Identify The Bankruptcies On Your Report

The first step is to get a copy of your credit report from all three credit reporting agencies: Experian, Equifax and TransUnion. Look over your reports carefully to identify any bankruptcies that are listed. These will usually be listed under the Public Records section of your report, but they may also show up under the heading Accounts in Collection.

If you find any errors on your credit report, you should file a dispute with the credit reporting agency as soon as possible. You can do this online, by mail or by phone.

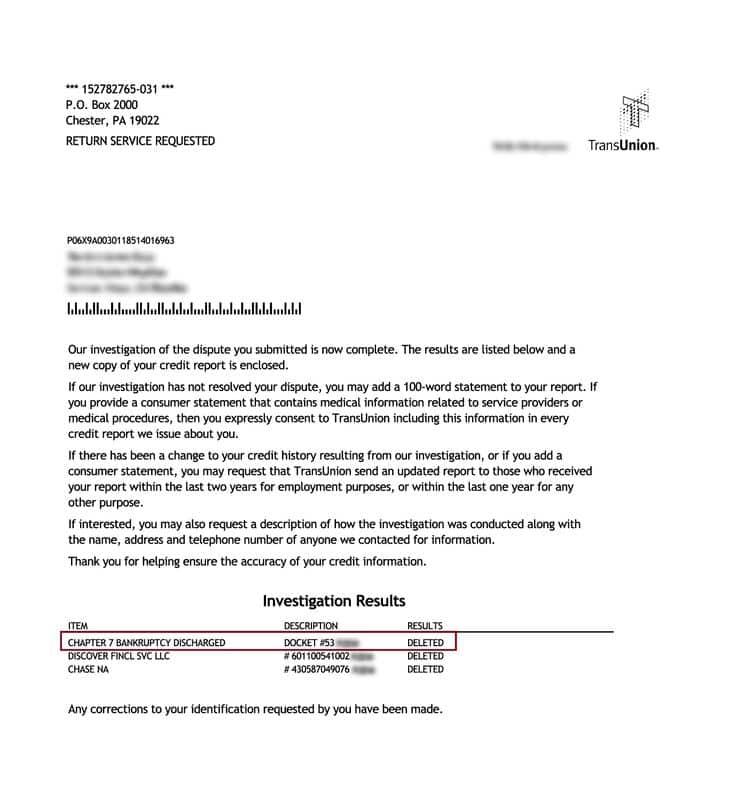

##Heading: Request Removal of the Bankruptcy from Your Credit Report##Expansion:Once you have identified the bankruptcy that you want removed, you will need to send a letter to the credit reporting agency requesting that the bankruptcy be removed from your credit report. In your letter, be sure to include:-Your full name-The reason for your request -A copy of your discharge papers

You should send your letter by certified mail with a return receipt requested so that you have proof that it was received by the credit reporting agency. Once the credit reporting agency receives your letter, they will investigate your claim and remove the bankruptcy from your credit report if they find that it is inaccurate or obsolete.

Getting A Bankruptcy Off A Credit Report

First, a bankruptcy can lower your credit score by 100-290 points, but late payments, charge-offs, and judgments ruin your credit score as well. Yet generally, you will come out with a higher credit score AFTER a bankruptcy because it drastically changes your debt to income ratio . A chapter 7 bankruptcy comes off your credit reports within 10 years and a chapter 13 bankruptcy comes off your credit reports after 7 years from completion. Can you legally remove a bankruptcy from your credit report before 7-10 years? Yes! The law states the upward limits of how long a bankruptcy can stay on your credit report but they dont have to be on your credit report that long or at all.

You have to know the game in order to beat them!

Persistently pester. Demand documentation. Provide proof. Look litigious. Trick and trap. NEVER, EVER, LIE.

To be clear, never lie. NEVER say you didnt file bankruptcy if you did. NEVER claim a debt is not yours if it is yours. In your disputes, the law is on your side. You need not prove anything, just cast doubt, the burden of proof is theirs.

ALSO, there is no law saying ANYTHING, including bankruptcy, has to be listed on your credit reports. The law does set limits on how long things CAN be listed, and how they can be listed, and that they must be valid. Validity is where most credit report clean-up lies.

Credit bureaus report data from collection agencies and original creditors. WHO REPORTS BANKRUPTCIES???

Bankruptcy Removal Option A

Kerry

How Soon Can You Buy A House After Chapter 7

During a Chapter 7 bankruptcy, a court wipes away your qualifying debts. Unfortunately, your credit will also take a major hit. If you’ve gone through a Chapter 7 bankruptcy, you’ll need to wait at least 4 years after a court discharges or dismisses your bankruptcy to qualify for a conventional loan.

Read Also: Can You Buy A House With A 620 Credit Score

How Can I Raise My Credit Score To 800

How to Get an 800 Credit Score

Which Credit Report Errors Arent Worth Disputing

![How to Remove a Bankruptcy from Your Credit Report [See Proof]](https://www.knowyourcreditscore.net/wp-content/uploads/how-to-remove-a-bankruptcy-from-your-credit-report-see-proof.jpeg)

Small errors that dont affect your score like a misspelled former employer name or an outdated phone number dont hurt anyones assessment of your creditworthiness and arent worth disputing.

And sometimes a negative mark might surprise you but is not an error. If its accurate, dont use the dispute process. Instead, try to resolve the problem directly with the creditor. For example, if you accidentally missed a payment, contact the creditor, arrange to pay up and ask if it will rescind the delinquency so it no longer appears on your reports.

The credit agencies are not obligated to investigate frivolous claims.

You May Like: How Do You Build Your Credit Score

When Can You Get A Line Of Credit Again

Once youve established good financial habits, the best way to start rebuilding your credit profile and score is to obtain a secured loan of some type. This includes secured credit cards from a bank or a line of credit.

Most banks will approve you for an approved secured credit card a few years after filing bankruptcy. That should be the next step someone takes, Exantus said.

In addition, dont be surprised if you start receiving credit card offers during the seven to 10 years that a bankruptcy remains on your report. Credit card companies make more from customers who have low credit scores or bankruptcies.

You are a prime candidate for credit because most credit card companies know that a person has filed for bankruptcy and that they are going to want to get credit again. And they know they can charge you a higher interest rate because you have a lower credit score, Exantus added.

Donât Miss: Who Is Epiq Corporate Restructuring Llc

Start Rebuilding Your Credit Today W/help From Credit Glory

Disputing negative items on your credit report is hard work! It takes a lot of time, effort, organization, and follow up. The good news? Our team of credit repair professionals is here to simplify everything! Let your dedicated credit repair expert relieve you of the stress, hassle, and time needed to fight your inaccuracies and boost your credit score

Call us at or set up a consultation to get started, today!

Also Check: How Long Will My Bankruptcy Stay On My Credit Report

Make Sure You Pay All Your Bills Early Or On Time

Your payment history is the most important factor that makes up your FICO score, accounting for 35 percent. With that in mind, youll want to make sure you pay every bill you have early or on time. Set a reminder on your phone if you have to, or take the time to set up each of your bills on auto-pay. Whatever you do, dont wind up with a late payment that will only damage your credit score further and prolong your pain.

Dispute Inaccurate Items Yourself

You can embark on DIY credit repair by ordering your three credit reports from AnnualCreditReport.com, a source of free credit reports authorized by the federal government. You need all three reports because creditors may report transactions to only one or two credit bureaus.

After receiving the reports, review the four sections for errors:

- Identification: Information identifying yourself, including your address, date of birth, and Social Security number. Incorrect information may be a tip-off that the report covers accounts that dont belong to you.

- Tradelines: This contains your account data, which includes your use of credit and your borrowing activity. The data includes loan and credit account balances, payment history, and a collection account or charge-off.

- Public records: Court information regarding adverse legal judgments, bankruptcies, liens, foreclosures, vehicle repos, and money owed for child support.

- Inquiries: Hard inquiries are those you authorize a credit provider to make when you apply for a credit card or loan. These can lower your credit score. Unauthorized soft inquiries have no impact on your score.

The hardest part of DIY credit repair is combing through your report data for accounts or account activity you dont recognize, incorrectly reported negative credit file items , and liens and judgments you have already paid. You also should check for hard inquiries you didnt authorize.

Also Check: What Does Natural Disaster Mean On Credit Report

Apply For A Credit Builder Loan

While working to have the bankruptcy removed, you can also apply for a credit builder loan through your financial institution or local credit union. Credit builder loans require a deposit into a savings account that is equal to the loan amount. The financial institution reports payments to the credit bureaus and the funds are accessible once you pay the loan off.

You can also use Self Lender, which only requires a small administrative fee upfront and monthly payments until the loan is paid in full. In a nutshell, they take the loan amount and deposit it into a certificate of deposit. Payments are reported to the three credit bureaus to help you establish a positive credit history. And at the conclusion of the loan term, you can withdraw the funds or choose to roll them over into another credit builder loan product.

Clean Up Your Financial Act

There are a number of reasons why you may have been forced to file for bankruptcy. But whats most important when rebuilding your credit is not the culprit, per se, but making sure that history doesnt repeat itself. In other words, you want to establish a solid plan for your finances to make your money work for you. In your list of objectives should be creating a realistic budget that keeps your spending in check, safety net, and plans to eradicate debt that wasnt included in the filing.

Read Also: Does American Express Give You A Free Credit Report

Mistake #: Applying For New Credit

If youre trying to repair your credit, the chances of being approved for additional credit, especially unsecured credit, are not great. You could be wasting a hard inquiry that ends up lowering your credit score right at the time youre trying to raise it. Its best to save applying for new credit for laterafter your credit has been repaired.

Also Check: Is It Bad To Dispute Credit Report

What Are The Consequences Of Having A Dismissed Bankruptcy Versus Having A Discharged Bankruptcy On My Credit

![How to Remove a Bankruptcy from Your Credit Report [See Proof]](https://www.knowyourcreditscore.net/wp-content/uploads/how-to-remove-a-bankruptcy-from-your-credit-report-see-proof.jpeg)

A “Dismissed Bankruptcy” is when a bankruptcy case has been dismissed, and the discharge of debts is not granted.

A “Discharged Bankruptcy,” on the other hand, is when a bankruptcy case has been dismissed and the discharge of debts has been granted.

The consequences of having a “Dismissed Bankruptcy” versus a “Discharged Bankruptcy” on your credit depending on the type of bankruptcy you filed for.

If you filed for Chapter 7, having a dismissed bankruptcy will have more negative consequences than if you filed for Chapter 13. In Chapter 7, your debts are discharged, and you are no longer liable to pay them back, but in Chapter 13, your debts are not discharged, so it’s important to make payments.

Recommended Reading: How Long Does Rental History Stay On Your Credit Report

Hire A Credit Repair Company To Help

If youd rather save yourself the time of going through this entire process yourself, you may want to look into hiring a professional company to help you do it.

Take a look at our review of the best credit repair companies.

Keep in mind that these companies charge a fee for their services, so youll need to factor cost into your decision.

How Long Does A Bankruptcy Or Consumer Proposal Stay On My Credit Report

How long bankruptcy stays on your credit report in Canada will depend on the credit bureau that is reporting.

The largest credit bureau in Canada, Equifax, maintains this record on your credit report for a period from the date of your discharge or last payment:

- A first bankruptcy for six years from the date of your discharge.

- A second bankruptcy for 14 years.

The TransUnion web site states that they keep a bankruptcy on your credit file for six to seven years from the date of discharge or fourteen years from the filing date .

At this point the bankruptcy will leave the credit report and you will need to start to rebuild your credit.

How long a consumer proposal stays on your credit report again depends on the credit bureau that is reporting.

With Equifax, a consumer proposal is reported for three years after your last payment.

Also Check: How To Bring Up Credit Score

How To Remove A Dismissed Bankruptcy

Verified bankruptcies can’t be removed from your credit report. However, you can remove them if they’re inaccurate. Finding & disputing these mistakes can be tricky. Here’s how you can do it.

- Check your credit report for errors – Before you can dispute an error, you have to find it first. You can find common errors in personal info, account status, and balance & data mistakes.

- Verify information – According to the FTC, 20% of the population has at least one error on their credit report. Inaccurate negative marks hurt your score. That’s why it’s important to verify the info on your report.

- Dispute inaccuracies – Once you have found errors, you can dispute them. This means gathering evidence, writing a dispute letter to all 3 credit bureaus, & waiting.

- Work w/a credit repair professional – Finding and disputing errors yourself is a hassle. Teaming up with a credit repair expert simplifies the process. They know what to look for & help you avoid costly mistakes, so you can easily boost your credit.

Early Removal Of A Bankruptcy From Your Credit Report

When you file for bankruptcy, it will appear on your credit history. Chapter 7 bankruptcy cases stay on your credit report for 10 years and Chapter 13 cases stay on for seven years. After this time passes, the bankruptcy should disappear from your credit report automatically.

Creditors are required by law to only report accurate information to credit bureaus. This requirement protects consumers from having any inaccurate information on their reports that would unfairly harm their credit. But this also prevents information from being removed when it is correct. So when you have a bankruptcy case on your credit report and itâs accurate, it canât be removed early.

That said, if the bankruptcy entry has incorrect information or has been wrongly entered, you have the right to dispute it. The Fair Credit Reporting Act gives you the legal right to dispute inaccuracies and errors on your credit report. If you challenge an entry and the agency that reported the entry canât defend it, then theyâre required to remove it.

Recommended Reading: How To Get Your Rent Payments On Credit Report

Request Credit Report From All Three Major Bureaus:

As youre working through your financials, request a copy of your credit report from each of the three major credit reporting bureaus. The three major credit reporting bureaus are : Experian, Equifax, and TransUnion. Review each one carefully for inaccuracies and discrepancies if you find mistakes, work with the bureau to correct them. If they refuse to make changes or additions that you think are correct, bring in legal representation to take on the case.

Where To Find A Bankruptcy On Your Credit Report

You should review your credit reports often to make sure theyre accurate. You can claim a copy of all three of your reports once every 12 months from AnnualCreditReport.com.

When youre reading your credit report to see if a bankruptcy is listed, start by finding the public records section of the report. In the past, tax liens and judgments could be found in this section too. However, the credit bureaus have since removed judgments and tax liens from credit reports as part of the National Consumer Assistance Plan . Now, bankruptcies are the only public records included on consumer credit reports.

You May Like: Does Klarna Show Up On Credit Report

Is Pay For Delete Illegal

The Fair Credit Reporting Act sets the rules for credit reporting as it applies to creditors, debt collectors, credit counseling organizations, and credit bureaus. The FCRA does not contain any language banning pay for delete, so its legal.

But before you get too excited, bear in mind that you can deploy pay for delete only on items that are incomplete or inaccurate. The FCRAs scope means you cant have accurate items removed from your credit report. If you try to use questionable techniques to remove accurate items, you may, in fact, be breaking the law.

Any pay for delete agreement you reach with a debt collector should be documented in writing in case you need to enforce the deal. Normally, you must first pay off the debt before the collector will remove the item, so a written agreement is required to ensure compliance.

Understand that without the agreement in place, the collector is under no obligation to remove items from your credit report, but theyre also not under any restriction to do so.

Learn Positive Financial Habits

As time goes by after your bankruptcy and you begin to earn new forms of credit, make sure you dont fall back into the same habits that caused your problems. Only use credit for purchases you can afford to pay off, and try using a monthly budget to plan your spending. Also, work on building an emergency fund to cover three to six months of expenses so a random surprise bill or emergency wont cause your finances to spiral out of control.

You May Like: How To Fix My Credit Rating

You Have Options To Legally Remove Items From Credit Report

It wont cost you anything to have a free consultation with one of our top-rated credit repair services. This process can, at the least, tell you where your reports stand and whether its services can help you legally remove items from your credit reports.

Knowing which items you can legally dispute will give you an idea as to whether you can go it alone or youd feel more comfortable enlisting a service. Check out Sky Blue Credit Repairs money-back guarantee if youre wary of spending money on a credit repair company.