Establishing Or Building Your Credit Scores

Depending on your experience with credit, you might not have a credit report at all. Or, your credit report might not have enough information that credit scoring models are able to assign you a credit score.

With FICO® Scores, you need to have at least one account that’s six months old or older, and credit activity during the past six months. With VantageScore, a score may be calculated as soon as an account appears on your report.

When you don’t meet the criteria, the scoring model can’t score your credit reportin other words, you’re “credit invisible.” As a result, creditors won’t be able to check your credit scores, which could make it difficult to open new credit accounts.

Some people may be in a situation where they’ve only opened accounts with creditors that report to only one bureau. When this happens, they may only be scorable if a creditor requests a credit report and score from that bureau.

If you’re brand new to credit, or reestablishing your credit, revisit step one above.

Consider How Many Credit Accounts You Have

Scoring models consider how much you owe and across how many different accounts. If you have debt across a large number of accounts, it may be beneficial to pay off some of the accounts, if you can.

Paying down credit card debt is the goal of many who’ve accrued debt in the past, but even after you pay the balance down to zero, consider keeping that account open. Not only can closing it hurt scores by eliminating that available credit and increasing your credit utilization ratio, but keeping paid off accounts open can also be a plus because they’re aged accounts in good standing. And again, you may also consider debt consolidation.

How Long Does It Take To Rebuild Credit

It’s hard to say with certainty how long it takes to rebuild credit because each person’s credit history is different. If you’ve had credit difficulties in the past, how long it will take to rebound depends in part on the severity of the negative information in your credit report and how long ago it occurred. While some actions can have an almost immediate effectsuch as paying down credit card balancesothers may take months to make a significant positive impact.

If you’re disputing information in your credit report you believe is fraudulent or inaccurate, the investigation can take up to 30 days. If the credit reporting agency finds your dispute valid, the information will be removed from your credit report, and your score will reflect that change as soon as it’s calculated again.

If you’re making payments or reducing your credit card balances, don’t worry if your credit report isn’t updated right away. Creditors only report to Experian and other credit reporting agencies on a periodic basis, usually monthly. It can take up to 30 days or more for your account statuses to be updated, depending on when in the month your creditor or lender reports their updates.

Recommended Reading: How To Report A Death To Credit Bureaus

Become An Authorized User On A Credit Card

Ask a friend or family member to contact their credit card issuer and have you registered as an authorized user. The card issuer will need your personally identifiable information in order to process the request. And the payoff can be big: you may find yourself with a credit score boost in a few months time.

Negotiate A Lower Interest Rate

A lower rate can help you pay off your balance faster, because more of your payment can be applied to your principal balance than interest. Lower balances can mean a lower credit utilization ratio . Learn more about how to negotiate a lower interest rate.

You May Like: Opensky Payment Due Date

Get A Secured Credit Card

This product is typically for people who want to build credit from scratch. If your credit card accounts have been closed, you may need to start over with a secured credit card. These cards require a deposit upfront. That deposit is typically your credit limit, but then they work like any other credit card. Choose one from an issuer that reports payments to all three major credit-reporting bureaus.

Improve Your Payment History

Your payment history is the most important component of FICO® scoring models. Late and missed payments will reduce your credit scores, and bankruptcies and collections can cause significant damage. This negative information will remain on your credit report and impact your credit scores for seven to 10 years.

Your scores often take into account the size of your debt and the timing of your missed payments. The bigger your debt is, and the more recent your missed payments are, the worse your score will be, typically. Bringing accounts current and continuing to pay on time will almost always have a positive impact on your credit scores.

Don’t Miss: 698 Credit Score Auto Loan

Reduce The Amount You Owe: 30%

The amount of money you owe is the second largest factor in determining your credit score and changing it is one of the best ways to raise your credit score quickly.

This factor of your score is split into a few subcategories the main three are your total debt, the number of credit cards with a balance, and your .

The total debt category is exactly what it sounds like: how much money you are currently borrowing. The less money you are borrowing, the higher your score, because lenders want to feel confident that you can afford to pay them back.

Similarly, the fewer credit cards you have that have a balance, the better.

Pay Your Bills On Time

If you are in the habit of paying bills late or you have paid some bills past their due date in the past, this is behavior you’ll want to change right away. Since the most important factor that makes up your FICO score is your payment history , late payments can cause more damage to your score than almost any other mistake.

To avoid late payments and the late fees that result, you can try setting up your bills for automatic payments. You can also mark your calendar or set up reminders on your phone.

Whatever you do, make sure you pay all your bills on time from this point forward. Where late payments can harm your credit score, on-time payments on all your bills will have the opposite effect.

Don’t Miss: What Card Is Syncb/ppc

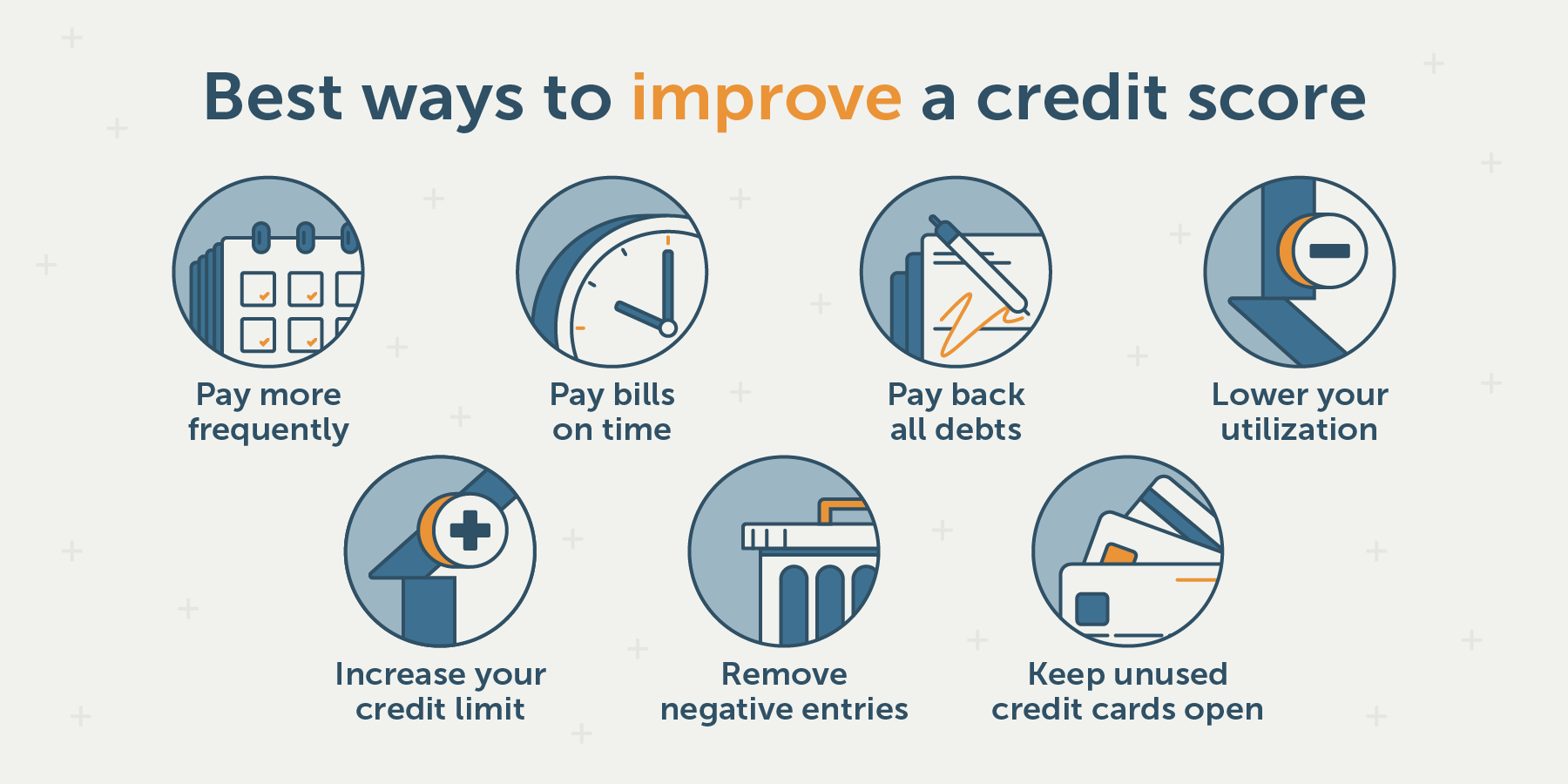

In Summary: Tips To Improve Your Credit Score

What To Do If Youve Been A Victim Of Credit Fraud

If youve been a victim of identity impersonation or credit fraud, your credit score might have taken a hit. Improving your credit score in these situation involves taking many of the steps on this page.

When you check your credit file, keep an eye out for a Victim of impersonation notice. This marker is provided by Cifas, a not-for-profit fraud prevention service.

Cifas markers are put on credit files by lenders in cases where they believe there has been an attempt at fraud by people mis-using a loan applicants identity. Lenders are legally obliged to report such concerns.

Having a Cifas marker on your file serves as a warning to future lenders that youve been a victim, or are vulnerable to becoming a victim, of fraud.

The marker will stay on your file for 13 months.

The good news is that having a Cifas marker doesnt affect your credit score and doesnt stop you from taking out credit. But it may create problems if youre applying for credit that is processed automatically, such as store finance. This is because a lender would have to carry out a manual review of your file to understand why the marker has been added.

Find out more on the Cifas website

Also Check: What Is Syncb Ntwk On Credit Report

Estimating Credit Score Changes

While youre waiting for your credit report and score to update, you can use a credit score simulator to estimate how your credit score might change. Credit Karma and myFICO both offer credit score simulators that can show how your credit score might change if the information on your credit report changes, like if you pay off an account or open a new loan, for example.

Review Your Credit Report

You are entitled to one free a year from each of the three reporting agencies and requesting one has no impact on your credit score. Review each report closely. Dispute any errors that you find. This is the closest you can get to a quick credit fix.

A government study found that 26% of consumers have at least one potentially material error. Some are simple mistakes like a misspelled name, address, or accounts belonging to someone else with the same name. Other errors are costlier, such as accounts that incorrectly are reported late or delinquent debts listed twice closed accounts that are reported as still open accounts with an incorrect balance or credit limit.

Notifying the credit reporting agency of wrong or outdated information will improve your score as soon as the false information is removed. About 20% of consumers who identified mistakes saw their credit score increase.

Also Check: Bpvisa Syncb

How To Improve Your Credit Score In : Easy And Effective Tips

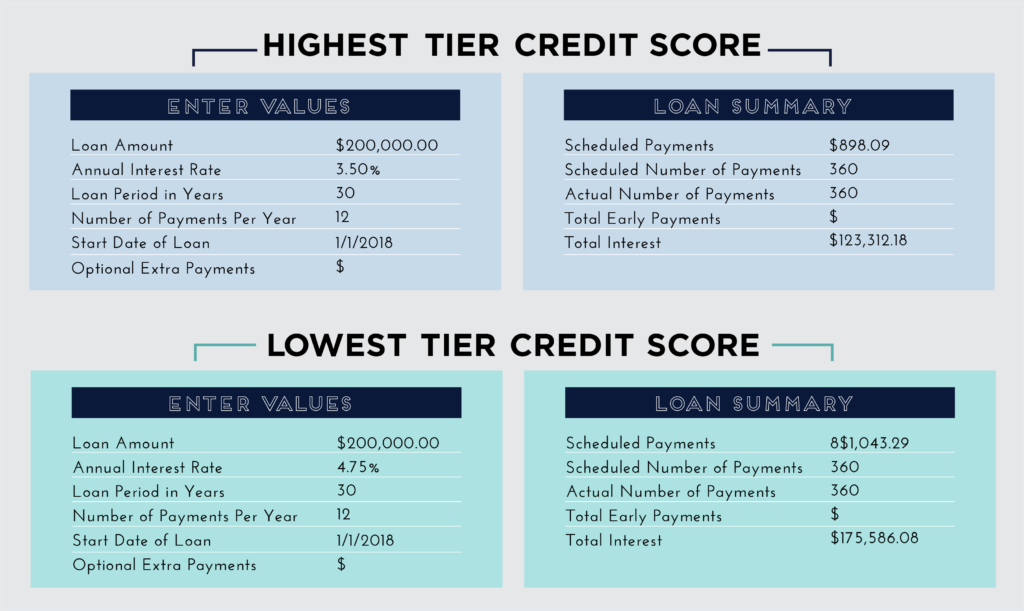

If you’ve ever wondered “What is my credit score?” it’s probably time to find out. Having a good credit score can make life a lot more affordable. If youre about to buy a house or car, for example, the higher your credit score is, the lower your interest rate will probably be.

Your number may also be the deciding factor for whether or not you can get a loan and ultimately determine if you are even able to buy something you want or need.

So, yes, the goal is to have the highest possible credit score you can, but increasing the number doesnt just happen overnight. There are important steps to take if you want to increase your score, and the sooner you start working on it, the better.

Pay On Time Every Time

The most vital thing you can do to build and maintain good credit is pay on time. This means every bill, every debt — every month. This is called your payment history, and it’s more than a third of your credit score. Even one payment more than 30 days late can hurt your score for years. If you think you can’t make a credit card payment, call your card company before you’re late to arrange a payment plan.

No matter what, be sure to make at least the minimum required payment on your accounts every month. Ideally, pay in full.

If you’re struggling with remembering due dates, you can set up automatic payments. The autopay feature will make your payments for you, in the amount you decide when you set it up.

This suggestion isn’t necessarily for how to build credit fast — it’s how to build credit for life.

Read Also: Does Klarna Affect Your Credit Score

How To Establish Credit When You Have No Credit History

There are many Americans with no credit experienceâespecially among younger populations. And though it may seem difficult, it is possible to build a credit score with no credit history. In addition to some of the strategies listed above, consider the following methods for building credit from scratch.

How to Establish Credit:

- Ask someone with established and good credit to help you get a loan or to add you as an authorized user to one of their existing credit card accounts. Doing this will allow you to have your first account listed in your credit report, allowing you to build a positive payment history. Over time, your payment history and experience with this account will help you build a score of your own. From there you can apply for additional credit on your own.

- Apply for a credit account that is tailored for people that are new to credit. Look for loans that are designed for people with no credit history. , for instance, can help you start building credit you can get one of these loans from a community bank or credit union. Before applying for a loan with the intention of building credit, always confirm that the lender will report your account and payment history to one or more of the three main credit bureaus .

How To Increase Credit Score To 800

Generally speaking, lenders typically like to see a credit score of at least 650 before they qualify a borrower for a loan. However, a score of 650 might not afford borrowers with the best interest rates, making their loans more expensive to pay down.

When it comes to getting approved for loans and securing the lowest interest rate possible, a higher credit score is best. If you can get your credit score to 800, youll likely be able to take advantage of the best rates and should have no problem getting approved for a loan, as long as all of your finances are in order and there are no other red flags that might worry your lender.

In addition to the above-mentioned tactics, consider the following measures to get your credit score to 800:

- Pay down the balance of your credit cards that are currently at or near their limit.

- Pay down higher-interest debt first .

- Consolidate your debt to pay it off more quickly and transfer the balance of a higher interest-rate card to a lower interest rate card.

- Have a mix of debt which can increase your credit score.

For more ways of improving your credit, .

Final Thoughts

Depending on your particular situation, it may take just a matter of a couple of months to inch your credit score back up. Regardless of where you fall on this spectrum, its important to take steps right now to improve your credit score so you can enjoy better rates and an easier time getting approved for a loan.

Rating of 4/5 based on 23 votes.

Also Check: How To Remove A Repo Off Your Credit

How Long Does It Take Your Credit Score To Improve

Thomas J. Brock is a Chartered Financial Analyst and a Certified Public Accountant with 20 years of corporate finance, accounting, and financial planning experience managing large investments including a $4 billion insurance carrier’s investment operations.

Your is a sensitive numberthree digits that can move up or down on any given day depending on how the information in your credit report changes. If youve been working to improve your credit scoreby paying off past-due accounts, correcting errors, making timely payments, or having negative items deleted from your credit report you undoubtedly want to see the results of your efforts as quickly as possible. And if you need your credit score to increase a few points so you can qualify for a loan or better interest rate, you’re probably eager to see improvement soon.

Avoid Expensive Credit Repair Companies

You might see adverts from firms that claim to repair your credit rating. Most of them simply advise you on how to obtain your credit file and improve your credit rating but you dont need to pay for that, you can do it yourself.

Some might claim that they can do things that legally they cant, or even encourage you to lie to the credit reference agencies.

Its important to not even consider using these firms.

You May Like: What Is Syncb Ntwk

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

It’s Only As Rapid As You Are

To have success with rapid rescoring, you may need to participate in the process. For example, if youre late on payments, you can get current on them and use rapid rescoring, but youll need to come up with the money and get it to your lender before ordering an updated credit score. Likewise, you may need to dig up documentation to prove that accounts were paid off, and that takes time and effortyou cant count on your lender to do all of the work for you.

Recommended Reading: Public Records Removed From Credit Report

Examples Of Rapid Rescores

Use these scenarios to get a sense of when a rapid rescoring is appropriate and how it can benefit your credit score and loan prospects.

Get a rapid rescore after taking steps to improve your score. Let’s say that your mortgage broker uses a computer simulator to see that you have an opportunity to improve your credit. If you raise your score by 20 points, youll fall into a category of a borrower that pays a slightly lower interest rate. The simulator says you might accomplish this if you pay down your card balances so that you’re using less than 30% of your . Even if you pay off your credit cards every month, your card issuer might take a snapshot when your balance is high, so the credit-scoring model thinks youre maxing out your cards. If youve got the cash available, pay down your debts. Then, use rapid rescoring to submit updated information to the credit bureau and have it pushed to your credit report within a matter of days. When you request a new credit score from that bureau, you’re more likely to obtain a higher score and get approved at a lower rate.

The VantageScore and FICO scoring models consider a credit utilization ratio of 30% or less to be ideal.