Send A Goodwill Letter

If your credit report is correct, you may be able to send a goodwill letter to your student loan lender.

Goodwill letters ask creditors to remove the negative item from your credit file. Though theyre under no obligation, some borrowers have found success in removing settled accounts this way. If youve been a great borrower other than your settlement, its worth a try.

Calculating The Time Needed To Rebuild Your Credit Score

6 Months or Less: There is a possibility that if you have successfully paid off most of your debts and have settled accounts, creditors may still consider you a good debtor who can pay debts on time. If you still have open accounts after debt settlement with good records, this may help you get a credit rebound and improve your credit score. Even if you have a settled account the total assessment of your credit history can outweigh this by demonstrating that you have strong, positive credit, and your credit score could improve within the next six months or less.

12 – 24 Months: If your credit history reflects that you are a delinquent debtor, you have not paid off any part of your debt, there were a lot of late payments, or if it takes you years to settle your old debts you will have an extended period to wait before your credit score improves. A poor credit history tells creditors that you are a risk, and it will probably take 12-24 months for you to improve your credit score.

Remember that as your settled accounts age, their effect on your credit report will diminish even if they are still apparent. Take the initiative not to incur new debts, and your credit score will slowly improve. It will not improve overnight, so relax and do your best to become a wise debtor during this time. Avoid obtaining new debts while you are in the period of rebuilding your credit score.

How Will You Attack Your Settled Account

You know what a settled account is and how it can affect your credit score.

If the account affects your credit score negatively and causing it to drop, its time to start thinking about ways to remove the account from your report.

How to remove settled accounts from credit reports may seem like a long and grueling process, but once the account has been removed you wont be a high risk for financial institutions.

As we have stated, if the account appears to just be hanging out and not affecting your score in a positive or negative way, its best to just let it on your report.

To be honest, showing this payment history can help your credit score as long as you were on time.

Now its time to decide if you will let the settled account stay on your report or if you will take steps to remove it.

For more finical tips and information be sure to check out our website.

Resolve Your Debts Today – See How Much You Can Save

Read Also: Does Getting Declined Hurt Credit Score

How Delinquent Debts Are Reported On Your Credit Reports

After your debt has been transferred or sold to a debt collector, it will probably appear twice in your credit history. According to the credit reporting agency Experian, this is how it works: The debt starts as a current, never late account. As you get behind on the payments, it is typically reported as being 30 days late, 60 days late, 90 days late, and so forth.

How To Remove Settled Status From Your Cibil Report

To clear the Settled status from your CIBIL report, you need to pay the outstanding amount on your loan and get a NOC from the lender. The next step is to raise a dispute on the CIBIL website. The credit bureau will confirm the update with the lending institution and change the status from settled to closed within 30 days.

Also Check: Can Delinquency Be Removed From Credit Report

How To Remove Settled Accounts From Your Credit Report

You can remove settled accounts from your credit report before the 7-year rule.

Before you do anything, you should first assess if the settled account negatively affects your credit score or its just showing your payment history.

Keep in mind that your payment history affects your credit score. A settled account that appears on your credit report as part of your payment history may help boost your credit score in the long run since it shows that youre a low-risk borrower.

How To Get A Closed Account Off Your Credit Report

Many people close credit accounts they no longer want, thinking that doing so removes the account from their credit report. The Fair Credit Report Actthe law that guides credit reportingallows credit bureaus to include all accurate and timely information on your credit report. Information can only be removed from your credit report if it’s inaccurate or outdated, or the creditor agrees to remove it.

Recommended Reading: When Does A Bankruptcy Come Off Credit Report

How To Remove A Settled Account From Your Credit Report

Removing settled accounts from your can help improve your score, so its important to take action if any of them show up on your report. You can remove closed accounts from your .

If you have a settled account thats been reported to the three major , and you want to remove it from your credit report, heres how:

You can do this in writing or by mailing a letter to the appropriate bureau. Make sure you include your name, address and phone number so that they can let you know when theyve received your request.

Heres an example of how to request a closed account be removed from your credit report: If you want to remove a closed account from your credit report, youll need to contact the creditor and ask them to remove it.

If you have a closed account in your credit report, the creditor will have an opportunity to dispute the information in the report. If they do not dispute it within 30 days, then it will be removed from your credit report.

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

Also Check: Does Afterpay Affect Your Credit Rating

How Long Does It Take To Rebuild Credit After Debt Settlement

Your overall credit history will play a role in how fast your credit bounces back after settling a debt. If you otherwise have a solid credit history and have successfully paid off loans or are in good standing with other lending institutions, you could rebuild your credit more quickly than if you have a larger history of late payments, for example.

The further in the past your debt settlement, the better your credit report will look. Still, there are some things you can do to help your over time by focusing on establishing a solid credit repayment pattern:

Strategies On Successfully Disputing Your Credit Report

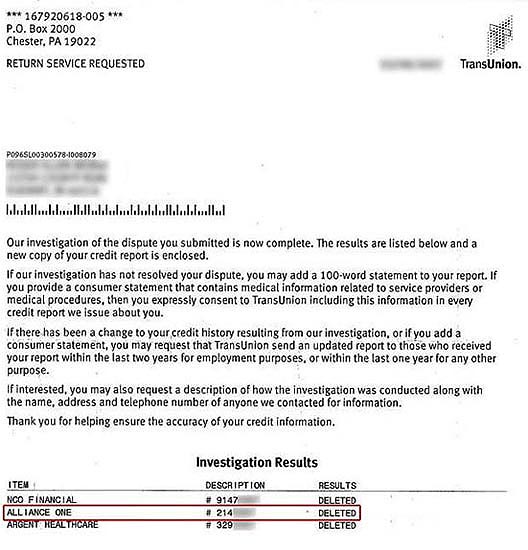

There are several strategies you can use to dispute your credit report because of inaccuracies in order to get settled accounts removed:

- File a dispute directly with the credit reporting agency – Write and submit a letter of dispute explaining inaccuracies in the credit report. You must explain the inaccuracy thoroughly and that you want it to be removed. Submit any documents that support your claim.

- Submit a letter of dispute with the reporting business – Another option is to submit a letter of dispute to the business that reported the debt, explaining the inaccuracies that you want to be removed.

- Hire a credit repair service – Credit repair services can help you remove errors, dispute inaccuracies, and handle negotiations.

- Saturation technique – Submit a letter of dispute to as many people as possible in order to increase your chances of having the settled account removed.

DoNotPay is a fantastic and effective alternative that offers all of these solutions and more under one roof.

Also Check: Does Chime Report To Credit Bureaus

Can Paid Collections Be Removed From A Credit Report

If you dont want to wait seven years for the paid collection to drop off your credit report, you may be wondering how to remove paid collections from a credit report.

When a debt is said to be sent to collection it means that the lender has given up on trying to get that money from you. Instead, they have employed a debt collections company to pursue the debt. This is bad for your credit report because it reflects badly on you as a debtor.

Accounts that get to the collection stage are considered seriously delinquent. It means that someone lent you money but you didnt repay it even after they did everything in their power to get you to pay it back. They had to send a debt collections company to try to collect money from you. Lenders dont want to give money to someone that has a bad record of repaying their debts. A collection will have a significant, negative impact on your credit score.

The problem is that, even if you then pay off this debt through the debt collection company, the collection still remains on your credit report. So even if you no longer owe the lender money, your credit score will still be negatively affected.

Luckily, there are some strategies you can employ to get paid collections removed from your credit report.

Can I Get A Collection Removed From My Credit Report If I Pay It Off

A paid collection account will not disappear from your credit history just because you’ve paid it off. It will stay there until the statute of limitations has passed, which is at least seven years in most cases. You cannot have it removed by contacting the credit bureaus and requesting it be removed.

You May Like: How To Boost Credit Score Quickly

Check For Possible Errors In Cibil Report

There are different types of errors that may occur in your CIBIL report. Some of the common errors include the following.

-

Wrong personal information:

There may be errors in personal information such as your name, your gender, date of birth, address or contact information. The PAN or Aadhaar number may also be incorrect in some cases.

-

Delayed updation of balance:

This is one of the most common errors in CIBIL reports. The outstanding balance in your name may not be updated soon enough. In this case, loans you have actually repaid may still be reflected as overdue.

-

Incorrect balance:

Sometimes, the outstanding balance may be updated, but there may be errors in the updates. Due to this, your CIBIL report may show an incorrect balance for your loans or your credit cards. Its easy to miss these errors, so keep an eye out for them.

-

Errors in outstanding loans:

This section is often prone to mistakes. For instance, the amount of loan taken or the amount of loan due may not be accurate. Alternatively, some loans that you have not taken may be shown in this section, or some loans you may have actually taken may not be reflected.

-

Duplication of accounts:

Lastly, in some cases, there may be more than one account registered in your name. If this is the case, bring it to the notice of the concerned authorities right away, and ensure that your duplicate account is closed to avoid bringing down your CIBIL score.

You Can Negotiate With Debt Collection Agencies To Remove Negative Information From Your Credit Report

If you’re negotiating with a collection agency on payment of a debt, consider making your part of the negotiations. You can ask the collector to agree to report your debt a certain way on your credit reports. Here’s how: The three major credit reporting bureausExperian, Equifax, and TransUnionproduce credit reports. Ask the collector to tell the bureaus to remove any negative information about the debt from your credit files. The collector might not agree, it might have to get the creditor’s approval first, or you might have to pay a bit more on the debt but it doesn’t hurt to ask.

And if you get the collector to agree to accept less than the full amount to settle the debt, be sure the collector also agrees to report the debt as “paid in full” on your report.

Don’t Miss: Is 594 A Good Credit Score

Will Settled Accounts Affect Your Credit Score

Accounts that were settled in full remain on your credit report for 10 years and will leave a positive mark on your credit. You can also settle an account when you pay less than the amount. It will remain on your credit report for 7 years and may affect your credit score. A settled account means you paid less than the actual amount owed. Since you didnt pay back the debt in full as agreed when you took out the loan, you have failed to meet the terms of your loan contract, thereby causing a negative mark on your credit report.

How does a credit card settlement affect your credit score? Closing a credit card account after settling your outstanding balances may negatively affect your credit report since it will lower your overall available credit limit and increase your credit utilization ratio. Furthermore, your credit score goes down because you only paid a portion of your credit card debt.

However, if you paid your balances in full and decided to close the account, your payment history will still appear on your credit report. Provided that there are no late or missed payments, it wont affect your credit score negatively and lenders will consider you as a creditworthy and low-risk borrower.

Debt settlement can help lower the amount of debt you need to pay and help you avoid bankruptcy. Even though theres a risk that lenders may not agree with the debt settlement, some may take the offer of a lower payment amount so they could recoup part of their losses.

How Do I Remove Negative Items From My Credit Report Before 7 Years

Negative items typically stay on your credit report for seven years or more. There are very few strategies that can help you remove these negativities from your report. They require your creditor’s cooperation. Therefore, it is crucial to avoid ignoring your creditor and maintain communication so you can negotiate a favorable settlement and reduce the negative impact on your credit report.

Don’t Miss: How Do You Boost Your Credit Score

Become An Authorized User

You may want to consider talking to a close friend or family member about the possibility of adding you as an authorized user to one of their longer established credit cards. This can help you gain some positive credit history that you lost. But you may not want to do that until all your settlements are complete.

Related article: Can being an authorized user on someone elses credit card help build your credit?

How long it takes to rebuild your credit after debt settlement depends on a number of factors. Theres no quick fix, but settling your debts wont hurt your credit nearly as much as not paying them at all with the added bonus of lifting the weight of the debt-related stress youve likely been experiencing.

What Is A Goodwill Deletion

The goodwill deletion request letter is based on the age-old principle that everyone makes mistakes. It is, simply put, the practice of admitting a mistake to a lender and asking them not to penalize you for it. Obviously, this usually works only with one-time, low-level items like 30-day late payments.

You May Like: How Personal Responsibility Can Affect Your Credit Report

Getting A Satisfied In Full Reporting

If the collection agency agrees to settle for less than you owe, be sure it also agrees to report the debt it holds as “satisfied in full” to the credit bureaus. Get written confirmation from the creditor and the collector. The debt collector’s confirmation should say that it will acknowledge the debt as paid in full when you pay the agreed amount.

Potential Tax Consequences of Settling Debt

The IRS generally considers canceled debt of $600 or more as taxable, and settling debts for less than what’s owed can increase your tax liability depending on your tax bracket and the canceled amount. Consult a tax professional for more information.

If the creditor, or the debt collector if it has the authority, agrees to delete the original account line, get confirmation that it will submit a Universal Data Form to the three major credit reporting agencies deleting the account/tradeline. If the debt collector doesn’t have the authority to act for the original creditor to delete the account information on the original debt, you might need to contact the creditor and the debt collector separately.