After Paying Off Debt

The length of time it takes for your credit score to update after paying off debt depends on the type of obligation you retired, the timing of your final check, and any additional spending if applicable.

- Your balance reaches zero after paying off installment loans and stays at zero. Your score should reflect this permanent change within ten days of your last billing period end date.

- Your balance can reach zero after paying off a revolving credit cardbut will not stay at zero if you continue charging purchases to the account. Your score should reflect this temporary change within ten days of your last billing period end date.

Best Credit Monitoring Apps In 2021

When looking for a credit monitoring service thats right for you, McCreary recommended comparing the services and benefits each service offers, while Saavedra noted that signing up for a free trial or even using a free version before investing in a paid subscription is worth considering to experience the offering first-hand and determine what information is most useful to you.

How To Remove An Authorized User From Any Chase Card

You have two options if you want to remove an authorized user from one of your Chase cards:

. You can call Chase by dialing the number on the back of your Chase credit card. You can also call: 1-800-432-3117.Send a secured message. Login to your Chase account and select Secure messages from the side bar . You can use this form to request an authorized user removal.

You May Like: What Is A Closed Account On My Credit Report

Discover Identity Theft Protection

For $15 per month, Discovers Identity Theft Protection service offers credit monitoring from all three bureaus, alerts you if a bank account opens in your name, scans thousands of sites on the dark web for your personal information and notifies you of significant credit balance changes greater than $5,000 and credit limit changes greater than $100 reported to Experian. As its name suggests, the service offers identity theft insurance up to $1 million covering legal expenses, stolen funds and lost wages. Child Identity Protection, which monitors fraudulent use of your childs personal information and social security number on the dark web, can include up to 10 children at no additional cost.

After Paying Off Collections

The length of time it takes for credit scores to update after paying off collection accounts can range from 15 to 45 days, depending on when your final check arrives relative to the agency reporting cycle.

There are thousands of collection agencies that operate throughout the country. Each might have a different day of the month when they report the most recent payment information to the bureaus.

- 15 days: your check arrives close to the end of a cycle

- 45 days: your money posts close to the beginning of a cycle

You May Like: What Does Fraud Alert Mean On Credit Report

Reasons You May Not Have A Medical History Report

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

How Often Do Credit Reports Update

Most creditors report to credit bureaus monthly. However, they report data at different times throughout the month, and they may report to only one or two credit bureaus instead of all three.

The credit bureaus add new information once its reported to them, according to TransUnion. That means your reports are continually evolving.

Once your credit report updates, the new data will be reflected in your credit score next time it’s calculated.

Don’t Miss: When Are Paid Collections Removed From Credit Report

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you havent applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you dont have.

You May Like: Usaa Fico Score

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

Recommended Reading: Care Credit Dental Credit Score

Read Also: Does Requesting A Credit Limit Increase Hurt Score

Gather Materials & Documents To Dispute Errors

Before you submit your dispute, you should gather the personal information and documents the credit bureau or creditor may need to investigate your claim.

When you open a dispute, you may be asked for the following personal information:

- A copy of your drivers license or government-issued ID

- Your current address and addresses for the past two years

In addition, you may be asked for the following documentation to support your dispute:

- Federal Trade Commission Identity Theft Report or a police report if an account has been added as a result of identity theft

- Billing statements

Read Also: Does Paypal Credit Help Credit Score

Check Your Credit Reports For Updates

It may take some time for your credit reports to be updated. Creditors can take up to 45 days to send a credit bureau new information, according to TransUnion. If the information isnt updated after 45 days, contact the credit bureaus or data furnisher again to see why inaccurate information is still being reported.

Dont Miss: How To Unlock My Experian Credit Report

Don’t Miss: What Is Tu Interactive On Credit Report

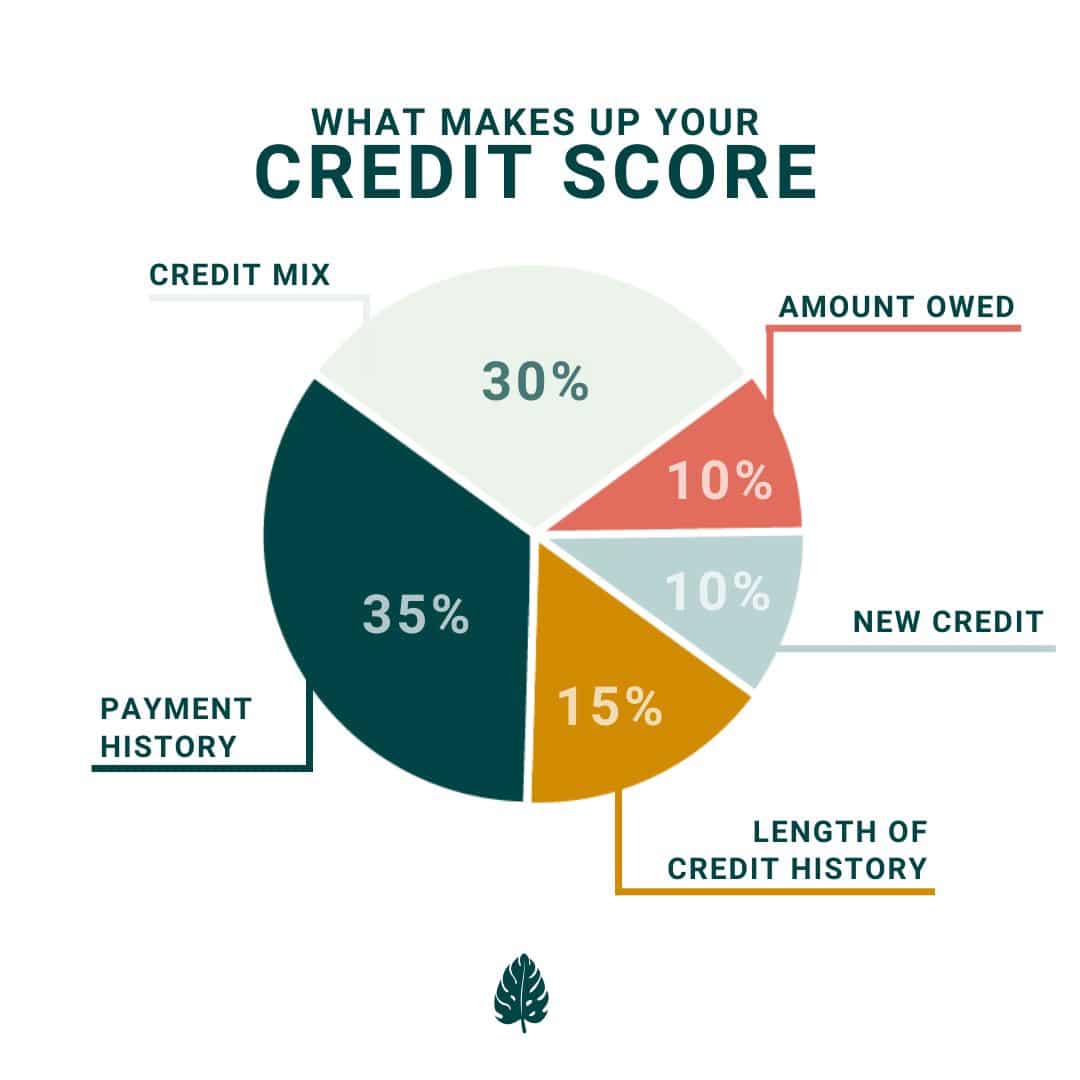

How Does It Affect Your Credit Utilization

Lets say you buy a big-ticket item using one of your credit cards. You know that the purchase is going to put you over the recommended 30 percent utilization rate, but your plan is to pay the purchase off when you get the bill . So far, so good.

However, if your credit card company, as many do, reports at the close of your billing cycle , your score is going to be negatively affected until you make the payment and it is reported to the bureaus in the next billing cycle. This is because your purchase has affected your credit utilization in a negative way.

Of course, if you stick to your plan, this will be a temporary problem and your score will bounce back once the payment is made and reported. But if you need to access new credit in the meantime, this could be a problem for you.

Even if you dont access new credit, others might look at your credit report while this factor is bringing your score down, like insurance providers or even potential employers or landlords. You may have an explanation ready, but the chances of them asking and you being able to explain yourself are probably pretty slim.

Check Your Report Regularly

If you already have a credit card, you begin checking your credit report on a regular basis. You need to make sure everything the report contains is accurate information. Believe it or not, 79 percent of credit reports contain some type of error. Some substantial errors — 25 percent — can cause a credit denial, according to the National Association of State Public Interest Research Groups. You have a legal right to get a free report from all three credit reporting agencies once a year.

Also Check: Does Everyone Have A Credit Score

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

You Ask Equifax Answers: How Often Do Credit Card Companies Report To The Credit Bureaus

Reading time: 3 minutes

Question: How often do credit card companies report to the nationwide credit bureaus?

Answer:

As with many areas of personal finance, the answer to this question depends heavily on the credit card you use and your unique financial situation reporting times vary from card to card.

If a creditor decides to report to one of the nationwide , there are guidelines that they must follow. They should report monthly, preferably on the billing cycle date. For credit card companies, this is usually the day that they issue your charges for the most recent billing cycle, also known as your statement date. For most companies, these dates are spread throughout the month so that they don’t have to produce every customer’s statement on the same day.

For example, if a credit card company has 25 billing cycles, they could send 25 files to the nationwide credit bureaus each month. Smaller companies may only send one file a month that contains all accounts in their portfolio but only includes data as of the statement date. Some credit card companies will report your information in the middle of the month, while others do their reporting at the end of the month. Ultimately, however, there’s no set day, time and frequency credit card companies have to report, as long as they meet the general guidelines.

Don’t Miss: What Credit Score Is Needed To Get A Mortgage

Choose A Credit Repair Firm Carefully

- Avoid offers of a quick debt reduction or debt settlement plan with high upfront fees.

- Be aware that some fraudulent agencies will get away with using a nonprofit status just to collect your money. Legitimate agencies should be willing to sit down with you and discuss your spending habits and help you come up with a budget.

- Unrealistic promises, such as erasing your debt for pennies on the dollar in a short time, or promising to reverse a bad credit score, should be red flags.

- Work with a Minnesota licensee that has a local office with staff available to answer your questions.

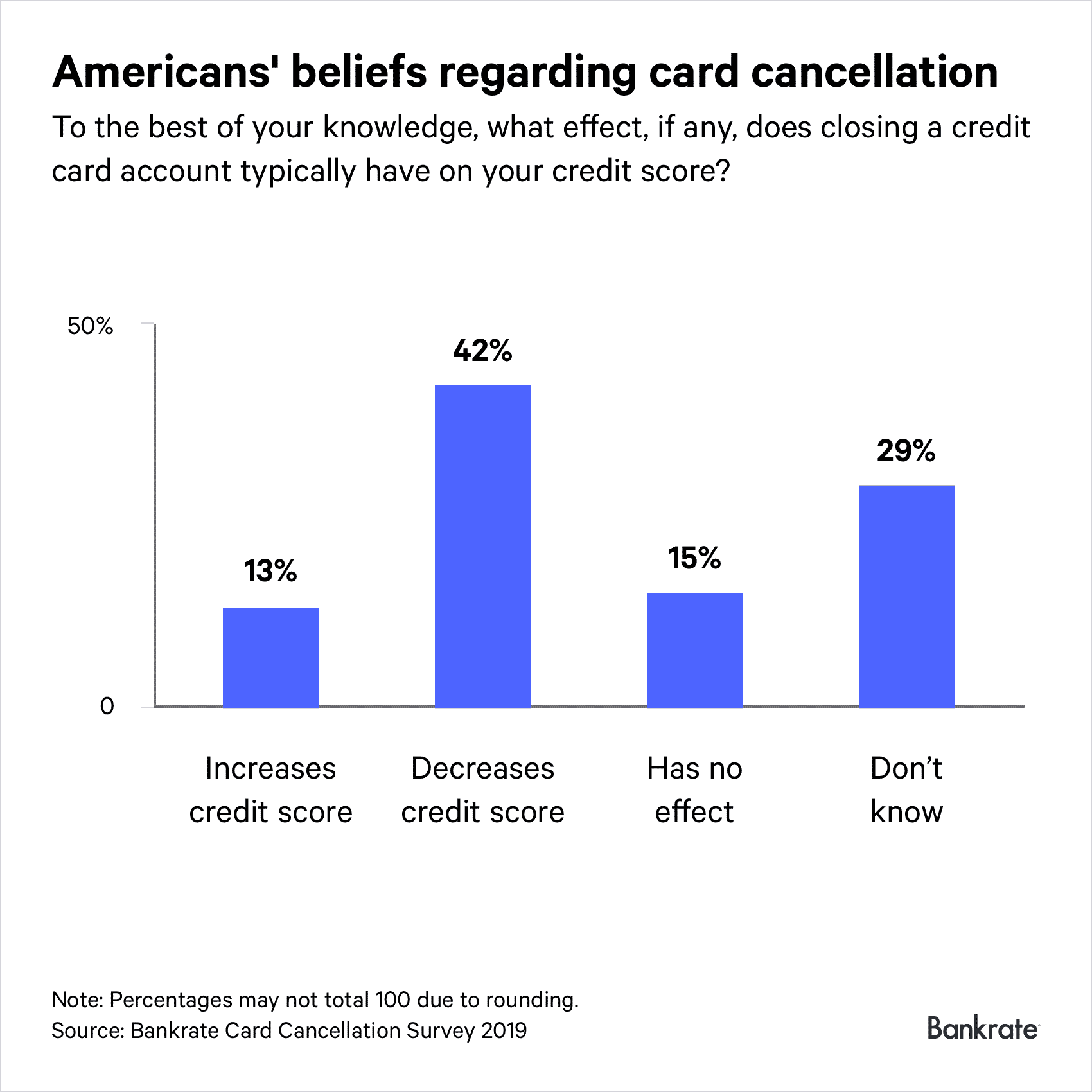

Fraudsters Prefer To Open New Accounts

Its important to safeguard your existing credit card accounts from being used by other people, but todays crooks find them less desirable than your personal information that can be used to open new credit cards. The 2020 Federal Trade Commission study discovered that 88% of credit card fraud in 2019 consisted of thieves opening new accounts.

Remedy: When it comes to identity theft, the most valuable piece of information is your Social Security number. With it, thieves can open accounts in your name, so locking down that number is crucial.

Youll want to make it as difficult as possible for criminals to steal your information. The Social Security Administration offers free cybersecurity protection to all consumers. When you enroll, it will add another layer of protection between you and cybercriminals.

Also Check: What Is The Best Credit Rating Agency

What Is My Credit Report

Think of your credit report as your financial CV. It contains information that helps lenders confirm your identity and decide whether youre a reliable borrower.

This includes details of credit accounts youve held , your current and previous addresses, and any financial connections for example, the name of the person you share a joint account with.

There are likely to be three slightly different versions of your credit report, because lenders dont always share the same information with all three major credit reference agencies – Experian, Equifax and TransUnion.

Our survey of 14,000 Which? Members in August 2021 found six in 10 hadnt checked their credit report in the past three years.

Find out more: is a credit report error wrecking your score?

How Often Should You Apply For A Credit Card

Author:

Being approved for credit can give your spending power a real boost, while also contributing toward a healthy financial life. However, that doesnt mean you should just start applying for every credit card you see all at once, so you have a large collection of credit cards at your disposal. Doing so can have some unintended consequences.

Recommended Reading: When Does Citi Card Report To Credit Bureaus

How To Check Your Credit Score For Free

There are dozens of resources available for you to check your credit score for free, but the type of score you receive varies between a FICO® Score and VantageScore. While both are helpful for understanding the key factors that influence your credit history, FICO Scores are used in the majority of lending decisions.

The simplest way to access your free credit score is through your credit card issuer. Many card issuers provide their cardholders with free access to their FICO® Score or VantageScore. Beyond your bank, consider free resources from Experian, Discover and Capital One.

Timing Is Everything With Credit

Your credit files can change every day. Thats because, as you open new accounts, pay your bills, close accounts and so on, the bureaus continue to collect information and activity from creditors and lenders. This collection alone changes the data in your files.

In addition, some lenders provide their information at the start of the month, others in the middle and some at the end. That means, not only will the information change on different days at different bureaus, but the information at each bureau may not match because it was received at different times.

In answer to the original question, how do credit bureaus get your information? it pretty much comes down to specific lenders and their processes regarding customer credit activity. Once they report that information to the bureaus, the bureaus provide the information in the form of a to the company or person who requested it.

Dont Miss: Cbcinnovis Credit Inquiry

You May Like: How To Find Out Credit Score For Free

How Often Is My Credit Report Updated

Erika Rasure, is the Founder of Crypto Goddess, the first learning community curated for women to learn how to invest their moneyand themselvesin crypto, blockchain, and the future of finance and digital assets. She is a financial therapist and is globally-recognized as a leading personal finance and cryptocurrency subject matter expert and educator.

If youre working to improve your credit or watching for a specific change to your , you probably want to know how often your credit report updates. Being able to predict how your credit reportand ultimately your credit scorewill change is a concern for anyone who knows the importance of having good credit or anyone who hopes to be approved for a major loan soon.

The timing of credit report updates largely depends on when lenders, credit card issuers, and other companies you have credit accounts with send your account information to credit bureaus. If you have multiple accounts with several businesses, your credit report could update daily.

Fix Mistakes In Your Credit Report

When you get your credit report, check that:

- all the loans and debts listed are yours

- details such as your name and date of birth are correct

If something is wrong or out of date, contact the credit reporting agency and ask them to fix it. This is a free service.

Some companies may try to charge you to get all negative information removed from your credit report. The only thing they can ask the credit reporting agency to remove is wrong information. And you can do that yourself for free see .

If there are loans or debts in your report that you know nothing about, it could mean someone has stolen your identity. See identity theft for what to do.

Don’t Miss: Will Disputing Items On Credit Report Lower My Score

High Balance On Credit Report

In addition to your last reported credit card balance, your credit report also includes a high balance. This balance is the highest balance ever reported to the credit bureaus for that credit card account.

The high balance remains the same each month unless a higher credit card balance is reported. While some creditors and lenders may include the high balance in a manual evaluation of your creditworthiness, this balance isnt currently included in your credit score.

How Often Are Your Credit Scores And Reports Updated

Credit scores are calculated only when your credit report is accessed and will reflect any changes in your credit history since the last time it was viewed. Credit reports are updated frequently, and . If you check your score often, you may notice small changes in either direction.

Why is your ? Even though an individual credit card issuer may only report your account history to each bureau once a month, they may report it to different consumer reporting agencies at different times. If you have multiple credit card accounts or loans, they may all get reported to the credit bureaus at various points throughout the month. Other items can pop up on your report and impact your score as well, such as late payments, collection accounts and hard inquiries when you apply for new credit or services.

Little fluctuations in your credit scores aren’t anything to lose sleep over. It’s more important to stick to consistent, smart credit habits, and over time, your score will gradually climb in an upward trajectory. Things you can do to encourage score improvement include:

- Pay every bill on time, every time.

- Keep credit card balances low.

- Get current on past-due accounts as quickly as you can.

- Avoid unnecessary applications for new credit.

Also Check: What Credit Score Does A Cosigner Need