How Long Does It Take To Lift A Credit Freeze

If you make the request online or by phone, the three major credit bureaus are required to lift the freeze within an hour. The request can be done by mail, but note that this is a longer process. The credit bureaus, however, are required to remove the freeze within three business days of receiving notice.

If you are making the request on behalf of a minor, note that submitting a request to lift a credit freeze can only be done by mail.

Who Can Access My Credit Report If Its Frozen

As a reminder, a freeze on your credit report will prevent lenders and creditors from accessing your credit history. So, dont expect to get approved for a personal loan, auto loan, home loan, or a new credit card as long as the freeze is in place.

Entities that can access your credit report even with a credit freeze in place include the following:

- The company that provides or monitors your credit report

- The government and courts

- Companies investigating individuals for possible fraud

- Collection agencies

When Do You Need To Unfreeze Your Credit

If you can ask TransUnion to freeze your credit report, you also have the option to thaw or unfreeze it.

Here are the reasons to lift the freeze on your credit report:

- If youre applying for a loan. Lenders and credit card issuers need to check your creditworthiness and pull your credit report to help them decide whether to approve your application or not.

- If youre going apartment or house hunting. Whether youre planning to buy or rent, landlords and creditors providing home loans need to access your credit history.

- If youre applying for utility services. Utility companies may conduct a credit check if you wish to install new services on your new home.

- If youre buying a new phone. Cell phone providers will check your credit report first if you want to purchase a new phone in installments.

- If youre looking for a job. Employers may check your credit report, especially if youre applying for a job that deals with money all the time.

Keep in mind that removing the credit report freeze means you wont be protected from possible identity theft and fraud. Unfreeze your credit only if you have to and for a limited time only until youve fixed the problem with your compromised information.

Can I freeze or Unfreeze my Credit Reports on All Major Credit Bureaus at One Time? No. You have to get in touch with each of the credit reporting agencies to freeze and unfreeze your credit report.

Also Check: How To Dispute Your Credit Report

How To Unfreeze Your Credit Reports

In most states, a credit report freeze is in place until you request it be removed. You have two options for removing a credit freeze: either a temporary lift or removing it altogether. If you have a specific reason for removing a credit freeze, like those mentioned above, a temporary lift may be the smarter option.

The credit bureaus have three days to remove a freeze after youve submitted your request, and it may cost money to have a freeze temporarily thawed . With each credit reporting agency, the process differs slightly.

Each Of The Major Credit Bureaus Is Slightly Different

Heres a guide to unfreeze your credit with Equifax, Experian and TransUnion. The three major credit bureaus are all different. So, you have to unfreeze your credit with each bureau individually.

Note: If your credit issuer lets you know which credit bureau they are going to use, then you can choose to thaw just that one.

The first big difference is with Experian. According to the bureau you need to create a personal identification number, or PIN, to unfreeze your Experian credit report.

TransUnion and Equifax, however, now require you to set up online accounts to freeze or unfreeze your credit reports with them.

Also Note: If your account was previously frozen and you were issued an Experian PIN, the bureau will direct you to establish a password-protected account. This account will let you manage your freeze within their portal.

Read Also: Can You Buy A House With A 600 Credit Score

Facts About Security Freezes

Reading time: 3 minutes

- Security freezes are now free under federal law

- Freezes must be placed separately at each nationwide credit bureau

- Freezes will not impact your credit scores

A security freeze, also known as a credit freeze, is one way you can help protect your personal information against fraud or identity theft. While you may know that, and may even have a security freeze on your credit reports, here are some facts you may not know about security freezes.

1. Security freezes are free

A federal law that went into effect in September 2018 made placing, temporarily lifting, or permanently removing a security freeze free nationwide.

2. Security freezes and fraud alerts are not the same

A fraud alert is a notice placed on your credit reports that alerts credit card companies and others who may extend you credit that you may have been a victim of fraud, including identity theft. With a fraud alert, if anyone including you! tries to open a new credit account in your name or make changes to an existing account, the company must take reasonable steps to confirm your identity, such as contacting you by phone at a number you provide, before granting the request.

With a security freeze, your credit reports cannot be accessed to open new credit unless you temporarily lift or permanently remove the credit freeze.

3. Security freezes must be placed separately at each of the three nationwide credit bureaus

4. Security freezes can be temporarily lifted

A Credit Freeze Can Help Protect Against Identity Theft

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Protecting your credit is important since your can impact your financial life in many ways. A credit freeze is a security measure you might consider if you want to prevent unauthorized people from accessing your credit file. Freezing and unfreezing your credit is a relatively simple process, but it helps to understand how it works to know when it’s the right move.

Don’t Miss: What Credit Score Do You Need For Chase Sapphire

Pros Of Locking Your Credit

- A credit lock can reduce your chances of becoming an identity theft victim, since lenders cant check your credit reports while theyre locked.

- You can lock and unlock your reports yourself at any time, making it faster than a freeze if you need to authorize a legitimate credit check.

- TransUnion and Equifax allow you to lock and unlock your credit for free.

Recommended Reading: How To Remove Child Support From Credit Report

Temporary Lift Vs Permanent Lift

When lifting a credit freeze, you have a choice between a temporary lift and a permanent lift.

A temporary lift allows creditors or companies access to your credit reports within a specific date range, determined by you. This option is likely the smarter choice because you can set it and forget it. Once the temporary lift expires, the credit freeze is reinstituted without your having to do a thing, which can help keep you protected.

A permanent lift is a little bit of a bigger deal. Your once-frozen and secure credit reports are now more vulnerable. With the option of a temporary lift available, a permanent removal is not recommended if you have any reason to be concerned about the security of your information.

You May Like: How To Remove Inquiries From Credit Report Sample Letter

Create An Account On Transunions Credit

The process starts at TransUnions credit-freeze page. Click Add freeze, after which you can create an account if you dont already have one.

To create an account, provide your name, address , date of birth, and the last four digits of your Social Security number. Using a strong and unique password is crucial, as is storing it securely for future logins.

When You Should Freeze Your Credit

If you think your personal information was exposed in a data breach or have other reasons to believe youre at risk, a credit freeze helps you gain control of the situation. Youll need to file a freeze request with all three credit bureaus: TransUnion, Equifax and Experian.

The biggest benefit of freezing your credit is that it stops malicious actors from using your name and Social Security number to open new financial accounts that could seriously harm your credit and ability to borrow.

Another bonus is that freezing your credit does not affect your score, so you can stay safe without your creditworthiness taking a hit. Although freezes used to carry a fee, they are now free to initiate, so you arent losing money by protecting your finances and your identity.

A freeze doesnt interfere with any accounts you already have, so you can continue using your credit cards as usual. However, even your existing creditors wont be able to open new accounts for you while the freeze is in place.

Don’t Miss: How To Read A Credit Report

Why Is My Credit Locked

A report lock or has the same impact on your reports as a security freeze, but isnt exactly the same. A report lock generally prevents access to your reports to open new accounts. If you want to apply for , you must unlock your report to allow a check.

What is an excellent credit score? For a score with a range between 300-850, a credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent. Most credit scores fall between 600 and 750.

Triple Check Your Personal Information

It may be simple, but scanning through the personal information section is crucial. Make sure your full name, address, and date of birth is accurate, along with your social insurance number.

There may be a risk that your information could be linked to another person, especially if you share an identical name or a common name.

There could be two reports out there tied to you and you dont know which one is making its way into your bankers hands.

Your employment is listed, too. Anytime you apply for a credit product, youre asked about your employment and income.

Don’t Miss: Is 701 A Good Credit Score

How To Freeze Your Credit Report After Identity Theft

Freezing your credit report is sometimes necessary. It can help prevent identity thieves from opening new lines of credit and other accounts in your name. Its often recommended when youre dealing with the ramifications of identity theft.

A credit freeze allows you to restrict access to your credit report. When you freeze your credit file, you prevent potential creditors from accessing certain financial and personal information. Creditors are unlikely to let you or an identity thief open, say, a new credit card, if they cant access your credit report. Thats because they wont be able to assess your creditworthiness.

If you need to freeze your credit, you can get a free credit freeze by requesting one at each of the three major credit reporting agencies. More on that later.

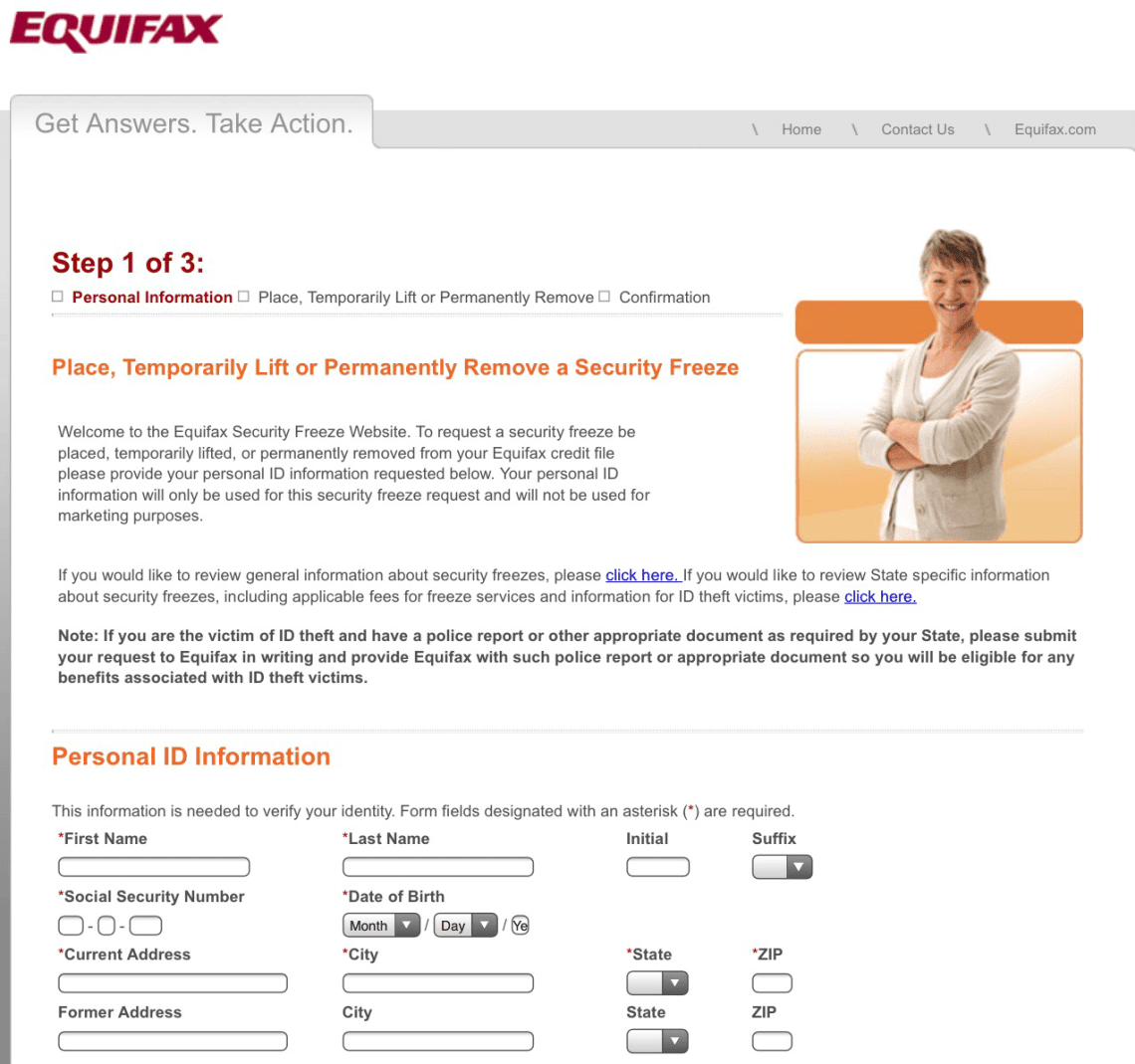

How To Unfreeze An Equifax Credit Report

The quickest way to manage freezes on your Equifax credit report is by heading over to Equifaxs Security Freeze center. Though, you can also remove a credit freeze via phone or mail. Freezing and unfreezing your credit report by phone requires you to prove your identity via answering security questions or confirming a one-time code sent by text message. To unfreeze credit via mail, fill out Equifaxs security freeze request form.

Read Also: How To Get Late Payments Off Your Credit Report

How A Credit Freeze Works

When you freeze your credit with the three major national Equifax, Experian, and TransUnionyou’re essentially telling them that you don’t want just anyone to be able to access your credit file. Again, there are some exceptions to who can and can’t see your credit file while a freeze is in place.

A credit freeze can stay in place for as long as you want it to it’s up to you to decide when to lift it. Freezing your credit is now completely free, thanks to a 2018 change in the law. Previously, there was a fee to freeze and unfreeze your credit.

What To Do After The Thaw

A lost cell phone, the handiwork of identity thieves, or just a balance transfer gone awry can all create a situation where you put a freeze on your credit. But when coming out of that deep freeze, youll want to keep a close eye on your activities.

Thats why you should consider credit monitoring. Check your credit report for free, every week. And pay close attention to any and all changes. Having a good credit score is important and monitoring changes to your score is one of the keys to rebuilding or re-establishing a good credit history.

Continental Finance is one of Americas leading marketers and servicers of credit cards for people with less-than-perfect credit. Learn more by visiting ContinentalFinance.net

You May Like: How To Get Public Records Removed From Credit Report

How Do You Unfreeze Credit At All Three Major Credit Bureaus

In order to place or remove a credit freeze on your credit reports, you must contact each of the 3 major individually. Unfreezing your credit is free and can be fast and easy, as long as you have carefully safeguarded your account passwords or PINs.

You can request to unfreeze your credit online, by phone, or by mail. Youll need to provide information like your name, address, birthdate, and Social Security number in order to place a freeze or lift one.

Heres a rundown of how it works at Equifax, Experian, and TransUnion:

How To Unfreeze Your Credit

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you placed a in order to prevent people from accessing your credit reports, you may want to reopen your credit files at some point for instance to apply for a new car loan, get a credit card or rent an apartment.

To allow a credit check, youll need to unfreeze your credit. Doing so is free and takes little to no time when done online.

You May Like: How To Make Your Credit Score Go Up

When Should I Freeze My Credit

If youve been a victim of identity theft, you have more than one option to consider when it comes to protecting your credit. In many cases, a security alert may be sufficient.

When you place a security alert, also known as a fraud alert, you can add a telephone number so lenders can call you when they receive an application and verify that its you who is applying. You also can request additional free credit reports when you add an initial security alert or victim statement. Reviewing your report can help you determine whether or not you are a victim and help you take appropriate action.

In more extreme cases in which youre experiencing ongoing fraud attempts, you may feel a security freeze is necessary.

Its worth considering taking action to protect your credit if:

- Unexplained bills or collection notices are mailed to your address, in your name or under anothers name.

- New inquiries or credit accounts appear on your credit report, indicating activity with lenders or other companies you dont recognize.

- Your bank or credit union notifies you about fraudulent activity on an account.

- You receive notification that you are or could be the victim of a data breach.

Before you proceed with a credit freeze, however, you should know that a better solution for many victims of identity theft may be to enact whats called a fraud alertmore on that later.

Heres what you know about how to freeze your credit, and how to decide whether or not you should.

How To Thaw Your Transunion Credit Report

Once you freeze your TransUnion credit report, you can unfreeze it with just a few clicks. Its an easy process that doesnt require you to answer any verification questions .

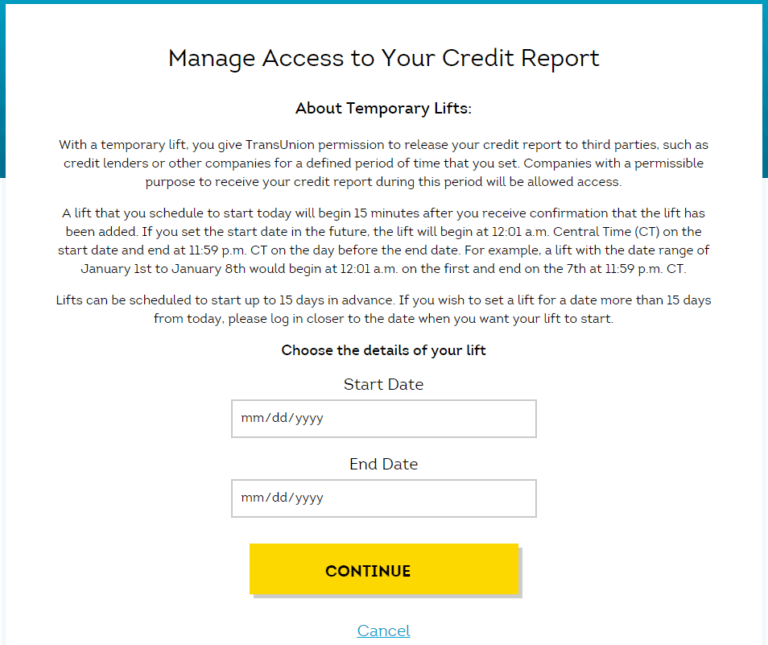

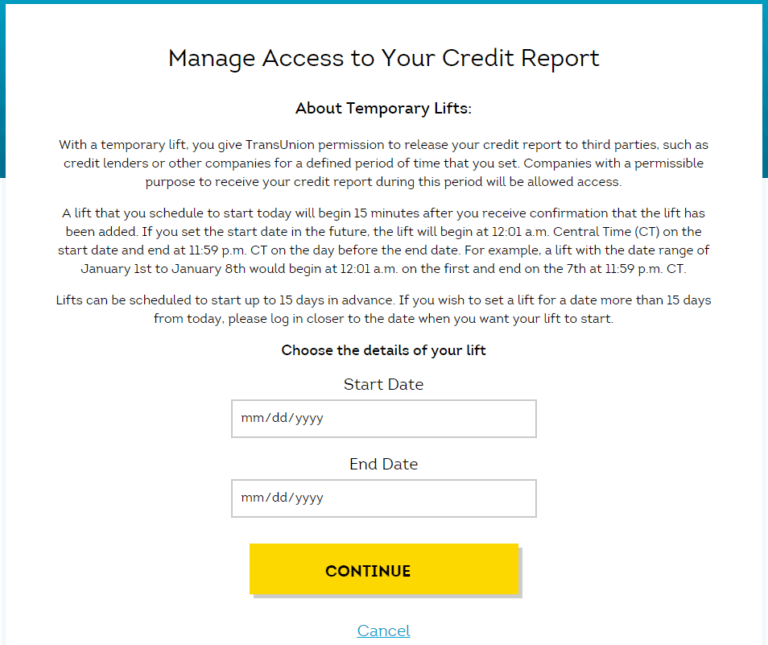

To begin, log in to your TransUnion account. You should see two available options: Remove freeze or Temporarily lift freeze.

When you select Remove freeze, you encounter a tiny speed bump: TransUnion asks if youd like to temporarily lift your credit freeze instead. Its a consumer-friendly prompt, and a reminder that temporarily thawing your credit report might be better for you than removing your freeze altogether.

If you decide to temporarily unfreeze your TransUnion credit report, you then have to select your start and end dates. Consider when you might need to apply for a loan or credit card, and try to time your thaw accordingly. Dont stress over this too muchyou can always unfreeze your report again.

If you choose to permanently unfreeze your credit report, set a calendar reminder to freeze it later.

You can also freeze and unfreeze your TransUnion credit report over the phone. Call 888-909-8872, and have your PIN available.

If you prefer an old-fashioned letter, include your name, address, and Social Security number with your request, and mail it to:

TransUnion

Read Also: How To Get Hard Inquiries Off Credit Report