When Should I Use A Credit Freeze

It’s a good idea to consider a credit freeze in a few situations, including these.

- Youve been the victim of a data breach. If your personally identifiable information has been exposed, cybercriminals could try to open new accounts in your name. A credit freeze can provide an extra layer of protection. Lenders wont be able to access your credit file, making it unlikely that theyll grant credit to anyone using your Social Security number.

- You believe youve been the victim of identity theft. You may start receiving bills for accounts you dont recognize. Or you may receive calls from collection agencies seeking payment on accounts you never opened. These are likely signals that you might be the victim of identity theft. A credit freeze could help prevent criminals from opening more accounts using your personal information.

- You want to protect against identity theft for a child. A provision of the Economic Growth, Regulatory Relief and Consumer Protection Act authorizes parents or guardians of children under 16 to set up a credit report for their child and then freeze it at no cost. This can help you protect against child identity theft.

A Credit Freeze Can Help Protect Against Identity Theft

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Protecting your credit is important since your can impact your financial life in many ways. A credit freeze is a security measure you might consider if you want to prevent unauthorized people from accessing your credit file. Freezing and unfreezing your credit is a relatively simple process, but it helps to understand how it works to know when it’s the right move.

Freezing Your Experian Credit Report Via Postal Mail

If you prefer to use the mail, you can send your request to Experian Security Freeze, P.O. Box 9554, Allen, TX 75013.

Experian has information on its website that should help you figure out what information and documents you may need.

In general, youll need to include your full name, Social Security number, birthdate, two years worth of addresses, a government-issued ID card, such as a drivers license, and a utility bill or other acceptable proof of address.

Recommended Reading: Is 627 A Good Credit Score

Can A Credit Freeze Affect Getting Approved For Credit

It’s important to understand that credit freezes limit access to your credit reports, but they don’t affect tracking activity on current credit accounts. Payments on your existing loans and credit accounts will continue to be reported whether or not a credit freeze is in effect, so timely payments and careful use of credit will continue to benefit your credit during a freeze. By that same token, late or missed payments and excessively high credit card balances will damage your credit even if a credit freeze is in place.

A credit freeze doesn’t change your ability to qualify for a loan or credit card, but it can be an obstacle to getting your application approved: Unless you unfreeze your credit before you submit your application, the lender will not be able to use your credit report to judge your qualifications as a borrower.

Lenders cannot use a credit freeze as grounds for denying your application, but they also are not obligated to follow up with applicants whose credit reports are inaccessible. Setting aside your application technically isn’t the same as denying it, but the end result could be the same for you: You won’t get the credit in question, even if you’re qualified for it based on your scores and credit history.

When You Shouldnt Consider Freezing Your Credit

You should always have a good reason to freeze your credit, though you shouldnât do it under these circumstances:

- Right before you apply for more credit: It takes a while to âthawâ your credit. Youre better off leaving your credit visible in case youâre in a situation where a credit check will occur.

- When no data hack or threat occurs: You may feel tempted to keep your credit frozen all the time until you need to apply for a loan. However, this tactic could backfire on you because you might lose out on a loan or job opportunity if you forget to unfreeze your credit.

Also Check: How To Get Credit Report Without Social Security Number

You May Like: How To Delete Collections From Credit Report

Manage Your Credit Freeze

How long does it take to freeze your credit? According to federal law, if you request a credit freeze online or by phone, the credit agency must place the freeze within one business day. When youre ready to lift a freeze, the agency must lift it within one hour of your request.You can request or lift a credit freeze by mail. In that case, the credit agency must place or lift the freeze within three business days after it receives your request.

When Should I Freeze My Credit

If you’ve been a victim of identity theft, you have more than one option to consider when it comes to protecting your credit. In many cases, a security alert may be sufficient. Learn more about other differences between a credit freeze and fraud alert.

When you place a fraud alert, also known as a security alert, on your credit report, you can add a telephone number so lenders can call you when they receive an application and verify that it’s you who is applying. You also can request additional free credit reports when you add an initial security alert or victim statement. Reviewing your report can help you determine whether or not you are a victim and help you take appropriate action.

In more extreme cases in which you’re experiencing ongoing fraud attempts, you may feel a security freeze is necessary.

It’s worth considering taking action to protect your credit if:

- Unexplained bills or collection notices are mailed to your address, in your name or under another’s name.

- New inquiries or credit accounts appear on your credit report, indicating activity with lenders or other companies you don’t recognize.

- Your bank or credit union notifies you about fraudulent activity on an account.

- You receive notification that you are or could be the victim of a data breach.

Don’t Miss: What Is The Highest Equifax Credit Score

How A Parent Can Freeze A Minors Credit

Usually, children are not the group to be concerned about when it comes to credit scores and reports, but also keep in mind that their credit is a blank slate. Many thieves know it, and if they get the chance to use your childs identity to open accounts, you may not know until they are an adult! Putting a freeze on your childs credit is a free way to restrict access to their personal information. It also provides the opportunity to give them the blank slate they deserve until they are 16. To freeze your childs credit, you will need to:

Why Doesnt Everyone Freeze Their Credit

While freezing your credit wonât guarantee safety, itâs a pretty strong defense against identity theft. But remember â you still need to unfreeze your credit if you legitimately want to apply for a loan or line of credit. While itâs not a heavy burden, it does add extra steps anytime you do something that requires a credit check.

You May Like: How Far Back Does A Credit Report Go

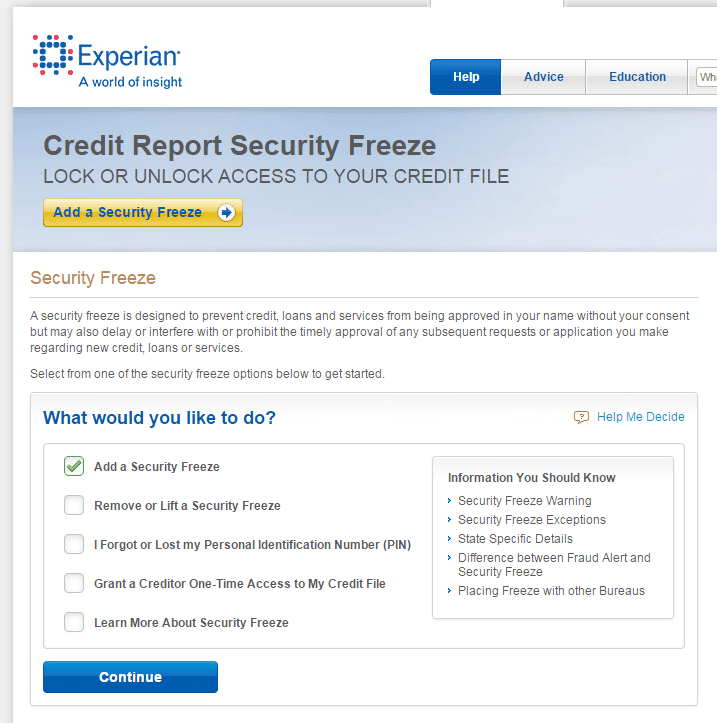

Go To Experians Security

The process to freeze your Experian credit report starts at Experians security-freeze website.

If you already have a credit freeze in place, this is also where you can lift your freeze.

Click Add a security freeze, at which point the system asks you to clarify that you want to freeze your credit report . If you do have a child under the age of 16, you can freeze their Experian credit report too. The Federal Trade Commission offers tips for how to do this.

If your kid doesnt have a credit report, Experian can create one for them and then freeze it. This helps ensure that con artists cant use their information to open up fraudulent credit accounts.

Unfreezing Your Credit Is Simple

Online toolsas well as phone and mail-based optionsmake it easy to unfreeze your credit file in a timely, secure manner. Whether you need to temporarily thaw your credit file or permanently unfreeze it, you can work with each bureau to make your report available to external parties when the need arises.

Recommended Reading: Is 717 A Good Credit Score

How Can I Lift A Credit Freeze

The same webpages used to set up credit freezes can be used to remove or suspend them, also known as unfreezing your credit. All three bureaus also provide instructions for lifting a freeze by phone or using the credentials connected to your freeze at each bureau.

In addition to your ability to permanently unfreeze your credit, you may have the option to lift the freeze temporarily by indicating a length of time you want the freeze to be suspended. Policies vary by bureau so make sure you understand what your options are before you begin the process.

When you request by phone, your credit will be thawed within one hour and in near real time when you create or log in to your Experian account to toggle your settings to “Unfrozen.”

Should You Unfreeze Your Credit Temporarily

If you want to lift a credit freeze on your Equifax, Experian or TransUnion credit reports, you have two options: you can either create a temporary credit freeze lift, which removes the credit freeze for a limited amount of time, or you can thaw your credit permanently.

Many people choose to unfreeze their credit temporarily. This gives banks and lenders enough time to perform which are essential steps in getting mortgages, car loans and credit cards without leaving your credit report unfrozen for so long that it could fall into the wrong hands.

A temporary credit thaw also means you dont have to worry about remembering to re-freeze your credit. After the designated time period ends, the credit bureau will automatically put a freeze back on your credit report. That way, you can unfreeze your credit for a few weeks and know that it will be securely frozen once the time limit is up.

Some people want a more permanent credit thaw. If youre moving to a new city, for example, everyone from landlords to utility companies might want to check your credit history. This process could go on for a few months, so you might decide to unfreeze your credit long-term. Just remember to re-freeze your credit once youre settled in.

Read Also: Does Business Line Of Credit Show On Credit Report

How To Unfreeze Your Credit

Go to the credit bureau website and use the account you used to freeze your credit to unfreeze your credit. You may also be able to unfreeze your credit by phone or postal mail if you can provide certain verifying information. Unless you use postal mail, unfreezing typically takes effect within minutes of requesting it.

When you are applying for credit, you can ask the creditor which credit bureau it will use to check your credit and unfreeze only that one. Or, if youre shopping for a loan and may make several applications in a short period, you may choose to lift the freeze at all three major credit bureaus.

You can choose to unfreeze for a specified time period, after which the freeze automatically resumes.

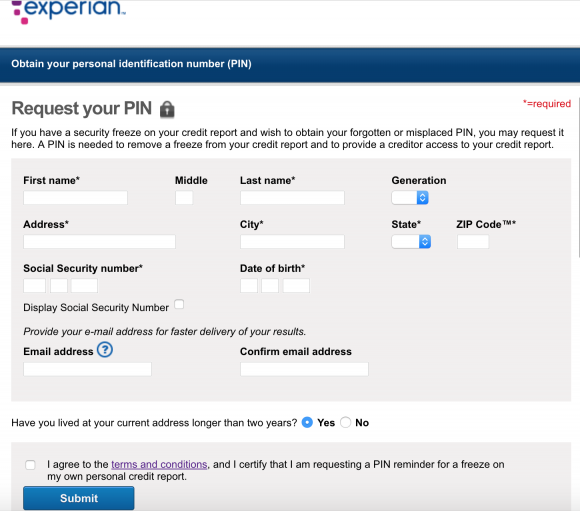

What If You Forget Your Pin

Having your PIN handy makes thawing your Experian credit report much easier, but you do have options if you forget it.

If you dont have your Experian PIN, click Retrieve your PIN on your homepage. Enter your name, address, Social Security number, and date of birth. When you agree to the terms and conditions, you move on to an identity-verification screen, where you need to answer questions based on the information thats in your credit report.

You can choose to skip this step and continue with your thaw request, but Experian still requires you to answer security questions before you can move forward.

The questions are fairly straightforward but can be tricky sometimes, particularly if you have a long credit history or lots of accounts. I learned this the hard way my first time, when I thought I answered the questions correctly but Experian disagreedand locked me out.

After I failed the test, the following page appeared whenever I tried to retrieve my PIN, unfreeze my report, or request a one-time creditor access code:

I tried again to lift my freeze online, but I wasnt given another opportunity to prove my identity. And when I called to ask if I could retrieve my PIN or thaw my report over the phone, Experians automated system asked me to verify my identity via mailand then hung up.

You can also mail your request to:

Experian Security Freeze

You May Like: Is 716 A Good Credit Score

Who Can Access A Frozen Credit File

A credit freeze works by essentially limiting potential lenders from accessing your credit report unless you lift the freeze in advance.

However, there are a number of exceptions that allow some entities to still view your credit history, even with a freeze in place. The exceptions include:

- Lenders with whom you already do business

- Landlords or leasing companies associated with a rental application

- Utility companies

- Potential employers whom you have already given written permission to

- Government agencies

How To Freeze Your Credit Report With The Major Reporting Agencies

If you want to protect your credit from fraud or identity theft, you’ll need to place a temporary freeze on your credit with all three of the major credit bureaus: Experian, Equifax and TransUnion. Here’s the process for contacting each credit agency individually to protect your credit report.

EXPERIAN

1-888-397-3742

Experian makes it easy to request a security freeze by going through their online questionnaire. Simply choose your method, either online or via mail, and fill out the personal information to prove your identity. Likewise, you can submit a mail-in request electronically using their online upload method.

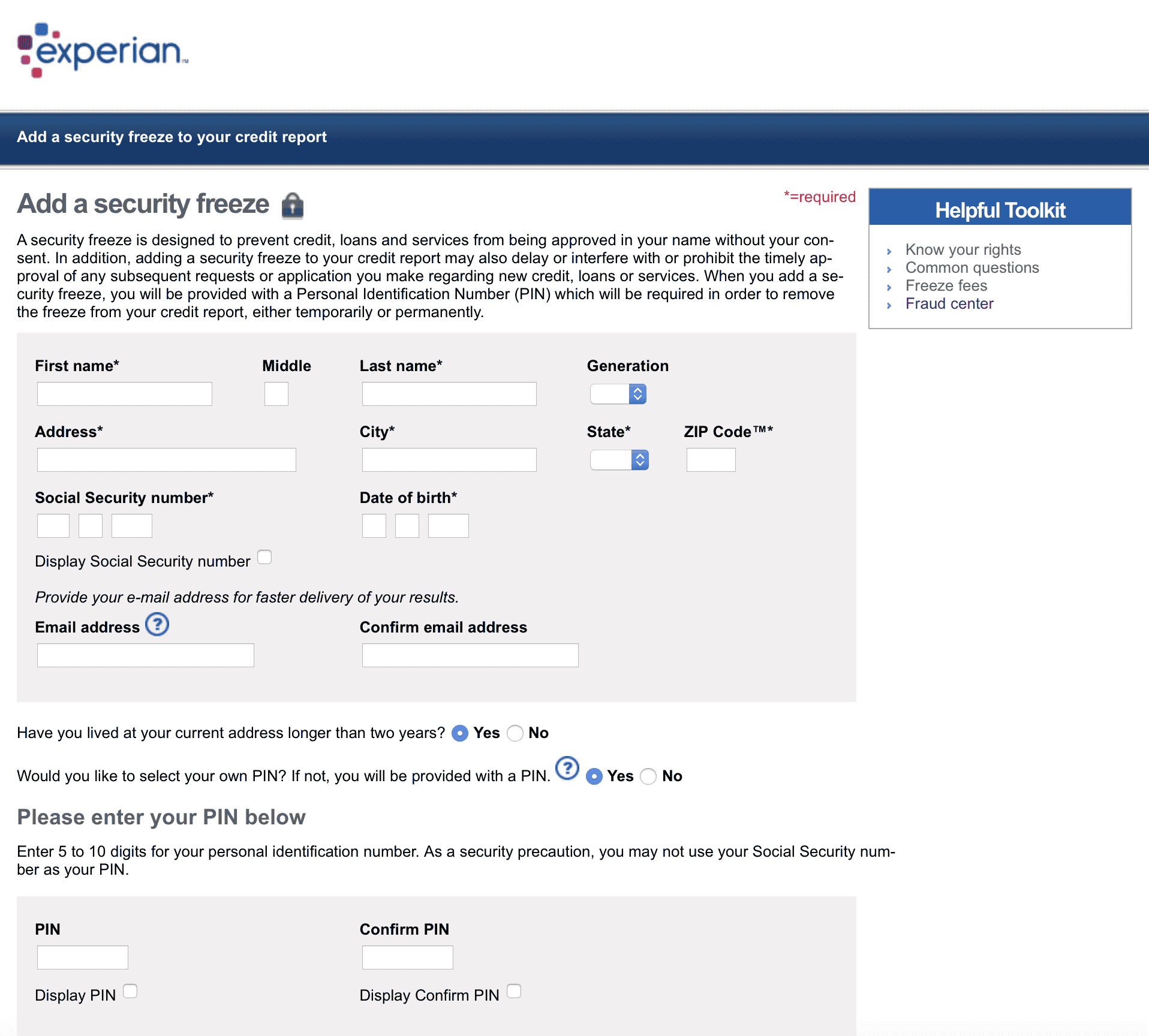

You can select your own PIN, or have them create one for you. You will need this when you put in a request to have the security freeze lifted, so make sure you record this and keep it in a safe place. When going through the credit security freeze with Experian, keep these various forms of personal identification handy:

- Full name, including middle name and generation

- State-issued ID or driver’s license

- Current physical address and addresses for the past two years

- Social Security Number

- One copy of a utility bill, bank or insurance statement

Credit freezes used to have fees attached, but as of 2018, all credit freeze requests are free of charge. One thing to note is that you should always make copies of your security freeze documents and send those to Experian. Keep the originals for your records.

EQUIFAX

1-800-525-6285

TRANSUNION

1-888-909-8872

Read Also: Do Student Loans Affect Your Credit Score

Set Up A Rent Payment System

There are a couple of different ways to pay rent online. If your landlord is already accepting digital payments, they may have a preferred system. Some popular rent payment options include:

- Digital payment services: Apps like Venmo and PayPal are one way to pay rent online. While free for tenants, both tack on transaction fees for landlordsaround 2% per transaction for Venmo and about 3% for Paypal. Zelle is a free option, assuming it’s supported by both the tenant and landlord’s banks. However, some banks may impose transfer limits or charge other fees.

- Online rent collection platforms: Some landlords prefer to use rent payment services. Avail and Rentec Direct are popular options. They’re free for renters who pay by electronic check or ACH transfer. Avail even lets you split your rent among multiple tenants in the same home, which can come in handy if you have roommates.

What Does Freezing My Credit Do

What is a credit freeze? When you freeze your credit, the credit reporting bureaus canât give any information to anyone who makes an inquiry about you. Typically, businesses inquire about your credit when you are trying to, for instance, open a new credit card, buy a car or rent an apartment. The credit check helps the business determine if they want to lend or rent to you, and it can help set your rates and lending terms for loans and credit cards.

When you freeze your credit and the business canât get any information about you, it typically stops the process â which means a fraudster will be unable to open an account while using your identity.

Also Check: Does Mortgage Pre Approval Affect Credit Score

What If You Need To Apply For A Loan

If you need to apply for a loan or credit card but dont want to unfreeze your credit permanently, you can give the creditor one-time access to your Experian file by creating a single-use PIN. Simply go to the Experian website and request the special PIN, then provide that number to your prospective lender. Youll need to get one-time PINs for every creditor you apply with while the freeze is in place.

Remove Experian Credit Freeze

Through Experian, lifting a credit freeze is available either temporarily for a set period or a specific creditor. The easiest way to remove a credit freeze is to visit Experians Freeze Center and request it there, with your PIN.

You may also call Experian to request a security freeze removal at 1-888-397-3742 or by mail at the following address:

Experian Security Freeze PO Box 9554 Allen, TX 75013

Like Equifax, Experian requires you to provide your personal information if you make a removal request in writing, including your PIN, date of birth, social security number, address, full name, and proof of ID.

Recommended Reading: How To Get A Free Credit Report And Fico Score