Top Tip: Lower Your Credit Utilization

His top tip? Lower your credit utilization ratio. “This is the amount of credit you’re using on your credit cards divided by your credit limits,” Rossman said.

He said that even if you pay off your balances every month, the credit-reporting firms Experian, Equifax and TransUnion often receive balance data before you’ve paid it.

“It’s typically reported on your statement date, so consider making an extra mid-month payment and/or asking for a higher credit limit to bring your ratio down,” Rossman said.

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Recommended Reading: What Credit Report Does Comenity Bank Pull

Why Having A Good Credit Score Is Important

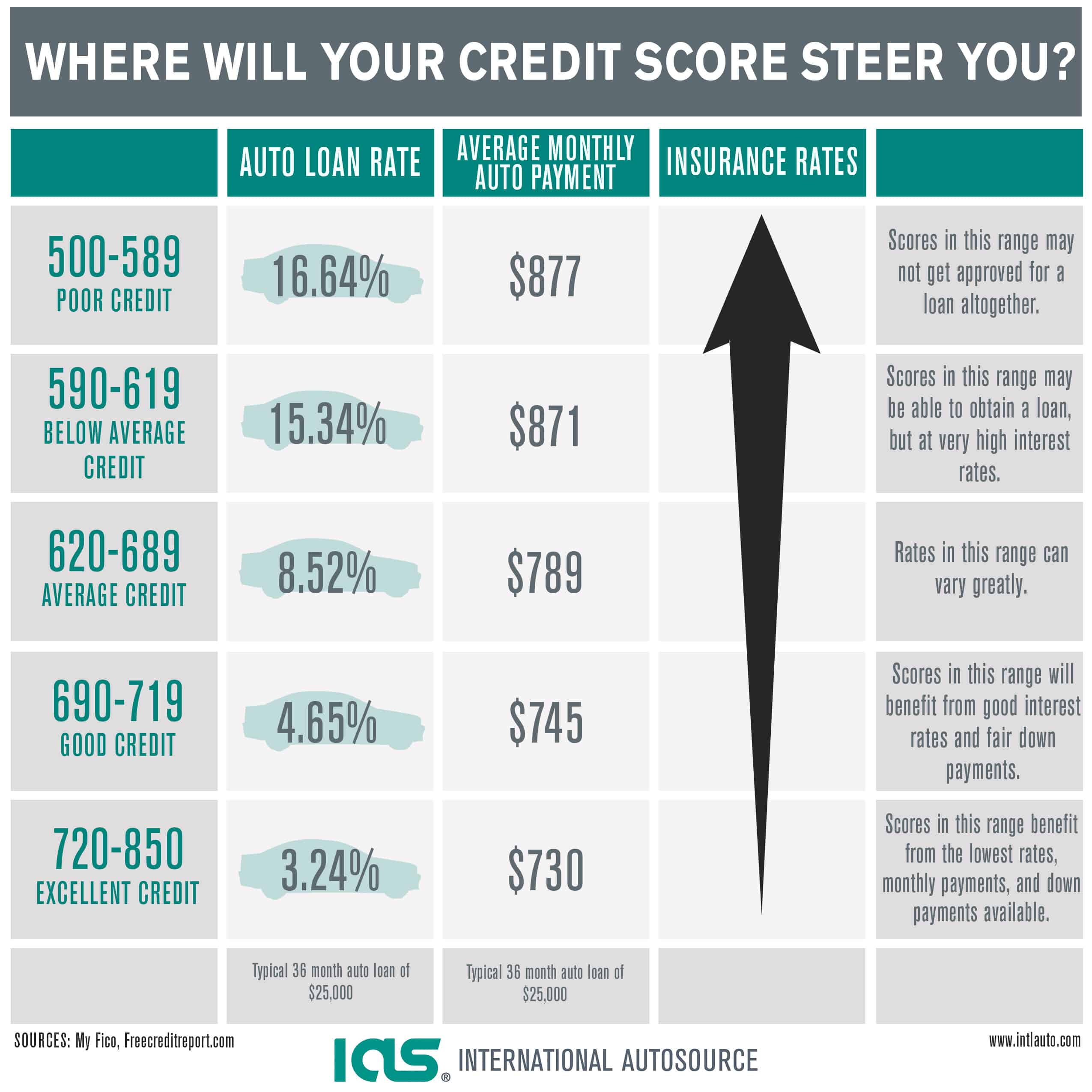

In general, having good credit can make achieving your financial and personal goals easier. It could be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan. And, it can directly impact how much you’ll have to pay in interest or fees if you’re approved.

For example, the difference between taking out a 30-year, fixed-rate $250,000 mortgage with a 670 FICO® Score and a 720 FICO® Score could be $72 a month. That’s extra money you could be putting toward your savings or other financial goals. Over the lifetime of the loan, having a good score could save you $26,071 in interest payments.

Additionally, credit scores can impact non-lending decisions, such as whether a landlord will agree to rent you an apartment.

Your credit reports can also impact you in other ways. Some employers may review your credit reports before making a hiring or promotion decision. And, in most states, insurance companies may use credit-based insurance scores to help determine your premiums for auto, home and life insurance.

You May Like: What Is A Good Experian Credit Score

How Much It Costs In Every State To Freeze Your Credit Report

Consumers in all 50 states, District of Columbia and Puerto Rico can ask the national credit bureausEquifax, Experian and TransUnionto place a freeze on their credit report. Thats a move we think is worth considering if you suspect identity thieves may have access to the information required to apply for credit in your name, including your address and Social Security Number.

A credit freeze prevents lenders from pulling your credit report, typically a necessary step lenders require in approving new credit. If you subsequently apply for new credit, and so want lenders to be able to access your reports, you may “unfreeze” those records, either permanently or temporarily.

The maximum fees the agencies may charge for freezing a report are governed by state law. Since all three credit bureaus may be contacted by a prospective lender, and because you must freeze your report separately at each bureau, weve combined the fees from all three to calculate a total cost by state to freeze and unfreeze your reports.

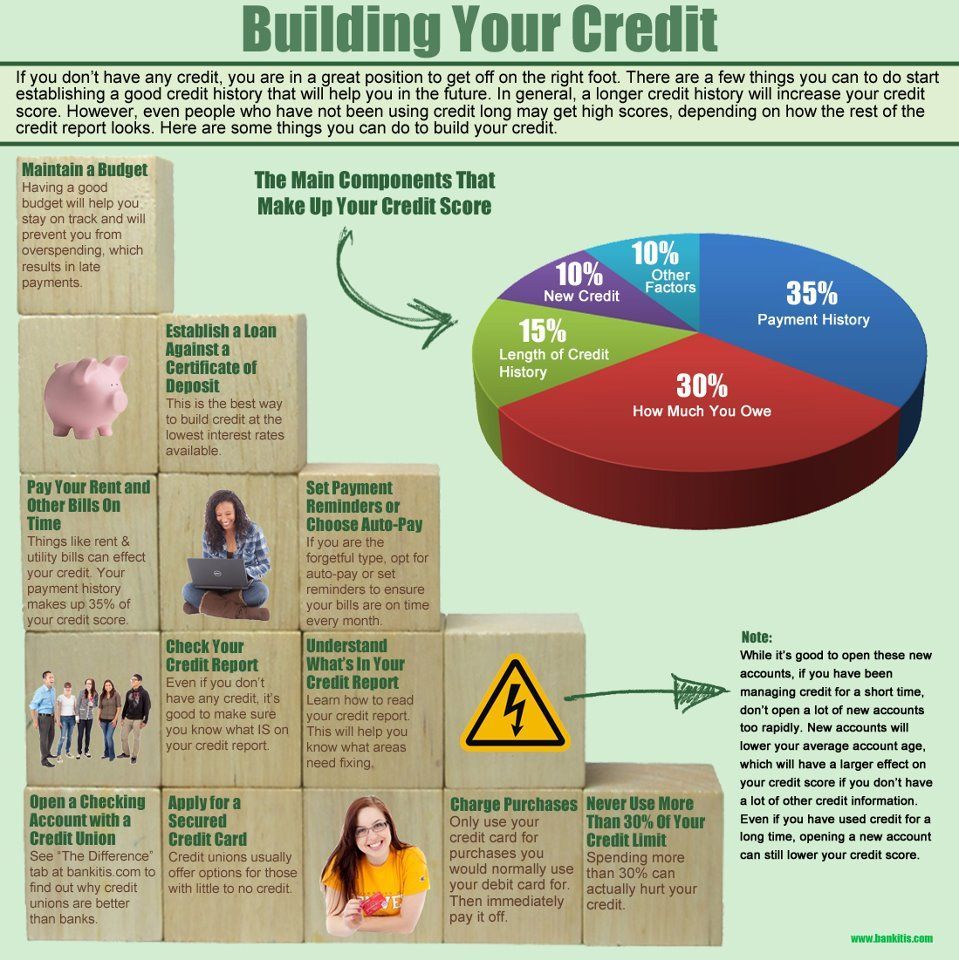

What Affects Your Credit Score

On the list of what affects your credit score, two factors have the biggest influence: Payment history, which is whether you pay on time, and credit utilization, which is how much of your credit limits you have in use.

Other factors matter but carry a little less weight: how long you’ve had credit, whether you have a mix of credit types and how frequently and recently you’ve applied for credit.

Read Also: When Does Charge Off Drop From Credit Report

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

One Score Matters Most

Other companies market their own versions of a credit score, but one score matters the most: your FICO score.

In 2016 the Mercator Advisory Group conducted research that showed that about 90% of all lending decisions factor a FICO score into the mix. Thus, if you are going to pay for your score, it should be for that one. However, there are ways to get your score for free.

Read Also: How To Get Bad Stuff Off Your Credit Report

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

How Lenders Use Credit Reports

Be aware that different lenders look for different things when reviewing your credit report and deciding whether to lend to you. They can also take other factors into account.

For example, you might have been furloughed and taken a payment holiday during the coronavirus pandemic. While this won’t directly affect your credit score, it may affect your ability to borrow in the future.

Recommended Reading: How To Access Free Credit Report

What Is A Good Amount Of Available Credit

The 30% credit utilization rule of thumb can be an easy benchmark to help you make sure you don’t use too much of your available credit. But for the benefit of your credit score and your overall financial health, it’s best to keep your utilization rate as low as possible.

To give you an idea of how people in different credit score ranges manage their credit cards, here’s how much available credit each range has on average, according to Experian data:

| Average Available Credit by Credit Score Range | |

|---|---|

| Exceptional | 94.3% |

As you can see, even people with good credit tend to use more than 30% of their available credit, which shows that going beyond that threshold won’t wreck your credit. But people with higher credit scores tend to use far less, showing that they can manage their credit well.

Can You Pay To Have Your Credit Repaired

Unlike how the name suggests, youre not able to just pay money for a good credit score. Thats because credit repair companies can only help to remove errors they cant remove information thats damaging but correct.

For example, if youve made several late payments, defaulted, have a large credit card balance relative to your total credit limit or other common negative marks, and its accurate, there is nothing can do.

Read Also: Can You Get Charge Offs Removed From Credit Report

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

What Makes My Credit Score Go Up Or Down

A credit score is based on information in your credit report. Some factors include how much money you owe, how long you’ve owed it, how many new accounts you have, how often you miss or are late with payments, and what type of credit accounts you have. Changes in any of those factors may cause a score to go up or down.

Recommended Reading: How To Get Hard Inquiries Off Credit Report

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

What Is Considered A Good Fico Score

A good FICO® Score starts at 670. If your score is above 740, you can generally expect lenders to offer you better-than-average interest rates. As you move closer to the top score of 850, you’ll more likely qualify for the lowest interest rates and the most premium credit card offers.

On the flip side, a score of 570 to 669 is considered fair, while 300 to 569 is considered poor. You can still qualify for loans and credit cards with a lower FICO® Score, but you may be required to pay higher interest rates, make a bigger down payment or pay additional fees. Even landlords may require a credit check before they will rent you an apartment. So a lower credit score could put you at risk for securing a place.

You May Like: How To Get Equifax Business Credit Report

What Affects Your Credit Scores

Common factors can affect all your credit scores, and these are often split into five categories:

- Payment history: Making on-time payments on your credit accounts can help your scores. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores.

- : How many of your accounts have balances, how much you owe and the portion of your credit limit that you’re using on revolving accounts all come into play here.

- Length of credit history: This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

- Types of accounts: Also called “credit mix,” this considers whether you’re managing both installment accounts and revolving accounts . Showing that you can manage both types of accounts responsibly generally helps your scores.

- Recent activity: This considers whether you’ve recently applied for or opened new accounts.

FICO® and VantageScore take different approaches to explaining the relative importance of the categories.

How Your Credit Report Influences Your Credit Score

Miranda MarquitFinancial Writer

Miranda is an award-winning freelancer who has covered various financial markets and topics since 2006. In addition to writing about personal finance, investing, college planning, student loans, insurance, and other money-related topics, Miranda is an avid podcaster and co-hosts the Money Talks News podcast.

Fact-checked byFinancial Writer/Fact Checker

Nancy has experienced all facets of finance in more than 30 years as a CPA, including tax, auditing, payroll, plan benefits, and small business accounting.

Just about anytime you make a sizable financial transaction or agreementapply for a loan, rent an apartment, or even land a jobsomeone wants to look at your credit report. But what is a credit report, and what can it be used for? And how does your credit report differ from your credit score?

You May Like: Is 603 A Good Credit Score

Free Sources Of Credit Scores

A growing list of card companies provide your FICO score free of charge. They include:

- Bank of America

Keep in mind that FICO scores are based on a single credit report from one credit bureau, not all three combined. Discover, for example, provides the TransUnion score. The differences among the scores should be minor, however.

How To Increase Your Credit Limit

If you don’t have a lot of available credit on your credit cards, it can be difficult to keep a low credit utilization rate. Fortunately, there are a couple of ways you can increase your credit limit.

First, you can request a credit line increase from your existing credit card issuer. If you’ve proven that you manage your debt well, your credit score has increased or your income has grown, the company may consider giving you more available credit.

The second way to get more credit is to apply for a new card. Once the bank or credit union opens the account, the available credit will be added to your total.

Keep in mind that both actions will typically result in a hard inquiry on your credit report. But that temporary, small impact on your credit score may be worth it if it helps lower your credit utilization rate.

Finally, it’s important to note that credit card issuers can also lower your credit limit. This can happen if you’ve missed recent payments, rarely use your card or report lower income than when you first opened the account. It can also happen if general economic conditions cause the financial institution to lower limits to reduce their exposure to risk.

If this happens, it could impact your credit score negatively, especially if you didn’t have a lot of available credit to begin with.

Also Check: Does Geico Use Credit Score

If The Tenant Doesnt Have Any Credit History

There are several reasons why a person may not have a credit history, including:

- Theyre young and havent built credit history yet.

- Theyre wary of banks.

- Theyve recently moved to the country.

- Theyre supplying you with false or incorrect information.

If the tenant credit check comes up empty, you can use employment verification and criminal background checks to verify the information they provided in their application.

How Much Is A Credit Check For A Tenant

The three main credit bureaus Equifax, Experian and TransUnion will charge a fee, typically around $25 to $75 per applicant, depending on the information requested .

Zillows application and screening tool provides you with an Experian credit report and Checkr background check at no cost to you. The applicant will pay a $29 fee, and they can use the reports for any Zillow rental application they complete within the next 30 days.

Don’t Miss: Which Credit Score Is Used To Buy A Car

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?

How Can I Get A Copy Of My Credit Report And Credit Score

You can ask for a free copy of your credit file by mail. There are two national credit bureaus in Canada: Equifax Canada and TransUnion Canada. You should check with both bureaus.

Complete details on how to order credit reports are available online. Basically, you have to send in photocopies of two pieces of identification, along with some basic background information. The reports will come back in two to three weeks.

The “free-report-by-mail” links are not prominently displayed the credit bureaus are anxious to sell you instant access to your report and credit score online.

For TransUnion, the instructions to get a free credit report by mail are available here. For Equifax, the instructions are here.

If you can’t wait for a free report by mail, you can always get an instant credit report online. TransUnion charges $14.95. Equifax’s rate is $15.50.

To get your all-important credit score, you’ll have to spend a bit more. Both Equifax and TransUnion offer consumers real-time online access to their credit score . Equifax charges $23.95, while TransUnion’s fee is $22.90. There is no free service to access your credit score.

You can always try asking the lender you’re trying to do business with, but they’re not supposed to give credit score information to you.

Read Also: Which Credit Score Is Used To Buy A House

What Is A Credit Freeze

A credit freeze, sometimes called a security freeze, is a free tool you can use to help protect yourself from credit fraud resulting from identity theft. A credit freeze limits most companies from being able to access your credit report until you lift it, or “thaw” your credit.

When you freeze your credit reports, it makes it harder for criminals who may have stolen your personal credentials to commit credit fraud by taking out loans or credit cards in your name.

A credit freeze limits what’s typically a lender’s first step in processing a credit applicationchecking your creditworthiness by reviewing your credit reports or requesting a credit score based on those reports. Because the lender isn’t able to complete this crucial step, having credit freezes in place at the three national credit bureaus effectively limits processing of any credit application in your name.

While that can be effective at limiting unauthorized credit applications, it can make life a little more challenging when you submit a legitimate loan or credit card application. To allow a lender to process your application, you’ll need to thaw your credit reports any time you apply for a loan or credit card account.

How Do I Improve My Credit

Look at your free credit report. The report will tell you how to improve your credit history. Only you can improve your credit. No one else can fix information in your credit report that is not good, but is correct.

It takes time to improve your credit history. Here are some ways to help rebuild your credit.

- Pay your bills by the date they are due. This is the most important thing you can do.

- Lower the amount you owe, especially on your credit cards. Owing a lot of money hurts your credit history.

- Do not get new credit cards if you do not need them. A lot of new credit hurts your credit history.

- Do not close older credit cards. Having credit for a longer time helps your rating.

After six to nine months of this, check your credit report again. You can use one of your free reports from Annual Credit Report.

Also Check: Is 818 A Good Credit Score