Keep Track Of Your Old Accounts

Some lenders don’t like it when customers have unused credit, in case they use it all at once and then struggle to pay it back. Closing old accounts could potentially improve your credit rating.On the other hand, by closing down a card, youre reducing the overall amount of credit available to you and then it may seem as if you need to utilise a larger percentage of your credit limit just to get by.

Lenders look at the credit limits available to you and how much you use to judge whether you can cope with new credit. If you have an overall credit limit of £1,000 and you use £250 of it, your credit utilisation is 25%. But if you cancel a card and your limit is reduced to £500, youll be using 50% of it already.Accounts that you’ve used responsibly for years is a great sign that you know how to look after your money. As a rule, you should aim to keep accounts with a long history of good repayments.If your memory needs jogging, you can find out if youve got any active credit cards or store cards by checking your credit report. Credit Reference Agencies will keep a record of closed accounts for six years before they are removed from your credit report.

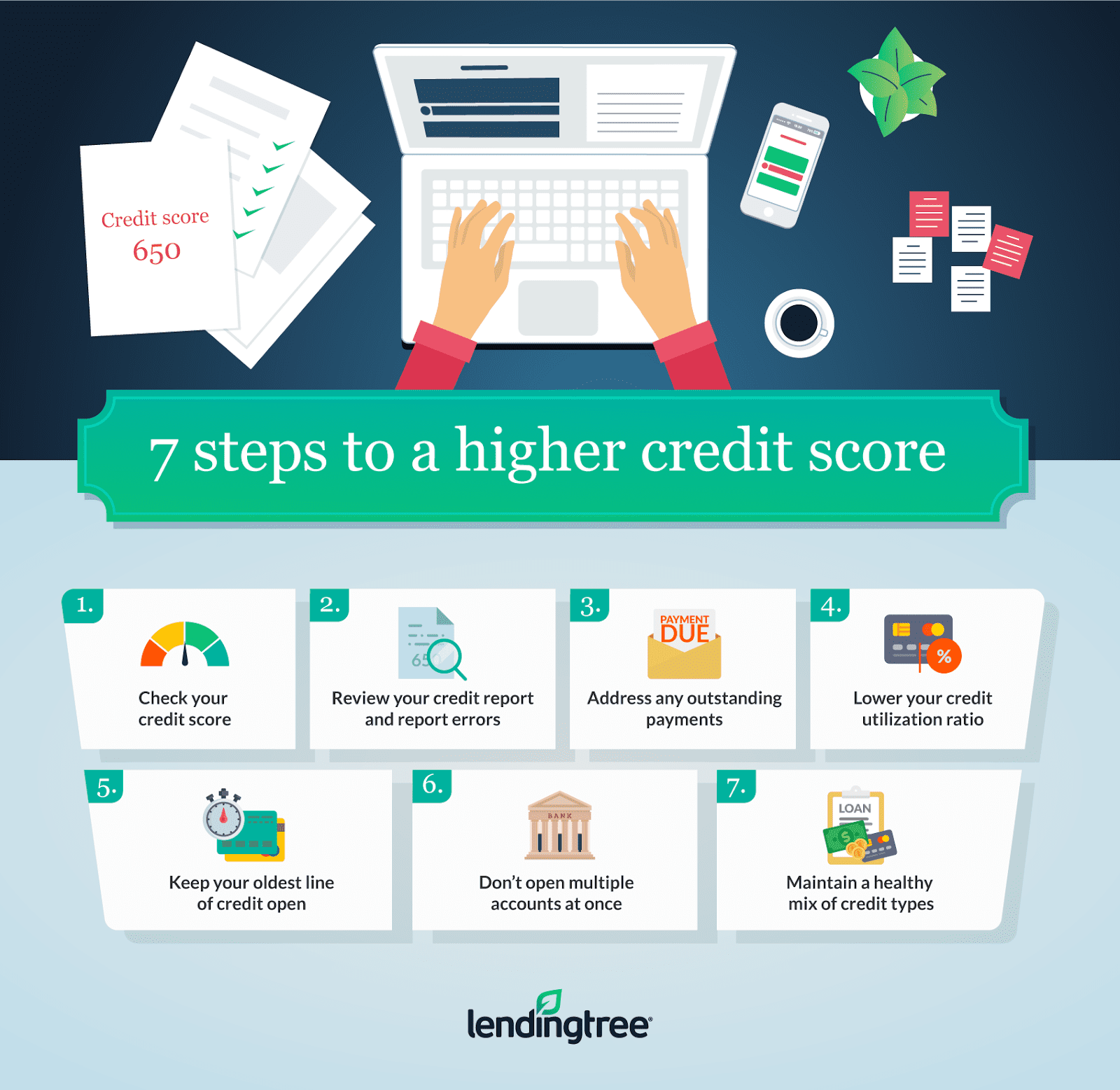

What Can You Do To Improve Your Credit Score

A good credit history is one thing that helps lenders to say yes to your application. Thats why its useful to know what things can affect your credit rating and how you can improve it.So whether youve recently been turned down for credit or just want to apply in the future take a look at some of the ways you could help improve your credit score.

If you’ve not tried our Credit Builder tool yet, have a go and get simple tips that could help give your rating a boost.

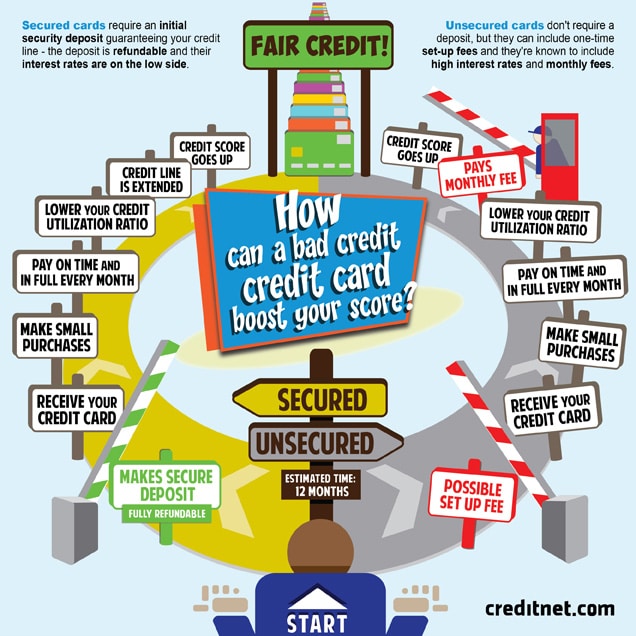

How To Get A Credit Card If My Credit Is Low

First things first, youll need to apply for a credit card. This can be difficult if you have no credit or have a low credit score, but there are dedicated designed to help you start or rebuild your credit score.

These accounts typically begin with lower limits that may increase over time, provided you make your payments on time and keep your balance below your credit limit. as you improve your credit rating. They also offer typically low repayments and allow you to monitor your credit score as you go along.

Read Also: Is 500 A Good Credit Score

Check Your Credit Report For Errors

One way to quickly increase your credit score is to review your credit report for any errors that could be negatively impacting you. Your score may increase if you are able to dispute them and have them removed.

About 25% of Americans have an error on their credit reports, so it’s important to take the time to review. Some common errors to look out for include fraudulent or duplicated accounts, as well as misreported payments.

“Most of the clients we meet with have not reviewed their report within the past year, and are often surprised by what we find to discuss with them,” says Thomas Nitzsche, a financial educator at MMI.

You can get a free credit report from the three major credit bureaus on a weekly basis by going to AnnualCreditReport.com now through April 2021.

Set Up Automatic Payments For Your Bills

While this might sound a bit obvious, the fastest way to proceed to build your credit after sorting all of your debt on credit accounts is by timely payments.

This mostly refers to your bill payments, and one of the easiest ways of managing those is by setting automatic payments.

Your credit scores drop with each missed payment, and paying bills on time should be the foundation of good credit.

So, you can use your baking app to schedule automated payments, and the amounts meant for bill payments will be deducted from your balance every month.

Don’t Miss: How Long Can A Debt Appear On Your Credit Report

How Can You Quickly Improve Your Credit Score

Have A Variety Of Credit Accounts

While you should only borrow money when necessary, having a variety of credit accounts can demonstrate you can manage credit responsibly. You might have one credit card, a home mortgage and a car loan. Each type of account can benefit your credit score differently.

Loans that you repay in full can remain on your credit report for up to ten years. You can have an easier time qualifying for a similar loan in addition to having a higher credit score.

Don’t Miss: How To View Your Credit Score

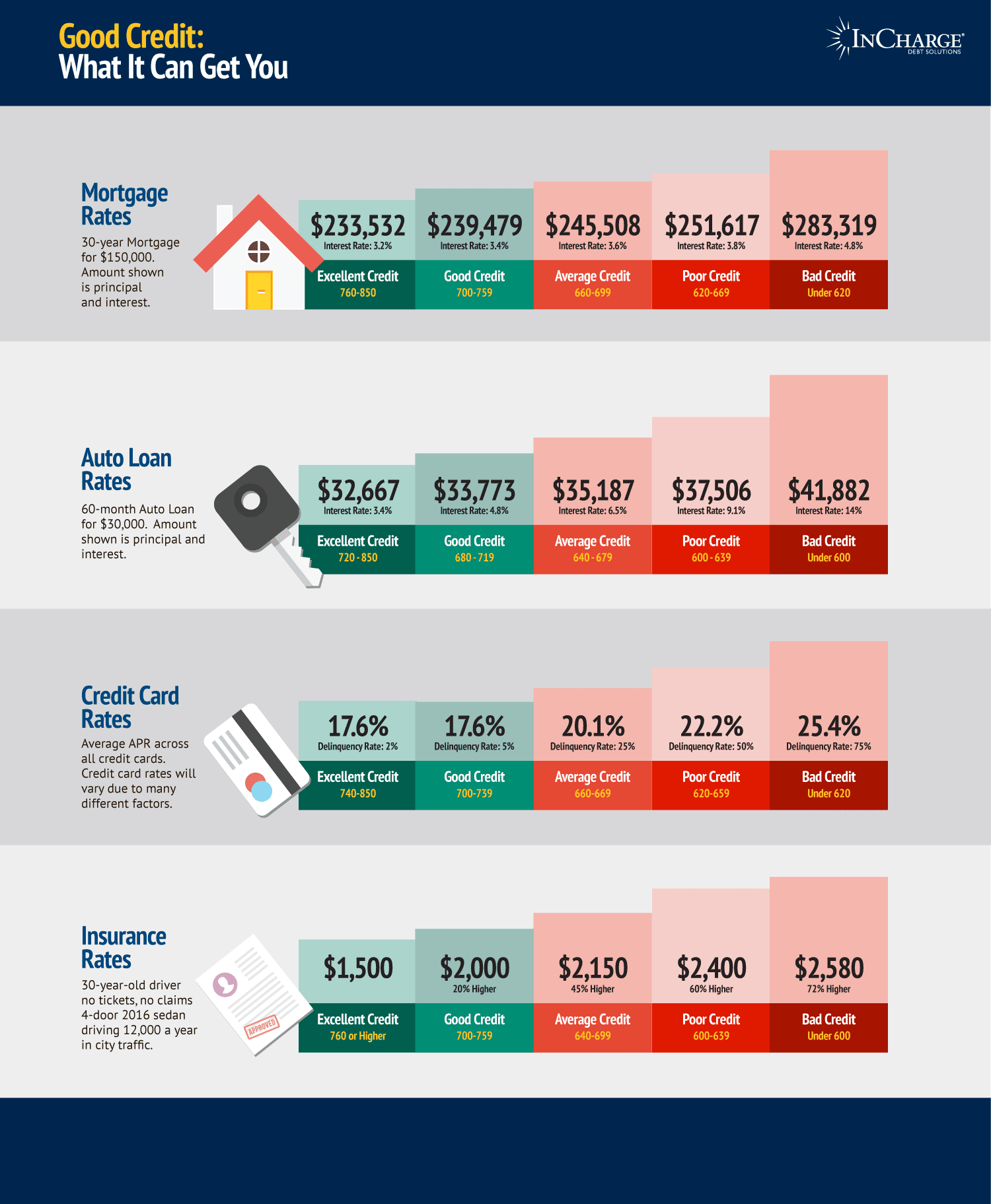

Understand How Much Of Your Available Credit Youre Using

Your credit utilization ratio compares how much of your credit card limit youâre using, for each billing cycle. You can determine the ratio by dividing your total credit card statement balance, by your total credit card limit. For example, if your credit card bill is $800 and your limit is $1,000, your credit utilization ratio is 80%. A lower numberâunder 30% is good, and under 7% is idealâshows that youâre managing your available credit well. A single month of big spending wonât make a significant impact to your ratio, but try not to make it a habit. Keep an eye on your credit utilization ratio as an average of how much money you borrow on a regular basis.

How Credit Scores Are Calculated

FICO, VantageScore, and TransRisk are just a few examples of credit-scoring models. Your exact score will depend on which model you’re looking at, and each model places a different amount of emphasis on the factors that make up your score. The most common model is probably FICO, with scores ranging from 300 to 850. Here’s how those numbers break down:

Under 580: poor

How are credit scores calculated? FICO assesses the following factors to compute your score:

Payment history: 35% Length of credit history: 15% New credit/inquiries: 10% Credit mix: 10%

If you’re wondering how you’re doing in each area, you can check your credit score for free by visiting , , or .

I use Credit Sesame, which creates a report card for your credit score and assigns grades for each category, so you can see where you’re thriving and where you’re struggling. Credit cards can be optimal tools for making progress in these five areas.

Read Also: Does Affirm Show On Credit Report

Make Your Payments On Time

Lenders look closely at payment history to make sure youâll pay your loans on time and in full. With payment history making up approximately 35% of your credit score, a history of late payments can have a significant impact on your credit rating. Using RBC Online Banking or the RBC Mobile app makes it easy to pay your bill immediately or set up recurring payments. Payments can also be made via phone or mail, and in-person at a branch. RBC makes paying your credit card bill easy, so you can focus on things that matter most to you.

Build And Monitor Your Credit

Whether you’re starting with a credit card or using a loan to build credit, you can monitor your progress by tracking your credit report and score online. While there are many credit myths, Experian offers free access to your credit report and a FICO® Score for free, as well as ongoing if there’s any suspicious activity so that you know what is going on with your credit. You can see which information gets reported, how your score changes over time and receive personalized suggestions for how to improve your credit.

Read Also: How Long Closed Accounts Stay On Credit Report

How To Check Your Credit Report

You can get a free copy of your report at annualcreditreport.com.

Under normal circumstances, you would be able to get one free report from each of the three major credit reporting bureaus per year. However, in response to COVID-19 you can access a free weekly report from any of the bureaus through December 31, 2022.

Check your which could be dragging your score down. If you find mistakes, you can get items removed from your credit report by disputing the information directly with the credit bureau. They are obligated to investigate any dispute and resolve it within a reasonable amount of time. Keep in mind, however, that only incorrect information can be removed from your report.

According to Richardson, each credit report will have the information you need to improve your score. There are four or five bulleted statements about your credit profile that can help you make a road map of what to do if youre really in a position where you need to improve your score, he says.

You may also find a numerical or text code in your report, but no additional information as to what it represents. These are factor codes and represent items that may be dragging your score down. VantageScore has a free website, ReasonCode.org where you can enter the code from any credit report and get an explanation of what it stands for and advice on how to resolve the issue.

What Is A Credit Card Authorized User

A credit card authorized user is a person who has permission to use another persons but isnt legally responsible for paying the bill. For personal cards, authorized users are usually family members, such as a child or a spouse. Depending on the credit card issuer, some credit card companies provide a unique card to authorized users linked to the holder of the primary account. Others simply authorize a credit card authorized user to make purchases with the primary account holder’s card.

Authorized users typically report lost or stolen cards, receive account information such as credit limit, available balance, and fees, make payments and initiate billing disputes. Cards generally do not allow authorized users to close an account, add another authorized user, change the address or or request a change to the credit limit or interest rate.

Don’t Miss: Does An Arranged Overdraft Affect Your Credit Rating

How Can I Get My Credit Score From 500 To 700

Asked by: Mr. Maximilian DuBuque VHow to Bring Your Credit Score Above 700

Adopt Good Credit Habits Early For A Healthier Financial Life

You can probably see by now that most of the tips for improving your credit score are really just common sense. And you donât have to be in credit trouble to follow them. In fact, if you have a good credit score, youâve almost certainly been doing some of them already. Theyâre not quick fixes, but theyâre good habits to get into for a better credit history â and future.

Read Also: Why Credit Rating Is Required

Tips On How To Improve Your Credit Score

Every situation is different. Yet depending on the information you discover on your credit report, one or more of the following actions might benefit your credit score.

Lets say you discover that your credit score isnt as high as you wish. You can search your credit report for clues to find out why your credit score isnt higher. From there, you may be able to create a customized plan to try to build a better credit score for the future.

Use Your Credit Card Responsibly To Raise Your Score Without Carrying Any Debt

Using credit cards irresponsibly can hurt your credit score. And, the opposite is also true: using your cards responsibly can help improve your credit score without having to carry any debt.

Whatâs the solution?

If overspending is the main reason why your credit score is so poor in the first place, consider signing up for a card issuer that has a low credit limit, as it will curb your overspending habits in the future, (and prevent you from having a weak credit score and having debts.

Steve is a writer, blogger, and smart card manufacturer at Cardzgroup. He lives in Los Angeles, California and enjoys spending time with his family and on his motorcycle when not writing.

Also Check: How To Get An 850 Credit Rating

New Electronic Alerts From Your Bank

Some banks have started sending new electronic alerts to help you manage your day-to-day finances and avoid unnecessary fees.

Your payment history is the most important factor for your credit score.

To improve your payment history:

- always make your payments on time

- make at least the minimum payment if you cant pay the full amount that you owe

- contact the lender right away if you think you’ll have trouble paying a bill

- don’t skip a payment even if a bill is in dispute

How To Pay Your Credit Card Bills While Increasing Your Credit Score

Making full on-time payments is the best way to increase your credit score. If you cant afford to do it, try to pay at least the minimum amount due on all your credit cards. Paying a custom amount is still better than paying only the minimum required amount.

If you have many credit cards with unpaid balances you have several options to choose from. You can use a for a balance transfer or a personal loan. Otherwise, the Avalanche and the Snowball strategies are the best approaches to your problem.

The important thing is to take action as soon as possible.

Pin it for later!

You May Like: What Credit Score For Car Loan

Keep The Same Card Open For A Long Time

This strategy falls under “length of credit history,” which makes up 15% of your score. If you’re tired of paying off your credit card, you may be tempted to cancel the card altogether. This could be the right move for you, but if the ultimate goal is to build credit, you may want to reconsider.

Lenders want to see that you can use credit responsibly for a long period of time. The longer you have a line of credit and use it responsibly, the better it looks. Especially if a card has no annual fee, consider keeping it open you can put it in a sock drawer or somewhere else out of sight. You should still use it once every year or two to make a small purchase , so the credit card issuer doesn’t assume your account is inactive and make the decision to close it.

I currently have a C in the “credit age” category on my Credit Sesame report card. I only have one credit card, and I’ve had it for less than three years. Credit Sesame recommends owning a card for at least five years to really boost a score.

Tips That Can Help Raise Your Credit Scores

Because , building credit takes time. Depending on your individual situation, there may be ways to raise your scores quickly like paying down all your debt in a very short span of time. But if youre starting out with bad credit, even a drastic measure like that may not have the immediate effect youre looking for. No matter what, the most impactful thing you can do for your credit is to create some consistent habits. Here are some tips that can help you raise your credit scores over time.

Recommended Reading: Is 784 A Good Credit Score

Card Recommendations To Increase Credit Score

* Current credit cards you are the primary account holder of: Ezcard Visa $5,000 limit, 8/2016 CareCredit $1,500 limit, 11/2016* FICO Scores with source 748 Transunion/Equifax* Oldest credit card account age with you as primary name on the account: 6 years, 1 month* Number of personal credit cards approved for in the past 6 months: 0* Number of personal credit cards approved for in the past 12 months: 0* Number of personal credit cards approved for in the past 24 months: 0* Annual income $: 52,000

CATEGORIES

* OK with category-specific cards?: Yes* OK with rotating category cards?: No* Estimate average monthly spend in the categories below. Only include what you can pay by credit card. * Dining $: 0 * Groceries $: 0 * Gas $: $50 BJ's Whole Sale Gas * Travel $: 0 * Do you plan on using this card abroad for a significant length of time ?: No * Any other categories or stores with significant, regular credit card spend : $ $12.50 gym membership, $10.59 Microsoft Gamepass, $17.49 BlueLink Subscription * Any other significant, regular credit card spend you didn't include above?: $ * Can you pay rent by credit card? If yes, list rent amount and if there's a fee for paying by credit card: Yes $1,000, $30 convenience fee

MEMBERSHIPS & SUBSCRIPTIONS

PURPOSE

* What's the purpose of your next card ?: Saving Money* Do you have any cards you've been looking at? No

Pay Credit Card Balances Strategically

The portion of your credit limits you’re using at any given time is called your . A good guideline: Use less than 30% of your limit on any card, and lower is better. The highest scorers use less than 7%.

You want to make sure your balance is low when the card issuer reports it to the credit bureaus, because that’s what is used in calculating your score. A simple way to do that is to pay down the balance before the billing cycle ends or to pay several times throughout the month to always keep your balance low.

Impact: Highly influential. Your credit utilization is the second-biggest factor in your credit score the biggest factor is paying on time.

Time commitment: Low to medium. Set calendar reminders to log in and make payments. You may also be able to add alerts on your credit card accounts to let you know when your balance hits a set amount.

How fast it could work: Fast. As soon as your credit card reports a lower balance to the credit bureaus, that lower utilization will be used in calculating your score.

Also Check: Does Applying For A Loan Hurt Your Credit Score