How Can I Get A Free Credit Check Report

Answer. Youre entitled to one free copy of your credit report every 12 months from each of the three nationwide credit reporting companies. Order online from annualcreditreport.com, the only authorized website for free credit reports, or call 1-877-322-8228.

How much is a credit check report?

Each credit bureau offers several services, including reports and scores from the other bureaus. Typically it costs $15-$16 for a one-time credit report and score from a single credit bureau, or $30-$40 for credit reports and scores from all three bureaus.

Is TransUnion more accurate than Equifax?

Equifax: Which is most accurate? No credit score from any one of the credit bureaus is more valuable or more accurate than another. Its possible that a lender may gravitate toward one score over another, but that doesnt necessarily mean that score is better.

Information Landlords Need To Get A Tenants Credit Report

To run a credit check, youll need a prospective tenants name, address, and Social Security number or ITIN , which will typically be on the rental application or consent to background check forms you ask prospects to complete. The application is also the place for applicants to authorize you to run a credit report. Be sure to tell prospective tenants the amount of any credit fee you are charging .

Is My Free Credit Score On Credit Karma Accurate

The free credit scores you see on Credit Karma come directly from Equifax or TransUnion. Its possible that more-recent activity will affect your credit scores, but theyre accurate in terms of the available data.

If you see errors on your credit reports that may be affecting your credit scores, you have options to dispute those errors.

Recommended Reading: Is 653 A Good Credit Score

Do Rent Payments Affect Credit

All three major credit bureaus Equifax, Experian and TransUnion will include rent payment information in credit reports if they receive it.

-

The most commonly used versions of the FICO score dont use rental payment information in calculating scores.

-

Newer versions of FICO, such as the FICO 9 and FICO 10, do consider rental information if it is in your credit report.

-

VantageScore, FICOs competitor, also considers rent payment information.

Also Check: How To Fight Collections On Credit Report

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

You May Like: What Charge Off Means On Credit Report

Fix Mistakes In Your Credit Report

When you get your credit report, check that:

- all the loans and debts listed are yours

- details such as your name and date of birth are correct

If something is wrong or out of date, contact the credit reporting agency and ask them to fix it. This is a free service.

Some companies may try to charge you to get all negative information removed from your credit report. The only thing they can ask the credit reporting agency to remove is wrong information. And you can do that yourself for free see .

If there are loans or debts in your report that you know nothing about, it could mean someone has stolen your identity. See identity theft for what to do.

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

Read Also: Does One Main Report To Credit Bureaus

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Check Your Credit Report With Annualcreditreportcom

Youre entitled to one free credit report from each of the three credit bureaus Equifax, Experian, and TransUnion each year. But because of the financial pressures of the COVID-19 pandemic, you can check your report weekly without any additional costs through April 2021. Visit AnnualCreditReport.com to access your credit report for free. Check out this article for detailed steps on checking your credit report.

Recommended Reading: How To Boost Credit Score

Why Should I Get My Credit Report

An important reason to get your credit report is to find problems or mistakes and fix them:

- You might find somebodys information in your report by mistake.

- You might find information about you from a long time ago.

- You might find accounts that are not yours. That might mean someone stole your identity.

You want to know what is in your report. The information in your report will help decide whether you get a loan, a credit card, a job or insurance.

If the information is wrong, you can try to fix it. If the information is right but not so good you can try to improve your credit history.

Which Credit Score Should I Check

This is a great question because when it comes to credit scores, there is a lot to unpack.

The most widely used of them all is the FICO score. This is the one most people think of when they think of their credit score, mainly because it invented credit scoring for lending decisions. But even within FICO, there are many iterations, the latest being FICO 10.

There is the fairly-new-to-game VantageScore, also with several versions . VantageScore looks a little different from the FICO score and is calculated somewhat differently. But it uses the information in your credit report come up with your score.

Then there are the lesser-known scores that are generated by other financial sites using their own algorithms. All should be somewhat similar since they will be mostly based on the same information, but you should also know that there are likely to be some differences.

Any of the sites Ive mentioned are probably fine for keeping up with your score. But if youre applying for credit in the near future, find out what score the lender will look at so you can check that one out for yourself beforehand. Even though your score will probably not match your lenders , it should be close enough to give you the confidence that you will be approved.

Don’t Miss: Does Chase Ink Report To Business Credit

How To Stay Compliant With The Fcra

Staying compliant with the FCRA is critical for property managers and landlords. Keep these rules in mind as you process applications and perform tenant background checks:

Only Request Credit Reports From Current Applicants

You can only request a credit report for someone applying to live in one of your properties or trying to renew their lease. You cannot request one for an existing tenant because youre worried about their financial situation and want more details.

Obtain Written Permission

You should obtain written permission before accessing applicants credit reports. Keep a copy of their consent to a credit check in your records in case you face any issues down the road.

Tell the Credit Bureau That You Plan to Use the Report for Housing Purposes

You are only allowed to use applicants credit reports to determine whether you want to offer them housing. You cannot pull one for any other reason. Its not acceptable to request one, for instance, if youre trying to decide whether or not to give someone a personal loan or to help you decide whether or not to raise the rent on an existing tenant.

Notify Applicants of Adverse Actions

Write the Adverse Action Notification Correctly

Consider Making Reports to the Credit Bureaus

Is It Safe To Check My Credit Score For Free

Checking your free credit scores on Credit Karma wont affect your credit, and any attempts to monitor your credit with Credit Karma will not appear on your credit reports.

If you want to learn more about how Credit Karma collects and uses your data, take a look at our privacy policy.

You can also read Credit Karmas security practices to learn more about Credit Karmas commitment to securing your data and personal information as if it were our own.

Ready to help your credit go the distance? Log in or create an account to get started.

You May Like: How To Get Credit Report Without Social Security Number

How Often Should I Check My Credit Report

Its generally recommended that you check your credit reports a minimum of one time a year, but you can check them as often as you like. Before you apply for credit, it can be a good idea to review your reports for errors to increase your chances of securing more favorable terms, such as lower interest rates.

Why Its So Important To Check Your Credit Report Periodically

Its important to check your credit reports periodically to make sure everything is accurate and that there are no mistakes.

Your credit reports are also the best way to check for any unauthorized financial activity. You may not even realize someone has gotten their hands on your information until you find an unauthorized bill or account in your name on your credit report.

Identity theft and other mistakes can really throw your financial life into disarray, so its crucial that you keep up with your reports.

Your include all the details on your credit accounts, both current and closed. The reports track payments and other information for every loan, credit card and line of credit you have.

Your , on the other hand, is a number based on your credit history and activity.

Recommended Reading: Does Looking At Your Credit Score Lower It

What Is Your Free Credit Score

Your credit score is the single most important financial score youll ever get. Yes, its even more important than matric aggregate, body fat count, or golf handicap, since credit providers use this credit score when deciding whether or not to extend credit to you. So be sure to maintain a good track record!

Your Experian credit score is calculated via a credit bureau check, using information from your full credit profile. Experian evaluates all of your accounts, your negative and positive information, and your payment history to assign you a credit score of 0999. The higher your credit score is, the better your credit profile, and the lower your risk will be of defaulting on an account or loan would be.

What Do Lenders See On Your Credit Report

What you see on your credit reports may be slightly different from the things lenders who are reviewing your credit might see. But generally, if a lender is reviewing your credit, they might see your:

- Personal information, such as your name, current address and previous addresses.

- Credit and loan accounts, including information about your payment history.

- Employment history.

Read Also: Is 752 A Good Credit Score

How Does A Credit Score Work

Your credit score is a number related to your credit history. If your credit score is high, your credit is good. If your credit score is low, your credit is bad.

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is different, but it usually goes from about 300 to 850 .

It costs money to look at your credit score. Sometimes a company might say the score is free. But usually there is a cost.

How Often Can I Get A Free Report

Federal law gives you the right to get a free copy of your credit report every 12 months. Through December 2022, everyone in the U.S. can get a free credit report each week from all three nationwide credit bureaus at AnnualCreditReport.com.

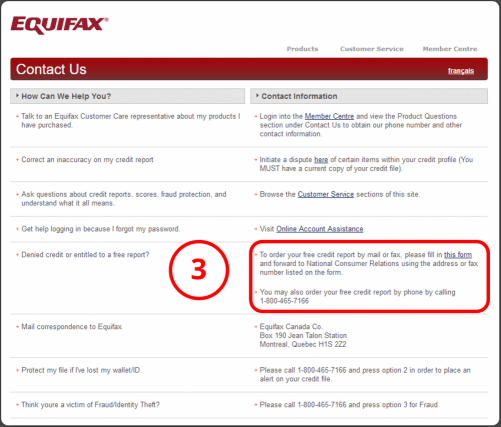

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get atAnnualCreditReport.com.

Recommended Reading: Does Child Support Show Up On Your Credit Report

How Can I Check My Credit Score With Social Security Number

How do I check my credit report?

What credit score do you need to buy a house?

620 or higherMinimum Credit Score Needed: At Quicken Loans, your credit score for a conventional loan must be 620 or higher.

| Type of loan |

|---|

Why Your Free Credit Scores From Equifax And Transunion May Be Different

You may think that your VantageScore 3.0 credit scores from Equifax and TransUnion should be the same, but thats not always the case.

Remember, VantageScore 3.0 is ultimately just a scoring model. The three-digit number it produces depends largely on the information that lenders report to each credit bureau.

When credit scores that use the same model differ between credit reporting bureaus, its typically because they dont have the same information. Here are a few of the reasons you might see different credit scores.

- Your scores are from different dates. Different bureaus receive information from lenders at different times. If new information is accounted for in one credit score and not the other, the scores may differ.

- Your scores are calculated using different credit reports. Its up to lenders to decide which credit bureaus they report your information two. Some report to all three major credit bureaus, while others report to only one or two. If your Equifax credit report has information that your TransUnion report doesnt , your scores may differ.

- Your credit reports contain incorrect information. Its possible that one or several of your credit reports contain errors. Thats why we recommend regularly checking your credit reports for errors that may affect your scores anddisputing those errors, if need be.

Also Check: How Often Should A Person Check Their Credit Report

What Should I Do When I Get My Credit Report

Your credit report has a lot of information. Check to see if the information is correct. Is it your name and address? Do you recognize the accounts listed?

If there is wrong information in your report, try to fix it. You can write to the credit reporting company. Ask them to change the information that is wrong. You might need to send proof that the information is wrong for example, a copy of a bill that shows the correct information. The credit reporting company must check it out and write back to you.

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

You May Like: How To Clean Up Your Credit Report Yourself

Understanding Your Credit Score

Credit scores range from 300-850, with 850 being the highest. The higher your credit score, the more likely you are to be approved for a loan or credit card with the best interest rate.

Since there are multiple different versions of your credit score, thanks to different formulas and approaches used by different credit bureaus, it can help to view any given credit score as a general representation of your creditworthiness. Different lenders use different scores, so the score a mortgage lender uses might slightly differ from the score a credit card issuer uses.

Most lenders use the FICO score, according to the Federal Trade Commission. Whatever score different lenders use, the higher the better in terms of getting the best rates. But because different lenders use different scores, the Consumer Financial Protection Bureau notes it can pay to shop around.

Do Rent Payments Help Build Credit

Rent payments do have the possibility to help you build credit, but thats only if you are actively making sure that your payments are being reported. If your payments are being reported, they can have a positive effect on your payment history and add another element to your credit profile, increasing your credit mix.

But remember, rent payments will only really have a positive effect if you are consistent with your payments. Falling behind on your rent payments can lead to negative reporting and a decrease in your credit score, especially if your debt is sent to a collections agency.

Recommended Reading: How To See My Credit Report