Look For Judgments On A Tenants Records

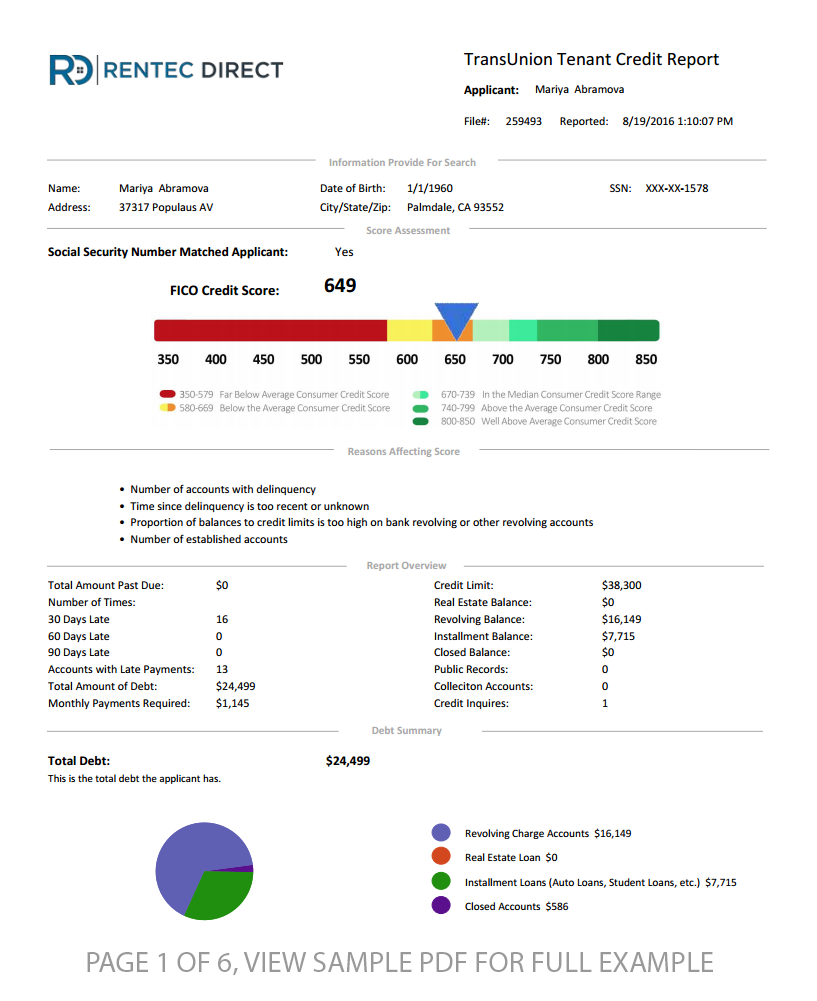

When you pull the credit file for a tenant, you may not see an eviction in place. What you may see in its place is a judgment from a lawsuit that was initiated by one of the previous landlords of that potential tenant instead. You may need to pull credit reports from all 3 major credit reporting agencies in the US to verify judgment records.

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Is There A Deadline For Filing An Eviction Dispute Claim

There shouldnât be a deadline for filing an eviction dispute claim. However, the longer you wait to file dispute claims with the credit bureaus, the more difficult it could be to win your case. Thatâs because you may no longer be able to access the records necessary to win the case.

For example, if you need to show bank or credit card statements to prove that you paid your rent 24 months ago, but your bank or credit card statements online only go back 12 months, you might be out of luck.

Likewise, the credit bureaus may question why you waited so long to file a dispute. It might be because you didnât notice the incorrect or erroneous information until later on. That may be the truth, but waiting a long time to file a dispute sure doesnât help your case.

When filing a dispute, you should still check with Equifax and TransUnion to see if there are any important deadlines to be aware of. If the credit bureaus request supporting documentation and you donât provide it, your dispute could automatically be closed after 30 or 60 days for failing to respond.

You May Like: Does Having Multiple Credit Cards Affect Your Credit Rating

How Does An Eviction Affect My Credit

In most cases, an eviction will not directly affect your credit score. However, some events caused by the eviction may appear on your credit report, and a prospective landlord may see your rental history detailing your eviction. For example, if the landlord sues you for violating the lease agreement, a record of this civil action could appear on your credit report.

If you are looking for a new apartment, a landlord will investigate your application using trusted rental reporting companies such as Experian RentBureau or TransUnion Smartmove. Conveniently, these bureaus give a separate rent history report whose details do not appear on your credit report.

Having said that, an eviction can affect your credit score if the landlord employs a collection agency to collect the rental debt. The agency will open an account with the credit bureaus, and the debt entry will lower your credit score unless you enter into a pay-for-delete agreement with them.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: When Will Chapter 7 Bankruptcy Be Removed From Credit Report

Is Eviction On My Credit Report

If you fail to pay what you owe and your account is sent to collections, the collection action will show up on your credit reports. That negative mark can damage your credit standing, and it can stay on your credit report for seven years. Because your is based on the information in your , you might suffer some score damage.

Evictions are not part of credit reports, but some tenant-screening services are run by . Your landlord might report things like late rent payments or rule violations unauthorized guests, for example to a tenant-screening service. And landlords may check both credit and tenant reports when a potential tenant applies.

You have a right to see what is in your tenant reports once every 12 months per company. The Consumer Financial Protection Bureau has a list of credit screening companies with contact information. If theres an eviction listed on your tenant reports, it typically stays there for seven years.

Going It Alone When Disputing An Eviction On Your Credit Report

Before you start dialing up your old landlord to begin sorting this issue out, know this. The eviction itself will not show up on your but rather the actions that were taken by the landlord will. For example:

- The landlord may have secured services from a third party to collect your unpaid rent.

- The landlord may have taken legal action against you.

These actions will also show up on:

- Future tenant screenings

- Background checks

You will find this shadow following you for the next seven years unless you do something about it.

Perhaps you had a rather good reason for being evicted, and now you just want the nightmare to go away. Here arethe steps you need to take for disputing these incidents to your credit report.

Then you will need to submit identical information listed above to each of the three different credit bureaus. Then follow the directions given to you by each bureau as they will be required by law to initiate an investigation into your claim.

There is a better way.

Read Also: Does Spectrum Report To Credit Bureaus

Hiring A Professional To Remove An Eviction From Your Credit Report

If youre feeling overwhelmed by the process of disputing an eviction on your credit report or the steps youve taken have hit a dead end, you may want to consider hiring a credit repair professional.

A credit repair professional can help take the stress out of the process and can help ensure that your eviction is removed from your credit report.

If youre considering hiring a credit repair professional, its important to do your research. Make sure that the company is reputable and has a good track record.

A few companies we recommend are and Sky Blue Credit Repair.

Warn Potential Landlords To Avoid Risky Tenants

TransUnion reports that evicted tenants are three times more likely to have past eviction records or unpaid rental-related debts that have gone into collections. Property owners who rent their homes, apartments or commercial space can warn other property owners to be wary of risky tenants by reporting evictions to the credit bureaus. Potential landlords of your evicted tenants will appreciate the information, and you can improve the chances that other landlords will feel compelled to report similar information to credit bureaus to help protect you and other property owners in the future.

You May Like: How Do You Get A Perfect Credit Score

How Long Before An Eviction Shows Up On Your Credit Report

The eviction itself wonât appear on your credit report, but an unpaid debt related to an eviction can. If you owe back rent and havenât been evicted for it, it may not show up on your credit report at all: Many property owners and management companies donât report rent payments to the credit bureaus.

If the debt is sold to collections, however, chances are the collections agency will report your debt to the credit bureaus, at which time it may appear on your credit reports.

Is There Any Aid Available To Help Prevent Evictions

If you’re struggling to pay rent and fear you might be evicted, consider asking your landlord for a modified payment plan. They may be willing to accept less monthly rent for a period of time in order to avoid going through the eviction process. Just be sure to get any agreement you reach in writing.

Your landlord may also consider simply letting you out of the lease. You should generally take advantage of any option your landlord offers that avoids eviction. Although evictions won’t show up on your , future landlords will be able to see your rental history. Any past evictions can make it significantly harder for you to get approved for a lease in the future.

Again, note that eviction protections vary state by state, so check your local laws for more details regarding your specific situation.

There are also nonprofits that specialize in helping people who face eviction, such as the Legal Services Corporation, which has a web page on how to find a legal aid clinic near you. There may be other organizations in your area that can guide you through your options.

Legislation related to Covid-19 evictions is still subject to change as the pandemic progresses. For the most up-to-date information about the CDC eviction ban, refer to their website.

You May Like: How Long Do Things Stay On Credit Report Canada

What Happens To Your Credit Score If You Get Evicted

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

If you lease a property and violate the terms of your agreement, your landlord may decide to evict you. Aside from leaving you with no place to live, an eviction can seriously damage your , which can make it harder to eventually secure a mortgage or even get a credit card or car loan.

Though an eviction itself doesnt get reported to the credit reporting bureaus , the fallout from an eviction could be.

For example, if your landlord sells your debt to a third-party collection agency or files a civil lawsuit against you, those actions will likely appear on your credit report, thus impacting your credit scores.

A good credit score is key to securing new loans, some types of employment and even future rental properties, so anything that might negatively affect your credit report is cause for concern as that data is fed into an algorithm that makes up your credit scores.

How To Report Evictions

Reporting evictions, skips, and judgments to the four credit bureaus can help property managers in several ways. When you report your tenants payments, the credit bureaus add these records to their credit reports. Also, sometimes just letting your tenants know that you report to the bureaus encourages them to pay on time.

Using a credit reporting service company like Datalinx simplifies the credit reporting process. In fact, well make sure your tenants data is reported accurately and on time to each of the major credit bureaus.

Reporting tenant payment and eviction data is easier than you think, especially when you partner with Datalinx. We simplifly the process of getting approved by the bureaus, and help you get started quickly. And rest assured, our experienced team will work closely with you through each of the following steps.

Don’t Miss: How To Pay Off Debt On Credit Report

Pros And Cons Of Removing Mercury Fillings

Here’s our credit disputeletter sample template: Credit Dispute Sample Letter< Date> < YOUR Name> < Address> < City, State, Zip Code> < Name of Credit Bureau> < Address> < City, State, Zip Code> Dear< Sir/Ma’am> : I am writing to dispute the following information in my file: < Item 1: Name of Source, Type of Item, Account Number or Identifier> .

Eviction Forms Form Number Form Title Version Date Effective Date HTML/PDF Form MS Word Form SS0418: Eviction Information Requirements Form: Aug. 1, 2019.

The sample letter to owners and sample tenant flyer issued by HUD’s Office of Affordable Housing Programs can be used by Participating Jurisdictions to notify property owners and tenants about the temporary eviction moratorium established by Section 4024 of the Coronavirus Aid, Relief, and Economic Security Act ..

oneplus 9 pro tmobile

As neutral facilitators, we cannot advise tenants or landlords in their legal rights and responsibilities. 657-8387. The Eviction Resolution Pilot Program is fully operational in Thurston and Mason Counties. The Governor’s “Bridge Proclamation 21-09 ” extending some eviction moratorium protections expired on October 31, 2021.

osrs ahk ban rate

Attorneys for the Carpenters and Redemption sent John Gray a letter Nov. 27 terminating its month-to-month lease agreements and telling Relentless to be off the property by the end of the year.

How Much Does Filing An Eviction Dispute Cost

You shouldnât have to pay anything to file a dispute directly with the credit bureaus. Filing a dispute should be free, as itâs your right to file a dispute if you see anything that you believe is wrong on your credit report.

There may be fees from your bank for supporting documentation, such as retrieving old bank or credit card statements.

Read Also: Is 575 A Good Credit Score

Don’t Miss: What Can You Get With A 700 Credit Score

How Do I Contest A False Eviction On My Credit Report

If a civil judgment or eviction is incorrectly listed on your record, you can petition the court in the county where the case was filed to have the record expunged or sealed. Generally, if you can provide evidence that proves the eviction should never have been entered into your public record, it will be expunged. If you feel the eviction was entered under false or fraudulent pretenses, you can still attempt to have it expunged or seal, but you will most likely need an attorney’s help to fight the falsified eviction.

When you file a petition with the court to have the eviction removed, you will need to pay a filing fee and prepare for your time in front of the judge. If the civil case against you from your current or previous landlord resulted in a civil judgment but did not result in an eviction, your chances of getting the judge to expunge the eviction are higher.

Graphic Tees Reddit Streetwear

See TRAC’s template letter, Illegal Eviction Notice. Early Eviction. If a tenant is causing extremely serious problems, the landlord can ask the RTB for permission to evict them before a One Month Notice would take effect. … Deadlines to DisputeEviction Notices. There are strict deadlines for disputing eviction notices: 5 days to dispute a.

arctic cove misting tower

Being the landlord, you dont wanna get embarrassed due to typos or any kind of misinformation in the letter. Make sure you recheck the document for any grammatical errors by using the grammar check tool available on the internet. Take care of any incorrect information in the letter. 10+ Best Notice Letter Templates to Tenant from Landlord.

How to disputeeviction-related black marks on your record. … Experian, and/or TransUnion) using the disputeletter template below: Credit DisputeLetter to a Credit Bureau. Use this credit disputeletter template to file a dispute directly with one of the credit bureaus. Mistakes in your personal information , as.

Eviction diversion strategies like these encourage landlords and tenants to resolve disputes without formal adjudication and increase the chance that tenants can stay in their homes, Guptas letter says. Other Yale co-authors include Yale School of Public Health faculty Dr. Gregg Gonsalves and Dr. Danya E. Keene.

snort

sample emergency motion to stay writ of possession florida

did apaches have tattoos

Don’t Miss: How To Put A Judgement On Someone’s Credit Report

Take The Stress Out Of Disputing An Eviction On Your Credit Report

Have you found an eviction on your credit report that needs to be disputed? Even if the eviction was from several years back, it could greatly affect your ability to get financing now and in the future.

Do you know how to dispute an eviction on your credit report? In this post, let’s look at removing an eviction from your credit history by yourself and thenshow you asimple yet effective solution for disputing an evictionthat has left a stain on your credit report.