings, job stability, overall debt, bankruptcy or defaults, length of credit history, recent financial record, and other mitigating circumstances.

The loan request is scrutinized to determine whether enough positive factors exist to overcome a low credit score. Things such as the down payment amount, whether there is collateral as in the case of a vehicle loan or mortgage, the loan term, APR all these factors will also come into play.

Auto Loan Rates For Poor Credit

Theres no specific minimum credit score required to qualify for a car loan. Still, if you have poor credit, it could be difficult to get approved for a car loan. Even with the best auto loans for poor credit, watch out for high interest rates, which can make it very expensive to borrow money.

If you have time to build your credit before you apply for a car loan, you may be able to eventually get better rates. But if you dont have time to wait, there are some strategies that can help you get a car loan with bad credit.

- Consider a co-signer if you have a trusted family member or friend with good credit who is willing to share the responsibility of a car loan with you.

- Seek out alternative lenders, such as a credit union or an online lender.

- Ask the dealership if theres a financing department dedicated to working with people with poor credit.

- Use buy-here, pay-here financing only as a last resort.

If your credit could use some work, its especially important to shop around to find the best deal for you. Our auto loan calculator can help you estimate your monthly auto loan payment and understand how much interest you might pay based on the rates, terms and loan amount.

Compare car loans on Credit Karma.

Don’t Miss: Does Capital One Report Credit Limit

Credit Score: Is It Good Or Bad

Your score falls within the range of scores, from 580 to 669, considered Fair. A 582 FICO® Score is below the average credit score.

Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications. Other lenders that specialize in “subprime” lending, are happy to work with consumers whose scores fall in the Fair range, but they charge relatively high interest rates and fees.

17% of all consumers have FICO® Scores in the Fair range

.

Approximately 27% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

What Is A Bad Credit Score

The definition of bad credit depends on the lending institution. There are general credit score ranges that are considered to represent excellent, good, fair, and bad credit. But each lending institution sets its own standards.

For example, one lender may consider bad credit to be a score of less than 580. Another may see it as beginning at 620 and below. But in the vast majority of cases, a credit score of 500 or below will be considered very bad credit. That will severely limit your options as to where you can apply for credit and the types of credit you can apply for.

The specific issue with credit cards is that they are generally unsecured loans. If youre unable to pay your debt, theres no collateral the lender can go after to satisfy the unpaid balance. This is the reason lenders are so selective when issuing credit cards, and especially with those cards that have the best terms and benefits.

Don’t Miss: Can A Closed Account On Credit Report Be Reopened

Faqs About Bad Credit Loans

Getting approved for a loan when you have bad credit can feel like youve just been thrown a lifeline, but dont forget that it also comes with risks. Bad credit loans have higher interest rates and fees, and stricter penalties than do conventional loans, and there is far less room for error such as missing a payment.

Here are some other things you need to know about bad credit loans.

How Long Does It Take To Get A 582 Credit Score

It depends where you started out.

If you have poor credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

Don’t Miss: How To Delete Collections From Credit Report

Can I Get A Credit Card With A 582 Credit Score

Yes, you can get a credit card with a 582 credit score. Although youre in the fair credit range according to FICO, your choices will still be limited to secured credit cards, or unsecured credit cards with high fees and interest rates. Thats because unfortunately, credit card companies still treat fair credit as subprime.

You may be eligible for some cards that people with extremely bad credit wouldnt be able to get. However, its safest to pick cards with a pre-approval process so theres no risk of being rejected and triggering a hard inquiry, which will cause your score to temporarily drop.

Here are some that would be appropriate for a 582 credit score:

Your major choice will be selecting between two categories:

- Secured credit cards: Youll need to pay a deposit, which your creditor keep if you default on your debt. Its easier to apply for these because youre putting up collateral upfront.

- Unsecured cards with high interest rates: With these cards, youll likely be charged a very high interest rates and additional fees to compensate for the lack of a security deposit.

Even in the fair credit range, its better to go with a secured credit card. Unsecured subprime credit cards are dangerous because their high interest rates and fees can further jeopardize your finances.

Get A Secured Credit Card

As mention earlier, getting a secured credit card is a great way to establish credit. Secured credit cards work much the same as unsecured credit cards. The only difference is they require a security deposit that also acts as your credit limit. The credit card issuer will keep your deposit if you stop making the minimum payment or cant pay your credit card balance.

Also Check: Does Amex Plan It Affect Credit Score

Factors That Can Affect The Calculation Of Your Credit Scores

There are five main factors that can affect the calculation of credit scores. If youre interested in improving your credit, understanding what these factors are can help you create a plan to build healthy credit habits.

1. Payment History

How you manage your payments is one important factor used during the calculation of your credit scores. This includes how many accounts you have open as well as all the positive and negative information about these accounts. For example, if you make payments on time or late, how often you make late payments, how late the payments were, how much you owe, and whether or not any accounts are delinquent.

2. Outstanding Debt

Sometimes referred to as a , many credit scoring models take into account how high your balance is compared to your total available credit limit. Specifically when it comes to revolving credit, for examples credit cards and lines of credit.

3. Length Of Credit History

Your credit file includes how old your credit accounts are and will influence the calculation of your credit scores. The importance of this factor will differ depending on the scoring models, but generally speaking, how long your oldest and newest accounts have been open is important.

4. Public Records

Public records include bankruptcies, collection issues, liens, lawsuits, etc. Having these types of public records on your credit report may have a negative effect on your credit scores.

5. Inquires

Additional Reading