How Having A Mortgage Affects Your Credit Score

Once you close on your mortgage, you could see another drop in your credit score since youve officially taken on new, additional debt. However, your score will likely increase over time as you start making timely payments. Heres why:

- Payment history Your payment history is the most significant factor in your FICO score, and when you apply for new credit, lenders typically look at your last two years worth of payments. As you build positive payment history by making on-time monthly mortgage payments, your score could begin to climb assuming you manage all your other debt payments responsibly. In the long run, if you consistently make your monthly mortgage payments on time, this will be a serious boost to your credit score, as youve proven you can manage this large loan, says Mazzara.

- Length of credit history Most mortgages are longer-term loans, which can benefit your score in terms of length of credit history. This component accounts for 15 percent of your FICO.

- While less of a factor in your score, your credit mix will also improve with the new type of debt youve borrowed. Lenders and creditors like to see a combination of installment loans and revolving accounts such as credit cards. The more diversified your credit profile, the better likelihood of a bump to your score.

How Can I Improve My Credit Score

Qualifying for a home loan was the first sign youre on the right path. But as you continue to strive to build your credit score, you might be wondering what factors impact it the most. Here is a breakdown FICO® shares of the model it uses to determine your credit score:

- Payment history : Never miss a payment to receive the full effect of this hefty percentage.

- Keep your revolving credit under 30% for the best results. Remember that this number doesnt take into account your installment credit, like your mortgage or a personal loan, as those will have set repayment terms.

- Length of credit history : Keep those older accounts open, even if youre not using them regularly.

- This refers to the different types of revolving and installment credit you have, including credit cards, vehicle loans, student loans and your mortgage. Lenders like to see that you can manage different types of credit responsibly.

- New credit : Lenders will take into account if youre applying for new cards, which could signal that youre planning a spending spree.

How To Consolidate And Best Payoff Debt

If you have an unhealthy amount of debt and are preparing to get a mortgage, consider these strategies to consolidate and pay down your debt.

The debt snowball method is one debt management method where you focus on eliminating the smallest debt balance first while paying just the minimum on all your other debts. On the other hand, the debt avalanche method, involves eliminating your highest-interest debt first. Both methods can be instrumental in helping you crush your debt balance in a more organized way.

Debt consolidation is another popular method for paying down debt if you carry balances on multiple credit cards or have multiple loans. Essentially, you’ll apply for a personal loan that’s enough to cover the total amount of debt on all your credit cards. Then, once you’re approved, the lender sends the funding amount to your creditors, which pays off your credit cards. From there, you’ll just have to pay back the personal loan you borrowed.

This method can potentially help you save on interest since personal loan lenders typically offer much lower interest rates compared to credit card issuers. The is one of the best debt consolidation loans out there since this lender will send your funds directly to up to 10 creditors.

You May Like: How To Add Rent To Your Credit Report

How Can I Get Rid Of Hard Inquiries Fast

If you find an unauthorized or inaccurate hard inquiry, you can file a dispute letter and request that the bureau remove it from your report. The consumer credit bureaus must investigate dispute requests unless they determine your dispute is frivolous. Still, not all disputes are accepted after investigation.

When You Apply For A Mortgage

When you want to buy a house, the first step is to get prequalified for a mortgage. Its a helpful step for everyone because it ensures youre shopping within your budget. During this process, lenders will typically check your credit using a soft inquiry, which doesnt hurt your credit score. However, some may process a hard inquiry.

Once youve found a house and need to finalize the mortgage, your lender will need to process a hard inquiry on your credit report, which will affect your credit score. How many points does a mortgage inquiry affect ? Its usually five or less.

If youre going to shop around for the best mortgage rate, which is a good idea, try to lump your applications together within a small window of time. When you do so, all the inquiries count as one, minimizing the negative impact on your credit score. The credit scoring bureaus can vary in their allowable time frame, but typically, its 14-45 days.

Also Check: Will Credit Card Companies Remove Late Payments Credit Report

How Does Applying With A Co

When applying with a co-borrower, credit checks will be done for each mortgage applicant. If one co-borrower has a lower credit score, lenders typically use the lower score of the borrowers to determine mortgage eligibility and what rates and terms to offer. For that reason, we often recommend that only the borrower with the higher credit score apply to get the best terms possible. If you decide to apply with a single borrower, youll still be able to put both names on the homes title. If youre unsure on whether or not youd like to add a co-borrower,we can help you figure that out.

Take a master class in mortgaging with our free guide.

Mortgages Where Credit Score Matters Less

With conventional loans those backed by Fannie Mae and Freddie Mac a lot of focus is put on your credit score, says Dan Keller, a mortgage professional in Seattle.

The impact of a lower score wont be as substantial on some types of loans as it would be with a conventional loan, Keller notes. For the best interest rates on a Federal Housing Administration or Department of Veterans Affairs loan, the focus isnt on a 760 score as it is with conventional loans, he says its on 700-plus.

-

For an FHA loan, you may be able to have a score as low as 500.

-

VA loans don’t require a minimum FICO score, although lenders making VA loans usually want a score of 620 or more.

-

USDA loans backed by the Agriculture Department usually require a minimum score of 640.

So, theres some leniency on credit scores and underwriting guidelines with government loans. But the loan fees are more expensive: Youll have to pay mortgage insurance as well as an upfront and an annual mortgage insurance premium for an FHA loan.

But those credit score guidelines dont tell the whole story. Most lenders have overlays, which are extra requirements or standards that allow them to require higher credit scores as a precaution, regardless of mortgage type.

Here are some of the best ways to build your credit score:

Also Check: What Is Tu Interactive On Credit Report

Does Clearpay Affect Getting A Mortgage

Before approving a mortgage, a lender must make an informed decision on your ability to pay.

Lenders will be able to see evidence of a borrower’s buy now pay later borrowing on their bank statements, so it could still have an impact on the mortgage application.

In addition to this, BNPL schemes like Clearpy have the ability to submit your payment information to credit reference agencies, so late payments could really hurt your credit.

To obtain a mortgage and continue their home buying journey, borrowers must remember that all credit payments will influence their credit profile.

So handling your Clearpay account responsibly could help your credit and in turn, improve your chances of being approved for a mortgage.

How Does A Mortgage Application Affect My Credit Score

Buying a home is a huge investment, and few people have cash on hand to make the purchase outright. Most homebuyers work with a bank or mortgage lender to borrow money to buy their home.

As a first-time homebuyer, you probably already know that your personal credit plays a large role in whether or not your mortgage application is approved. What you may not know is that simply submitting that application has an impact on your credit score.

But wait! Before you start worrying that your credit is about to take a nosedive, this is one of those good news/not-that-big-of-a-deal news scenarios.

Yes, its true that your credit score may drop slightly while mortgage lenders are reviewing your home loan application. However, as long as you make all of your payments as agreed, a mortgage is one of the best ways to increase your credit score in the long term.

Here are answers to more frequently asked questions about how applying for a home loan affects your credit score.

Recommended Reading: How Long For Collections To Fall Off Credit Report

Is There Any Way To Avoid Hard Inquiries While Searching For The Best Loan Or Credit Card Offer

Finding the right lender can get you a more suitable deal, including benefits like flexible repayment plans or competitive interest rates. But this may mean submitting multiple applications, which can affect your credit score quite significantly. Instead, with some careful research, you can identify lenders who offer terms that are suitable for your circumstances without making multiple applications.

Optimizing Credit In The Futureand Now

Getting a mortgage is a positive opportunity to build your credit, accumulate wealth and live in your own home. Checking your credit score before you begin the application process can help you determine whether it might be a good idea to take time to improve your credit score before submitting your applications.

If your score isn’t where you want it to be, check out Experian Boost®ø. This free service lets you add on-time utility, phone and streaming service payments to your credit score calculation, which may help offset a minor dip in your credit score while you’re waiting for the positive effects of paying your new mortgage to kick in.

You May Like: When Disputing Credit Report What Reason

The Fico Mortgage Shopping Period

If your mortgage shopping spans a few months, it will look back at older inquiries grouped together in those specified shopping periods and treat them as just one inquiry.

So if you shopped with mortgage lenders A, B, and C in a 14-day period two months ago, but didnt actually close your loan, then decide to restart the process, those three credit pulls would only count as one.

Unlike a credit card application where you apply just once, a home loan may involve multiple credit pulls with a variety of different lenders.

Instead of making it appear like youre on a debt rampage, they bundle these similar inquiries into one group if they occur in a designated time period.

Ultimately, you could have your credit pulled by 10 mortgage lenders in a week and it would only count as a single inquiry.

This shopping period can range from 14-45 days, depending on which version of the FICO scoring formula is being used.

The latest FICO version allows a 45 day shopping period, while the oldest just 14 days. Unfortunately, many mortgage lenders use older versions of FICO.

Either way, one credit inquiry will likely only lower your credit score by five points or less, so it may not even be a concern if you already have a solid credit score.

Of course, mortgage inquiries can and will affect consumers differently based on their credit profile, so theres no absolute rule in terms of impact.

Why Credit Scores Matter For Mortgage Rates

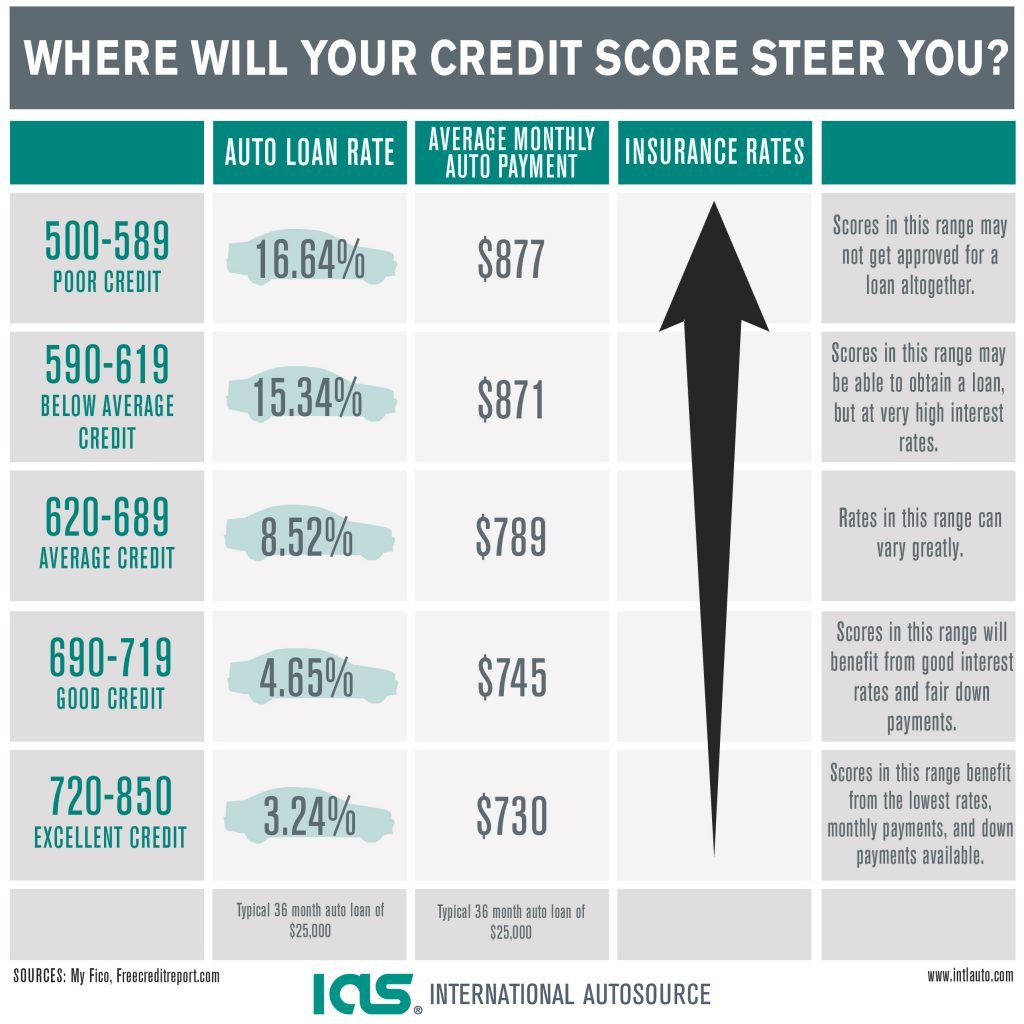

When it comes to determining your mortgage rate, your credit score is a critical factor.

Think about it from the bankâs perspective. They are lending you money for 30 years. Over that time frame, youâll likely change jobs, face tough times, watch your neighborhood change, and go through multiple market cycles. Your current financial picture â including down payment, assets, and income â are important. But a credit score gives the bank an idea about whether youâre likely to make payments responsibly even if things change.

Yet, it isnât just low credit score borrowers that pay the price. The difference between a good and great score can still add up over the life of a loan. Assuming nothing in a mortgage application changes except the credit score, someone with a score in the 680-699 range would have a mortgage rate approximately 0.399 percentage points higher than a person with a 760-850 score. Thatâs a difference that may sound minuscule, but isnât.

In 20-years, someone with a 680-699 score will still pay over $20,000 more in interest on a $244,000 mortgage than a person with a high score.

So, what score do you need to consider before applying for a mortgage?

Don’t Miss: What Credit Score Do You Need To Buy A House

Good Credit Vs Bad Credit Does It Matter

Of course, that journey can be different if your credit started out on the lower end. While theres no hard and fast number at which you wont qualify for a mortgage, in general, most lenders like Rocket Mortgage® look for a credit score of at least a 620 for a conventional loan. Otherwise, you might need to look into other types of loans for which you might qualify or be prepared to pay a higher interest rate.

Credit industry leaders like FICO®, VantageScore® and Experian® use slightly different measures to calculate credit scores. Below is a general guide to credit score rankings, according to FICO®.

- Exceptional: 800+

- Poor:579 and below

In other words, does having a mortgage help your credit score? Yes, eventually. You might just have to exercise some patience, accompanied by good spending habits, while you wait.

How Much Will Credit Inquiries Affect My Score

The impact from applying for credit will vary from person to person based on their unique credit histories. In general, credit inquiries have a small impact on your FICO Scores. For most people, one additional credit inquiry will take less than five points off their FICO Scores.

For perspective, the full range for FICO Scores is 300-850. Inquiries can have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk. Statistically, people with six inquiries or more on their credit reports can be up to eight times more likely to declare bankruptcy than people with no inquiries on their reports. While inquiries often can play a part in assessing risk, they play a minor part are only 10% of what makes up a FICO Score. Much more important factors for your scores are how timely you pay your bills and your overall debt burden as indicated on your credit report.

Read Also: Is 530 A Bad Credit Score

What Is Buy Now Pay Later

With buy now pay later schemes, shoppers can spread out the cost of a purchase over several weeks or months, usually interest-free.

This is also now one of the most popular choices at checkout points.

Companies like Clearpay give customers the option to spread out payments if they are shopping at well-known retailers online and in-store, like Marks & Spencer and Asos.

The term BNPL also refers to other, more traditional payment options like catalogue credit and store cards.

It is estimated that one in five people have used BNPL schemes over the last year and out of those, 20% of shoppers said their credit scores have been negatively impacted.

Why Does Your Credit Score Matter To Lenders

Along with a low debt-to-income ratio and a strong financial history, youll need a high credit score for the lowest mortgage rates. Why?

Youd probably hesitate to lend money to a friend who usually takes forever to pay you back or doesnt pay you back at all. Lenders feel the same way about mortgages. They want to lend to people who have a record of on-time payments to creditors.

If somebody has a high credit score, what that shows us is that theyve been good on meeting their obligations, whether it be credit cards, car loans or other home loans in the past, says Brian Hoovler, a loan production partner with Peoples Home Equity in San Francisco. It means were more likely to want to give you a loan because we know youre going to pay us back.

Your credit score is calculated most often with the FICO scoring model and is derived from the information on your credit reports, which are compiled by credit reporting companies. Your reports include a history of your payment habits with borrowed money.

Your credit score is one of the most important parts to qualify, but it is a part, says Michelle Chmelar, vice president of mortgage lending with Guaranteed Rate in New York. You have to have the whole package: income, sufficient assets, and credit.

Read Also: Is 584 A Good Credit Score

What To Remember When You Are Rate Shopping

If you need a loan, do your rate shopping within a focused period such as 30 days. FICO Scores distinguish between a search for a single loan and a search for many new credit lines, in part by the length of time over which the inquiries occur.

When you look for new credit, only apply for and open new credit accounts as needed. And before you apply, it’s good practice to review your credit report and FICO Scores to know where you stand. Viewing our own information will not affect your FICO Scores.

As a general rule, it is OK to apply for credit when needed. Be mindful of this information so you can start the credit-seeking process with more confidence.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range