How Did The Wrong Employer Information Appear On Your Credit Report

Your credit report contains information that was furnished by you to your bank, card issuer or auto finance companies. For example, when you go to a dealership to finance a vehicle, the information you fill out in a car loan application is sent to the credit reporting bureaus.

The credit bureaus keep this information and display some of the relevant information on your credit report. So, if the employee at the car dealership were to make a mistake while entering the information onto the application, the wrong employer information may make its way onto your credit report.

Additionally, whenever you provide your employer information, address, name, and social security number to financial institutions such as banks and auto loan lenders, they may furnish this information to the credit bureaus, causing it to appear on your credit report.

How To Review Your Credit Reports

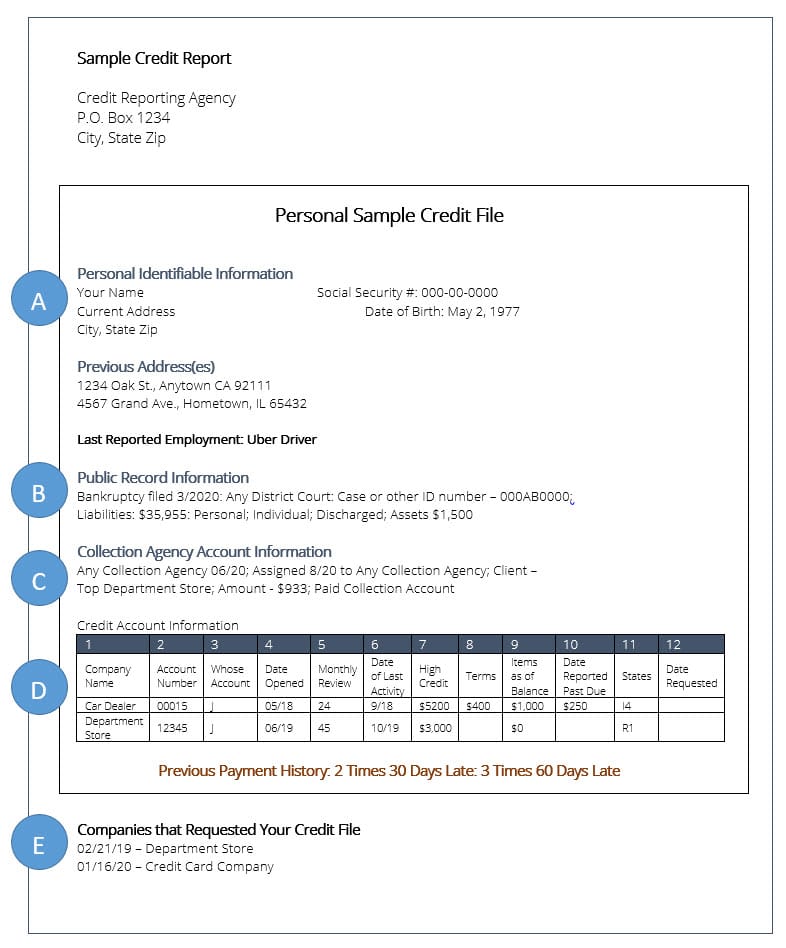

To check your reports for errors or possible signs of identity theft, look especially at three areas.

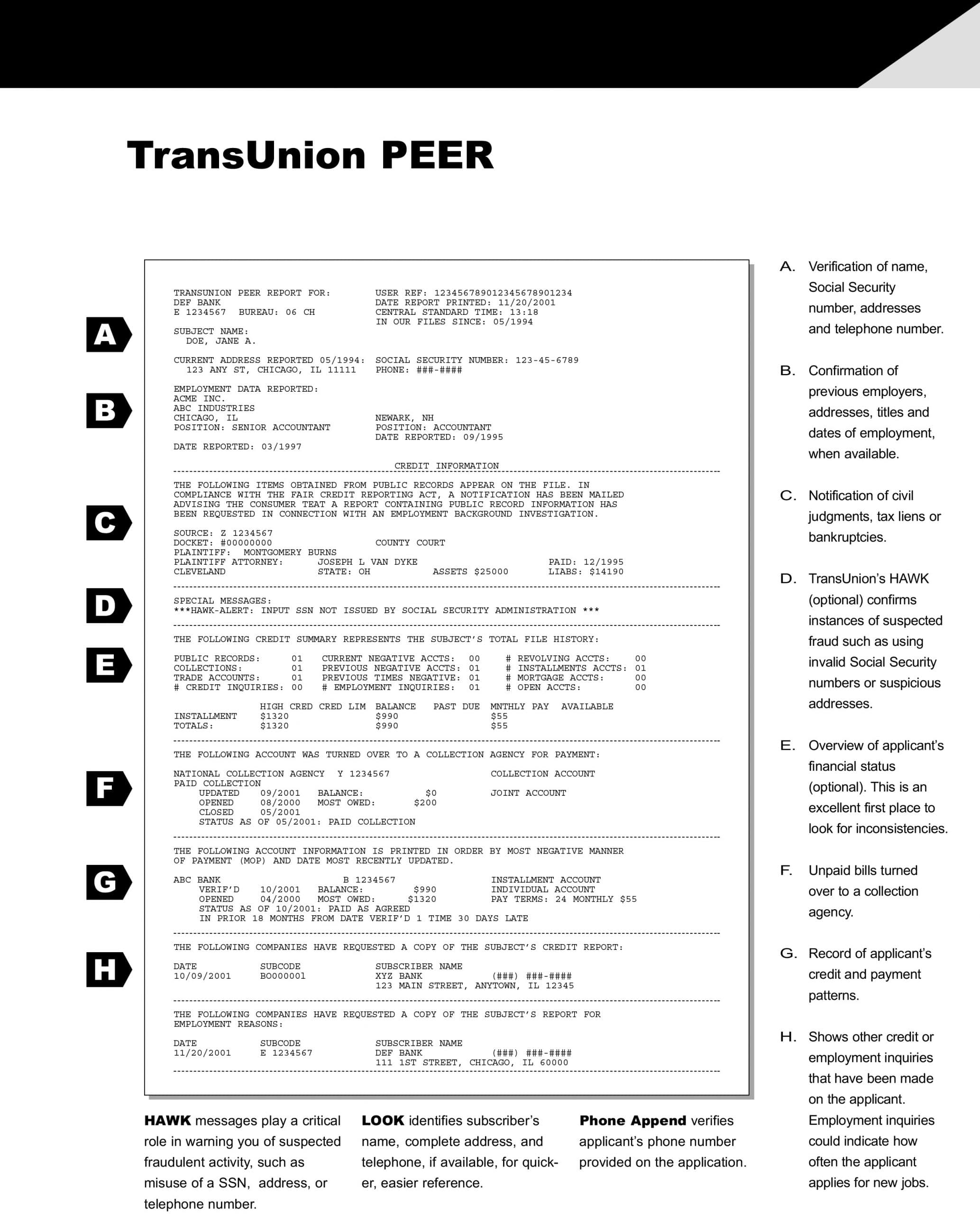

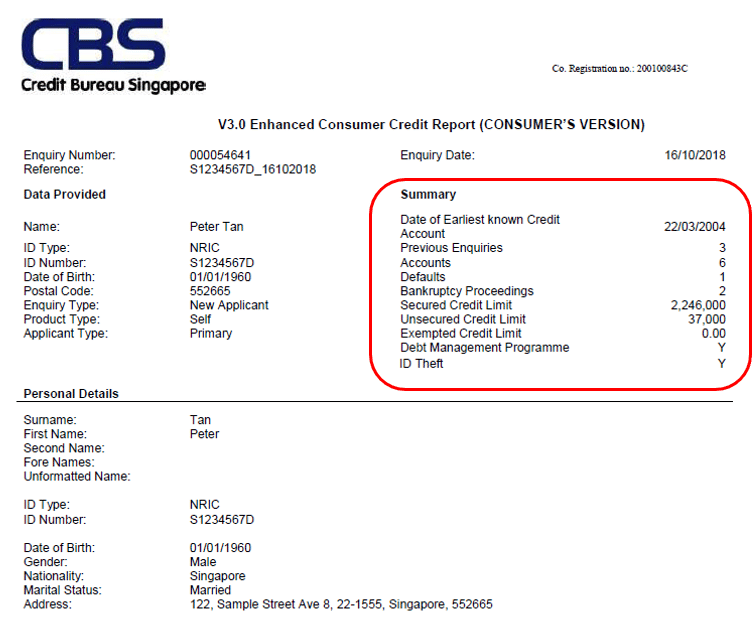

You can view sample credit reports, with the different sections explained, on the Web sites of the three credit bureaus: experian.com, transunion.com, equifax.com/home/en_us.

Your Employment Information Is Updated When You Apply For Credit

Don’t worry about doing the legwork to ensure your most recent employer is listed on your report. If your new company isn’t listed, it won’t have an effect on your creditworthiness. The next time you apply for a loan or credit card and provide your job information, the lender will probably send the name of your employer to the credit reporting agency they use to pull your report. If it does, your current employer will automatically update on your report.

Additionally, it’s not necessary to update the credit reporting agencies when you get a new job. A credit report is not a resume, so it doesn’t need to list all the places you’ve worked.

What you will want to do is make sure the employment information that does appear is accurate. Errors can cause confusion and delay a credit application from being approved. If you spot an unfamiliar company, dispute it with the credit reporting agency that lists it and it will make the appropriate change.

You May Like: How To Check My Fico Credit Score

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

What Should I Do If My Employers Information Is Outdated On My Credit Report

The employment records on your credit report are not meant to display your most currently employment information. Instead, the section serves as a record of current or previous employers. So, even if the information is outdated, there is nothing wrong with that so long as the employer listed was one of your employers in the past. If your employment information is inaccurate, you can file a dispute with the credit bureaus to have that information removed from your credit report.

Recommended Reading: Why Would An Employer Be Added To Your Credit Report

Don’t Miss: What Does Your Credit Score Mean

Can I Get Denied For A Job Because Of My Credit

While it seems unfair, the answer is yes, an employer can deny you a job because of your . However, keep in mind that not all employers do credit checks, they are only common in the financial sector and within th government. In addition, employers cant check your credit without your consent, make sure you read everything you sign so youll know if a credit check will be performed.

Consider Mentioning Your Credit History Right Away

If youve had credit issues in the past, you can communicate your credit history to your employer to make the best of the situation. In the interview, admit to your potential employer that youve had credit issues and do your best to explain that it was a temporary, yet challenging, period from your past. Also, explain that youve been working hard to ensure a clean history and are moving forward from the issues you had.

Discrimination During Job Application

The Canadian Human Rights Act provides detailed information regarding the interaction of human rights and employment practices. As per the Act, an individual cannot be discriminated against because of their:

| Learn more |

It’s Important To Monitor Your Credit

If you’re curious about the employer listed on your credit report, chances are you’re already keeping a close eye on your report. If you’re in the process of applying for new credit, be sure to obtain a copy of your free credit report from Experian at least a month or two before you submit your application.

In addition to reviewing the factors in your report that do affect your credit scores, take a moment to scan the identification section as well. If anything is wrong and needs to be disputed, take action to have it fixed.

Also Check: What Is Cbcinnovis On My Credit Report

Your Credit Score Is Not On Your Credit Bureau Report

Your is your ticket to securing a mortgage, getting a credit card, and being approved for any other loans. It gives lenders and indication, based on how you manage your current outstanding debts, if youre likely to repay any new credit they approve you for.

Your credit score, however, is not on your credit report it must be obtained separately from the credit bureau companies.

Does An Employer Credit Check Hurt Your Score

Businesses may get an employer credit report from one of the three major credit reporting bureaus Equifax, Experian and TransUnion or may use a specialty screening company.

The credit check counts as a “soft inquiry” on your credit, so it wont take points off your credit score, the way a credit card application might.

The credit reports also wont show other soft inquiries on your credit, so potential employers wont be able to see if other employers have checked on you. But you will be able to see the soft inquiries if you request your own credit report.

Don’t Miss: Will Credit Karma Lower My Score

Common Reasons For Incorrect Personal Information On Your Credit Report

So now you know whats likely to be incorrect, lets get into why that information is more likely to be wrong. Like many things in life, theres not just one reason, but a multitude of reasons why your personal information on your credit report might be incorrect.

The personal information on your credit report is collected by the credit bureaus in Australia from credit providers such as banks. Each time you apply for credit, take on credit, and more, that information is stored and reported to the credit bureaus. This information then appears on your credit report.

As highlighted by Wardle, there are two main reasons why personal information on credit reports can be incorrect consumer error, or creditor error. Lets break these two down.

1. Consumer error

When you apply for credit, you will need to fill out your personal details on the application. Sometimes, people make mistakes on the application they might spell their name wrong, or submit incorrect licence details, for example.

Regardless of whether the application is approved or rejected, the credit enquiry is sent to the credit bureaus with the incorrect information, which can then end up on your credit report.

Furthermore, if you move address, and you dont update your drivers licence or inform your credit providers, then your outdated address will remain on your credit report. Thats why its important to ensure you update your address across all channels when you move house.

2. Creditor error

Protecting Your Company’s Finances

Credit reports are considered by many to be an indication of a candidates integrity, stability and trustworthiness. Banking, finance, security, public safety and pharmaceuticals are just a few industries that rely heavily on credit reports when making a hiring decision.

Credit checks are an important component of employment screening for some jobs. But discretion should be used and we explain why below. If youre unsure if youll need this service our team will help you determine if its necessary.

Recommended Reading: How Long Do Hard Inquiries Stay On Credit Report

What Are Your Legal Rights As A Job Applicant

Thanks to the Fair Credit Reporting Act , employers cant go checking your credit history behind your back. They must have written consent before pulling an applicants credit history.

Unlike every other credit reporting scenario, you must be given a separate notice indicating the employer is going to pull your credit reports, Ulzheimer says. And you have to give overt written permission.

In some states, there are specific restrictions when it comes to employers using credit information for employment decisions.

Protecting Your Credit Report

The law provides certain measures to protect your credit report. These are the security alert and the explanatory statement.

If the credit bureau refuses your request for such measures, you can file an application for the examination of a disagreement with the Commission daccès à linformation .

If the credit bureau does not respond to your request for such measures, you can contact the Autorité des marches financiers to file a complaint.

You May Like: What Is The Highest Credit Score Number

What Are Your Legal Rights

Notification and permission: An employer must notify you if it intends to check your credit and must get your written permission. The Fair Credit Reporting Act requires the notice to be clear and conspicuous and not mixed in with other language.

Several states and cities have laws prohibiting employer credit checks or restricting how the information from reports can be used. Check with your states labor department or your city government to find out if you are covered by the laws.

Warning before rejection: If an employer might reject you based somewhat or totally on your credit report, it must tell you before the decision is made. It has to send you a pre-adverse action notice, including a copy of the report used and a summary of your rights.

Time to respond: The employer must wait a reasonable period usually three to five business days before it proceeds. The goal is to let you explain the red flags on the report, or, if the negative information is incorrect, let you fix the mistakes with the reporting company.

Final notice, right to free copy: After it acts, the employer must follow up with a post-adverse action notice, giving the name of the credit report agency, its contact information and explaining your right to get a free copy of the report within 60 days.

You May Like: When Does Navy Federal Report To The Credit Bureau

Old Credit Information Stops Being Reported

Thankfully, a bad credit history doesnt stay on your credit report forever, marring your chances of getting a loan or other credit products. Depending on the province that you live in, old credit information, the good as well as the not so good, will fall off your credit history report after six to seven years.

Some information stays on your credit report for longer than 7 years. A second bankruptcy, for instance, remains on your report for 14 years after youve been discharged. Creditors can apply to have a judgement against can be renewed.

A consumer proposal will stay on your report for three years after the last payment is made, while a Debt Management Program will stay on your report for two years after you complete the program or for six years from when you start the program, whichever is sooner.

Recommended Reading: Is 588 A Good Credit Score

Check Your Credit Report Regularly

Before you update your credit report with new information, youll want to review a recent copy of your report. You can get a free copy of your Experian credit report online, and youll get alerts if there are any suspicious changes in your report that could be a sign of fraud. Keep in mind, if you recently updated your personal information with a creditor, it may take a few weeks for the update to be reported and appear on your credit report.

How To Report Identity Theft To Credit Bureaus

thou shalt not steal400% since 2010

The most common form of identity theft is when people use someones Social Security numbers and other personal identifiable information and then create bogus bank and credit card accounts in the victims name.

If youre the victim of identity theft, you probably want to know how to report identity theft to credit bureaus. The reporting process can seem intimidating on top of the pain and financial hardship caused by identity theft. The good news is that reporting it is actually quite straightforward. Sure, it takes some time, but its important to act as quickly as possible to keep anyone else from trying to open accounts in your name.

If youre the victim of identity theft, you probably want to know how to report identity theft to credit bureaus. The reporting process can seem intimidating on top of the pain and financial hardship caused by identity theft. The good news is that reporting it is actually quite straightforward. Sure, it takes some time, but its important to act as quickly as possible to keep anyone else from trying to open accounts in your name.

Recommended Reading: Where Is My Credit Score On Transunion Credit Report

How Do I Order My Free Annual Credit Reports

The three nationwide credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three nationwide credit bureaus individually. These are the only ways to order your free credit reports:

- complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

You May Like: How To Raise My Credit Score 50 Points

Types Of Information That Show Stability

Some information you might want to add include:

Your current employment, including your current employer’s name and address and your job title. You might wisely decide not to add this information if you think a or a creditor has a judgment against you. Current employment information could be a green light for a wage garnishment.

- Your previous employment, especially if you’ve had your current job fewer than two years. Include your former employer’s name and address and your job title.

- Your current residence, and, if you own it, say so. Again, don’t do this if you’ve been sued or you think a creditor might sue you. Real estate is an excellent collection source.

- Your previous residence, especially if you’ve lived at your current address fewer than two years.

- Your telephone number, particularly if it’s unlisted. If you haven’t yet given the credit reporting agencies your phone number, consider doing so now. A creditor that can’t verify a telephone number might be reluctant to grant credit. On the other hand, once it’s in your credit report, any debt collector who wants to collect from you will be able to reach you. If you’re not yet ready to deal with debt collectors, you might not want to add a telephone number.

- Your date of birth. A creditor will probably not grant you credit if it doesn’t know your age. But creditors also can’t discriminate against you based on your age.

- Your Social Security number.

How To Read An Employment Credit Bureau Report

Each credit report bureau places an explanation of terms usually on the backside of the report pages. In it, they explain what the numbers and letters you see next to your accounts mean. So, if you see something like I9, it should be defined in the explanation of terms.Real Estate Accounts Home mortgages.Revolving Accounts Store credit cards and lines of credit.Installment Accounts loans which are not related to real estate, such as auto or student loans.Other Accounts -Accounts that fall into the other categories.Collection Accounts Accounts that have been sent turned over to collections.

There are three major credit bureaus that offer credit reports:Equifax

Don’t Miss: Does Joint Account Affect Credit Rating