Contacting The Credit Agencies Directly

If you prefer, you can call the major credit agencies directly and request a credit report at no charge. However, the FCRA-mandated Annual Free Credit Reports are only available through the website and phone number above. In other words, you might have to pay if you contact a directly.

The only way to get your annual free credit report is to use AnnualCreditReport.com or the phone number above. If you go any other route, you may have to pay or subscribe to a private service.

If you need additional credit reports , numerous companies try to sell subscription services or paid reports. That said, you might not need those services.

Contact the credit bureaus:

What’s A Good Credit Score In Canada

A good credit score in Canada is any score between 713 and 900. Credit scores in Canada range between 300 and 900. There are five distinct categories that your credit score could fall into, ranging from poor to excellent. Having a good credit score can help you qualify for financial products at lower interest rates. Not sure where you stand? Check your credit score with Borrowell!

Where Can I Check My Credit Scores And Reports

There are a number of places where you can check your credit reports and scores. Just be aware that some of those places may charge you for the information. To check your credit scores or reports, you could:

- Sign up for a service like .

- Check what options are available from the credit bureaus or .

Monitoring your credit can help you understand where you stand. But itâs important to note that decisions about loan applications or credit cards are ultimately up to each lender. And because there are multiple scores and reports out there, what you see in reports and scores youâre given might not be exactly the same as what lenders use to judge creditworthiness.

Also Check: Is 700 A Good Credit Score To Buy A House

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Don’t Miss: What Credit Score Do You Need For Klarna

How Are Credit Scores Calculated

Reading time: 4 minutes

Highlights:

-

Payment history, the amount of credit youre using, and the length of your credit history are factors included in calculating your credit scores

While your credit score is important, it is only one of several pieces of information an organization will use to determine your creditworthiness. For example, a mortgage lender would want to know your income as well as other information in addition to your credit score before it makes a decision.

Other Credit Score Factors

Your Credit Mix

10 percent A combo of credit cards, auto loans, mortgage and personal loans is the mix of installment and revolving accounts that lenders look for in this category.

Your Credit Age

10 percent Older credit accounts in good standing are better. Creditors are able to see how well you manage the repayment of your debts.

Your Credit Inquiries

5 percent Who is checking your credit profile is a signal to lenders of how active you are in seeking new lines of credit. Checking your own credit scores and credit reports is not counted against you.

Recommended Reading: How Often Does Your Credit Score Update On Credit Karma

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

What About Free Credit Scores

There is no such thing as a free government credit score. Again, federal law currently provides free reportsbut not the scores that scoring models generated from the information in your reports. You won’t need to sign up for to access the scores either.

While going through the process of getting your free reports, you can buya credit score from each credit reporting agency if you want tothey will make it very easy to do so, and youll see several offers.

Read Also: How To Remove Timeshare Foreclosure From Credit Report

See What Impacts Your Rating

With the Credit Score Simulator Tool, you can try different credit scenarios to see how small changes can positively or negatively affect your credit score.

- See how new credit could impact you.

- Explore different ways to improve your current rating.

- Use it as often as you like with no impact to your rating.

What is a credit score? Your credit score is a good indicator of your financial health and reflects your ability to borrow money and repay it responsibly. Itâs one of the key tools that banks, credit card companies or other institutions use to determine whether you qualify for credit.

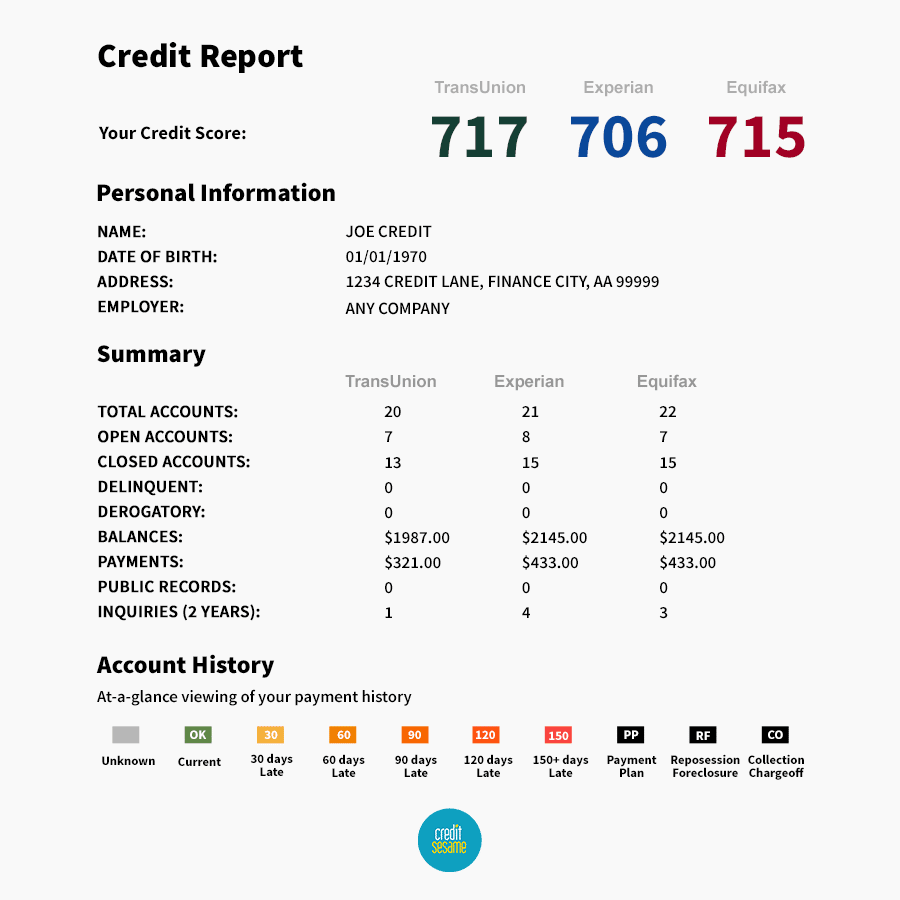

Whats The Difference Between A Credit Report And A Credit Score

Although they are interconnected, your credit report and credit score are separate.

Your credit report contains information about your credit accounts, including any balances you owe and your payment history. Your , on the other hand, is a three-digit number that usually ranges from 300 to 850. Credit scoring models, such as FICO, use the information listed in your credit reports to calculate your score.

Recommended Reading: How Often Does Apple Card Report To Credit Bureaus

What Do I Do With My Credit Report

Read it carefully. Make sure the information is correct:

- Personal information are the name and address correct?

- Accounts do you recognize them?

- Is the information correct?

The report will tell you how to improve your credit history. Only you can improve your credit history. It will take time. But if any of the information in your report is wrong, you can ask to have it fixed.

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Recommended Reading: How Long After Paying Off Debt Does Credit Score Change

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Challenging Your Information With Experian

Experian now holds two databases of consumer information this information is used by financial services providers when performing a credit assessment and in some instances a score enquiry on consumers. We receive consumer data from financial services providers when consumers make an application or update their details with the service provider. We also receive payment information that reflects consumer payment behaviour, such as if theyve made payments on time, have skipped payments or closed an account.

Read Also: How Often Can You Review Your Credit Report For Free

Why Trust Your Credit Score

The Experian credit score is derived from a credit bureau check, and includes your borrowing, charging and repayment activities. It summarises a number of positive and negative factors that aim to predict how likely you are to honour your credit commitments in the future.

A favourable credit report helps you reach your financial goals while poor credit reports and credit scores limit your financial opportunities. Since your credit report could influence whether you are able to buy a home or get any kind of credit, it is extremely important to protect your credit score by making loan and account payments on time and not taking on more debt than you can handle.

Key information used to calculate your credit score includes account information , public records, such as judgments and administration and sequestration orders. Information such as race, gender, where you live and marital status are not used in calculating credit scores.

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

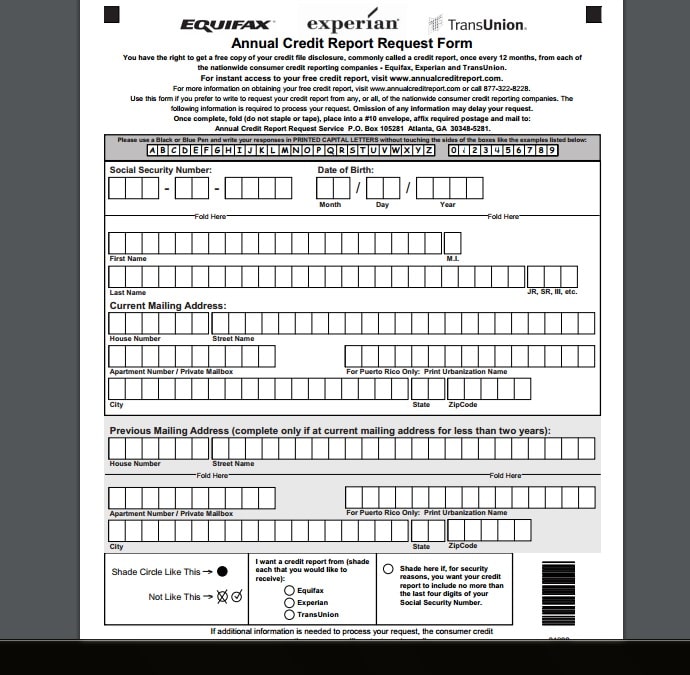

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report Is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

You May Like: Can A Closed Account On Credit Report Be Reopened

Option : Get Instant Online Access To Your Credit Report And Score

Both Equifax and TransUnion are now providing online access to your credit report for free. Equifax is also including a credit score as part of this free package. We’re not sure how long this offer will last, but it’s worth taking advantage of if you’re looking for either your credit report or your score. Here is where you can access Equifax’s free online credit score and report and TransUnion’s free online credit report. If either of these options don’t work for you, don’t worry. It doesn’t mean you’ve done anything wrong, it just means that you’ll have to try one of the other methods listed below. It’s possible that for some reason the information you entered doesn’t perfectly match the credit reporting agency’s records.

How To Get A Free Credit Report From Annualcreditreportcom

AnnualCreditReport.com is the only website authorized by the federal government to provide you with your free annual credit reports from Equifax, Experian and TransUnion. This website is also where you can access a free copy of your credit report each week until April 20, 2022.

Once youre ready, head to AnnualCreditReport.com on a private, secure internet connection. Do not enter sensitive information while connected to public Wi-Fi, even if you trust the website. And do be sure that youre on the correct webpage, as there are many look-alike sites that will try to harvest your personal information.

From the home page, click on Request your free credit reports. Youll need to complete three main steps to access them, which shouldnt take you more than five or 10 minutes if you have all of your personal information memorized or have the necessary documents nearby.

The first step is to fill out an online request form. You will need to provide the following information:

- Your phone number

- Your current address

- And your previous address if youve lived at your current residence for two years or fewer

The second step is to select which of the three you would like a credit report from. You can select one or all three, if youd like.

Lastly, you’ll need to answer a few questions to verify your identity for each of the credit bureaus you selected.

Repeat this process as necessary for each credit bureau.

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

You May Like: Does Applying For A Loan Affect Your Credit Rating

Why Is It Important To Check My Credit Report

Its important to check your credit report because credit reporting mistakes happen. They can be the result of a creditor reporting inaccurate information or a sign of identity theft. If the error lowers your , it can decrease your approval odds when applying for a loan and it could prevent you from securing the best rate.

Vantagescore 30 Credit Score Factors

Different credit scores can have a lot in common under the hood, but each individual scoring modeluses its own combination of factors to determine your score.

Here are the major factors that determine your VantageScore 3.0 credit scores.

Payment history The biggest factor in your scores is your history of paying bills on time. Late or missed payments in your credit history could affect your scores significantly.

Age and type of credit A longer credit history, particularly with the same accounts, shows lenders that youve been able to stick with your accounts over time. Lenders may also consider it a plus if you have a mix of credit accounts with positive use.

Your measures the amount of credit you use relative to the amount available to you. Most experts recommend shooting for a rate below 30%, meaning you use less than 30% of your available credit.

Balances Similar to credit utilization, this factor takes into account your total balances across your accounts but in terms of the dollar amount and not the percentage. If you already owe a fair amount elsewhere, lenders may be less inclined to extend more credit to you.

Also Check: What Does Settled Mean On A Credit Report

What Goes Into A Credit Score

Each company has its own way to calculate your credit score. They look at:

- how many loans and credit cards you have

- how much money you owe

- how long you have had credit

- how much new credit you have

They look at the information in your credit report and give it a number. That is your credit score.

It is very important to know what is in your credit report. If your report is good, your score will be good. You can decide if it is worth paying money to see what number someone gives your credit history.

Your credit history is important. It tells businesses how you pay your bills. Those businesses then decide if they want to give you a credit card, a job, an apartment, a loan, or insurance.

Find out what is in your report. Be sure the information is correct. Fix anything that is not correct.

Why Are Your Credit Score And Report So Important

Your credit report is like your financial report card, and your credit score is like your final grade. In Canada, banks and lenders review your credit when you apply for financial products. Your credit report can also be pulled by car dealerships, insurers, cell phone companies, landlords, and future employers to determine your ability to manage debt and meet financial obligations. Because of this, it’s important to know your credit.

Recommended Reading: Can Employers Pull Your Credit Report

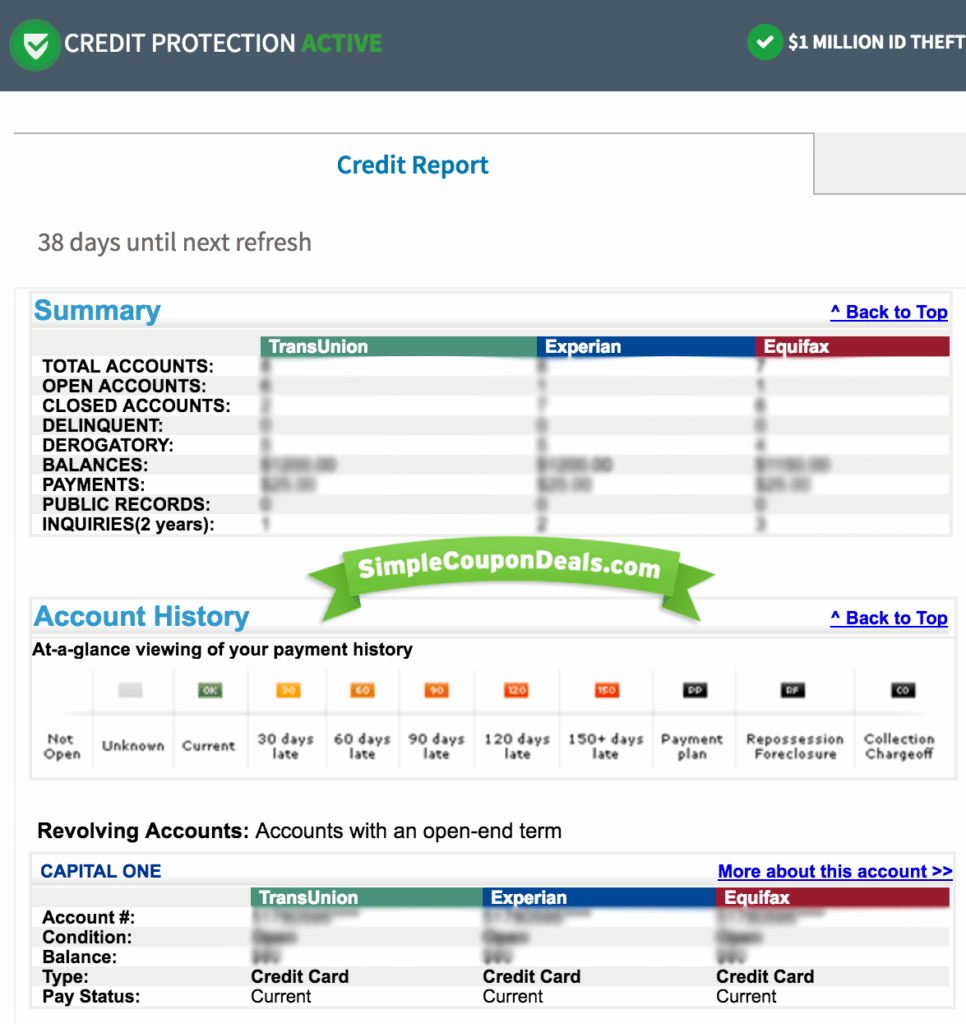

Freescoreonlinecom Helps You Keep An Eye On Your Credit Scores With:

Immediate access to your Experian, TransUnion and Equifax scores and reports, and updates so you can quickly spot unauthorized credit accounts opened in your name.

Daily credit monitoring for suspicious activity and alerts notifying you of changes.

Our online Dispute Center to learn how to dispute any inaccurate information on your reports.

$1 million in Identity Theft Insurance* to help you recover your good name should identity thieves strike.

The Scores To Go® app, which lets you check your current scores and reports from TransUnion, Equifax and Experian anytime on your mobile devices.

FreeScoreOnline® and ScoreSense® are registered trademarks of One Technologies, LLC.

One Technologies, LLC is the proud owner of this website. For a complete list of our properties,

*Identity Theft Insurance underwritten by insurance company subsidiaries or affiliates of American International Group, Inc. The description herein is a summary and intended for informational purposes only and does not include all terms, conditions and exclusions of the policies described. Please refer to the actual policies for terms, conditions and exclusions of coverage. Coverage may not be available in all jurisdictions.

After verification of your identity, your scores are available for secure online delivery in seconds.