Why Are Your Credit Score And Report So Important

Your credit report is like your financial report card, and your credit score is like your final grade. In Canada, banks and lenders review your credit when you apply for financial products. Your credit report can also be pulled by car dealerships, insurers, cell phone companies, landlords, and future employers to determine your ability to manage debt and meet financial obligations. Because of this, it’s important to know your credit.

What’s Included In Your Credit Report

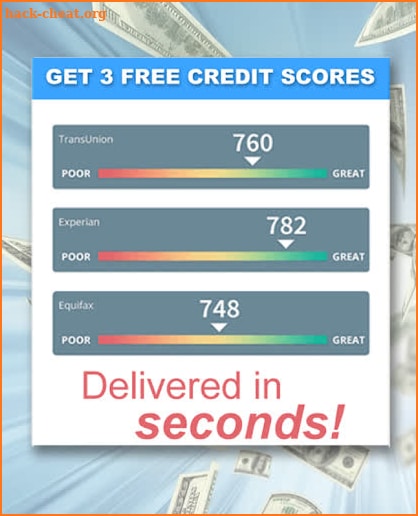

Credit reports are maintained by the three national consumer credit bureaus: Experian, TransUnion and Equifax. Your credit report with each bureau may be slightly different, but will contain personally identifiable information, including the year you were born, address and more. It may also include information about current or past employers.

Your about your history with credit and debt, provided by creditors, and a record of who has requested your information. Your credit report may be pulled when you apply for credit, an apartment or sometimes a job. In addition, your current creditors and others you do business with may have access to your credit report under certain conditions. You may also see a list of lenders who have requested information about you in order to send you preapproved offers.

Credit-scoring formulas use information about how you have managed your credit found in your credit report to calculate your credit scores.

Best For Daily Updates: Wallethub

WalletHub

-

Access to TransUnion report only

-

Account required

Your credit report information can change frequently as your creditors send in updates to the credit bureaus. Weekly or monthly updates can keep you a bit out of touch with your credit report details. WalletHub is the only site that provides free daily updates to your full credit report information along with a summary of important changes to your credit information.

Youll have the most updated information from your TransUnion credit report, allowing you to act quickly to changes or suspicious activity on your credit report. WalletHub also provides personalized credit advice based specifically on your credit information.

In addition to your free credit report, youll also have access to your free credit score , which allows you to quickly see where your credit stands and how potential lenders might view your credit risk. Theres no credit card necessary to sign up and you wont damage your credit by using the service, even if you check your credit report every day.

Also Check: What Is The Best Credit Score You Can Get

How Often Should You Check Your Credit Score

Your credit score is the number that reflects your credit activity. Its a simplified version of your credit report, and you can check it for free. You should check your credit score at least once per year, but its smart to check it more often if you are working hard to improve it, like in the situation of preparing to apply for a loan.

Recommended Reading: Whats The Highest Credit Score You Can Get

Why Get Your Free Experian Credit Report

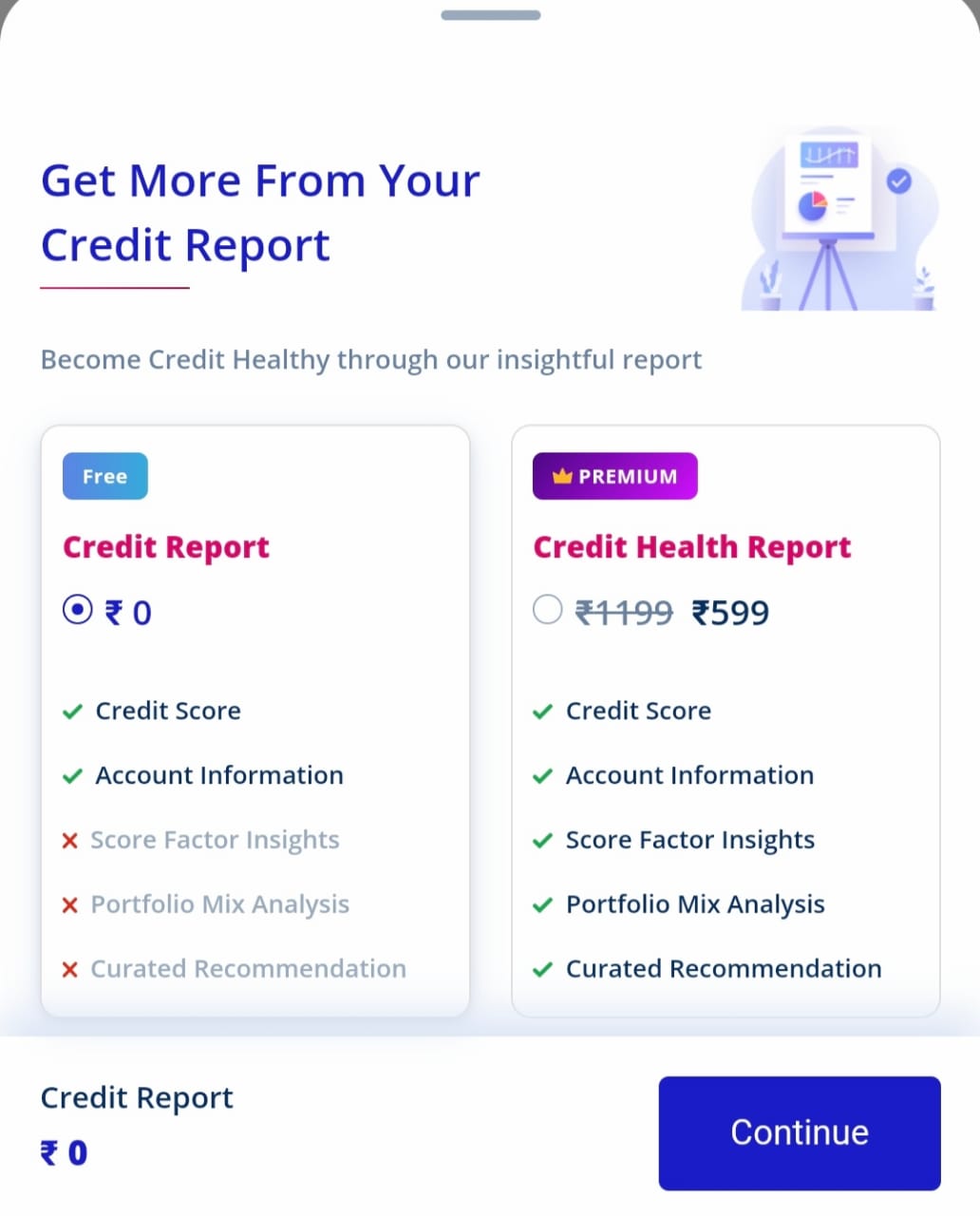

Gain credit insights

View the same type of information that lenders see when requesting your credit. See whoâs accessing your data and get tips on how to improve your financial health.

View your score factors

Your credit score is calculated from the information found in your credit report. See the positive and negative factors that impact your FICO® Score.

Raise your credit scores instantly

Get credit for your phone and utility bills by adding positive payments to your Experian credit file.

Average users who received a boost improved their FICO® Score 8 based on Experian Data by 12 points. Some may not see improved scores or approval odds. Not all lenders use credit information impacted by Experian BoostTM.

Don’t Miss: What Does Debt Consolidation Do To Your Credit Score

Getting Free Credit Reports Under The Fcra

The three major credit bureaus have set up a central website and a mailing address where you can order your free annual report.

You may get your free reports at the same time or one at a time – the law allows you to order one free copy of your report from each of the credit bureaus every 12 months.

To get your free reports, visit AnnualCreditReport.com. You can also complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281.

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

You May Like: Does Checking Credit Score Hurt Credit

How We Chose The Best Free Credit Reports

We evaluated and selected the best free credit reports based on a few factors, including the number of credit reports you can access, the frequency of updates, the ease of understanding the information, the ease of signing up for a new account, and whether a free credit score or analysis was also included. We excluded any companies that required credit card information to sign up or that only offered a free credit report on a trial basis.

Does Checking My Credit Report Hurt My Credit

No, checking your credit report does not hurt your credit. And checking your credit score doesn’t hurt your credit either. These actions are considered “soft pulls” which don’t affect your credit score. Actions, such as applying for a credit card, which require a “hard pull,” temporarily ding your credit score.

Learn more: Check your odds of getting approved for a credit card without hurting your credit score.

Also Check: Is My Credit Karma Score Accurate

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

Warning About Impostor Websites

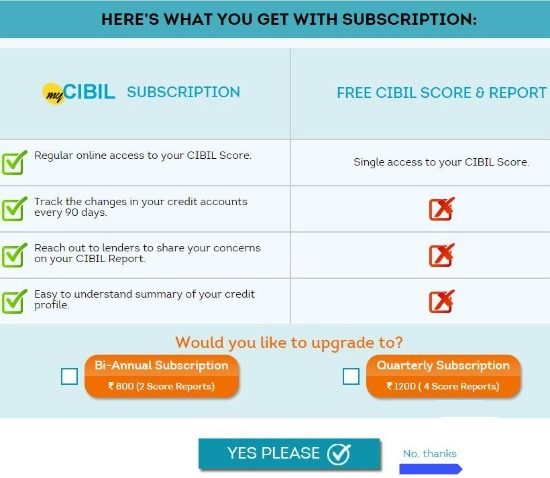

Only one website is authorized to fill orders for the free annual credit report you are entitled to under law: AnnualCreditReport.com. Other websites that claim to offer “free credit reports,””free credit scores,” or “free credit monitoring” are not part of the legally-mandated free annual credit report program.

In some cases, the “free” product comes with strings attached. For example, some sites sign you up for a supposedly “free” service that converts to one you have to pay for after a trial period. If you don’t cancel during the trial period, you may unwittingly agree to let the company start charging fees to your credit card.

Some “impostor” sites use terms like “free report” in their names others have URLs that purposely misspell Annualcreditreport.com in the hopes that you will mistype the name of the official site. Some of these “imposter” sites direct you to other sites that try to sell you something or collect your personal information.

Annualcreditreport.com and the nationwide credit reporting companies will not send you an email asking for your personal information. If you get an email, see a pop-up ad, or get a phone call from someone claiming to be from Annualcreditreport.com or any of the three nationwide credit reporting companies, do not reply or click on any link in the message. It’s probably a scam. Ensure you are on the right website by verifying through the Consumer Financial Protection Bureau .

Also Check: Does Running Credit Check Lower Score

Whats The Best Site To Get A Free Credit Report

The best site for free credit reports depends on what you need.

If you want to take a look at your credit reports from Equifax and TransUnion, you can do so on Credit Karma.

The Fair Credit Reporting Act entitles you to one free copy of your credit report from each of the three major consumer credit bureaus every 12 months. You can order them online at annualcreditreport.com.

Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free credit report if

- you get a notice saying that your application for credit, employment, insurance, or other benefit has been denied or another unfavorable action has been taken against you, based on information in your credit report. Thats known as an adverse action notice. You must ask for your report within 60 days of getting the notice. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

If you fall into one of these categories, contact a credit bureau by using the below.

You May Like: How To Check Credit Score Chase

How To Get A Free Credit Report

Many consumers wonder how to get a free credit score report. According to FTC.gov, the Fair Credit Reporting Act requires the three national credit bureausExperian, Equifax, and TransUnionto provide free copies of credit reports once every 12 months to consumers who request one. They must also set reasonable prices for scores for consumers who need to retrieve their credit report more than once per year. Here are some guidelines on how to get a credit report:

For those wondering how to get a free credit score report, you can use the governments free website AnnualCreditReport.com, or get your free credit report from websites like Mint.

Protect Yourself When Getting Your Credit Report Or Score

Make sure you do your research before providing a company with your personal information. Carefully read the terms of use and privacy policy to know how your information will be used and stored.

For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit reports or credit scores to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

Also Check: When Buying A Car What Credit Score Is Used

Why Should You Check Your Credit Reports Frequently

Your credit reports are updated about once a month with data the credit bureaus have received. Credit reports may contain information about your credit card accounts, loans and credit applications youâve submitted.

If you find errors in your credit file, it could mean youâve been a victim of identity theft. Any incorrect information may hurt your , which are calculated based on whatâs in your credit report. And a lower credit score might make borrowing more expensive or prevent you from getting credit. If you find an error, you may want to dispute the information.

Read Also: What Is An Inquiry Credit Report

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Also Check: How To Check My Credit Score Bank Of America

How Do I Get A Copy Of My Credit Reports

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies . You can request a copy from AnnualCreditReport.com.

You can request and review your free report through one of the following ways:

- Mail: Download and complete the Annual Credit Report Request form. Mail the completed form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

You can request all three reports at once or you can order one report at a time. By requesting the reports separately you can monitor your credit report throughout the year. Once youve received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $13.50 for a credit report.

You are also eligible for reports fromspecialty consumer reporting companies. We put together a list of several of these companies so you can see which ones might be important to you. You have to request the reports individually from each of these companies. Many of the companies in this list will provide a report for free every 12 months. Other companies may charge you a fee for your report.

You can get additional free reports if any of the following apply to you:

Difference Between Credit Reports And Credit Scores

While your credit score and credit report are related, they’re not the same thing. Your credit score is a single three-digit number that signals your credit health to lenders and creditors. Your credit report doesn’t include your credit score. The report, which includes credit activity, is used to calculate your credit score.

Don’t Miss: How To Access Credit Report Again

Where Can I Check My Credit Scores And Reports

There are a number of places where you can check your credit reports and scores. Just be aware that some of those places may charge you for the information. To check your credit scores or reports, you could:

- Sign up for a service like .

- Check what options are available from the credit bureaus or .

Monitoring your credit can help you understand where you stand. But itâs important to note that decisions about loan applications or credit cards are ultimately up to each lender. And because there are multiple scores and reports out there, what you see in reports and scores youâre given might not be exactly the same as what lenders use to judge creditworthiness.

See Your Latest Credit Information

See the same type of information that lenders see when requesting your credit.

Your Credit Report captures financial information that lenders use to determine your creditworthiness. This includes the type of credit accounts, current balances, payment history, and any derogatory items you may have. You will also get a summary of your account totals, total debt, and personal information.

Recommended Reading: Why Would An Employer Be Added To Your Credit Report

A Better Score Means Better Deals

Your credit score is a number that reflects your financial history on your credit report. This is what banks and lenders often use to help them decide whether or not to lend to you. A high credit score may mean you are eligible for more products at lower rates – and we can help you improve your score.

Why Is It Important To Maintain A Good Credit Score

listed down some of the important reasons due to which you must maintain a good credit score:

improves your eligibility for loans: a good credit score improves your eligibility to get a loan faster. a good credit score means that you pay the bills or outstanding amount timely that leaves a good impression of yours on the banks or other financial institutions where you have applied for a loan.

quicker loan approvals: applicants with a good credit score and long credit history are offered pre-approved loans. moreover, the loan that you have applied for gets approved quickly and processing time is zero.

lower interest rate: with a good credit score, you can enjoy the benefit of a lower rate of interest on the loan amount that you have applied for.

you are offered credit cards with attractive benefits and rewards if you have a healthy credit score.

higher : a good credit score not only gets you the best of credit cards with attractive benefits or lower rate of interest on the loan you have applied for but also you are eligible for getting a higher loan amount. a good credit score means that you are capable of handling the credit in the best possible manner, therefore, banks or financial institutions will consider offering you a credit card with a higher limit.

Recommended Reading: When Will Chapter 7 Bankruptcy Be Removed From Credit Report

Different Credit Bureaus Available In India

a credit bureau is a credit agency that collates your information and shares it with lenders and creditors in the form of a CIBIL score that is helpful in checking your creditworthiness.

below are some leading credit bureaus of the country –

1 . transunion CIBIL score

it is a complete credit bureau that reports the analysis for organisations as well as individuals. the credit score ranges from 300 to 850 720 or above is an excellent score. in the case of any entity or company, the credit score is known as a performance score. transunion cibil members include all the major financial institutes, lenders, nbfcs, and banks, etc.

2. equifax credit score checker

equifax gives portfolio scores and risk scores along with credit scores that usually range from 1 to 999 for individuals. working as an approved credit rating agency since 2010, equifax provides different reports like portfolio management, industry diagnosis, credit fraud, or risk management report in the case of companies.