Which Credit Cards Provide Instant Approval

Just about every credit card issuer provides a decision within seconds of submitting your online application. In some cases, the bank may require additional information that youll need to submit before receiving an official ruling.

No card, though, provides guaranteed approval.

Each card issuer has different things it looks for in an applicant, but every bank has certain requirements from an applicant. This includes, but isnt limited to:

- Proof of residency You must have a permanent address where the card issuer can contact you.

- Proof of income A bank wants to know that you can repay your debt. This can include income from employment, government benefits, a structured settlement, an annuity, child support, or pension income. Credit card applications allow you to declare your total household income if you have access to shared money, not just your individual income.

- You must be 21 or older This came into effect after the , though some card issuers will accept applications from someone who is 18 or older and has parental permission.

- Social Security number This is a way for the bank to pull your credit history.

This information can help banks identify you, and make certain that someone else isnt filling out an application for credit in your name. Some cards may also require an active checking or savings account from which you can submit electronic payments.

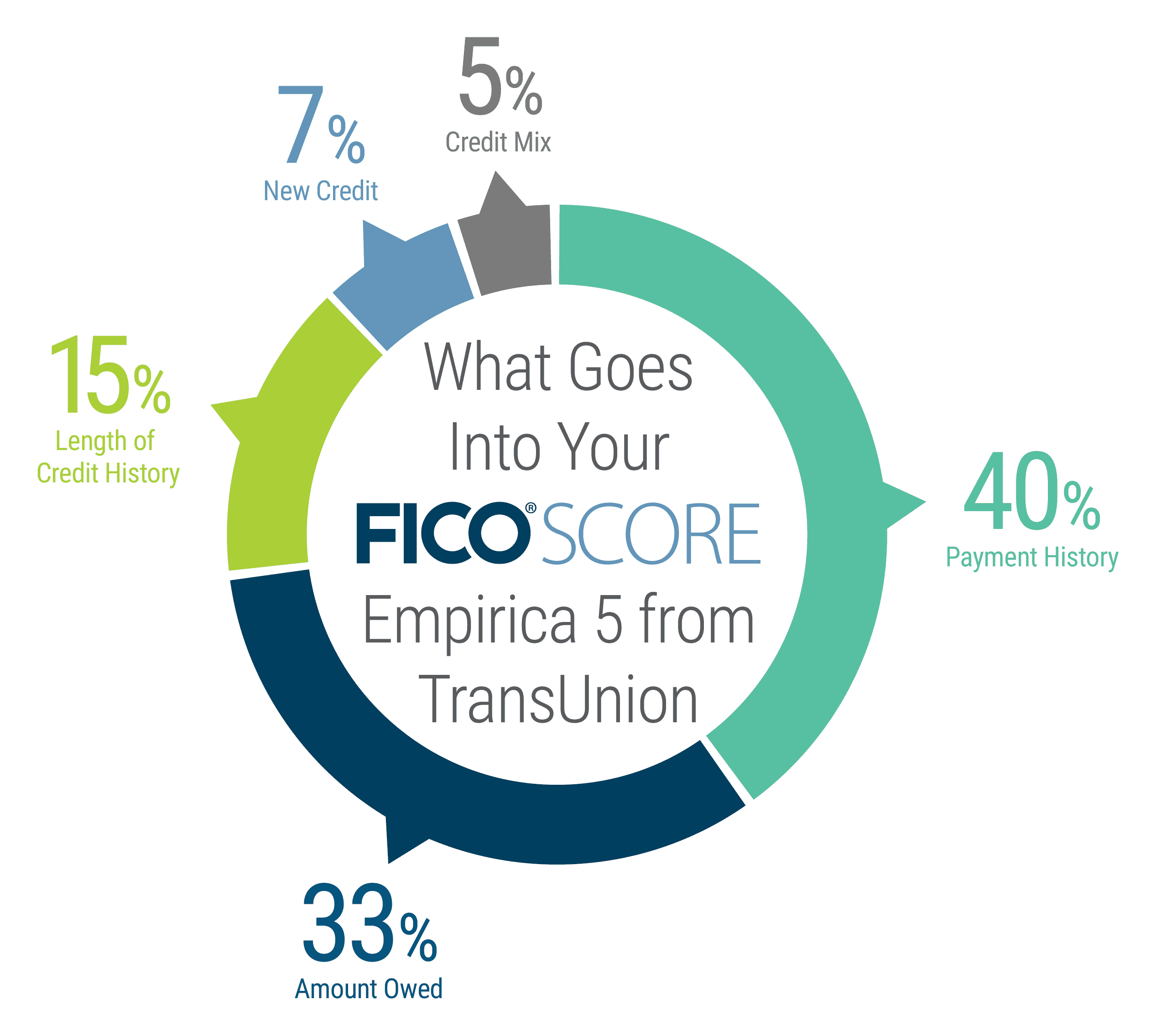

The Five Pieces Of Your Credit Score

Your credit score is based on the following five factors:

Ultimately, one way to potentially improve improve your credit score is to use loans and credit cards responsibly and make prompt payments. The more your credit history shows may be able to responsibly handle credit, the more willing lenders will be to offer you credit at a competitive rate.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Score plus tools, tips, and much more. Learn how to access your FICO Score.

How Do You Get A 800 Credit Score In 45 Days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.

Also Check: How To Pay Off Bad Debt On Your Credit Report

How Can I Improve My Credit Scores

You are never stuck with a bad credit score. Work on your financial habits and you can improve your credit scores over time.

Paying your bills on time, even if you pay just the minimum amount due, accounts for 35% of your FICO® Score. Set up automated bill pay to avoid late payments.

Your is another important credit-scoring factor to be aware of. This takes into account how much of your total available credit you are using on a monthly basis. Your credit utilization ratio accounts for 30% of your FICO® Score. Focus on paying down your balances will help to lower your utilization rate.

You might also want to consider a to help improve your credit.

Do You Need Credit To Get A Credit Score

Its not necessary for you to get credit to start building your credit history. Some companies, such as Experian, eCredable and LevelCredit, give you the ability to report your qualifying utility, phone, online streaming services and rent payments to credit bureaus:

- Experian Boost helps add eligible bill payments to your Experian credit report.

- eCredable reports eligible bill payments to TransUnion.

- LevelCredit reports rent payments to TransUnion and Equifax and eligible utility and other bill payments to TransUnion.

Also Check: How To Check Credit Score Without Affecting It

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Other Questions You May Have About Credit Scores

1. What is the credit score of someone with no credit?

Someone with no credit typically has no credit score. There might be an exception if you get your bill/rent payments to reflect on your credit reports or if youve been a victim of identity theft.

2. Whats the average credit score for a 20-year-old?

The average credit score of those between 18 to 23 years of age was 674 in 2020 and 667 in the preceding year. In both years, this average was the lowest of all age groups.

3. Is no credit worse than bad credit?

Any credit score from 670 to 739 is considered good. Very good to exceptional credit scores range from 740 to 850.

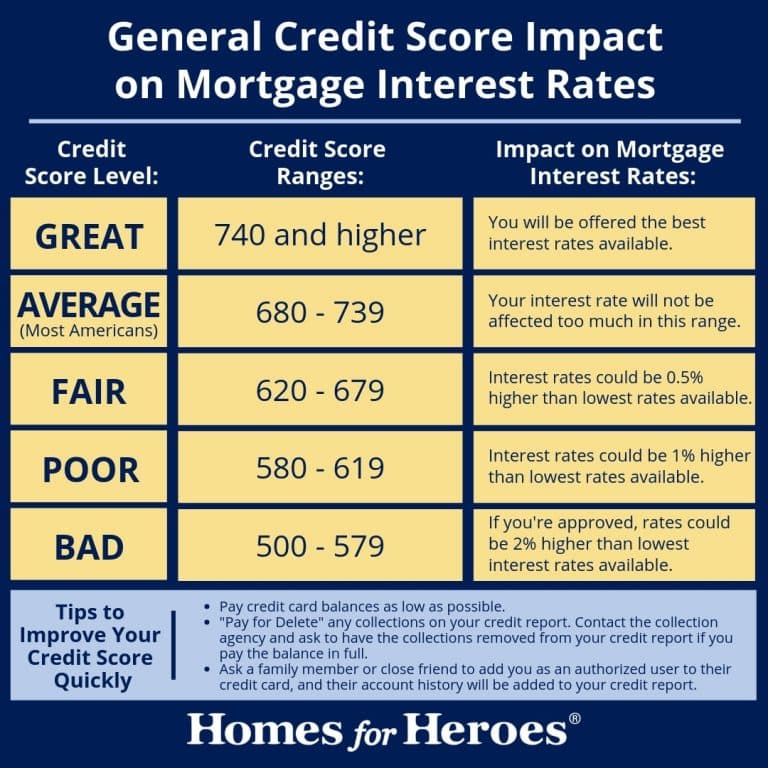

4. What credit score is needed to buy a house?

The credit score you need to qualify for a mortgage depends on the type of mortgage youre after and the lender in question. While it is possible to get a mortgage with fair/average or no credit history, you stand to get the best terms if you have good to excellent credit.

For conventional loans, you would need a credit score of 620 or higher. You might qualify for a Federal Housing Administration loan if your credit score is 500 or higher. The minimum credit score required to apply for a United States Department of Agriculture loan is 580, although lower scores might qualify in some scenarios. While Veterans Affairs loans come with no minimum credit score requirements, it is common for providers of such loans to look for scores of 620 or higher.

5. What is a decent credit score to buy a car?

Read Also: What Credit Score For Care Credit

How Do Credit Score And Credit Limit Relate

Lenders view your credit score as a measure to gauge the risk you pose as a borrower. If a lender looks at you as someone with minimal risk, it might be willing to offer you a higher credit limit than it would have if you had less-than-perfect credit. You might qualify for a higher credit limit than someone with the same income if you have a better and longer credit history that results in a higher credit score.

Your , on the other hand, may have an effect on your credit score through your credit utilization ratio. This refers to the amount youve borrowed from your total available credit and should ideally be 30% or lower. If you have a total available credit limit of $10,000 through different credit products and have borrowed $5,000 so far, your current credit utilization ratio stands at 50%, which is significantly higher than the desired limit.

How Are Credit Scores Calculated

FICO and VantageScore credit-scoring models rely on data retrieved from credit reports to come up with credit scores. Both assign varying levels of importance to different aspects that go into generating your credit score.

FICO relies on five categories, and each is assigned a fixed percentage value.

- Payment history: 35%

- Amounts you owe : 30%

- Length of credit history: 15%

- New credit: 10%

VantageScore does not assign fixed percentages but relies on varying levels of influence.

- Payment history: Extremely influential

- Duration of credit history and mix of credit: Highly influential

- Percentage of available credit youve used : Highly influential

- Total balances you owe: Moderately influential

- Recent credit inquiries and behavior: Less influential

- Available credit: Less influential

Recommended Reading: What Does It Mean When Your Credit Score Is 0

Becoming An Authorized User

This strategy requires that a primary credit card owner allow you to become an authorized user. You get a copy of the card under your own name and have full rights to use the card, although some cards may allow the owner to place restrictions on your use.

Unlike the cosigner case, are not held responsible for payments, although the credit bureaus report your status as an authorized user, which is positive for your credit score. Your risk is that you will alienate the card owner by abusing your user privilege for example, by running up bills on the card without first getting permission.

To leverage your authorized user status into a higher credit score, make sure the card issuer actually reports authorized users to the credit bureaus.

is most helpful if you have scant credit history since the new account will appear on your credit report. Your credit score can improve as your account ages FICO rewards you for managing a credit account over a long time period.

Strategically, youll get the most benefit if you become an authorized user for a long-established account with a perfect payment history, and that boasts a low credit utilization ratio. If the primary owner stops making payments, your score could be adversely affected, but keep in mind that you can ask the credit bureaus to no longer report you as an authorized user.

How To Get A Personal Loan With A 500 Credit Score

If you have a 500 credit score, these are generally the steps youll take to get a personal loan:

- Review applicant requirements. Many lenders advertise the credit score you need to have to qualify for a loan. Before applying for a loan, see if you can find out the lenders credit score requirements first so you know if you need to rule them out.

- Ask about fees. Lenders try to lower their risk level with borrowers who have bad credit scores by charging them more fees on top of higher interest rates. Confirm what type of fees each lender youre considering charges and how these fees will affect your overall cost of borrowing.

- Prequalify and compare potential loan offers. When you prequalify, your credit score wont be affected and you can get a general idea of how much a lender will be willing to lend you before you officially apply for a loan. You can prequalify with multiple lenders and compare the different potential offers to see whos likely to offer you the best loan terms, interest rates, and fees for your situation.

- Apply. Once you review your prequalification offers, choose which lender you want to officially apply with and submit your application.

If youre ready to apply for a personal loan, Credible makes it easy to compare personal loan rates from various lenders to find one that meets your needs.

Also Check: Will Disputing Items On Credit Report Raise My Score

How Low Can Your Credit Score Go And What Hurts Your Score

What would you choose between $10,000 USD and excellent credit ?

If youre anything like most people, youll certainly go for the money. Your choice is understandable. At a time when most people are living paycheck to paycheck, anyone will welcome a $10K boost.

However, if you were looking at the bigger picture, you would choose excellent credit. With such a credit, you can secure loans at preferred rates. Its for this reason people strive to maintain good credit.

Unfortunately, credit scores can fall.

Why Did My Credit Score Go Down When Nothing Changed

Sometimes your score does change based on factors outside of your control, but most times your behavior influences your score in ways that may not be obvious.

Lets take a look at the factors that influence your score and a few reasons as to why it might change even when you dont think youve changed your behavior.

You May Like: How To Check My Credit Rating For Free

An Account Has Closed

When you pay off a loan, your credit score could be negatively affected. This is because your credit history is shortened, and roughly 10% of your score is based on how old your accounts are. If youve paid off a loan in the past few months, you may just now be seeing your score go down.

Your score could be negatively impacted by a closed credit card, too. Not only is your credit history shortened, but your credit limit would also decrease and your credit utilization ratio would be impacted.

Often youll be the one authorizing a credit card to close, but card companies can close them without your knowledge. The Equal Credit Opportunity Act allows creditors to close a card due to inactivity, delinquency or default with no notice. If they close an account for any other reason, they only have to give you 30 days notice after closing the account, so you could have a closed credit card that you dont even know about.

How Low Can Your Credit Score Go

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Your credit score is one of the most critical numbers in your financial life. It can affect your ability to rent an apartment, buy a house or get a job. A low score can result in higher interest rates and may even prevent you from obtaining credit in the first place.

In common credit scoring models, 300 is typically the lowest possible score. However, scores that low are extremely rare.

There are two major credit scoring models: FICO and VantageScore. FICO is the older and more common model, with modern FICO Scores first introduced in 1989. VantageScore was established in 2006 by the three major , Experian, TransUnion and Equifax.

A number of factors go into determining your credit score, including:

- Payment history

- Types of accounts

The most influential factor in both your FICO Score and VantageScore is your payment history, but the amount of debt you owe compared to your credit limit also has a big influence.

You May Like: When Do Public Records Fall Off Your Credit Report

Does A Fico Credit Score Accurately Predict A Borrower’s Future Ability To Repay Debt

FICO did a study on how well its credit scores mirrored borrowers’ risks for defaulting on their debt, and according to an analysis for the Federal Reserve, it looks like its credit score does correlate with a borrower’s ability to repay debt in the future. It looked at the actual performance of borrowers between 2008 and 2010, relative to their credit scores and found this:

|

FICO® Score |

|---|

Lending Products And Industries

As if things werent complicated enough, there are special scores for different types of lenders, too. For example, in addition to its most widely used FICO Score 8, FICO has the following industry-specific scores:

- FICO Auto Score: Used in the auto industry

- FICO Bankcard Score: Used in the credit card industry

- FICO Score 2, 4 and 5: Used in the mortgage industry

For its base scores, FICO uses a range of 300 to 850. But it uses a range of 250 to 900 for its industry-specific scores.

While there are various ways to see your base FICO Score for free, youll need to pay a subscription fee to access your industry-specific FICO Scores.

You May Like: Who Can Pull My Credit Report

Dont Cancel Cards Needlessly

As you can see, both models look favorably on consumers who have longer credit histories and lower credit utilization ratios.

Unfortunately, you cant magically create 10 years of credit history. What you can do is choose one or two credit cards to keep active and never cancel. Not only will this help you build a longer credit history, but it can also help you keep your credit utilization rate low, since more active credit cards in your name means more available credit.

What Factors Matter For A Credit Score

The FICO credit scoring model looks at these five key factors and weighs each differently:

Read Also: What Credit Score Is Needed For A Mortgage

What Affects Your Credit Score

On the list of what affects your credit score, two factors have the biggest influence: Payment history, which is whether you pay on time, and credit utilization, which is how much of your credit limits you have in use.

Other factors matter but carry a little less weight: how long you’ve had credit, whether you have a mix of credit types and how frequently and recently you’ve applied for credit.

Review Your Credit Reports

Monitor your credit reports at least once a year for errors. Any incorrect or inaccurate negative information could damage your credit score. To fix an error listed on your report, dispute it with each credit bureau that lists it.

You can view all three of your credit reports for free by visiting AnnualCreditReport.com. Due to Covid-19, you can view your credit reports weekly through April 20, 2022.

Read Also: Will Credit Card Companies Remove Late Payments Credit Report

Build A Credit History If Needed

A low credit score doesnt always mean you have bad credit. It can just mean you have thin credit. In other words, you havent demonstrated enough creditworthiness to potential lenders, at least that they can see on your credit report.

If thats the case, you may need to open a credit account, such as a credit card, and make payments on it regularly. Try to get a card with no annual fee, if possible. Dont overspend, or use this as an excuse to take out loans you dont need.

You could get a secured credit card, for example, and pay for gas and other regular expenses with it. To avoid paying high interest charges or building credit card debt, track your balance throughout the month and pay the balance off every month.