Should You Pay Even Though The Collection Account Will Remain

Now that you know that pay for delete is iffy at best, you need to consider what you want to do about your collection account with pay for delete off the table.

First, you need to confirm a few things:

A debt collector must provide proof of the debt, who owns it, and show their legal right to collect. If they havent, you need to request a debt validation letter before you do anything else.

If the debt was a credit card, the original account should show a zero balance and the status should be charged off. The debt validation letter will also tell you who owns the debt. If the collector doesnt own the debt, you should be negotiating with the original creditor instead. For a medical debt, you may want to call the original service provider to negotiate.

Collectors only have a set amount of time that they can sue you in civil court over a debt. If the debt has passed that time limit, then the collector can still bother you, but they cant sue you. In this case, you may be better off simply telling them you no longer wish to be contacted.

If the collector owns the debt, its within the statute of limitations, and they provided proper validation, then you can decide what you want to do. A paid collections account can still negatively affect your credit score, but it will at least show up on your credit report as paid. Whats more, you can stop the stress of dealing with the collector.

5701 West Sunrise Blvd. Fort Lauderdale, FL 33313

Cookie Policy

Online Collections Grvl Complaints

Most collection agencies have numerous complaints filed against them with the Consumer Financial Protection Bureau and the Better Business Bureau . Most consumer complaints are about inaccurate reporting, harassment, or failure to verify a debt. If a debt collector is harassing you, you may want to consider filing a complaint.

You have many consumer rights under the Fair Credit Reporting Act and the Fair Debt Collection Practices Act . Lexington Law knows that you have rights, and Online Collections GRVL does too.

Best Services For Removing Collections From A Credit Report

Aaron Crowe is a seasoned journalist who specializes in personal finance writing and editing. Aaron has written for a variety of websites, including AOL, Learnvest, U.S. News & World Report, Wells Fargo, WiseBread, AARP, and many insurance and investing sites. He is a self-proclaimed storyteller who enjoys explaining in layman’s terms personal finance and how it affects consumers lives. Aaron has several years experience working as both a reporter and editor in newspapers where he won several awards, including a Pulitzer Prize.

Edited by: Lillian Guevara-Castro

Lillian brings more than 30 years of editing and journalism experience, having written and edited for major news organizations, including The Atlanta Journal-Constitution and the New York Times. A former business writer and business desk editor, Lillian ensures all BadCredit.org content equips readers with financial literacy.

Paying an old bill that a collection agency has asked you to pay doesnt mean it will soon be removed from your credit report. A paid collection could lower your credit score for years. The good news is that help is out there, and weve come up with a list of the best services for removing collections from a credit report.

Collections are an indication that youve previously defaulted on an account. They can lower a credit score, which is used with your credit history by future lenders to determine if youre approved for a loan and how much youll be charged for financing.

Recommended Reading: Does Applying For A Credit Card Affect Your Credit Score

What Are My Rights Under The Fair Credit Reporting Act

The Fair Credit Reporting Act, or FCRA, is composed of our legal rights that are under the oversight of the Consumer Financial Protection Bureau.

The Federal FCRA is in place to protect your rights regarding the privacy of information held by consumer reporting agencies.

If you are the victim of identity theft or are active-duty military personnel, you have additional rights under FCRA.

Step Six: Settling Debt With Original Creditor:

If the collection company doesnt agree to remove, then you can call the original creditor and see if theyll accept your payment and be willing to withdraw the account from the collection agency, thereby deleting it. The original creditor is likely to do this if you have a case where the original creditor somehow did not communicate to you at the right address, if they have records that bills mailed to you were returned to them or if they miscalculated monies owed etc.

Recommended Reading: Which Gives Credit To Sources In A Research Report

How Do You Find Out Which Collection Agency Has Your Debt

You have a few options to find out which collection agency owns your debt. You could ask your original creditor, but that information may not be accurate if it’s been sold multiple times. You can also get a free copy of your credit report and see how it’s listed there. The information could be out-of-date, though, especially if you’re debt has recently been purchased. Many collection agencies call, so you could also check your voicemail or unknown phone numbers that have called.

Determine Who Owns The Debt

The first step is to find out who your letter is going to be mailed to. Thatâs why you need to find out who owns the debt: does the original creditor own it? Or a collections company?

Keep in mind that if a debt is delinquent, such as 60-90 days late or more, companies sometimes sell that debt to collections agency who then tries to obtain a portion of it.

Other times, the collections agency works as a middleman for the company and is paid a percentage when the debt is collected.

This is the case for any kind of debt, including:

You can find out which debt collector owns the debt by looking at your credit report â it will most likely be listed.

If that doesn’t work, you can contact the company you originally used for services or a loan.

Don’t Miss: Is 637 A Good Credit Score

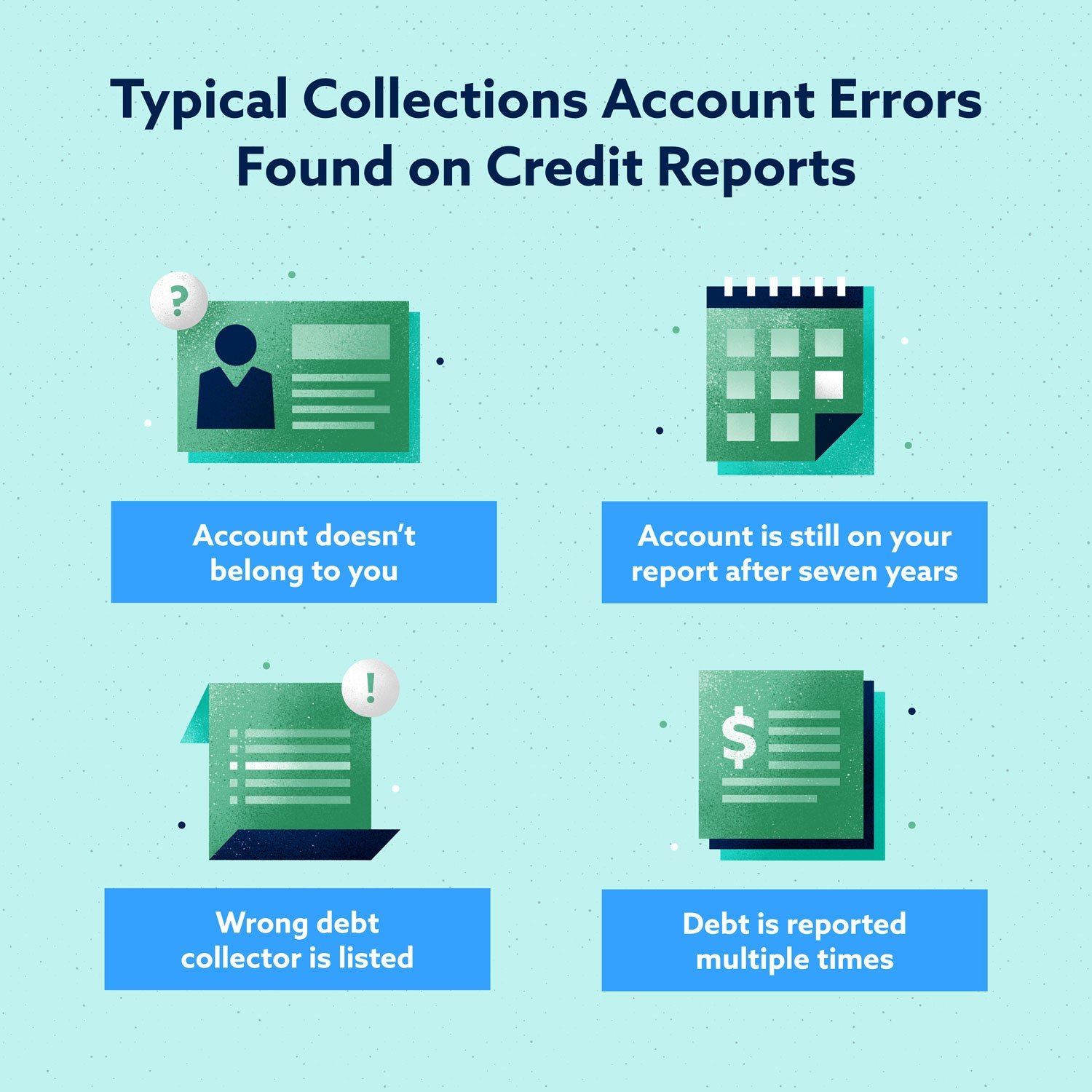

Identify The Derogatory Item

The first step is to identify the derogatory item on your credit report. This can be anything from a late payment to a charge-off or bankruptcy. Once you know what the item is, you can begin working on removing it.

There are a few different ways to remove a derogatory item from your credit report, but the most effective method is to dispute the item with the credit bureau. This process involves sending a letter to the credit bureau detailing why you believe the item is inaccurate. The credit bureau will then investigate the claim and, if they find that the information is indeed inaccurate, they will remove it from your report.

If you are unable to remove the derogatory item through a dispute, there are other options available. You can try negotiating with the lender to have the item removed in exchange for paying off the debt in full, or you can wait seven years for the item to fall off your report naturally. However, neither of these options is guaranteed to work, so its always best to try disputing the item first.

How To Remove Collections From Your Credit Report In 2022

Credit is a useful tool for building up your finances. However, consumer debt is on the rise in the United States in an unprecedented way. In 2021, average consumer debt reached over $90,000 for American families. In some cases, these families cant pay back their debts, causing bills in collections.

Debt collections hurt your credit score. But how severe is this effect? Are there any strategies you can use to get the collection removed from your credit score?

With a little understanding, you can navigate this stressful situation and come out the other side with a plan to tackle the debt and the collection report.

Recommended Reading: How Often Does Your Fico Credit Score Update

Pay For Delete Letter Success

The collection agency is under no obligation to agree to your terms. Most creditors will tell you that its impossible because they dont want to go through the hassle of updating your credit report with the credit reporting agencies.

Debt collection agencies like AFNI or Alliance One only want to make money. If you stick to your guns, you will probably be able to talk to someone who will know what a pay for delete agreement is. They might be willing to work with you, especially if it means theyre going to get some money.

Keep in mind, while youre working on the pay for delete process, there might be other legal deadlines to consider, such as the 30-day limit for debt validation.

You will want to change the templates below to fit your situation. If this seems complicated, and often, it is, consider hiring a credit repair company to take the hassle out of the process. They can help you improve your credit score by disputing inaccurate items on your credit reports.

How To Get Collections Removed From Credit Report

First things first, where do collections accounts come from? Well, trouble starts after the borrower misses an upcoming payment. After 30 days, the lender reports the missed payment. If the borrower fails to pay in subsequent months, the lender reports all the late payments, harming scores further.

The debt keeps growing as the interest, and late fee penalties pile up. Before long, over 180 days may have elapsed since the last payment. At this point, the lender decides to charge off the account. That means writing it off as a loss in their books and selling it for pennies on the dollar to debt collection agencies.

Debt collections accounts appear as separate accounts on credit reports and are very serious derogatory marks. All hope is not lost, though. Consider the following steps to get rid of collection accounts from reports:

Don’t Miss: Will Paying Off Collections Help My Credit Score

How Long Should A Collection Account Appear On Your Credit Report

A settled collection account that is incurred legitimately is not a mistake, even though its negative. Thus, by law, its required to be reported accurately. It should, by the letter of the law, remain on your credit report for seven years from the date the account became delinquent.

If the collections you have are from credit cards, then the seven-year clock starts from the date the original credit card account became delinquent. Credit card companies usually wait 180 days before they charged off an account and sell it to collections. You can look at your credit report to note the month and year that the first payment was reported as missed.

If the collection account comes from something like medical debt, then the clock would generally start from the date the collection account first appears on your credit report.

NOTE: Paying a debt collection account doesnt remove it!

If you pay a debt collection account off, it will still remain on your credit report for seven years. The balance will show as $0 and the status would be listed as paid in full. However, the collection account itself will still remain.

If you settle an account for less than the full amount owed, the balance should also be reduced to zero. The status of the account will indicate that it is settled or settled in full.

Negotiate A Pay For Delete Agreement

If you have a paid collection on your credit report, you may be able to negotiate a pay for delete agreement with the collection agency. Under this agreement, you would agree to pay the collection in full in exchange for the agency removing the collection from your credit report. This is an ideal solution if you are trying to improve your credit score and can afford to pay off the debt in full.

Before you attempt to negotiate a pay for delete agreement, make sure that the collection agency is willing to work with you. Some agencies may be open to this type of arrangement, while others may not be interested. You should also make sure that you have the financial resources available to pay off the debt in full. Once you have confirmed these two things, you can begin negotiating with the agency.

If you are able to successfully negotiate a pay for delete agreement, make sure that you get everything in writing before you make any payments. This will protect you in case the agency does not fulfill their end of the bargain. Once everything is finalized, pay off the debt as agreed and then request confirmation from the agency that the debt has been removed from your credit report.

Also Check: When Do Banks Report To Credit Bureaus

How To Improve Your Credit Score

Once youve settled the collections on your credit report, your credit score could likely use a boost. This wont happen overnight, and it will take time to get things back on track. A few things to keep in mind:

- Pay your debts on time and in full

- Dont open too many new lines of credit at once

- Dont close old lines of credit, like old credit cards

- Keep your credit utilization low

Credit health is important for so many aspects of your life and should be taken care of. When it comes to rebuilding your credit, our team can help you get the ball rolling. Contact us for a consultation today.

Its not a guarantee that this will help, but it doesnt hurt to ask. Especially if youre about to make a big financial move like applying for a mortgage.

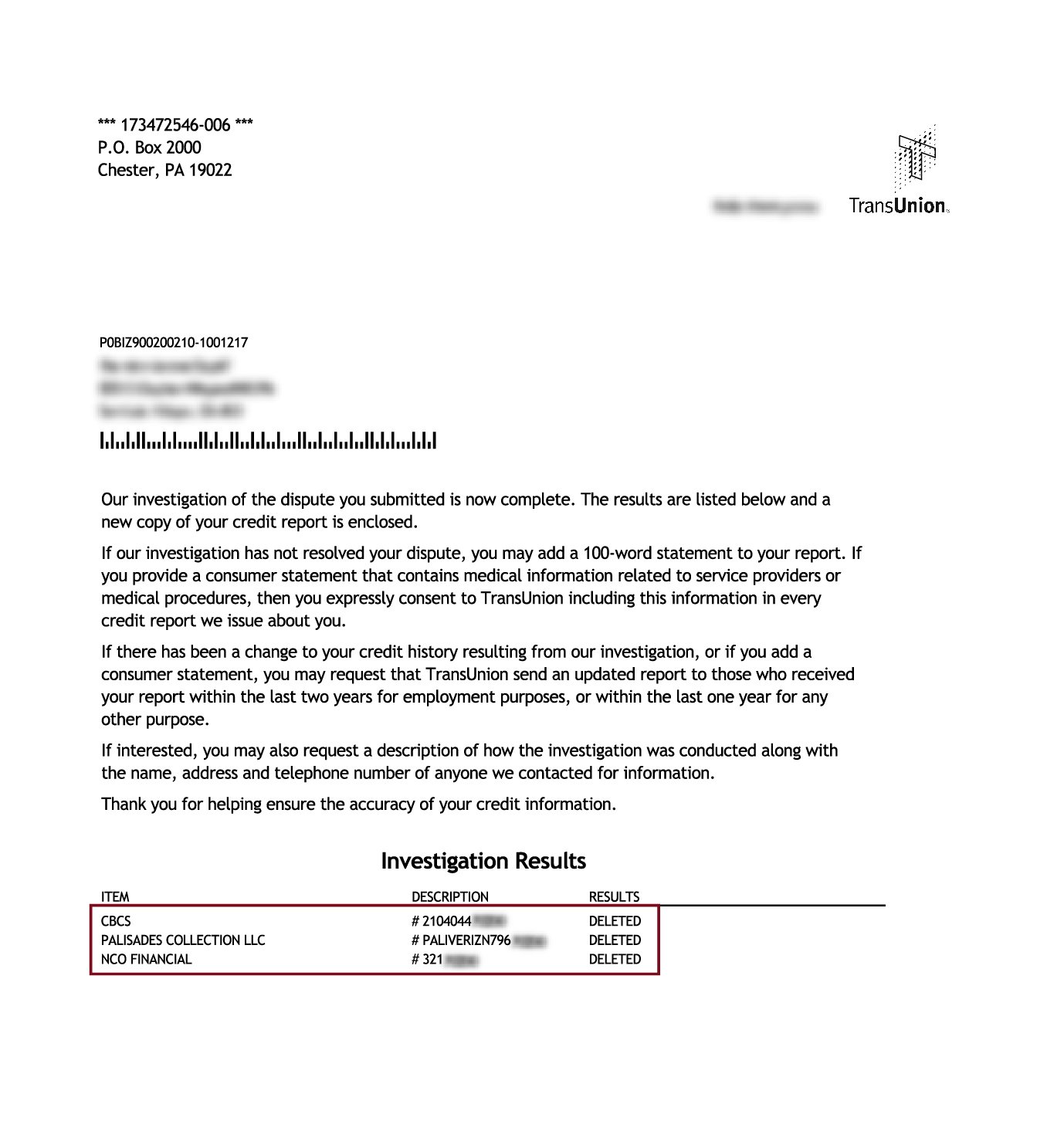

Wait For The Credit Bureau To Investigate

The credit bureau has 30 days to investigate and respond to your dispute. If the creditor agrees that the information on your credit report is inaccurate, they will notify the credit bureau, who will then remove the derogatory item from your report.

If the creditor does not agree that the information on your credit report is inaccurate, they will notify the credit bureau, who will then send you a notice of the results of their investigation. At this point, you can either accept the creditors version of events or you can file a statement with the credit bureau explaining why you believe the negative item is inaccurate.

If you have any documentation to support your case , be sure to include it with your statement. The credit bureau will then re-investigate and may remove the derogatory item from your credit report if they agree with you.

Recommended Reading: How Do Hard Inquiries Affect Your Credit Score

How Do I Get A Collection Removed

To remove the collection account from your credit report early, you can ask a company for a goodwill deletion, but there’s no guarantee you’ll receive forgiveness. If you have a collection account on your report that’s inaccurate or incomplete, dispute it with each credit bureau that lists it on your credit report.

What To Know About Debt Collection

What types of debts are covered under the law?

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA. Business debts are not.

Can debt collectors contact me at any time or place?

No. Debt collectors cant contact you before 8 a.m. or after 9 p.m., unless you agree to it. They also cant contact you at work if you tell them youre not allowed to get calls there.

How can a debt collector contact me?

Debt collectors can call you, or send letters, emails, or text messages to collect a debt.

How can I stop a debt collector from contacting me?

Mail a letter to the collection company and ask it to stop contacting you. Keep a copy for yourself. Consider sending the letter by certified mail and paying for a return receipt. That way, youll have a record the collector got it. Once the collection company gets your letter, it can only contact you to confirm it will stop contacting you in the future or to tell you it plans to take a specific action, like filing a lawsuit. If youre represented by an attorney, tell the collector. The collector must communicate with your attorney, not you, unless the attorney fails to respond to the collectors communications within a reasonable time.

Can a debt collector contact anyone else about my debt?

What does the debt collector have to tell me about the debt?

What if I dont think I owe the debt?

What are debt collectors not allowed to do?

Also Check: Does A Mortgage Help Your Credit Score

What Not To Do When Elite Pay Calls

Dealing with debt collectors can be a stressful experience. Theyre often aggressive and pushy, and they may even threaten legal action if you dont pay up.

Here are four things you should never do when a debt collector calls.