How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report Is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Why Should You Check Your Credit Report

Mistakes happen. In fact, a study finds that 34% of consumers have at least one error on their credit report. These errors can affect your ability to get approved or cause you to pay higher rates when you are approved. The only way to verify that your credit report contains the right information is to review the information on an ongoing basis.

Quincy Listed Information From His Credit Report Which List Could Quincy Have Written

Category: Credit 1. understanding credit Flashcards | Quizlet Quincy listed information from his credit report. Which list could Quincy have written? previous address, current address, bankruptcy, car loan payment Quincy listed information from his credit report. Which list could Quincy have written? previous address, current address, bankruptcy, Quincy listed information

Don’t Miss: Is 692 A Good Credit Score

Which Credit Score Matters The Most

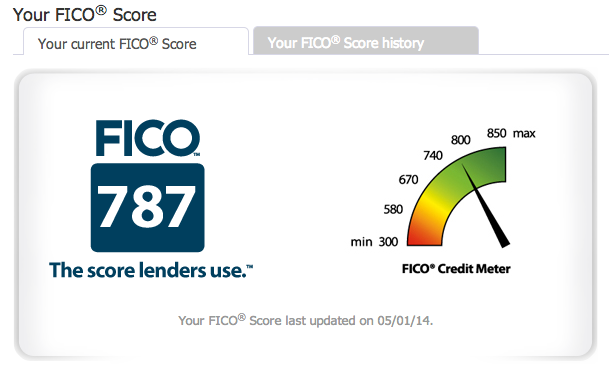

While theres no exact answer to which credit score matters most, lenders have a clear favorite: FICO® Scores are used in over 90% of lending decisions.

While that can help you narrow down which credit score to check, youll still have to consider the reason why youre checking your credit score. If youre accessing your credit score simply to track your finances, a widely-used base score like FICO® Score 8 works. This version is also helpful for gauging which credit cards you qualify for.

If you plan to make a specific purchase, you may want to review an industry-specific credit score.FICO lists the specific scores that are used for various financial products. FICO® Auto Scores are ideal if you want to finance a car with an auto loan, while its good to check FICO® Scores 2, 5 and 4 if you plan to buy a house.

Dont miss:

Recommended Reading: Experian Boost Paypal

What Should I Look For In My Credit Report

When , check that all the information listed is up-to-date and accurate. Heres a brief breakdown on the kinds of things to verify within each credit report:

- Personal Information: Social Security number, name and address

- Inquiries: everyone who has reviewed your credit report in the past 2 years

- Public Records: bankruptcies, which can stay on a credit report for up to 10 years

Also Check: What Is Locking Your Credit Report

There Are Multiple Credit Score Formulas At Play

The second reason, which is actually even more of a problem, is multiple credit scoring formulas are used. Even FICO, which youve probably encountered, has several different scoring formulas.

There are a couple of reasons for this. FICO is constantly tinkering with its credit scoring formula to get the most predictive tool possible. The goal is to get a formula that accurately predicts credit risk, and theyre constantly adjusting it to achieve that goal. Some lenders may choose to use the newest version of the formula, but others may continue to use older versions.

The second problem is that some lenders and industries have customized versions of the FICO formula. For instance, the FICO formula used on your credit file when you apply for a home loan might differ from the formula used for a credit card.

And theres still one more problem. Lenders can customize their processes even more on their own. Some lenders take into account other information outside of your FICO score or even your credit file. Some develop their own formulas or use a formula FICO didnt develop. Others take into account other information they may have on you.

That’s the bad news.

The good news is that if you check your credit score through FICO, it will likely be reasonably close to what most lenders will see. I know reasonably and most are caveats here. You could wind up with a lender that doesnt use the FICO Score or uses an older version of the formula.

Read More:

Whats The Best Site To Get A Free Credit Report

The best site for free credit reports depends on what you need.

If you want to take a look at your credit reports from Equifax and TransUnion, you can do so on Credit Karma.

The Fair Credit Reporting Act entitles you to one free copy of your credit report from each of the three major consumer credit bureaus every 12 months. You can order them online at annualcreditreport.com.

Read Also: Is 673 A Good Credit Score

Get Your Credit Score

Your credit score comes from the information in your credit report. It shows how risky it would be for a lender to lend you money.

Learn more about how your credit score is calculated.

You can access your credit score online from Canadas 2 main credit bureaus.

Your credit score from Equifax is accessible online for free and is updated monthly. If you live in Quebec, you can also access your credit score from TransUnion online for free.

Other companies may also offer to provide your credit score for free. Some may ask you to sign up for a paid service to get your score.

Monitor Your Credit For Free

Join the millions using CreditWise from Capital One.

Will Checking My Scores Hurt My Credit?

Checking your scores wonât affect your credit, as long as the service uses a soft inquiryâlike CreditWise does. That means you can check your credit as many times as you want without hurting your scores.

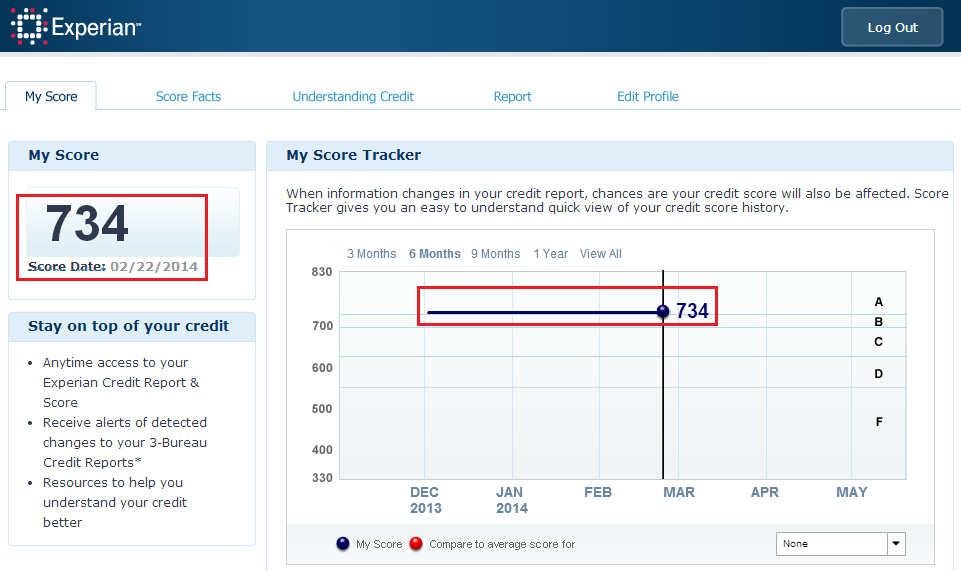

According to Experian, you should do a credit check once a year to keep an eye on your credit score range and check to make sure the information in your credit report is accurate. If you find inaccurate information, you may file a dispute with the credit bureau where you found itâor directly with the lender.

Don’t Miss: How Long Does High Balance Stay On Credit Report

Experian Vs Credit Karma: Whats The Difference

Experian is one of the three major credit bureaus, along with Equifax and TransUnion. These companies compile information about your credit into reports that are used to generate your credit scores.

Instead, we work with Equifax and TransUnion to provide you with your free credit reports and free credit scores, which are based on the VantageScore 3.0 credit score model. We also offer recommendations for credit cards, personal loans, auto loans and mortgages.

Great If Looking For A House

We are in process of buying a home and this app gave us the exact info we needed across all three bureaus. Was able to clean up some negative stuff and they updated any changed info along the way. One of my scores does not reflect the actual since changes on my end and I think the subscription only checks for an update once a month, but for the most part if something major changes the bureaus usually report it an its takes effect almost immediately. Happy with this app an service and yes I do recommend if your serious about fixing your credit or buying a house or car

Recommended Reading: What Is The Highest Credit Rating

Deseret First Credit Union

Category: Credit 1. Deseret First Credit Union | LinkedIn Deseret First Credit Union | 621 followers on LinkedIn. YOU KNOW WHY | WE SHOW HOW | Deseret First Credit Union exists to foster the financial independence DFCU Mobile Banking by Deseret First Credit Union allows convenient access 24/7 on your

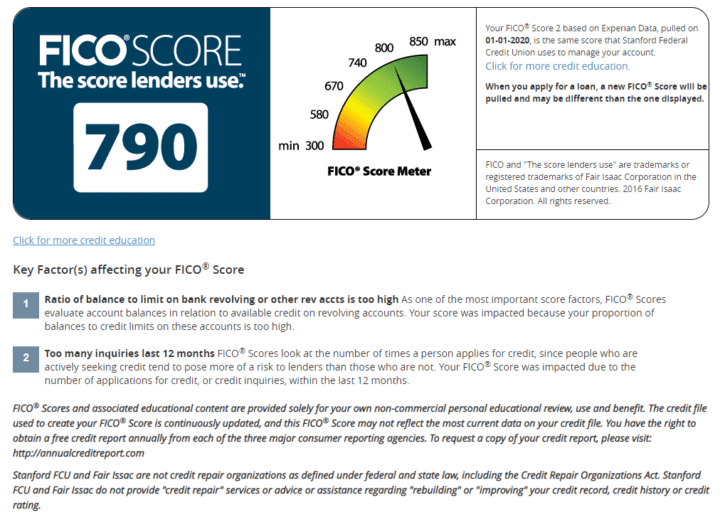

What Is A Good Experian Fico Score

A good Experian FICO score is considered to be 670 or better when looking at the FICO 8 scoring model. The chart below shows the ranges of credit scores from poor to excellent.

Its important to know your credit score and what a good credit score is because having a poor or fair Experian credit score could cost you lenders may be reluctant to give you a loan or approve you for a credit card, or you may pay a higher interest rate than a borrower with a good credit score.

You May Like: Does Credit Line Increase Affect Credit Score

Keep An Eye On Your Credit

Your real FICO® Score can be had for free in several ways, but if you want to check multiple FICO® Scores, you’ll generally need to opt for a paid service. You can look for services that come with more than just your credit scores, such as Experian CreditWorks Premium. Experian’s service also includes free credit report and score monitoring with notifications if there are any suspicious changes. Additionally, you get a wide-range of identity theft monitoring and protection services, including dark web surveillance and up to $1 million in identity theft insurance.

You can also match your score checking or monitoring with your current needs. A free score tracking service can help you keep an eye on one of your FICO® Scores and give you a sense of if your credit is improving. But a paid service may make more sense if you want identity theft protection, or if you’re planning to buy a home and want to check the FICO® Scores that mortgage lenders commonly use.

How Creditwise Stacks Up

Compared with other free credit-monitoring products, CreditWise favors depth over breadth. It offers only one credit score, from TransUnion, but its credit simulator is among the most comprehensive weve seen.

With the credit simulator, you can choose from any combination of 17 credit-influencing events. For example, you could see what might happen to your score if you canceled your oldest card. Or you could see what might happen to your score if you canceled your oldest card and charged $517 to another account and were 30 days delinquent on a payment. Its unusual to see a credit simulator thats so customizable.

People wanted to see how certain decisions were going to affect their credit, Solomon says. When designing the app, we really wanted to demystify what goes into credit scores.

Like many free credit-scoring services, CreditWise doesnt offer FICO scores, which most lenders use, but it offers VantageScore 3.0 scores, which are based on similar factors. VantageScores are used by seven of the 10 largest banks, according to the VantageScore website.

The CreditWise apps biggest drawback is that it gives you only one credit score from one bureau. If you want to know your FICO scores or your Experian or Equifax VantageScores, youll have to look elsewhere.

Read Also: How To Make My Credit Score Go Up Fast

Which Credit Bureau Report Or Score Is Most Accurate

If youve ever applied for a loan, apartment rental or even a job, you might have seen the 3-digit number that is your credit score. And if that number changes from day to day, or application to application, chances are youre wondering why.

What many people dont realize, however, is that there are multiple credit scores. So, if youre wondering which credit bureau, report or score is the most accurate, heres what you need to know.

Fico Vs Vantagescore: Which Is Better

VantageScore and FICO are both software programs that are used to calculate credit ratings based on consumers spending and payment history. FICO, for Fair Isaac Corp., is the older and better-known model, having been introduced in 1989. VantageScore, released in 2006, was developed by the three leading consumer credit agencies, Experian, Equifax, and TransUnion.

Because they are different models, your VantageScore will inevitably be a little different from your FICO score. For that matter, you may get a different FICO score from various sources at any given time, depending on whether the source uses a specialized variety of FICO or the most-often-used base model, and which of its many versions is used.

The key point is, your score should be in the same range on any or all of those models. You should not have a good VantageScore and only a fair FICO score.

Read Also: How To Dispute Credit Rating

What Other Free Tools Does Credit Karma Offer

Free credit reportsOn Credit Karma, you can check your free credit reports from Equifax and TransUnion. And as with your credit scores, you can check your free credit reports as often as you like.

Free credit monitoringCredit Karmas free credit-monitoring service can alert you to important changes on your Equifax and TransUnion credit reports. Along with checking your credit scores regularly, this feature sends you an alert so you can sniff out any suspicious activity.

Mobile appThe allows you to check your credit scores on the go. The app also features tools ranging from the newRelief Roadmap to opt-in push notifications that help alert you to potential changes on your Equifax or TransUnion credit reports.

How Does Credit Karma Compare To Actual Credit Scores

A lot of people also wonder how Credit Karma compares to actual credit scores. Well, Credit Karma generates credit reports from two of the three credit report agencies that are at the top. As already mentioned, they create these credit reports through agencies like Equifax and TransUnion. The score reported from these two is very close, and even if the points will be a bit off, they wont be by much.

The only top credit agency that does not report to Credit Karma is Experian. This is basically where the few points that are off are coming from. This relates to the actual credit or FICO score, so that is why it is affected.

You May Like: Do Cash Advances Hurt Your Credit Score

How Do I Get My True Fico Score For Free

The first place you should check for your free FICO Score is with your credit card issuer. Many card issuers provide their cardholders with free access to their credit score. While there’s a good chance you’ll have access to your credit score, the key is whether it’s your FICO Score or VantageScore.

Like This Article Pin It

Disclaimer: This site contains affiliate links from which we receive a compensation . But they do not affect the opinions and recommendations of the authors.

Wise Bread is an independent, award-winning consumer publication established in 2006. Our finance columns have been reprinted on MSN, Yahoo Finance, US News, Business Insider, Money Magazine, and Time Magazine.

Like many news outlets our publication is supported by ad revenue from companies whose products appear on our site. This revenue may affect the location and order in which products appear. But revenue considerations do not impact the objectivity of our content. While our team has dedicated thousands of hours to research, we arent able to cover every product in the marketplace.

For example, Wise Bread has partnerships with brands including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi, Discover, and Amazon.

Don’t Miss: What Do Landlords See On Your Credit Report

Best For Credit Monitoring: Credit Karma

If you’re interested in viewing your credit performance over time, CreditKarma may fit the bill. It lets you access your Equifax and TransUnion reports quickly and easily.

-

Only offers reports from two credit bureaus

-

Account required

While you will have to create an account to use Credit Karma, you dont have to enter your credit card information or remember to cancel any free trial subscription. You can access your credit reports at any time by logging into your account either directly through your web browser or through their mobile app. Your credit report information is updated to reflect changes in your credit history and activity, giving you continued access to changes in your credit information. Although, changes my require some days to be reflected in what is shown by Credit Karma.

Youll have access to your credit report information along with an explanation of the factors that are currently contributing to your credit score. Credit Karma also uses your free credit report information to show credit card and loan offers that you may qualify for based on your credit standing. You dont have to take advantage of these offers if youre not on the market for a new credit card or loan product.

How Credit Karma Makes Money

Credit Karma’s business model is not entirely altruistic. It is a for-profit business that makes money by giving you a free credit score in exchange for learning more about your spending habits and charging companies to serve you targeted advertisements.

Credit Karma places advertisements in front of its users, hoping that they will respond to them by clicking on them. Many of these advertisers are lenders, and Credit Karma may earn a fee if you apply through one of its links.

Your personal data is valuable stuff to advertisers, and they pay more to target it. With more than 100 million users,

Read Also: Is 724 A Good Credit Score

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means