How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Determine Reasons For Running Credit

Many companies have reasons to run a credit check before engaging in a business relationship with someone. The most common companies are financial and insurance institutions. However, cellphone companies, utility companies and any business engaging in contract terms might be interested in seeing the credit history of a potential customer.

Before you can run a credit report, you must have a legitimate reason for the information. For example, a landlord has a right to know if potential tenants pay their bills on time, while a former girlfriend has no reason to see her exs credit history. Prospective employers also have a legitimate interest to see if someone could be at risk of skimming money from the company to pay financial debts.

Recommended Reading: What Credit Score Do You Need To Rent An Apartment

Why Should I Get A Copy Of My Report

Getting your credit report can help protect your credit history from mistakes, errors, or signs of identity theft.

Check to be sure the information is accurate, complete, and up-to-date. Consider doing this at least once a year. Be sure to check before you apply for credit, a loan, insurance, or a job. If you find mistakes on your credit report, contact the credit bureaus and the business that supplied the information to get the mistakes removed from your report.

Check to help spot identity theft. Mistakes on your credit report might be a sign of identity theft. Once identity thieves steal your personal information information like, your name, date of birth, address, credit card or bank account, Social Security, or medical insurance account numbers they can drain your bank account, run up charges on your credit cards, get new credit cards in your name, open a phone, cable, or other utility account in your name, steal your tax refund, use your health insurance to get medical care, or pretend to be you if they are arrested.

Identity theft can damage your credit with unpaid bills and past due accounts. If you think someone might be misusing your personal information, go to IdentityTheft.gov to report it and get a personalized recovery plan.

Read Also: What Is An Inquiry On My Credit Report

Get Your Credit Score

Your credit score comes from the information in your credit report. It shows how risky it would be for a lender to lend you money.

Learn more about how your credit score is calculated.

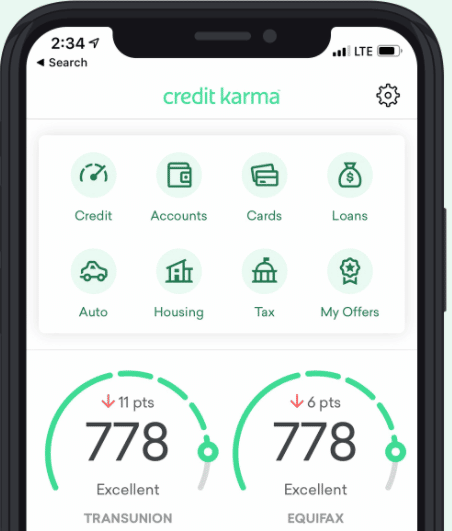

You can access your credit score online from Canadas 2 main credit bureaus.

Your credit score from Equifax is accessible online for free and is updated monthly. If you live in Quebec, you can also access your credit score from TransUnion online for free.

Other companies may also offer to provide your credit score for free. Some may ask you to sign up for a paid service to get your score.

How You Can Get Your Credit Reports And Scores

If you want to know your credit scores, you have a couple of options. First, a number of personal finance websites offer a free credit score look for one that also offers free credit report information, such as NerdWallet. That gives you a way to monitor information being added to your report monthly. In addition, some credit card companies offer credit scores to anyone, even noncustomers.

You should review your credit reports regularly to make sure there are no errors. Material errors can hurt your credit score, lowering the chances that youll get approved for a loan and potentially costing you extra money due to higher interest rates.

You are entitled to a free copy of your credit report weekly through the end of 2023 from each of the three major credit reporting agencies by using AnnualCreditReport.com.

About the author:Erin is a credit cards expert and studies writer at NerdWallet. Her work has been featured by USA Today, U.S. News and MarketWatch.Read more

Don’t Miss: What Is The Highest Credit Score Number

How To Check Your Credit Report With An Itin

Unfortunately, a Social Security number is the only way to get free copies of your credit report from the three major credit bureaus using annualcreditreport.com. Instead, you can submit your request individually to each bureau.

Experian requires the request to be mailed and to include:

-

Copy of a photo ID

-

Copy of a bank statement

-

Copy of a utility bill in your name

You can find mailing information for Experian here. Experian includes a credit score with your credit report.

TransUnion requires you to contact customer service you can find the information here.

Equifax also requires that you submit your request in writing and include at least two pieces of information, one to prove identity and one to verify address. These can include:

-

Drivers license

You can find the information here.

What Is A Free Credit Check

- – If you want to see your actual credit score, you can check it for free on WalletHub the only site that offers free daily updates.

- Anonymous Credit Estimate Performing a casual credit check by using a credit estimator like the one on this page is a great way to get a general sense of where you stand. Its especially useful if you have a small-scale financial decision such as applying for a credit card in your near future.

- Reviewing your credit reports should be a regular practice. It allows you to find and dispute errors, which are all too common. And it gives you the chance to make sure there are no signs of identity theft on your files.

Recommended Reading: How To Dispute A Missed Payment On Credit Report

Request Credit Checks With Avail

Requiring a credit check from applicants is an important step in the tenant screening process. Whether youre interested in learning more about a tenants payment history or credit score, Avail provides accurate and trusted TransUnion credit reports to help you find your next tenant.

Create an account or log in to screen prospective tenants with landlord software designed with landlords and their tenants in mind.

- TransUnion credit report

Fix Mistakes In Your Credit Report

When you get your credit report, check that:

- all the loans and debts listed are yours

- details such as your name and date of birth are correct

If something is wrong or out of date, contact the credit reporting agency and ask them to fix it. This is a free service.

Some companies may try to charge you to get all negative information removed from your credit report. The only thing they can ask the credit reporting agency to remove is wrong information. And you can do that yourself for free see .

If there are loans or debts in your report that you know nothing about, it could mean someone has stolen your identity. See identity theft for what to do.

Also Check: What Does Settled Mean On A Credit Report

Running The Credit Check

Once you have determined you have a legitimate reason to run a credit check and have obtained an application gathering the required information with authorization to check credit, you can run the credit report. The three credit reporting agencies are Equifax, Experian and TransUnion. All have online request forms. There is a charge for the report, often paid by the potential customer.

Enter the application information, confirming the key details such as Social Security number, date of birth and name spelling. You will also be asked the reason for the inquiry: mortgage, auto loan, credit card, employment or rental property. Ensure you have identified the correct person, then request the report.

Shortly after the report is generated, the customers credit profile will reflect that an inquiry was conducted. Depending on the reason for the credit inquiry, the customer might see a drop in his credit score. For example, a mortgage inquiry can result in a 5-point reduction.

References

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Also Check: Is 671 A Good Credit Score

How Does A Credit Score Work

Your credit score is a number related to your credit history. If your credit score is high, your credit is good. If your credit score is low, your credit is bad.

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is different, but it usually goes from about 300 to 850 .

It costs money to look at your credit score. Sometimes a company might say the score is free. But usually there is a cost.

Can I See My Credit Report

You can get a free copy of your credit report every year. That means one copy from each of the three companies that writes your reports.

The law says you can get your free credit reports if you:

- go to AnnualCreditReport.com

Someone might say you can get a free report at another website. They probably are not telling the truth.

Don’t Miss: What Is A Fair Credit Score

Who Checks Your Credit Score

A lender, business or potential employer might ask for a credit check to get a sense of how reliable you are with money. You might be asked for a credit check when applying for loans, credit cards, mortgages, bank accounts, phone contracts, car finance, insurance and rental accomodation.

If the lender or business thinks your credit history makes you seem risky, they might reject your application.

In most cases, the person or business wanting a credit check must get your consent first. Consent is not needed for some organisations and businesses, eg certain public sector agencies, debt collectors.

Who Can’t Access Your Credit

Unless youre posting pictures of your credit reports on social media, your credit information shouldnt be available to the public. It wont show up as a search engine result, and your loved ones cant request it, regardless of your relationship.

If an individual does use your personal information to obtain your credit history, you can sue for actual damages or $1,000 whichever is greater according to legal website Nolo.

Recommended Reading: Does It Affect Your Credit Rating To Apply For Cards

Justifiable Reasons To Check Another Persons Credit Report And Score

In a nutshell, there are only a few circumstances in which its considered okay to perform a creditworthiness search on someone else. These situations are generally for the purposes of reducing financial risk on the part of the inquirer, saving money and even to assist someone when it comes to mitigating or offsetting trouble. These reasons can include:

- Evaluating a possible future roommate

- Evaluating a potential employee

- Concerns regarding a seniors finances

- Checking to see if your childrens credit has been hijacked

- Making sure that a deceased spouses identity hasnt been stolen

As you can see, the underlying theme for these reasons to look up someones credit has to do with protecting yourself or another individual. These, and other, permissible reasons are outlined in the 15 U.S. Code § 1681b Permissible purposes of consumer reports.

Another Businesss Poor Credit Could Affect Your Own Survival

As a small business, you depend on your customerâs ability to pay their bills. If your customers fall behind on their payments to you, then your cash flow suffers, which might mean that youâre forced to make late payments to your vendors. And late or partial payments can have long-term negative effects on your business.

Yet most small business owners donât run credit reports on potential business partners. Maybe a friend or colleague whom you trust refers you to your prospective partner. Or the meeting takes place in person and you âget a good vibe.â More likely, your conversation unfolds via email, and everything seems legit. But as above board as a company may look, proof is in the numbers.Always remember that a partner is going to present the best version of themselvesâafter all, they want to do business with you.

The sad reality is, though, that small businesses are more susceptible to fraud because of their limited resources. There often isnât a large accounting team that can catch discrepancies immediately, or an IT department that can go all out on security. And due to limited fraud protection for businesses , itâs up to you as the business owner to protect yourself. And youâve worked too hard to fail due to another companyâs bad business practices.

Also Check: How Long Does It Take To Get 800 Credit Score

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services will notify you after certain updates have been made to your credit report and credit score, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if youve been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services. Some institutions may offer it for free under certain conditions.

Also Check: What Credit Score Do You Need For Home Depot Card

What Can Help Your Credit Score

| Your credit report is a summary of all of your credit history over time. | Your credit score is a formula used by bureaus to determine how creditworthy you are. | |

| Where can you get it? | You can get your report with Credit Sesame or with a major credit bureau. | You can get your credit score from Credit Sesame or other places such as myFico. |

| What kind of information does it show? |

|

|

| Who uses which? | Your creditor will typically do a hard credit inquiry to see if there is risk to giving you credit. | Your utility or phone company will do a soft credit inquiry before making a decision if you have to make a downpayment or not. |

How To See Whats On Someone Elses Credit Report

Every now and again Im asked if its possible to check someone elses credit report and credit score. The answer, of course, is Yes. However, before I offer any advice as to how this is accomplished, I first make sure to ascertain the individuals particular motivation for looking it up.

Thats because there are only a few reasons why this bit of research should be performed. Therefore, Im going to start this article off with the reasons in which one could ethically justify accessing and reviewing another persons and score.

Read Also: What Is A Remark On A Credit Report

What Do Employers See When Checking Your Credit

“They see largely what a lender sees, except for your credit score,” Ulzheimer says.

Since a lot of the credit report data that lenders and employers see is the same, employers have access to a comprehensive background report that includes, in addition to your credit history, your past employment, insurance and legal activity.

Though prospective employers don’t see your credit score in a credit check, they do see your open lines of credit , outstanding balances, auto or student loans, foreclosures, late or missed payments, any bankruptcies and collection accounts.