Removing Inquiries From Your Report

Most hard inquiries stay on consumer credit reports for 24 months. Yet its sometimes possible to remove them sooner. The Fair Credit Reporting Act gives you the right to dispute questionable items on your credit reports including unauthorized inquiries with the three consumer credit reporting agencies. Unauthorized business inquiries can be disputed too, but its not always helpful.

But keep in mind that inquiries generally have a small impact on credit scoresless than 5-10 points for each hard inquiry and often less. In addition, most credit scoring models ignore inquiries that are more than a year old, even if they still appear on credit reports.

How To Remove Negative Items Related To Identity Theft

If you believe youve been a victim of identity fraud, you should first file a dispute with the Federal Trade Commission online at IdentityTheft.gov or by phone at 1-877-438-4338. You should also file a police report.

After you report the incident, make sure to take the following steps:

- Request a copy of your credit report through AnnualCreditReport.com

- Look out for unauthorized transactions or new accounts that dont belong to you

- Contact the credit bureaus through phone or mail to dispute any credit information that doesnt belong to you

- Place a security freeze and fraud alert on your credit report

- Contact creditors to close compromised accounts

- Consider subscribing to an identity theft protection or credit monitoring service

Will Disputing An Inquiry Improve Your Credit

In the case of fraud, it is always important to take steps to investigate the unauthorized inquiry as this can help prevent future fraudulent activity. There is no guarantee that disputing the inquiry will impact your credit score. FICO estimates that a single inquiry has less than a 5 point impact on your credit score.

Hard inquiries are part of what makes up the New Credit portion of your credit score. However, this factor accounts for only 10% of your overall credit score. Not all hard inquiries are weighted the same way. Newer inquiries have the most significant impact. Once inquiries are 1 year old, they no longer affect your credit score. And after 2 years, they fall off your credit report.

Read Also: What Is A Middle Credit Score

Search For Unauthorized Hard Inquiries

Once you have copies of your credit reports, review them for mistakes, errors, and fraud. Search for credit accounts you dont recognize, incorrect credit reporting on valid accounts , and other mistakes. Finally, check your credit reports for unauthorized inquiries.

If you discover inquiries you dont recognize on your credit report, it could be a sign of identity theft. Make a list of any suspicious inquiries you find. Youll need this information to complete the next step.

Will Removing A Hard Inquiry Improve Your Credit Score

Jason Mikula learned the hard way how to remove inquiries from credit reports â after he had become a victim of identity theft. The financial technology professional battled unrelenting identity thieves throughout 2021 after noticing two unauthorized hard inquiries on his credit report.

As Mikula worked with authorities to close fraudulent accounts and rebuild his creditworthiness, one thing became clear.

It’s far too easy for identity thieves to open new credit accounts in your name and tank your credit score. Victims grappling with the aftermath of identity theft have a long and grueling remediation process ahead of them.

While removing inquiries doesnât guarantee an improvement in your credit score, leaving suspicious credit pulls or errors undisputed on your report can be problematic.

You May Like: Is 676 A Good Credit Score

You Bought A Car From A Dealership

You may notice multiple hard inquiries in a short period after taking out an auto loan to buy a car. This indicates that the dealership sent your application to multiple lenders to find the best deal.

Although youll receive multiple hard inquiries in situations like this, theyll count as one for the purpose of your credit score. When you receive multiple hard inquiries for a certain type of loan within a short period, both FICO and VantageScore treat them as a single inquiry. This way, youre not penalized for shopping around to find the best rates.

FICOs shopping period is 14 days in older models and 45 days in newer models, whereas VantageScores is 14 days. 34

The Impact Of Identity Theft On Your Credit Report

Identity theft when someone steals your personal information and uses it to open new financial accounts can wreak havoc on your credit. These new accounts show up on your credit record and hurt your score, especially if theyre delinquent or if the identity thief applied for several in a short amount of time.

Cleaning up your credit after identity theft can take anywhere from several months to years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. This is why keeping a close eye on your report and learning how to protect yourself from identity theft will help you to keep your information safe.

Read Also: When Do Banks Report To Credit Bureaus

Why Do Hard Inquiries Hurt Your Credit

Hard inquiries signify that youre trying to get new credit. Thats not a bad thing except when you do so incessantly, then its a red flag.

It tells lenders you are desperate for money and may not pay your bills on time or at all.

Hard inquiries dont hurt your credit a ton, but five points here and there adds up. If you dont do it right you could knock your score down quite a bit just because you apply for credit too often.

Instead, only apply when you need the credit and when it makes sense to do so.

In short, dont apply for every credit opportunity that comes your way it makes you look desperate to lenders when you really do need the money, say for a car loan or mortgage.

Why Use Donotpay To Remove Inquiries From Your Credit Report

Credit companies may be reluctant to assist you if you experience identity theft or a similar problem because everyone would like to see their credit score improved, and proving that your situation is completely beyond your control is often difficult or even impossible. DoNotPay’s high level of expertise assisting people like you with removing errors from your credit report makes us one of the most convenient options you have for quickly solving problems that are unfairly impacting your credit score. Our credit inquiry removal and other credit repair services are:

- Easier than having to contact credit companies multiple times

- Faster than waiting for credit companies to respond to you

- More successful than trying to convince credit companies that a particular inquiry is an error on your own

Read Also: How To Get Charge Offs Removed From Your Credit Report

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Hire A Credit Repair Service

Disputing errors can be time consuming, especially if your history has several mistakes or if you were a victim of identity theft. Reputable credit repair companies such as , Lexington Law or Sky Blue may be viable solutions if your file is riddled with inaccuracies.

Credit repair services can help you dispute inaccurate negative information and handle creditor negotiations. However, if you decide to hire a credit repair agency, remember there are consumer protection laws that regulate how they operate and what they can do. The establishes the following regarding credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the services they provide

- They cannot charge for their services until they have been completed

- There must be a written contract detailing the services theyll provide, the time frame in which these services will be provided and the total cost for them

- They cannot promise to remove truthful information from your record before the term set by law

- You have three days in which to review the contract and cancel without penalty

You May Like: Which Credit Report Does Apple Card Pull

How To Dispute A Hard Inquiry

Itâs frustrating that these errors hurt your credit score. Luckily, you have the opportunity to dispute a hard inquiry. A successful dispute will get it removed from your credit report.

If you have not reviewed your credit report, you can get a free one from AnnualCreditReport.com. When you see an error on a copy of your credit report, you should report it immediately. This can lead to a credit inquiry removal, where the inquiry gets taken off your record. Your credit report is not just used by credit card companies to consider whether to give you new credit or when you file a loan application. Many other corporations can file credit inquiries on you, such as employers, insurance companies, utility service companies and other businesses. So, itâs important to take steps to protect your own credit.

When filing a dispute, you will likely go through three major credit bureaus: Experian, Equifax and TransUnion. They compile your financial information by looking at your record with lines of credit, your car loan and other financial factors to create a credit report, which reflects your credit score.

These three bureaus gain information about your credit history through a few ways. Creditors will report data to Experian, Equifax and TransUnion. The credit bureaus also buy data from various databases. Finally, Experian, Equifax and TransUnion will all share information between each other.

How To Remove Inquiries From Your Credit Report On Your Own

Under most circumstances, you will not be able to remove legitimate hard inquiries that you made or approved from your credit report on your own. Although these inquiries will have an impact on your credit report until they resolve themselves, they will usually only remain on your credit report for two years. While this is a much shorter amount of time than many other categories remain on your credit report, you should not have to deal with them for two years if they were the result of identity theft, mistakes, or other types of fraud.

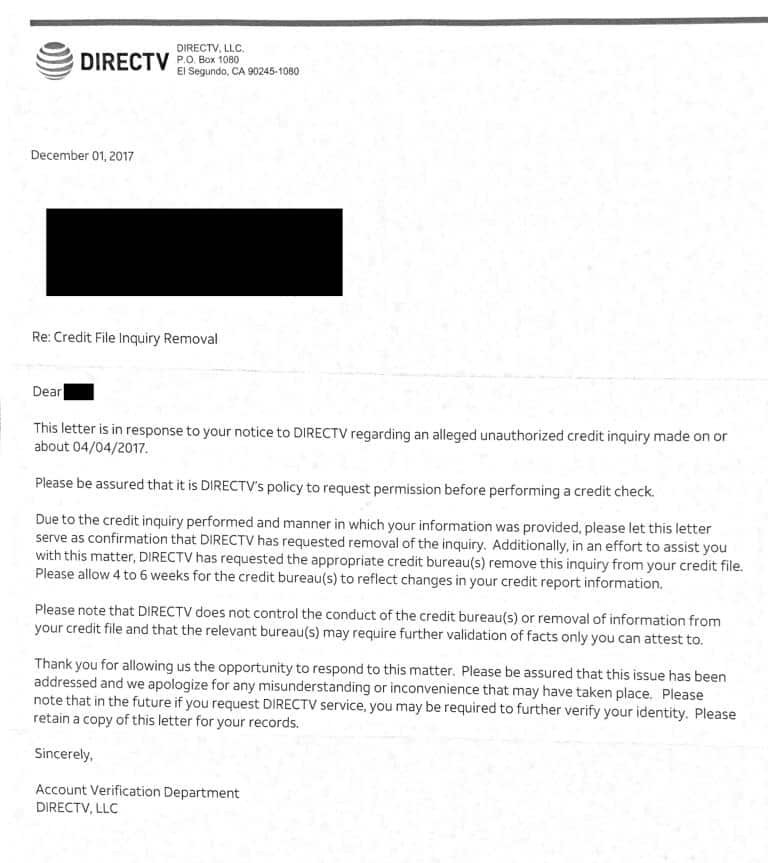

Attempting to deal with credit companies on your own can be a lengthy and difficult process. If you have experienced identity theft or otherwise do not recognize a particular inquiry, you may be able to have it removed by getting in touch with the lender or credit company and providing sufficient evidence that you did not request or approve a particular inquiry.

Don’t Miss: Do Utility Bills Show On Credit Report

Not All Incorrect Inquiries Indicate Fraud Aura Can Help

While not every unfamiliar credit check is fraudulent, even honest credit reporting mistakes can harm your credit score â which can then lead to your being denied a credit card, car loan, or student loan.

Order your free credit report via AnnualCreditReport.com or by calling 1-877-322-8228. Remember, the free credit reports don’t include your credit score â you may need to pay to get that information from one of the three bureaus.

You can save a lot of time and hassle when you use an identity theft protection service that monitors your credit 24/7 for signs of fraud.

With Aura, youâll get:

- Rapid credit monitoring and fraud alerts â Receive alerts for suspicious activity on all your bank and credit accounts and credit reports. Aura alerts you to any issues 4x faster than any competing digital security provider.

- Virtual Private Network with malware protection â Keep all your devices safe from hackers by browsing with Wi-Fi protection and military-grade encryption.

- Instantly lock your credit report â Prevent unauthorized credit report inquiries with our one-click credit lock feature.

- Dark Web scanning â Check your personal data exposure to ensure that your SSN or credit card numbers are not at risk.

- $1,000,000 identity theft insurance policy â Get comprehensive coverage for eligible losses resulting from identity theft.

For ironclad identity theft protection and credit monitoring, try Aura.

Obtain Free Copies Of Your Credit Report

You can order free credit reports once a year from each bureau. The three bureaus often record the same information. But sometimes, there are differences so it’s essential to check all three reports carefully for signs of identity theft.

What to do:

- Get into the habit of checking your credit every few months to safeguard against fraud.

- Visit AnnualCreditReport.com to order your free credit report.

- Order a credit report from all three bureaus every year â each bureau version includes your credit score.

You May Like: How To Check Your Child’s Credit Report Free

How To Remove A Hard Inquiry

Last updated Aug. 25, 2022| By Larissa Runkle

FinanceBuzz is reader-supported. We may receive compensation from the products and services mentioned in this story, but the opinions are the author’s own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies.

Your credit score is affected by a number of factors, and credit inquiries are one of them. If youve recently found a hard inquiry on your credit report, you might be wondering why it happened and if youre worried about your score how to get that hard inquiry removed.

But credit inquiries happen for a variety of reasons and not necessarily bad ones. They make it possible for you to get approved for new loans or credit cards and also to check your own .

The main thing to keep in mind is that not all credit inquiries are the same, and they wont all negatively affect your credit score. In this article, well go over the different types of inquiries that exist and how you can manage them to protect your credit score.

How To Remove Credit Inquiries

Did you make a credit inquiry to raise your credit score? Credit inquiries can actually lower your credit score. Dont get caught in the trap of having too many credit inquiries draining your credit score. We will walk you through how to remove credit inquiries.

Don’t Miss: Does Affirm Show On Credit Report

Check Your Credit Report Regularly

It isn’t common to find inaccurate information on your credit report, but it can happen. To avoid letting fraudulent and other erroneous information go unchecked, make it a goal to check your credit report regularly. Review what’s listed and watch out for anything you don’t recognize.

Also keep an eye on your credit score , and watch out for sudden drops that could indicate fraudulent activity, such as a bogus account opened in your name that’s gone unpaid.

It’s not always possible to prevent identity theft, but as you keep track of your credit history, you’ll be in a better position to stop a difficult situation from getting much worse.

How To Dispute A Hard Inquiry On Your Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If youve checked your credit reports, you may have noticed youre not the only one taking a peek.

-

Utilities use them to decide whether to charge you a deposit.

-

Companies may check your credit standing so they can market products to you.

-

Potential landlords and employers may look to see how reliable you are.

Inquiries stay on your report for two years, but not all of them affect your score. Heres what you need to know about when and how to remove a hard inquiry from your credit report.

Also Check: How To Cancel Experian Credit Report

How Much Does A Hard Inquiry Affect My Score And When Will It Go Away

How long a hard inquiry sticks around on your score and the damage it can do will depend on a few things. To start, having multiple hard inquiries tends to be more damaging for those with relatively short credit histories than for those with longer ones. So if you havent been using credit for very long and only have a few accounts open, you may want to avoid making too many hard inquiries all at once.

As far as how much these inquiries can affect your score, the general agreed-upon value is that hard inquiries may lower your credit score by a maximum of five points. However, according to FICO, a single hard inquiry may not even lower your credit score at all, meaning not every hard inquiry results in an automatic drop of five points.

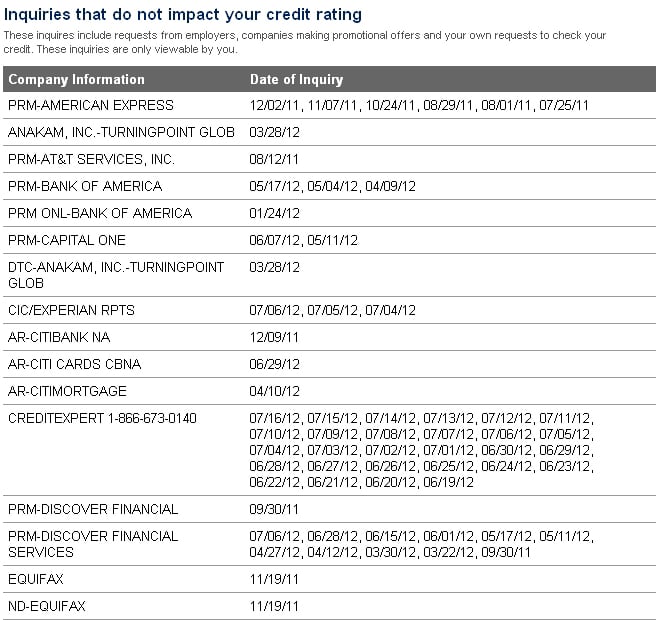

All inquiries, both hard and soft, will stay on your credit report for two years from the date of the inquiry, but hard inquiries will only affect your score for the first year. Even though both types of inquiries stay on your credit report for some time, you dont need to sweat the soft ones. Föehl says, While hard inquiries generally impact your credit score and are included in a copy of your consumer report provided to others, soft inquiries do not impact your credit score and are not included. So even though the soft inquiries might be there, no one is going to see them.